February 10th, 2015 by Elma Jane

National Transaction Corporation and it’s medical software partners is introducing new “Payment Processing” solutions that can help your practice, securely and efficiently, capture payments and better serve patients. NTC offers a variety of solutions to accept patient payments/co-pays in the office, on the phone and online. With our solutions, you can make it more convenient for patients to pay via debit or credit card at the point of care to help drive more consistent cash flow. In addition we can help expedite receipt of claim payments using Medipaid, our new solution from NTC that replaces paper check payments you receive from insurance companies with fast, secure electronic deposits. Medipaid combines the convenience of electronic payments with standardized ERAs (electronic remittance advice) and automated posting options. It can help your practice accelerate cash flow and simplify reconciliation processes.

Here are some benefits when using this new and exciting program:

- Eligibility resolution

- Claims and tracking

- Rejections and denials

- Patient billing and payments

- Reporting and metrics

- Clinical tools

- 24/7 support

- Updated payer list information

- Payment Integrity/PCI compliant

- Tokenization & Encryption payment security (EMV microchip cards)

- Clinical exchange solutions

- HIPAA simplified

- E-payment (EFT & ERA)

- ICD-10 information on deadline set for October 1, 2015

- Regulation mandates from HIPAA and Affordable Care Act

If you are interested in learning more about our payment processing solution and Medipaid, we will be happy to e-mail additional information. Please feel free to contact us regarding any of your payment processing needs.

Contact Elaine Zamora RN @ 954-346-3300 Ext. 1111 or Email: elaine@nationaltransaction.com

Posted in Medical Healthcare, nationaltransaction.com Tagged with: cash flow, claim payments, credit-card, debit, electronic deposits, electronic payments, electronic remittance advice, insurance companies, paper check, payment processing, payments, solutions

May 19th, 2014 by Elma Jane

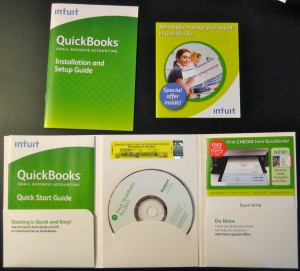

Keeping your business’s finances in order doesn’t have to take all day. Bookkeeping is a necessary for small business owners, but it’s a time-consuming chore.

If you use QuickBooks for payroll, inventory or keeping track of sales, there are several timesaving shortcuts you can utilize to make bookkeeping easier.

Time-saving tips for getting the most out of QuickBooks in the least amount of time. Help you spend more time building your business and less time using QuickBooks.

Download data whenever possible. Even after factoring in initial setup time, downloading banking and credit card activity directly into QuickBooks is a huge time saver. Doing this will minimize the chance of human error and enable you to record activity faster than if you did it manually.

Make the Find feature your friend. Using the Find feature is the most efficient way to locate a particular invoice in QuickBooks. Those who usually open the form and click Previous until the form appears on the screen know how tedious this process can be. The Find tool will search for almost any transaction-level data, depending on your filters.

Memorize transactions. QuickBooks has the capability to memorize recurring transactions (invoices, bills, checks, etc.) and set them for automatic posts daily, weekly, monthly, quarterly and annually, eliminating the need to enter the same transaction into the software every month.

Use accounts payable aging. Use this feature for a snapshot on who you owe money to and manage your cash flow more efficiently.

Use accounts-receivable aging. Use this feature for a snapshot of information on who owes you money, how much you are owed and how long the individual has owed you.

Use classes. Classes can be very helpful to track income and expenses by department, location, separate properties or other meaningful breakdowns of your business.

Use QuickBooks on the go with remote access. Remote-access methods include QuickBooks Online, desktop sharing and QuickBooks hosting on the cloud, which allows you to take the program on the go and make changes no matter where you are.

Posted in Best Practices for Merchants Tagged with: accounts, accounts payable, banking, banking and credit card, bills, Bookkeeping, card, cash flow, checks, cloud, credit, data, desktop, desktop sharing, finances, hosting, income and expenses, invoices, online, program, QuickBooks, Remote-access, software, transaction