September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

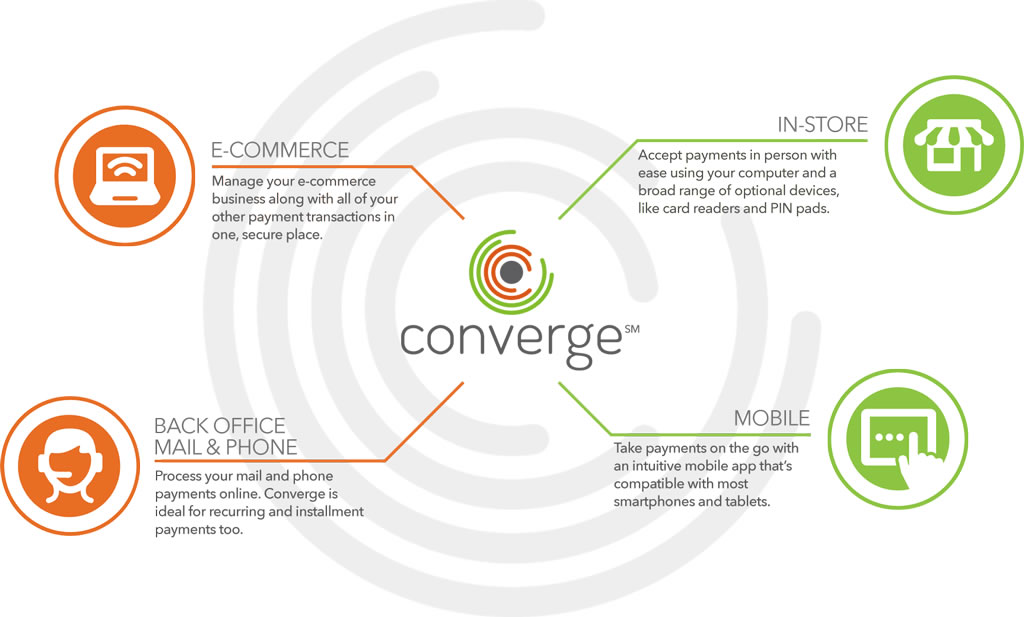

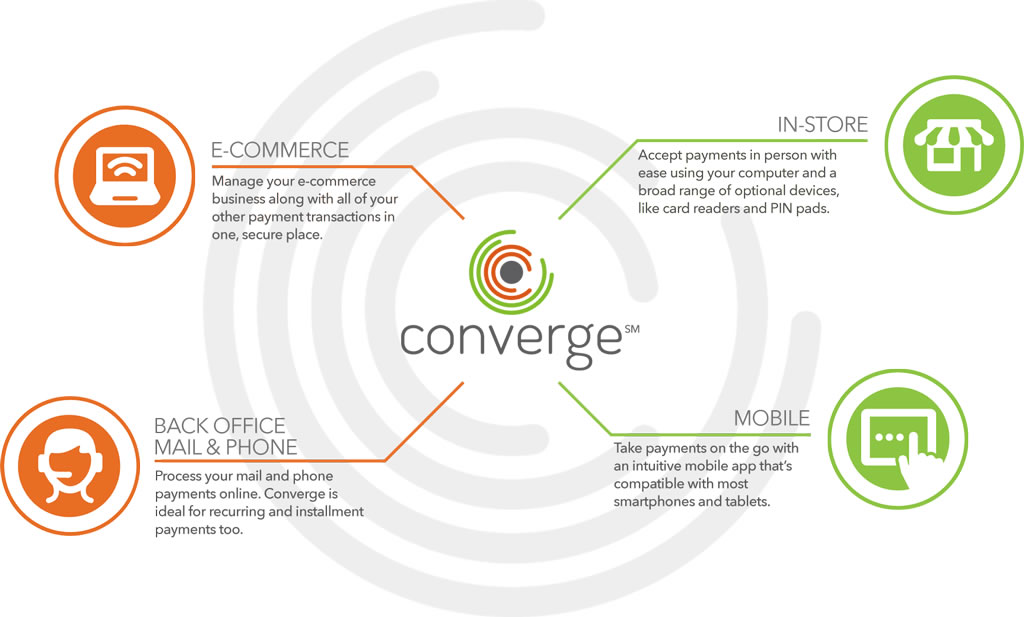

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

April 7th, 2016 by Elma Jane

The EMV technology does improve security because EMV cards are more difficult to counterfeit. Since U.S. is using chip-and-signature cards not the one requiring a PIN, anybody can use an EMV chip card whether it might be a lost or a stolen card. EMV chips will not prevent the data breach from occurring, but it will make it harder for criminals to successfully profit from what they steal.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: cards, chip card, data, EMV, PIN, Security

January 28th, 2016 by Elma Jane

The shift to EMV is helping to address vulnerabilities in the United States payments ecosystem. It has been shown that EMV can deliver benefits as a part of industry efforts to combat fraud.

EMV migration is a critical focus for enhancing payments security, which is why the current efforts around chip card deployment are greatly beneficial for consumers and merchants alike. EMV technology helps to reduce counterfeit card fraud, as it generates dynamic data with each payment to authenticate the card, after which the cardholder is prompted to sign or enter a PIN to confirm their identity.

The EMV rollout represents a dynamic time for card payments that promises great advances, among them is enhanced security for cardholders. It also presents an opportunity to consider other innovations such as mobile wallets and mobile POS to further engage your customers and drive customer loyalty. When merchants continue to invest in EMV and NFC (near field communications, used for tap-and-pay transactions), the purchases made at their EMV-enabled terminals are made more secure than magnetic stripe.

New mobile payment options such as mobile wallets support EMV and therefore offer this added layer of security. Ultimately, by enabling contactless payments, merchants can also enable more flexibility in addition to increasing security for their customers.

Additionally, industry players are backing major mobile wallets, such as Android Pay, Apple Pay, and Samsung Pay.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card, cardholder, chip card, consumers, contactless payments, customers, data, EMV, fraud, magnetic stripe, merchants, mobile, mobile payment, mobile wallets, near field communications, nfc, payments, PIN, POS, Security, terminals, transactions

January 25th, 2016 by Elma Jane

New Timeframes for Electronic Gift Card Orders

Please be aware that NTC’s Electronic Gift Card (EGC) Design & Artwork team has upgraded their printers. The new timeframes for both FanFare and EGC (Givex) gift card shipments during non-peak times are the following:

- Standard Card Orders: 8 Business days, plus 2 Day Delivery

- Custom Card Orders: 12 Business days, plus 2 Day Delivery

Converge Mobile: Frequently Asked Questions

Will there be more EMV chip card readers in the future? Yes! Additional devices ranging in price points and feature/functionality will be introduced throughout 2016.

Do VirtualMerchant Mobile login credentials work with Converge Mobile?Yes! The mobile login credentials that customers use today for VirtualMerchant Mobile are the same for Converge Mobile.

Is the talech iCMP the same as the one sold for Converge and Converge Mobile? No! Please use item code CICMP for devices that will be used with Converge and/or Converge Mobile. Otherwise, there is device reconfiguration work that has to take place resulting in a negative customer experience.

UPCOMING EVENTS

April 19-21 May 2-4

TRANSACT 16 (ETA) Southeast Acquirers Association (SEAA)

INDUSTRY LINKS

|

|

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: card, chip card, Electronic gift card, EMV, gift Card, merchant, mobile, payment, payment technology, processor, travel, travel industry

October 19th, 2015 by Elma Jane

Small merchants don’t consider themselves at risk for a cyberattack. But Cybercriminals thrive on data about employees, customers, bank accounts and many other types of information any small business would carry, with fewer resources than large firms, small businesses are especially at risk for attacks.

Here are Steps to find out to make your business more cybersecure:

Employ best practices on payment cards – Credit card companies are now shifting from magnetic-strip payment cards to safer, more secure chip card EMV Technology. Are you ready for the shift? Now is the time, you should work with your banks and processors to ensure you’re using the most trusted and validated anti-fraud services. You may also have additional security obligations pursuant to agreements with your bank or processor. You should isolate payment systems from other, less secure programs and don’t use the same computer to process payments and surf the Internet.

Educate employees about cyberthreats – Educate your employers about online threats and how to protect your organization’s data, including safe use of social networking sites.

Protect against viruses, spyware, and other malicious code – Make sure all of your organization’s computers are equipped with antivirus software and antispyware and update regularly. Such software is readily available online from a variety of vendors. All software vendors regularly provide patches and updates to their products to correct security problems and improve functionality. Configure all software to install such updates automatically.

Require employees to use strong passwords and to change them often – Consider implementing multifactor authentication that requires additional information beyond a password to gain entry. Check with your vendors that handle sensitive data, especially financial institutions, to see if they offer multifactor authentication for your account.

Secure your networks – Safeguard your Internet connection by using a firewall and encrypting information. If you have a Wi-Fi network, make sure it is secure and hidden. To hide your Wi-Fi network, set up your wireless access point or router so it does not broadcast the network name, known as the Service Set Identifier (SSID). Password protect access to the router.

No one can guarantee your safety from a cyberattack, appropriate planning makes a big difference. By using these tips and resources, you can help promote the safety of your employees, customers, and the future success of your small business.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: bank accounts, banks, chip card, credit card, data, EMV, magnetic strip, merchants, payment cards, payment systems, processors

October 16th, 2015 by Elma Jane

U.S. customers with the Ingenico iSC250 may now process EMV chip card transactions for Visa, MasterCard, American Express and Discover, (as well as mag stripe and contactless, including mobile wallet payments). For customers using the Ingenico iSC250, please make sure you have downloaded the latest version of ConvergeConnect and enabled EMV chip cards in Converge. Go to the Converge login page to download the software update or start the update process from their Windows system tray. If you do not have the Ingenico iSC250 but want to upgrade to process chip card transactions, give us a call at 888-996-2273 for more information.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: chip card, EMV, mag stripe

September 14th, 2015 by Elma Jane

The security rules for fraud liability of credit and debit cards will change in the United States, starting October 1, 2015.

The new security rules would prompt major plastic card brands like MasterCard and Visa to upgrade their magnetic stripe based cards to more modern and secure chip technology based cards.

Credit and debit card fraud amount in the U.S. reached around $11.27 billion, in 2012.

With the new rules, any financial institution and payment processing merchant who would not upgrade their cards to chip technology would be held responsible for any committed fraud with their cards instead of their customers. This new rule would effectively transfer the liability in case of a fraud from the consumer to the least secure card provider. The rule specifically says that liability will fall on the bank or retailer with the least secure technology.

If the bank has not given you a new chip card, and you use your magnetic swipe card and there’s resulting fraud, the bank will be responsible for that.

All merchants who do not offer payment terminals that support chip based cards would be held liable for any fraud committed on their premises as well, from October 1. The new rules say that if the card is chip based and the merchants fail to offer a chip based terminal, and a fraud is committed, they would be held liable instead of the card holder.

With chip based cards, the customer would need to insert their card inside a chip enabled payment terminal while making a purchase. Then, they need to confirm the amount and enter a private pin to verify their identity. The customer would also sign for the purchase like using a regular magnetic card.

Besides MasterCard, Visa has already rolled out the new chip based terminals in the U.S. under its Zero Liability Policy.

The chip based cards are more secure compared to the old magnetic technology. That is one of the reasons why the new rules are promoting the chip based technology over the 55 years old magnetic cards.

Not all merchants have to replace their old magnetic terminals and it is still an optional decision, but industry analysts think that the shift of liability in case of fraud from consumers to financial institutions and merchants would likely prompt them to start using chip based technology.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank, card holder, card provider, chip card, debit cards, magnetic swipe, magnetic terminals, merchants, payment processing, payment terminals

August 13th, 2015 by Elma Jane

The credit card processing industry, have been working towards including EMV technology in all of the point of sale systems.

Many processors have sent out EMV capable devices that will need to be adjusted before they can start accepting EMV card transactions.

See which category you fall into so you are prepared when October 1 rolls around.

First, check and see if your credit card machine has the slot to accept EMV cards (it’s either a slot in front, or on the top of, the unit). If you don’t, you need to contact your processors or sales agent to update your equipment .

If you do have the slot for EMV cards, you’ll need to contact National Transaction to see if your EMV capable machine has been enabled to accept EMV cards.

What is the difference between EMV capable and EMV enabled?

- EMV Capable – EMV capable means that your credit card machine is equipped with the hardware (i.e. the slot) and has the capability to do a transaction, but first you’ll have to update the application to enable you to process the cards. At National Transaction, we have a support specialist to assist you with step-by-step instructions to switch your credit card Point-of-Sale System, from EMV capable to EMV enabled.

- EMV Enabled – When your machine is EMV enabled, your terminal is ready to accept EMV transactions. According to MasterCard, 73 percent of consumers say owning a chip card would encourage them to use their card more often. In addition, 75 percent of consumers expect to use their chip card at the merchants where they shop today. Keeping these numbers in mind, it only makes sense to equip your business with an EMV enabled credit card POS system.

What makes EMV technology so important?

EMV is a global payment system that adds a microprocessor chip into credit cards and debit cards, and reduces the chance a transaction is being made with a stolen or copied credit card. Unlike traditional magnetic-stripe cards, anytime you use an EMV card, the chip in the card creates a unique transaction sequence that can’t be replicated. Because the number will never be valid again, it makes it hard for hackers to fake these cards. If they attempt to use the copied EMV card, the transaction would be denied.

The rollout of EMV technology is ongoing, but even with the October 1 deadline, it’s estimated that only 70 percent of credit cards and 40 percent of debit cards in the U.S. will support EMV. Despite these numbers, that doesn’t mean you shouldn’t update your equipment.

Following the deadline, card present fraud liability will shift to whoever is the least EMV compliant party in a fraudulent transaction.

Make sure that’s not you!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: card present, card transactions, chip, chip card, credit card, credit card processing, debit cards, EMV, EMV capable, EMV enabled, emv technology, magnetic stripe cards, merchants, payment system, point of sale, POS, processors, terminal