January 21st, 2016 by Elma Jane

HYATT DATA BREACH HITS 250 HOTELS WORLDWIDE

Hyatt hotel company noted that the breach that occurred over the course of almost four months hit 250 different hotels over the span of about 50 countries.

The breach covered payment card data from the cards used at various Hyatt hotels in that range of dates, reports note, and most of the breaches seem to have hit at hotel restaurants. Those who also hit the spas at Hyatt, along with front desks, gold shops, and even parking structures may also have been impacted by the breach.

The company couldn’t confirm how long the network was vulnerable nor if any payment card data had actually been stolen.

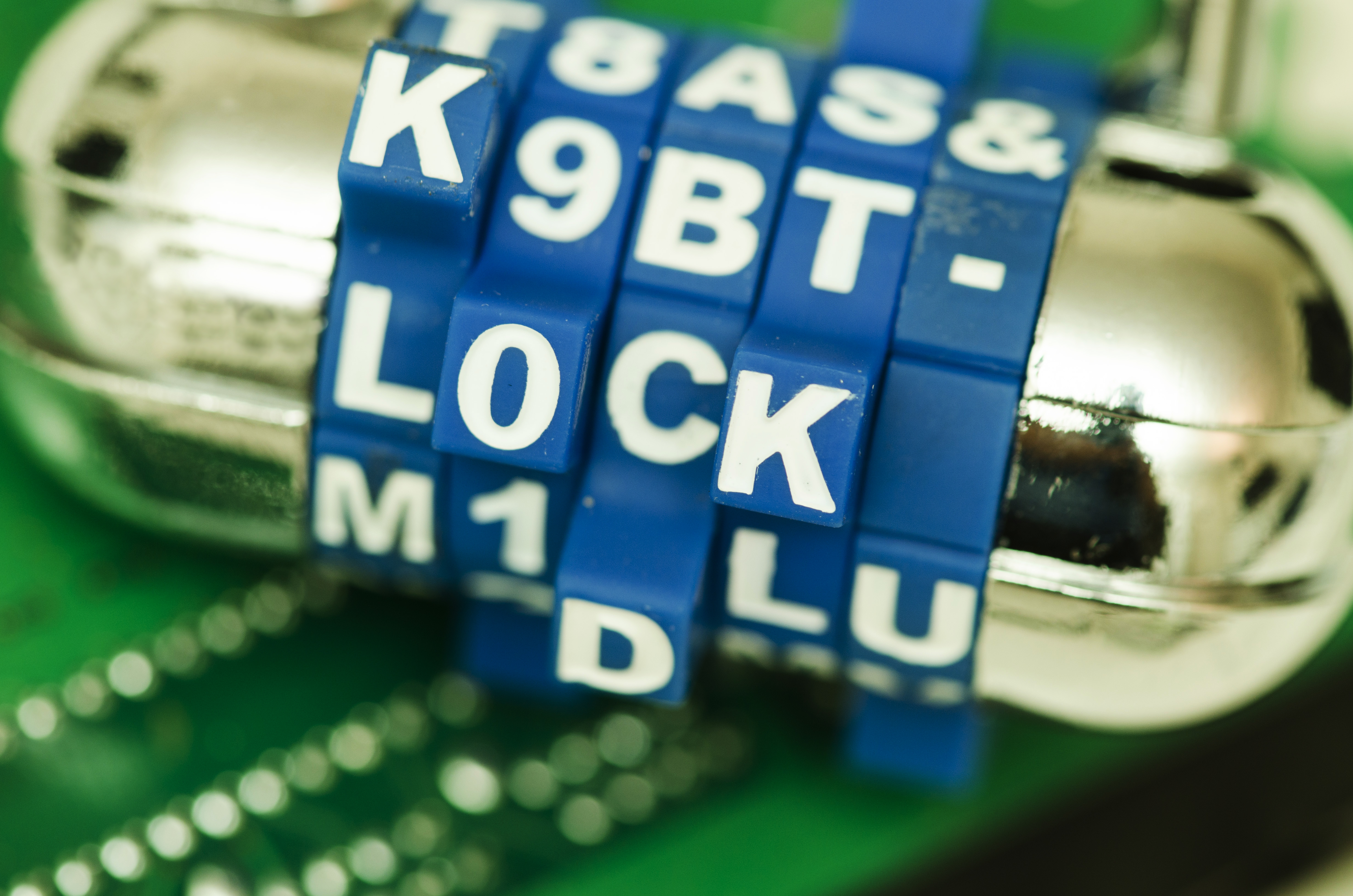

Perimeter Defense where data is protected with passwords and firewalls and the like is fine and well, but more needs to be put into protecting the data in the event someone clears security.

Encrypting Data is a great step to take, assuming someone manages to clear the perimeter, the encryption makes the data itself much more difficult to access and use. So while perimeter defense keeps unauthorized users away from data, encryption keeps those who reach the data from being able to readily read it.

Data Security is something none of us can take for granted, so doing what we can to protect that data being vigilant about statements, putting up proper security, encrypting data all of these contribute to better protected data and a safer time online.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card data, cards, data, online, payment, Security

January 18th, 2016 by Elma Jane

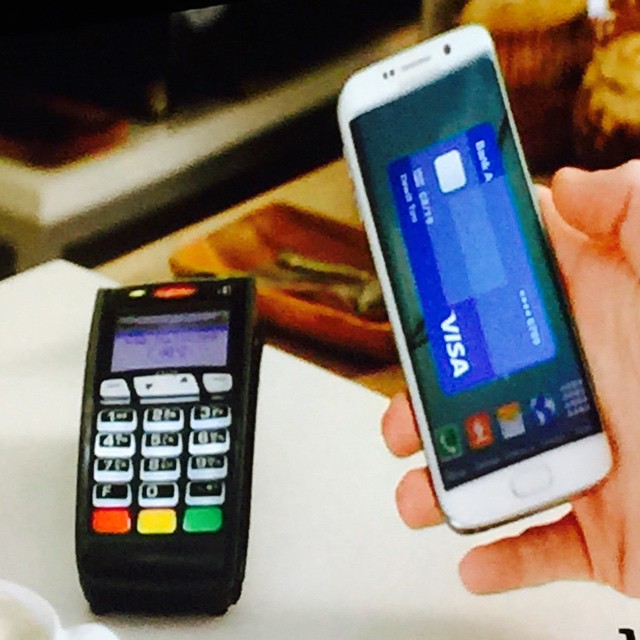

EMV + NFC = BIG PLUS FOR YOUR BUSINESS

The business is already making upgrades, so If you’re a merchant, business owner who’s still on the fence about upgrading your payment processing equipment to accept EMV cards why not take that upgrade a step further and add NFC while adding EMV systems?

Not only will the upgrade help prevent potential financial responsibility for fraudulent transactions, but you can also realize the added benefit of being able to process NFC transactions at the same time.

Customers want the ability to pay with a mobile device, and NFC will allow for such transactions to go on.

Having NFC tools in place will help provide a valuable note of future-proofing to systems in place, being ready for it will be to the business’ benefit.

EMV and NFC technology is just good business sense for three important reasons Added Security, Economic Sense and Staying Current.

For more information about terminal upgrade and features that suits best for your business give us a call at 888-996-2273.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale, Smartphone Tagged with: cards, customers, EMV, merchant, mobile, nfc, Security, transactions

December 15th, 2015 by Elma Jane

Visa Inc. has launched the Visa Token Service in Asia Pacific, in association with United Overseas Bank (UOB). Store tokens on mobile devices, cloud-based mobile applications, and e-commerce merchants carry less risk of security hack. This security technology will replace sensitive account information to make payments without exposing bank details.

Tokenized cards are linked to customer’s wallet application or mobile and validated by VisaNet. Biometric authentication and device identification features are available through this service. Visa debit or credit cardholders with NFC-enabled Android smarthphones cardholders will be able to make contacless payments.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: bank, biometric, cardholders, cards, contacless payments, credit, debit, e-commerce, e-commerce merchants, merchants, nfc, payments, token, Tokenized cards, visa

December 14th, 2015 by Elma Jane

Samsung Pay now supports 50 popular merchant gift cards as well as a gift card store that enables users to buy gift cards from supported merchants, within the Samsung Pay app. According to press release, more gift card options will be added to Samsung Pay in the coming months. Samsung Pay is bringing consumers an easier way to use gift cards. With Samsung Pay, you can easily carry your gift cards with you everywhere you go and not to have to worry about a card going unspent.

http://paymentweek.com/2015-12-14-samsung-pay-adds-support-for-popular-gift-cards-9116/

Posted in Best Practices for Merchants, Smartphone Tagged with: cards, Gift Cards, merchant

December 7th, 2015 by Elma Jane

Most payments will probably be made with apps in phones or smartwatches in less than a decade from now, using NFC, biometrics or other mechanisms that don’t involve swiping or using plastic cards.

If your mobile device has an integrated NFC chip, you can use a mobile wallet app like Apple Pay and Android Pay to pay for items that support NFC transactions at a retail store. Simply wave your device near an NFC compatible terminal to pay, no card swiping required.

Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

In some countries, it’s easy for consumers to get credit cards with imbedded NFC chips. This means that you may be able to wave your card at the terminal instead of swiping, no phone required. In America, though, because NFC hasn’t caught on until recently, analysts expect that NFC via smartphone and smartwatch services such as Apple Pay and Android Pay will dominate contactless transactions in the next few years.

Just as credit cards replaced cash, credit cards will be replaced by digital payments which will continue to rely on the credit infrastructure but will obscure the plastic card itself.

As consumers, we love to see better products. When it comes to payments, we need Standards and Reliability.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: biometrics, cards, contactless transactions, credit cards, digital payments, mobile wallet, nfc, NFC chip, payments, smartphone, terminal

August 27th, 2015 by Elma Jane

Merchant processing fees is one expense you should look at as an investment. If you try to avoid merchant processing fees, you risk antagonizing prospective buyers and losing opportunities.

If you limit payment options for customers, you run a real risk of losing customers.

In addition to losing customers, you can run the risk of not being able to close deals. If you don’t provide your customers with easy, hassle free ways to pay they will likely seek out other vendors that do offer more convenient ways to pay for the services they need.

Do yourself and your business a favor, offer prospective customers and existing customers easy ways to pay you. Your customers will appreciate it and in return, are more likely to become repeat customers.

We live in a nearly cashless society. Accepting credit cards is a requirement in today’s business trend.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: cards, credit cards, merchant, merchant account, processing fees

July 10th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal. Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: cardholder, cards, chips, EMV, emv cards, EMV terminal, EuroPay, magnetic stripes, MasterCard, merchant, nfc, payment cards, payments, PIN transactions, terminal, visa

June 18th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal.

Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

By accepting chip cards EMV terminal, you help protect your business from card present fraud liability and prepare your business for the future of payment application technology. If your business accepts and processes a counterfeit card transaction on a non-EMV terminal, the liability for that fraudulent transaction is yours, not incurred by the card issuers.

How do you process an EMV chip card transaction?

- Insert Card. Instead of swiping, the customer will insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal. The card must remain in the terminal during the entire transaction.

- The Receipt or Enter a PIN. As prompted, the customer will sign the receipt or enter their PIN to complete the transaction.

- Remove Your Card. When the purchase is complete, remind the customer to take the card with them.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: cardholder, cards, chips cards, contactless payment, EMV, emv chip cards, EMV terminal, EuroPay, magnetic stripe cards, MasterCard, merchant, nfc, payment cards, payments, visa

May 14th, 2015 by Elma Jane

The way customers Pay In Stores Is Changing.

Chip cards are here to provide advanced security with every transaction. Accepting chip cards could be as simple as changing your payment terminal.

What do you need to know about Chip Card and EMV? Chip cards are payment cards that have an embedded chip, which offers advanced security when you use the card to pay in store. Chip cards are based on a global card payment standard called EMV (Europay, MasterCard and VISA) currently used in more than 80 countries.

Why Is it More Secured? Chip card transactions offer you advanced security for in store payments by making every transaction unique, and, more difficult to counterfeit or copy. If the card data and the one-time code are stolen, the information cannot be used to create counterfeit cards and commit fraud.

How do you know if a customer has a Chip Card? The customer’s card will have chip on the front of it, magnetic stripe remains on the back.

How to use Chip Card at the POS? Swipe the card as they normally would and follow the prompts. If the terminal is chip-enabled, it will prompt them to insert it instead. The customer should insert their card with chip toward terminal, facing up. The chip card should not be removed until the customer is prompted.

Customer will provide their signature or PIN as prompted by the terminal.

Some transactions may not require either.

When the terminal says the transaction is complete, the customer can remove their card.

Chip-enabled terminals will still accept magnetic stripe card payments for customers who do not have a chip card.

What does a chip-enabled terminal look like? They have all of the features you are used to with a payment terminal, with the addition of a slot for the customer to insert their card. The slot is typically located at the bottom or the top of the payment terminal.

How will you know if a terminal accepts chip card? During the transition to chip, customers are being told to swipe their card as they normally would and follow the prompts. If the terminal is chip-enabled, it will prompt them to insert it instead. If you have chip-enabled terminals, you can tell your customer to insert their card for a chip transaction, if a customer has a chip card.

How can you get a chip-enabled terminal? Contact your acquirer or merchant service provider.

Show your customers that you care about their information security by making the move to chip. This will ensure that your business and your customers are protected from fraud. Start accepting chip cards!

You may be liable for fraud if you don’t make the change from chip terminal. Starting October 2015, rules are changing. Merchants that accept chip will be protected from fraud losses resulting from in store counterfeit magnetic stripe card transactions just as you are today. However, liability will shift from issuers to merchants if their payment terminals are not chip-enabled for in store transactions. Fraud liability for lost or stolen cards varies by payment network. Contact your acquirer or payment services providers for more information.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Point of Sale Tagged with: card data, cards, chip cards, Chip-enabled terminals, data, EMV, EuroPay, magnetic stripe, MasterCard and VISA, merchant service provider, Merchant's, payment, payment cards, payment network, payment terminal, POS, Security, terminal, transaction

All merchants that accepts, transmit or stores cardholder data are required to be PCI (Payment Card Industry) Compliant. Most believe that because they do not charge the credit cards themselves, they are exempt. Why all agencies are required to be complaint even when they don’t charge credit cards themselves, and some steps to ensure your agency is PCI compliant.

What is PCI compliance?

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to ensure that all companies that process, store or transmit credit card information maintain a secure environment. PCI applies to all organizations or merchants, regardless of size or number of transactions, that accepts, transmits or stores any cardholder data. Travel agents accepting, storing and transmitting credit card information to suppliers, are required to be compliant too. Suppliers reinforce this through their travel agent guidelines/contracts. Travel Agency must adhere to the applicable credit card company’s procedures for credit card transactions.

Consequences of Not Being PCI Compliant

If an agency is not PCI compliant, the agency can lose the ability to process credit card payments with that supplier. Not being able to pay with client credit cards can be a serious roadblock for agencies, and an inconvenience for clients.

If you have a merchant account and are found to be out of compliance, you can be fined.

How to be PCI Compliant

Don’t store the CCV security code from the client’s credit card. The client does not have the authority to grant you permission to store their CCV code. The credit card company explicitly forbid storage of the CCV code.

Make sure you securely store any client information, including their credit card number and expiration date. If you use a CRM, ensure that you have a strong password. If your CRM database is stored on your computer hard drive, encrypt it (there is a great encryption software that is free of charge). If you have an IT resource, talk to them about installing a firewall on your network, installing anti-virus and anti-malware protection, and any other steps that you can take to secure your client data even further.

If you keep paper copies of client information, keep it in a locked filing cabinet or desk drawer. When you no longer need their credit card information, cross shred it.

Home based businesses are arguably the most vulnerable simply because they are usually not well protected, according to the PCI Compliance Guide. Having strong passwords, encryption, a firewall, anti-virus and anti-malware protection are all inexpensive steps that you can take to protect your business and your clients’ sensitive data.

If you receive a courtesy call reminding you about PCI Compliance, don’t ignore it.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security Tagged with: cardholder, cardholder data, cards, CCV, CCV code, credit, credit card company, credit card number, credit card payments, credit card transactions, credit cards, crm, CRM database, data, database, encryption software, merchant account, Merchant's, network, Payment Card Industry, PCI, security code, transactions, travel agents