September 29th, 2016 by Elma Jane

MerchantConnect is a great tool for merchants because it contains all the information that a merchant needs to manage their electronic payment activity. Furthermore, it’s fast, easy and secure!

- Merchant can either view or update account information and make changes.

- Find copies of statements.

- Furthermore find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants, Electronic Check Services, Electronic Payments Tagged with: bank, card, chargeback, electronic payment, merchants, payments, risk, terminal, transactions

August 25th, 2016 by Elma Jane

Chargeback bumps still not clear, yet some says consumers are taking advantage of the chargeback system, while others think this increase is due to EMV implementation. Same as other countries experienced.

Whatever the reason, these chargebacks are causing stir in the payments industry.

Merchants should know two facts because of the tide in chargebacks:

- Merchants should not be accountable for chargebacks on valid, non-fraudulent cards without chips.

- Additionally, merchants who do not have EMV terminals are at a higher risk for fraud.

- The merchant is held responsible not the bank if fraud is involved as a result of card swipe.

There are a few things that merchants can do to prevent chargebacks.

- Always swipe non-chip cards rather doing it manually.

- Ask for a signature and verify each transaction.

- Be on the lookout for fraudulent cards.

- EMV chip card should not be swipe or manually keyed in.

- Follow chip card processing procedures, insert them correctly and guide your customers through the chip transaction process.

- If the chip card payment fails, ask for an alternate form of payment. Most of all do not override or swipe the chip card.

- If you have to manually enter a card number, use the security code, check the expiration date and further more take an imprint.

Better be equipped to stop chargebacks by adopting few changes in your business before they happen. If your business is not yet EMV compliant, give us a call at 888-996-2273 or visit us at www.nationaltransction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: chargeback, EMV, fraud, merchants, payments, terminals

July 21st, 2016 by Elma Jane

Always ask for the card security codes:

CVV2 for Visa

CVC2 for MasterCard

CID for Discover and American Express.

Always use the Address Verification Service (AVS) and only process sales after receiving a positive AVS response.

Avoid using voice authorizations, unless absolutely necessary.

Billing descriptor must set up properly and shows your phone number. Customer can contact you directly if there is an issue,

Consider using the associations’ 3-D secure services:

Verified By Visa

SecureCode by MasterCard

A 3-D transaction confirmation proves card ownership and protects you from certain types of chargeback. An additional layer of security for online credit and debit card transactions.

Inform your customers by email when a refund has been issued or a membership service cancelled. Notify them of the date the refund was processed and provide a reference number.

Make available customer support phone number and email address on your website so that customers can contact you directly. You need to meet this requirement before opening a merchant account.

Make it easy for your customers to discontinue a recurring plan, membership or subscription. Have a no-questions-asked policy.

Notify your customers by email of each transaction and indicate that their cards will be charged.

Obtain a confirmation of delivery for each shipment.

Process refunds as quickly as possible.

Secure an authorization approval for every transaction.

Secure customers’ written or electronic signatures, for recurring payments or monthly fees. Giving you express permission to charge their cards on a regular basis.

Terms and conditions must be clearly stated on your website. Customers must acknowledge acceptance by clicking on an Agree or a similar affirmative button.

Transaction amount must never exceed the authorized amount.

You are required to reauthorize the transaction before settling it if an authorization approval is more than seven days old.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Merchant Services Account Tagged with: card, chargeback, credit, customer, debit, merchant, merchant account, online, sales, Security, service, transaction

June 14th, 2016 by Elma Jane

Getting a merchant account is an important step for any business that sells services. Helping merchant to understand the underwriting process and some of the key things that are reviewed, in order to get approved.

Billing policy – Does the business bill in advance or after products or services are rendered? Businesses that bill too far in advance are at greater risk for a chargeback.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip, you’ll need to reimburse your customers.

Business type – Some business types are riskier. Industries with vague products or services are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback might be issued by the cardholder when they feel that the merchant does not fulfil the product or service being rendered as agreed.

Owner / signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – Are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting, it speaks for their legitimacy. They are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants Tagged with: business, cardholder, chargeback, customers, financial, Industries, merchant account, products, services, travel, travel agency

May 9th, 2016 by Elma Jane

Preventing double refunds depend on the timing of the chargeback. It is a bit challenging, the key lies in attention to detail.

A chargeback may already exist for the transaction when a customer say they just spoke to their bank. Merchants must pay attention to this big clue.

There are different time limits for resolving disputes before they become actual chargebacks, depending on the issuing bank.

- If customers indicate they did contact their bank, merchants need to call the issuing bank to determine if a case number has been assigned to the transaction dispute.

- If there is a case number that has been assigned, the merchant can disregard the refund request.

If a case number has not been assigned, merchants need to inform the bank that a refund has been initiated and a chargeback is not necessary.

Preventing Double Refunds Before Chargebacks are Filed

Provide prompt refunds to customers when they are warranted.

- Estimate when the funds will be available.

- Let customers know that a refund has been issued.

- Take care to ensure the credit isn’t process as a debit.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, credit, customer, debit, merchants, refunds, transaction

May 3rd, 2016 by Elma Jane

MerchantConnet is a great tool for merchants, it contains all the information that a merchant needs to manage their electronic payment activity. It’s fast, easy and secure!

- Merchant can view or update account information and make changes.

- Find copies of statements.

- Find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History.

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal.

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, card, chargeback, merchants, payment, terminal, transactions

April 25th, 2016 by Elma Jane

There are a lot more details of what makes up a credit card rate, this information is a good start to know more about a merchant account. All merchant accounts are subject to the same costs with respect to interchange fees and assessments.

Most rates are made up of three parts:

Assessments – are paid directly to card network associations (Visa, MasterCard, Amex, etc.)

Interchange – are paid to the issuing bank that issued the card, and is typically made up of a flat rate.

Card present transactions (the card is physically present or swiped) are typically lower than card-not-present transactions (the card is keyed-In like e-commerce and mail-order transactions).

Card-not-present transactions have higher interchange rates because they are riskier.

Processor fees – the fees involved with providing the service, risk assessments, the type and size of the transaction. This includes the margin between the total rate and the two previous parts, along with other fees, like chargeback or statement fees.

Posted in Best Practices for Merchants, Credit card Processing, Travel Agency Agents Tagged with: bank, card, card network, chargeback, credit card, merchant account, rate, transaction

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

March 9th, 2016 by Elma Jane

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

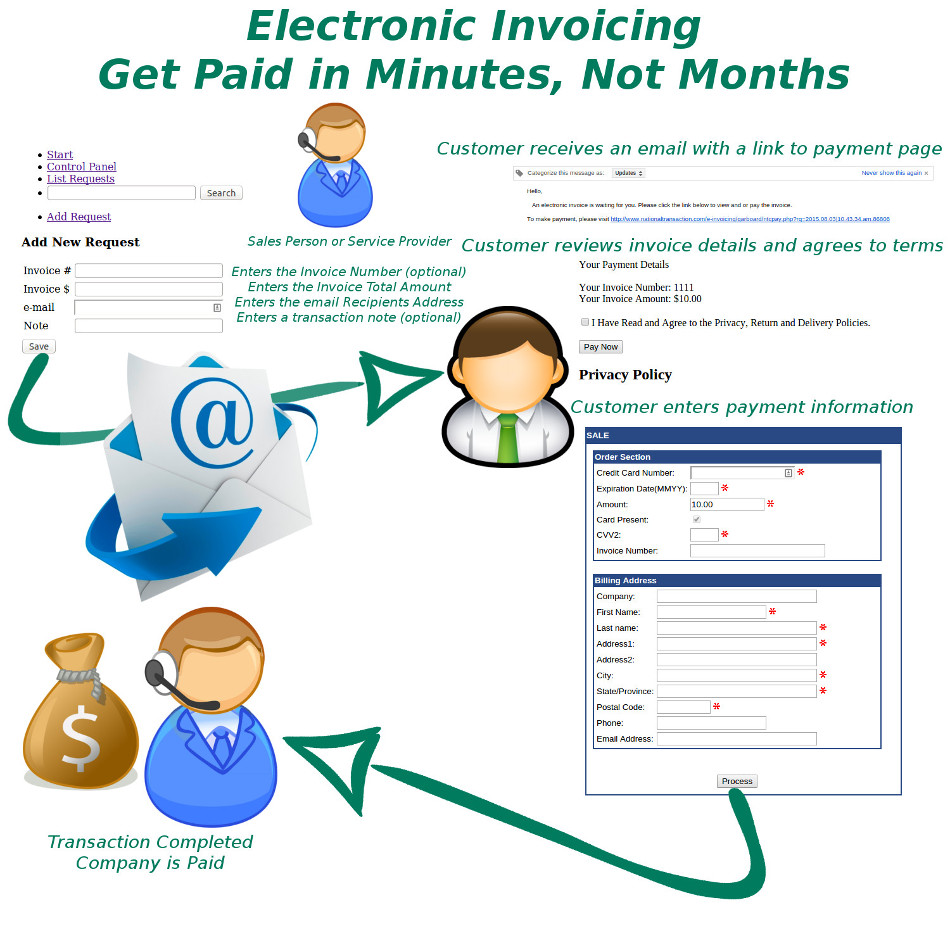

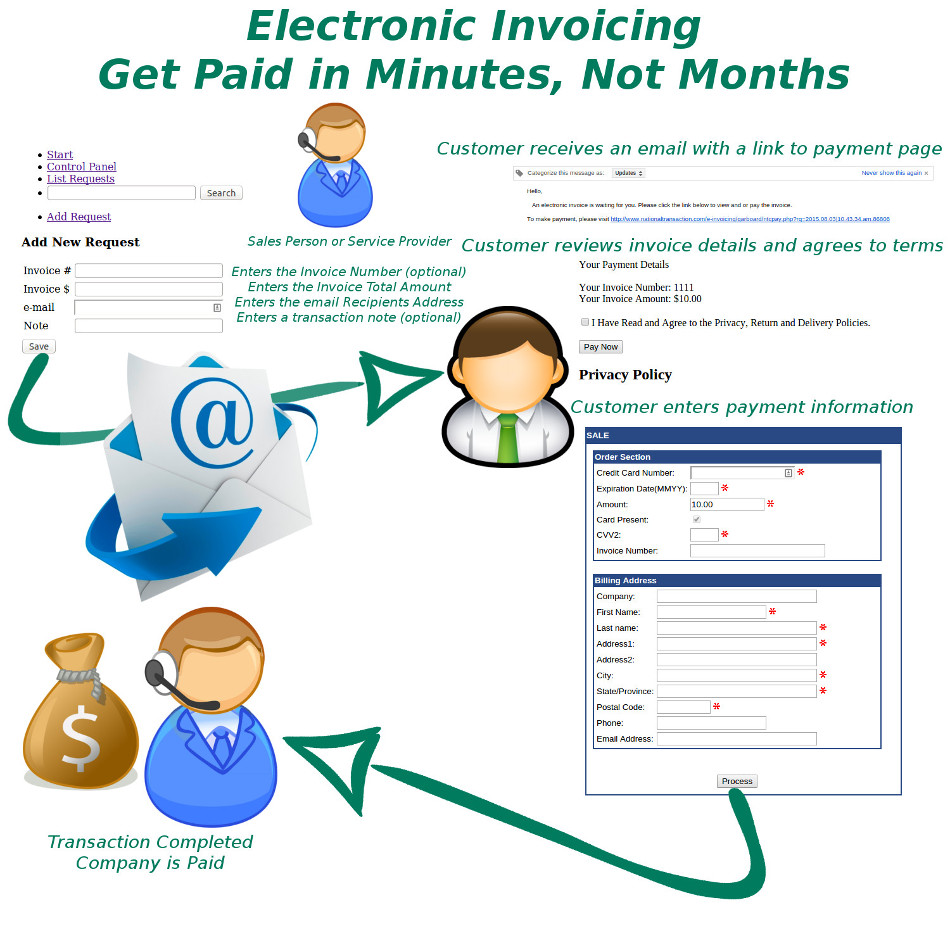

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

September 16th, 2014 by Elma Jane

Card-not-present merchants are battling increasingly frequent friendly fraud. That type of fraud..The I don’t recognize or I didn’t do it dispute. This occurs when a cardholder makes a purchase, receives the goods or services and initiates a chargeback on the order claiming he or she did not authorize the transaction.

This problem can potentially cripple merchants because of the legitimate nature of the transactions, making it difficult to prove the cardholder is being dishonest. The issuer typically sides with the cardholder, leaving merchants with the cost of goods or services rendered as well as chargeback fees and the time and resources wasted on fighting the chargeback.

Visa recently changed the rules and expanded the scope of what is considered compelling evidence for disputing and representing chargeback for this reason code. The changes included allowing additional types of evidence, added chargeback reason codes and a requirement that issuers attempt to contact the cardholder when a merchant provides compelling evidence.

The changes give acquirers and merchants additional opportunities to resolve disputes. They also mean that cardholders have a better chance to resolve a dispute with the information provided by the merchant. Finally, they provide issuers with clarity on when a dispute should go to pre-arbitration as opposed to arbitration.

Visa has also made other changes to ease the burden on merchants, including allowing merchants to provide compelling evidence to support the position that the charge was not fraudulent, and requiring issuers to a pre-arbitration notice before proceeding to arbitration, which reduces the risk to the merchant when representing fraud reason codes.

The new “Compelling Evidence” rule change does not remedy chargebacks but brings important changes for both issuers and merchants. Merchants can provide information in an attempt to prove the cardholder received goods or services, or participated in or benefited from the transaction. Issuers must initiate pre-arbitration before filing for arbitration. That gives merchants an opportunity to accept liability before incurring arbitration costs, and Visa will be using information from compelling evidence disputes to revise policies and improve the chargeback process

Visa made those changes to reduce the required documentation and streamline the dispute resolution process. While the changes benefit merchants, acquirers and issuers, merchants in particular will benefit with the retrieval request elimination, a simplified dispute resolution process, and reduced time, resources and costs related to the back-office and fraud management. The flexibility in the new rules and the elimination of chargebacks from cards that were electronically read and followed correct acceptance procedures will simplify the process and reduce costs.

Sometimes, an efficient process for total chargeback management requires expertise or in-depth intelligence that may not be available in-house. The rules surrounding chargeback dispute resolution are numerous and ever-changing, and many merchants simply do not have the staffing to keep up in a cost-effective and efficient way. Chargebacks are a way of life for CNP merchants; however, by working with a respected third-party vendor, they can maximize their options without breaking the bank.

Reason Code 83 (Fraud Card-Not-Present) occurs when an issuer receives a complaint from the cardholder related to a CNP transaction. The cardholder claims he or she did not authorize the transaction or that the order was charged to a fictitious account number without approval.

The newest changes to Reason Code 83, a chargeback management protocol, offer merchants a streamlined approach to fighting chargebacks and will ultimately reduce back-office handling and fraud management costs. Independent sales organizations and sales agents who understand chargeback reason codes and their effect on chargeback rates can teach merchants how to prevent chargebacks before they become an issue and successfully represent those that they can’t prevent.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, account number, acquirers, agents, Back Office, card, card holder, card-not-present, Card-not-present merchants, cardholder, cards, chargeback, chargeback fees, chargeback rates, cnp, CNP merchants, CNP transaction, fees, fraud, fraud management, Independent sales, independent sales organizations, issuer, management protocol, Merchant's, organizations, protocol, purchase, Rates, resolution, resolution process, resources, risk, sales agents, services, transaction, visa