With the EMV migration just a few months away, Visa is stepping up its merchant education efforts, by launching an online portal for merchants featuring a background on chip cards, demonstrations on proper usage, and tips for implementation.

Visa also kicked off its 20-City Small Business Chip Education Tour expounding on the benefits and necessity of chip cards to local small businesses.

Visa is bringing payment industry experts to connect directly with merchants to answer their questions on the transition across the United States.

Merchant education will be a herculean task, but payments industry stakeholders should make every effort to make sure chip cards are adopted and used effectively by both merchants and consumers.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: cards, chip, chip cards, consumers, EMV, EMV migration, Merchant's, payment, payment industry, visa

May 4th, 2015 by Elma Jane

The rate of payments fraud is steadily decreasing, the current frequency stands at 0.06 percent or six basis points.

The perception of risks associated with card payments are much larger than the actual threat or reported losses. But the lack of trust that comes from such perception could impact the growth of the payments industry.

Recent advancements in payments security, such as tokenization and multiple tier authentication protocols, have contributed to the manageable number of fraudulent transactions. The EMV migration is expected to push the figure even lower, as chip-enabled technology spreads to over 50 percent of the US by the end of 2015.

For criminals, breaking into robust financial systems is becoming more costly and time consuming, which has discouraged many from attempting such unlawful acts.

Fraud is something that we can’t say will be eliminated completely. But efforts by all stakeholders in the industry can contain it to the minimum.

Counterfeit cards and payments data falling into the wrong hands are the two most common types of fraud that consumers are facing today. The surge in e-commerce has been linked to greater risks of fraud in the online channel, and while counterfeiting cards may be more difficult with EMV in place, online fraud has historically increased in its place.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: card payments, cards, consumers, data, e-commerce, EMV, EMV migration, fraud, payments, payments industry, Payments Security, tokenization, transactions

December 1st, 2014 by Elma Jane

Few Americans will likely remember the life and work of Martin Cooper, largely because most Americans have no idea who Martin Cooper is. Without Martin Cooper much of what we identify as normal life for the last two decades would not have been possible, as without his invention we would still be looking for pay phones, dropping off film to be developed, printing out boarding passes and contemplating a future where a plastic rectangle was the height of payments technology.

Anyone reading this has a phone with internet access which means no one has to guess, with a few taps on a smartphone most readers who didn’t already know were able to find out that Martin Cooper invented the handheld mobile phone and by so doing changed the lives of not just Americans, but people all over the world.

Mobile has integrated so seamlessly into our life that we didn’t realize it was changing everything we do.

Here are the list of all of the ways that mobile has improved life for us all.

We All Get To Know Everything All The Time, with just a smartphone. Impulse buy is a thing of the past because consumers just don’t buy on impulse as much anymore. A new intentionality has taken hold of shopping. Many Americans have the money and the will to spend. But they are time-pressed and deal savvy, visiting stores only when they run out of items like cereal or toilet paper and after doing extensive research on purchases online and with friends. They buy what they came for and then leave. Plus consumers are harder to fool, they know if they are being overcharged because they can look it up in real time while they are in the showroom.

Full Price Is A Notion Utterly Without Meaning. There are sites like Groupon, LivingSocial and a thousand imitators offer coupons pretty much across every retailer that mean no matter where one is shopping or eating they’re probably a few button taps away from paying less for the type of service they are out for. And then there are the retailer rewards programs all bent on giving consumers more stuff for free as long as they use their mobile coupons.

We All Think Way More About Privacy And Digital Security Than We Used To. Twenty years ago one’s largest security concern was probably that their home or car would be broken into, followed closely by their wallet being stolen. Now we wait for Russian cybercriminals to steal our cards by hacking into POS systems and lifting the data. Or for cybercriminals to hack our phones and upload naked pictures of us to the internet (celebrity readers only). Or for Nigerian princes to trick our grandparents into wiring them money. In short, while we still fear for our physical possessions as much as we ever did, the mobile world gave us something entirely new to worry about, the integrity of our data and who could use our phones, cards and email accounts as a backdoor into our entire personal and financial lives.

We Want It All, And We Want It Now. Anyone with a phone in their pocket can, in one way or another, buy it on the spot. Which has given rise to the push for same-day delivery, consumers who can buy it now, also want to be able to get it now, or as close to now as possible.

We Also Want It Later. Maybe the consumer likes going to the store, enjoys the Christmas lights, wants to eat at a mall food court, they just don’t want to stand inline. And now, through the magic of omnichannel commerce, they may not have to do. Through the magic of multi-device shopping an instore pick-up, consumers are increasingly getting used to finding something on their mobile, paying on their computer and picking up in store. Or some combination thereof.

Mobile has made commerce less a race between the e-markets and the brick-and-mortars, and more a race to offer the most seamless commerce experience. Mobile has taught ever one to care less about where they buy, and more about what the total buying experience is.

We Pay For Access Instead Of Objects. Ten years ago when your family set about its early experiments in binge watching television with the first season of Lost, odds are everyone gathered round and watched a DVD set or maybe a Blue Ray, if your family happened to be full of early adopters.

This weekend, when entire families are sitting down to watch How To Get Away With Murder, more likely than not they are streaming it through Hulu. Unless they don’t want to watch that, in which case, they are watching something else on Netflix on their phone while sitting in the same room with their family. Unless of course this is a football family, in which case you are paying the NFL for access to every football game played everywhere in America tomorrow and a cable company to watch in HD.

We Want To Use A Phone To Access Everything. It’s almost now quaint to refer to a time when phones were used primarily to talk. With the rapidly emerging internet of things, it will soon be quaint to talk about a phone as a tool used primarily for communicating and shopping.

The smartphone is already heading toward being the key interface between connected devices and products (The Internet of Things) and their users. Among other things, people will use the device to remotely control household appliances, interact with screens and automatically adjust car settings to their preferences.

We Kinda Hope The Phone Might Keep Us Alive. With the release of Apple Pay, also came the release of Apple Health that has widely been reported as ushering in the age of mobile device as wellness guru. Smartphones can already help people lead healthier lives by providing information, recommendations and reminders based on data gathered through sensors embedded in users’ clothing (shoes, wristbands, etc.) or through other phone capabilities (motion detectors, cameras, etc.).

And, even if you don’t listen to your phone and put your health at risk, it will still probably save you. Internet-enabled mobile devices are becoming important tools in broadening access to health care, diagnosing diseases and saving lives in crisis situations.

Making Life A Lot Better For Everyone. Small merchants can do something now that they couldn’t do en masse twenty years ago. Take credit card payments and use a tablet to do that and run their business. With the emergence of mobile, came thousands of the other mPOS solutions and platforms exploding all over the world. This has not only changed the way these small businesses operate, it has changed their entire pitch to their customers.

Mobile has made life easier for many consumers, but for some businesses and many people mobile has made mainstream financial participation possible.

Posted in Best Practices for Merchants, Smartphone Tagged with: (POS) systems, brick-and-mortars, cards, consumers, credit card payments, customers, data, e-markets, email accounts, mobile, mobile coupons, mobile device, mPOS solutions, omnichannel commerce, pay phones, payments technology, platforms, Small merchants, smartphone, tablet

September 24th, 2014 by Elma Jane

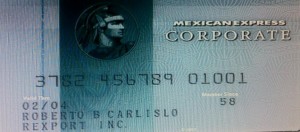

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

September 23rd, 2014 by Elma Jane

Home Depot, US retail chain says that 56 million payment cards are at risk following a malware-laden cyber-attack on eftpos tills across its stores in the US and Canada.

The investigation into a possible breach began on September 2nd,Tuesday morning, immediately after Home Depot received reports from its banking partners and law enforcement that criminals may have breached its systems.

According to Home Depot’s security partners, the malware had not been seen previously in other attacks.

Criminals used unique, custom-built malware to evade detection. The cyber-attack is estimated to have put payment card information at risk for approximately 56 million unique payment cards, after lurking in the company’s eftpos tills for four months between April and September.

While the breach has been seen as a further proof-point in the US push to adopt Chip and PIN at the point-of-sale, the fact that the outbreak also hit the home improvement chain’s Canadian stores, where the EMV standard has been implemented, leaves pause for thought. Nonetheless, the retailer has committed to installing 85,000 PIN pads at its US outlets, well ahead of the national 2015 deadline.

Home Depot has set aside $65 million to cover the cost to investigate the data breach, provide credit monitoring services to its customers, increase call center staffing, and pay legal and professional services. Approximately $27 million of the projected outlay will be covered by the company’s insurance.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: banking partners, Breach, call center, card information, cards, Chip and PIN, credit monitoring, credit monitoring services, customers, cyber-attack, data breach, EMV, EMV standard, Malware, payment, payment card information, payment cards, PIN pads, point of sale, risk

September 18th, 2014 by Elma Jane

Americans love gift cards, but many of those pieces of plastic go partially or entirely unused. Some are lost or forgotten. Others simply are ignored once the balance drops to a few dollars or less.

A gift card’s unused value…known in industry parlance as spillage or breakage…long has meant big profits for the gift card industry .

But the Credit Card Accountability, Responsibility and Disclosure Act of 2009, better known simply as the Credit CARD Act, tightened rules on retailers, making it more difficult for stores to cancel unused cards or charge inactivity fees. That prevents retailers from quickly cashing in on breakage.

In addition, savvy consumers are catching on and appear to be finding ways to avoid losing breakage while getting the most out of their gift cards.

According to the most recent figures, about 1 percent of the total value of gift cards was predicted to go unused in 2013. That’s down from a record high of 10 percent in 2007. Some of the reduction in breakage is a result of growing cardholder realization that even though there’s only $2.12 on gift card, they got to find a way to use it.

However, even with the decline in breakage, around $1 billion worth of gift cards will be lost to fees and expiration dates or misplaced, shoved in a drawer or otherwise neglected this year. That’s a huge amount of money that consumers will not be able to use toward a new shirt, stuffed animal or bicycle.

Retailers love when people use gift cards because studies show that most customers spend more in the store than the card is worth. Breakage makes gift cards even more profitable: An estimated $127 billion in gift cards will be sold in 2014, even a small percentage of unused cards boost a company’s bottom line.

Those profits make it feasible for retailers to make some consumer-friendly moves, such as selling gift cards at a discount. However, most of the money goes toward other endeavors.

Wal-Mart may have a billion dollars (in unused gift cards) sitting there. Wal-Mart could go out and build 30 new superstores without borrowing a penny. They know those gift cards will come in eventually, but for now, they have the use of that money.

Ways to make sure you’re not ‘breakage’

The longer you let a card sit untapped, the less likely you are to use it. Here are eight ways to make sure your gift cards are not lost to breakage:

Give again. Instead of letting that last two bucks on a card go to waste, use it to make a donation. Stockpile cards and combine them into higher-value gift cards that are donated to the needy.

A Gift Card Giver founder, got the idea when he asked a group of acquaintances how many had unused gift cards sitting in their wallets. They literally started pulling out gift cards from their wallets, everyone had one.

The Gift Card Giver founder offered to redistribute the unused cards to the needy and a new nonprofit was born.

Give low-end cards as gifts. To make sure your gift card doesn’t languish in someone else’s wallet, consider purchasing cards at Walgreens and Wendy’s instead of Nordstrom and Saks. Practical gift cards, such as those for fast-food chains and discount retailers are used faster than cards to fine dining establishments and pricey department stores.

Corral your cards. Make sure you can quickly locate your cards by storing them all in the same place.

If you have too many cards to tuck into your wallet, stowing them in a durable plastic envelope. Or upgrade to a Card Cubby (about $24), which includes alphabetized tabs and is tiny enough to keep in a purse.

Plan your shopping ahead of time. Set up your e-mail program to send you a monthly reminder to use your gift cards. Think in terms of the week or month ahead, when will you be near the store? What items do you need there? Is there a gift you need for someone else? You are more likely to use the card if you know what you want ahead of time and can get in and out quickly.

Rethink general-purpose gift cards. Gift cards from credit card companies can be used anywhere you can use a credit card. But these cards also come with drawbacks.

Use-anywhere cards, known as open-loop cards are more likely to come with startup fees and monthly inactivity fees that chip away at your balance. Many of these gift cards also include a valid through or good through date stamped on the front. Your card’s underlying value will not expire after that date, but you will have to call customer service for a replacement card, and that raises the risk that you will simply toss the card and your remaining balance.

Read the fine print. The CARD Act prohibits gift card inactivity fees for the first year, and requires that gift cards cannot expire within five years of when activated. State lawsmay extend additional gift card protections. That gives you a big, but not permanent cushion of time to use the cards.

Trade or sell your cards. If you get a card you know you will not use, a Hot Topic gift card, for instance, when you are more of an L.L.Bean type, use one of the many card-swapping and card-selling sites to get what you really want.

That is because with a Wendy’s and a Walgreens on practically every corner, such lower-end cards simply are more convenient to use. They also offer more value for your card. If you give a Wal-Mart gift card to your mailman, there are plenty of things to use it on.

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: card-selling, card-swapping, cardholder, cards, consumers, Credit CARD Act, credit card companies, credit-card, customer service, customers, drawbacks, e-mail program, fees, gift card industry, Gift Cards, inactivity fees, lower-end cards, open-loop cards, retailers, startup fees, Wal-Mart gift card

September 17th, 2014 by Elma Jane

Commuters using the London tube network can now tap their contactless bank cards on the ticket barriers to pay for their journeys, further displacing cash on the capital’s transit system.

Fares are cheaper than cash, with users being charged adult pay as you go fares and benefiting from daily and Monday to Sunday fare capping. Customers without bank cards will continue to benefit from cheaper fares through Transport for London’s Oyster card.

This is not the end of Oyster and it’s not the end of cash, but it is a significant dent in the market for cash.

The move follows the abolition of cash on London’s buses and covers all tube, overground, DLR, tram and National Rail services that accept Oyster.

The shift to contactless has future-proofed the capital’s transit system for up-and-coming innovations in payments. You can already use your mobile phones to make your payments and tap and go through the tube turnstiles, and in the future it will open up many other connected devices as well, whether that’s smart wristbands or smart watches.

An incredible response to the launch of contactless payments on London Buses with nearly 19 million Visa contactless journeys made since it launched in 2012. Today’s launch will be another major boost to contactless usage leading to the three-fold increase expected in the next year. To coincide with the rollout, Londoners are invited to sign up for 10,000 free bPay contactless payments bands. Its wearable device will let commuters pay for their journeys with a wave of their wrists and help avoid card clash.

Posted in Best Practices for Merchants Tagged with: bank, card clash, cards, contactless bank cards, contactless payments, customers, devices, mobile, mobile phones, network, payments, phones, smart watches, smart wristbands, Visa contactless journeys, wearable device

September 16th, 2014 by Elma Jane

Card-not-present merchants are battling increasingly frequent friendly fraud. That type of fraud..The I don’t recognize or I didn’t do it dispute. This occurs when a cardholder makes a purchase, receives the goods or services and initiates a chargeback on the order claiming he or she did not authorize the transaction.

This problem can potentially cripple merchants because of the legitimate nature of the transactions, making it difficult to prove the cardholder is being dishonest. The issuer typically sides with the cardholder, leaving merchants with the cost of goods or services rendered as well as chargeback fees and the time and resources wasted on fighting the chargeback.

Visa recently changed the rules and expanded the scope of what is considered compelling evidence for disputing and representing chargeback for this reason code. The changes included allowing additional types of evidence, added chargeback reason codes and a requirement that issuers attempt to contact the cardholder when a merchant provides compelling evidence.

The changes give acquirers and merchants additional opportunities to resolve disputes. They also mean that cardholders have a better chance to resolve a dispute with the information provided by the merchant. Finally, they provide issuers with clarity on when a dispute should go to pre-arbitration as opposed to arbitration.

Visa has also made other changes to ease the burden on merchants, including allowing merchants to provide compelling evidence to support the position that the charge was not fraudulent, and requiring issuers to a pre-arbitration notice before proceeding to arbitration, which reduces the risk to the merchant when representing fraud reason codes.

The new “Compelling Evidence” rule change does not remedy chargebacks but brings important changes for both issuers and merchants. Merchants can provide information in an attempt to prove the cardholder received goods or services, or participated in or benefited from the transaction. Issuers must initiate pre-arbitration before filing for arbitration. That gives merchants an opportunity to accept liability before incurring arbitration costs, and Visa will be using information from compelling evidence disputes to revise policies and improve the chargeback process

Visa made those changes to reduce the required documentation and streamline the dispute resolution process. While the changes benefit merchants, acquirers and issuers, merchants in particular will benefit with the retrieval request elimination, a simplified dispute resolution process, and reduced time, resources and costs related to the back-office and fraud management. The flexibility in the new rules and the elimination of chargebacks from cards that were electronically read and followed correct acceptance procedures will simplify the process and reduce costs.

Sometimes, an efficient process for total chargeback management requires expertise or in-depth intelligence that may not be available in-house. The rules surrounding chargeback dispute resolution are numerous and ever-changing, and many merchants simply do not have the staffing to keep up in a cost-effective and efficient way. Chargebacks are a way of life for CNP merchants; however, by working with a respected third-party vendor, they can maximize their options without breaking the bank.

Reason Code 83 (Fraud Card-Not-Present) occurs when an issuer receives a complaint from the cardholder related to a CNP transaction. The cardholder claims he or she did not authorize the transaction or that the order was charged to a fictitious account number without approval.

The newest changes to Reason Code 83, a chargeback management protocol, offer merchants a streamlined approach to fighting chargebacks and will ultimately reduce back-office handling and fraud management costs. Independent sales organizations and sales agents who understand chargeback reason codes and their effect on chargeback rates can teach merchants how to prevent chargebacks before they become an issue and successfully represent those that they can’t prevent.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, account number, acquirers, agents, Back Office, card, card holder, card-not-present, Card-not-present merchants, cardholder, cards, chargeback, chargeback fees, chargeback rates, cnp, CNP merchants, CNP transaction, fees, fraud, fraud management, Independent sales, independent sales organizations, issuer, management protocol, Merchant's, organizations, protocol, purchase, Rates, resolution, resolution process, resources, risk, sales agents, services, transaction, visa

September 16th, 2014 by Elma Jane

When plastic cards become digital tokens, they become virtual. So how do you say that the Card is Present or Not Present. The legendary regulatory difference that the cards industry has relied on to differentiate between interchange fees for Card Present and Card Not Present transactions.

Apple secured Card Present preferential rates for transactions acquired by iTunes on the basis that the card’s legitimacy is verified with the issuer at the time of registration and the token minimizes probability of fraud. If an API call to the issuing bank is sufficient to say that the Card is Present, who is to say that the same logic can’t apply to online merchants who also verify the authenticity of Cards on File when they tokenize them? How can one arbitrarily say that the transaction processed with token from an online merchant is Card Not Present, but the one processed with Apple Pay is Card Present even though both might have made the same API call to the bank to verify the card’s validity?

In the Apple case, a physical picture of the card is taken and used to verify that the person registering the card has it. It is not that hard for an online merchant to verify that the Card on File converted as a token does belong to the person performing an online transaction.

As we move towards chip and pin the card present merchants will spend substantial money upgrading their hardware and POS systems. That expense will be offset by that savings in losses due to fraud. MOTO and e-commerce transactions ( card NOT present ) will always have a higher cost because the nature of processing is NON face to face transactions. Of course the fraud and losses are higher when the card is manually entered or given to someone over the phone……Face to face will always have the lowest cost per transaction because it is usually the final step in the sale. Restaurants are low risk because you had the transaction AFTER you eat. If there is a dispute it happens before the merchant even sees the credit card.

In the long run, as cards become digital and virtual through tokens, we are all going to wonder if card is present or not present. May be some will say. Card is a ghost.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: (POS) systems, API call, Apple secured Card Present, bank, Card Not Present transactions, card present, card present merchants, cards, cards industry, chip, credit-card, digital and virtual, digital tokens, e-commerce transactions, fees, fraud, hardware, industry, interchange, interchange fees, issuer, issuing bank, low risk, Merchant's, moto, NON face to face transactions, online, online merchants, online transaction, PIN, Processing, Rates, token, transactions

September 5th, 2014 by Elma Jane

A cup of coffee, a pack of chewing gum., a newspaper at the airport. For even the smallest, most casual purchase, credit cards and debit cards are replacing cash as the preferred form of payment. One in three usually uses a credit card or a debit card for in-person purchases of less than $5. Eleven percent prefer credit cards, 22% debit cards and 65% cash, but the generational divide is striking. A slight majority (51 percent) of consumers 18-29 prefer plastic to cash, the only age group to do so. A preference for cash becomes stronger in each advancing age bracket, until at age 65-plus, 82 percent prefer cash.

Survey conducted by landline and cellphone found that: Credit cards and debit cards are used more frequently for small purchases by those employed full time (42%) or part time (34%) than for the unemployed (23%). People with children are more likely to use the cards for small purchases (41%) than those without children (30%), perhaps because parents have less time to wait around for change. Income doesn’t seem to be much of a differentiator, except for those near the bottom of the scale. A combined 38% of those making $75,000 or more preferred plastic for small purchases, compared with 43 percent of those making $50,000 to $74,900, 32% of those earning $30,000 to $49,900 and only 23% percent of those making less than $30,000.

Politically, we’ve finally found something on which we all can agree. Thirty percent of Democrats and a nearly identical 28% of Republicans favor credit cards or debit cards rather than cash for small purchases. Interestingly, those describing themselves as politically independent also were more independent from cash, 40% of them prefer plastic for such transactions.

The casual use of plastic is moving steadily through age brackets and already has a firm grip not only on millennials, but also increasingly on Gen Xers. Crunched another way, the data show that if you’re 49 or younger, you’re almost as likely to pay for a $5 purchase with plastic as you are to pay with cash. Fifty two percent prefer cash, 46% prefer debit or credit cards. Now, if you’re 50 or older, you’re still somewhat unlikely to pay for a $5 purchase with plastic. Seventy seven percent still prefer cash, with 21% reaching for debit cards or credit cards. Those who graduated from or attended college are significantly more comfortable than others with using plastic for small purchases.

A combined 39% of those with college degrees prefer debit cards (21%) or credit cards (18%) over cash (59%). Only 16% of those who have not attended college usually use debit cards for purchases of less than $5, along with only 6 percent who prefer credit cards for that purpose.

The trend is clear. Regardless of some differences in magnitude based on demographic factors, plastic is replacing cash as the currency of choice even for small purchases. Plastic use will increase for small purchases, both for debit and credit cards.

Why the shift to cards There are many reasons:

Technological advancements at the point of sale have made it just as fast to pay by plastic as by cash. Rewards have become a common feature of credit cards, with two out of three credit cards offering rewards, encouraging rewards chasing. Debit cards, with their balances available instantly and online have largely replaced paper checks and tedious manual records.

Financial institutions have spent decades persuading consumers to use and merchants to accept cards universally. Small purchases represent particularly appropriate uses of a debit card, assuming you don’t get carried away and overdraw the card-linked bank account. Why keep going to the bank and then carry cash if you don’t have to? Moving away from cash and moving toward using cards for even small purchases is more convenient.

Debit cards are everywhere already, but because their use can’t be reported to the credit bureaus and thus, they don’t build credit, they should only be used as a matter of convenience. People who frequently use credit cards for small, casual purchases also could overdo it, but probably not to a great degree. It would take a lot of lattes to send someone into credit counseling or bankruptcy court. In truth, we like the idea of using credit cards frequently for small, manageable expenses. This gives users the benefit of an active credit history, but leaves them with monthly bills that are small enough to pay off in full, so they don’t have to pay any interest. It’s getting to the point where, if I’m out and about, I’m using plastic the whole time. It’s just so much easier.

Posted in Best Practices for Merchants Tagged with: account, bank, bank account, bankruptcy, bills, cards, cash, cellphone, credit, credit counseling, credit history, data, debit cards, financial, financial institutions, Merchant's, payment, transactions