September 28th, 2016 by Elma Jane

Business Lines of Credit – is for businesses with an inconsistent cash flow. Either businesses that needs to borrow a small amount of capital, and businesses that use invoices.

Different types of lines of credit:

Cash Account, the most basic line of credit – which you can access when you’re in need of capital; whether you’re making a large purchase or covering a temporary gap in cash flow. You only have to pay the interest on the amount that you borrow; with this form of financing, the money is always available when it’s needed.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

- First of all, you can purchase inventory wholesale.

- Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit. Furthermore, personal loans are term loans that can be used for a number of purposes.

If your business is new to qualify for a business loan, consider using a personal loan.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing call us at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance, Small Business Improvement Tagged with: cash advances, credit, financing, loans, merchant

June 13th, 2016 by Elma Jane

Lines of Credit – is for Businesses with an inconsistent cash flow, businesses that only need to borrow a small amount of capital, businesses that use invoices.

Different types of lines of credit:

Cash Account the most basic line of credit – which you can access when you’re in need of capital, whether to make a large purchase or cover a temporary gap in cash flow. This form of financing is that the money is always available when it’s needed, and you only have to pay interest on the amount that you borrow.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

First, you can purchase inventory wholesale.

Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit.

If your business is new to qualify for a business loan, consider using a personal loan. Personal loans are term loans that can be used for a number of purposes.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing give us a call at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance Tagged with: cash advances, credit, financing, loans, merchant

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

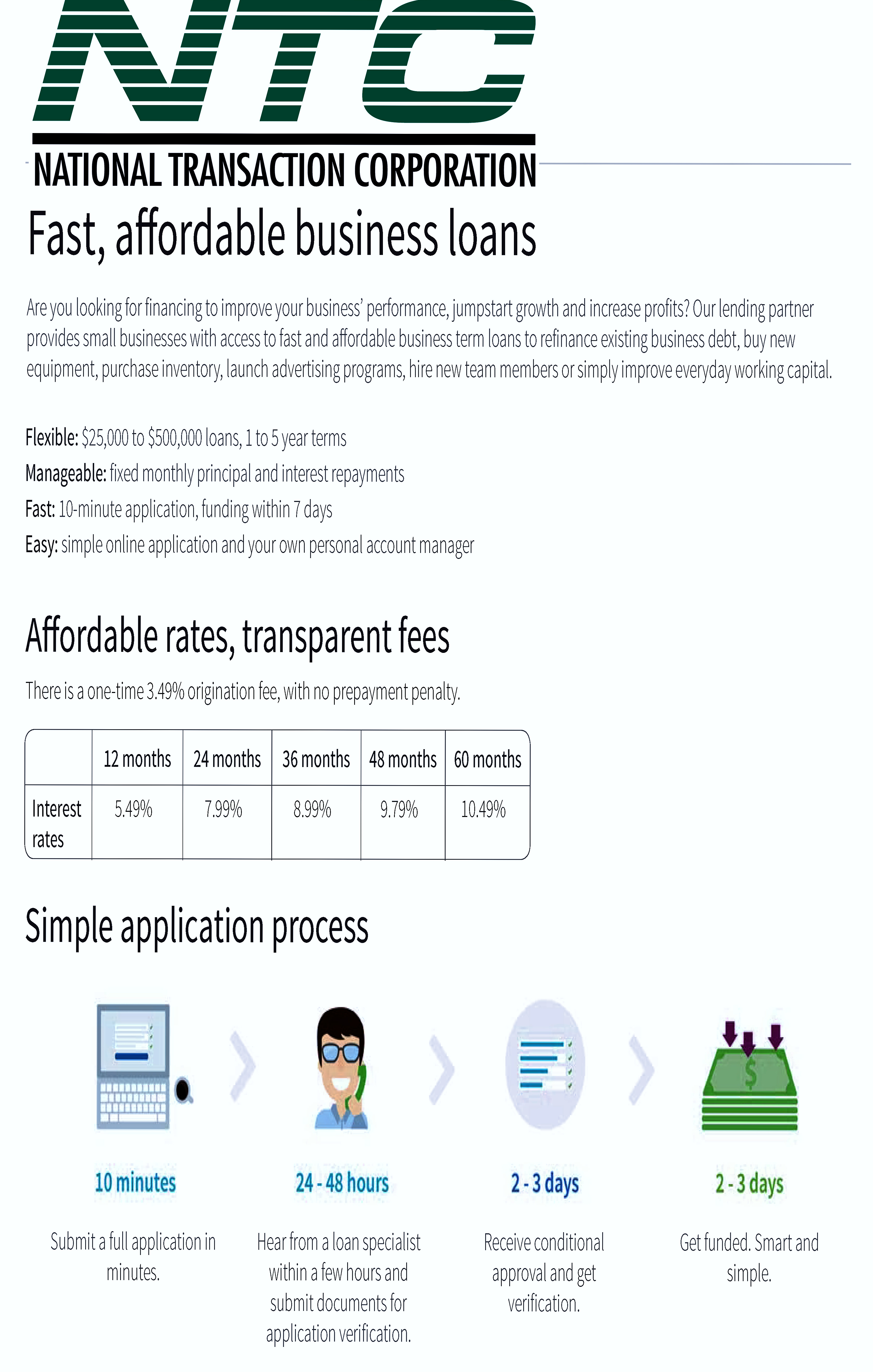

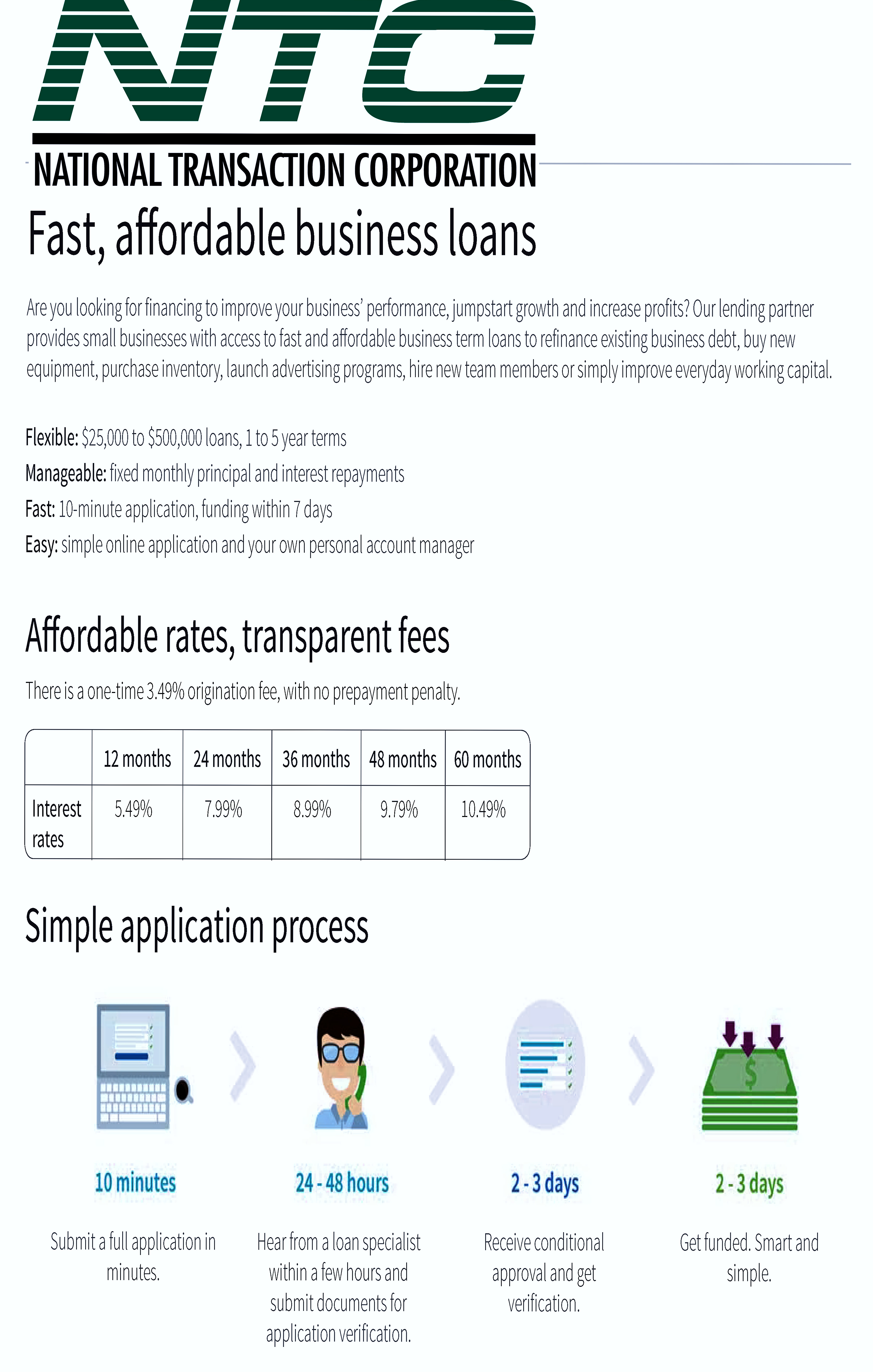

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service