February 6th, 2017 by Elma Jane

Managing Chargeback:

Chargeback – a forcible reversal of funds due to a credit card holder’s dispute of the transaction. Chargebacks can be a huge headache for a business owner, it can affect a business’ ability to maintain a credit card processing account and put funds on hold.

How can you protect your business and maintain a good processing account? First, you need to know the basic chargeback types:

- Clerical – duplicate billing, incorrect amount billed or refund never issued.

- Fraud – consumer claims they did not authorize the purchase or claims identity theft. Fraud disputes can be more complicated since they are the result of fraudulent consumer purchases.

- Quality – consumer claims to have never received the goods as promised at the time of purchase.

- Technical – expired authorization, non-sufficient funds or bank processing error.

Managing chargebacks is an important piece and it can certainly be reduced, to save your business, time, money and reputation.

For Electronic Payments Set up call now 888-996-2273 or visit www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants Tagged with: bank, chargeback, consumer, credit card, fraud, funds, processing account, refund, transaction

January 20th, 2017 by Elma Jane

Qualified vs Non-Qualified credit card rates

The most common forms of rate structures for credit card rates are:

2-Tiered: Qualified and Non-Qualified

3-Tiered: Qualified, Mid-qualified, or Non-qualified

Each and every transaction you accept is classified into one of the above and is the basis for the credit card rate you see on your statement.

As a general rule, qualified transactions are going to be “standard” cards; without any consumer or corporate rewards associated with them. Accepted in the “standard” method expressed in your merchant processing agreement, this is where Card-Not-Present (CNP) setup comes into play.

Mid and Non-Qualified transactions include:

Rewards cards, keyed-in payments (for swipe accounts), AVS (Address Verification Service) does not match or is not performed, not all required fields are entered, or the payment was entered in a late batch. Ex. the payment was sent to the processor 48 hours or more past the time of the authorization.

Posted in Uncategorized Tagged with: card-not-present, consumer, credit card, merchant, payment, processor, transaction

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

May 9th, 2016 by Elma Jane

Double refunds are when a customer is provided with two refunds for the same transaction. Chargebacks can be involved in a double refund.

Double Refunds Happen When:

Chargebacks are filed after a refund is issued. The consumer contacts the merchant and requests a refund, but the funds aren’t returned immediately. The consumer thinks the request for the refund was ignored and files a chargeback. Then both the chargeback and the refund are being processed.

Chargebacks are filed before a refund is issued. The consumer calls the bank and initiates a chargeback. Then, the consumer calls the merchant and expresses dissatisfaction. To try to avoid a chargeback, the merchant provides a refund. However, the merchant has no idea of the fact that a chargeback has already been filed because the consumer calls the bank first

Even thou a merchant provided a refund with a customer that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

Just because a merchant provided a customer with a refund that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

It is possible for the customer to receive a double refund for the one purchase transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, consumer, customer, merchant, refunds, transaction

April 20th, 2016 by Elma Jane

ECS: An Electronic Mode Of Funds Transfer From One Bank Account To Another

- Paper check conversion

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- Image

ACH E-CHECK: Uses Bank Routing and Account Number In a CNP Environment.

- Card-Not-Present e-Processing of ACH Debit

- Known Relationship B/Consumer and Business

- NOT for Ecommerce “Sale of Goods and Services”

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- No Image

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: account, ACS, bank, card-not-present, cnp, consumer, debit, ecommerce, ECS, merchant, risk, services

April 11th, 2016 by Elma Jane

Card-not-present fraud is projected to worsen. However, 3D secure technology has made progress and is gaining more and more adoption.

How can e-Commerce merchants avoid CNP fraud?

Here are other ways to make card-not-present transaction safe:

Biometrics – Using Fingerprint Scans and Facial Recognition or Selfie. To validate the identity of the consumer.

Challenge Questions – Such as listing your father’s middle name or a fact known only to the consumer is an effectively added layer of security.

Location Data – Another way to fight against fraud is location data and the use of IP addresses to certify the location and identity of the consumer making the transaction.

Outsource Your Payment Platform – Payments pages hosted by a reputable payment service provider are much more secure.

One-time Passwords – During the checkout process, there will be a window to enter a one-time password which the consumer receives a text message on his/her mobile phone. The consumer enters the password within a short time frame to authenticate the transaction. This solution is especially effective against cyber criminals who steal credentials.

For your payment services needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: 3D Secure, biometrics, card-not-present, cnp, consumer, data, e-commerce, fraud, merchants, payment, Security, service provider, technology, transaction

March 9th, 2016 by Elma Jane

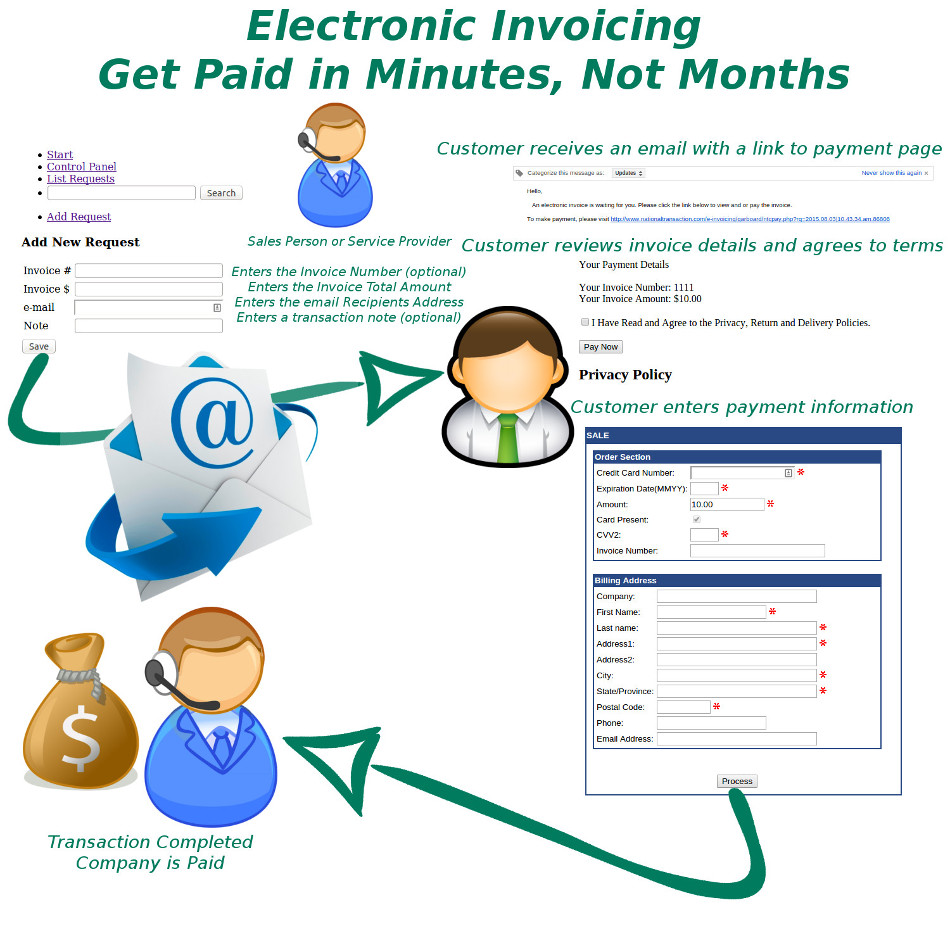

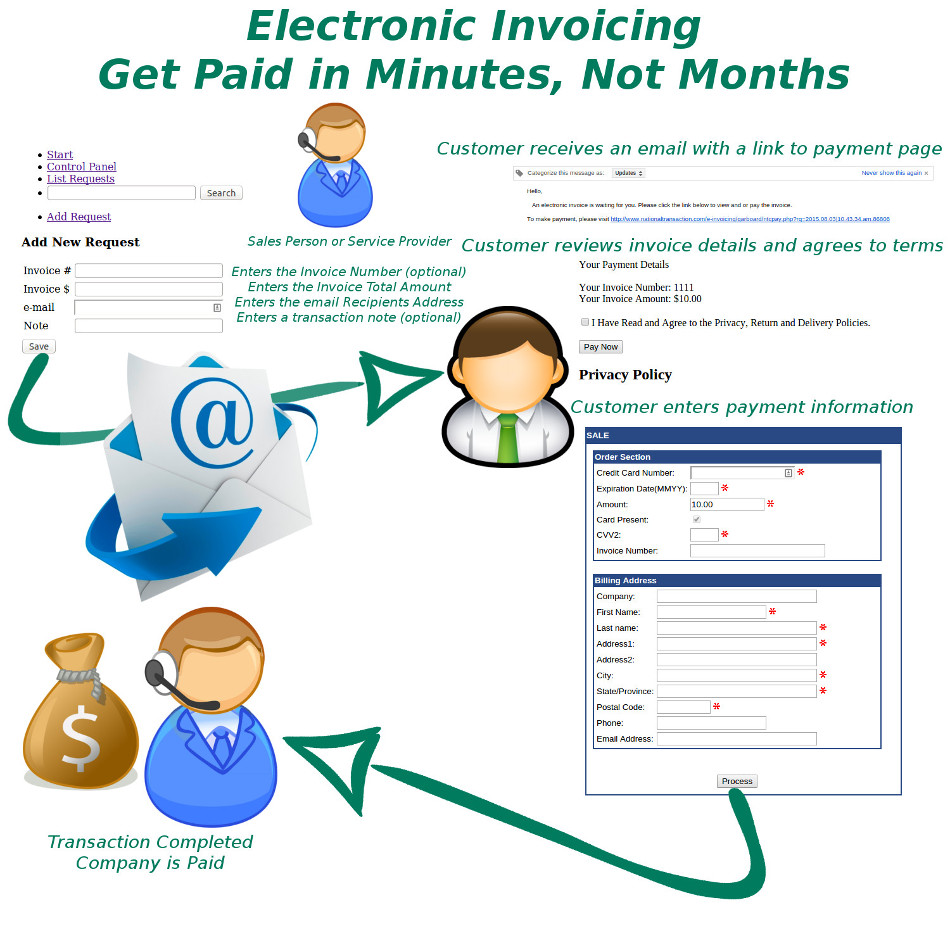

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

February 11th, 2016 by Elma Jane

E-commerce is a virtual platform, where we can get products and services and make payments through the internet.

E-commerce trend is constantly changing, it is necessary for a merchant to watch out for the upcoming Trends in this industry for a business to success.

To help boost your conversion rates here are the trends to be followed:

Contextual Commerce – The next big thing in payments and e-commerce. Providing complete description with images and videos to help your customer decide to purchase a product. Customization is an important factor as well to convince about the products or services.

Fast Delivery Shipping – Customer wants to receive the products after purchasing as soon as possible. So Reliable, Timely shipping means a lot.

Mobile Shopping – getting your online store ready for mobile shoppers is not an optional feature, it’s a mandatory part of a strategy.

Multiple Channels For Shopping – optimization is a great experience for shoppers. Having online store presence in different technology gadgets is a must.

Real Time Analytics – analyzing consumer behavior based on data entered into a system less than one minute before the actual time of use. Finds out why a customer leaves the store and prevents customer loss.

Virtual Sales Force – Hiring virtual salesforce, utilizing pop-ups and live chat who will help customers which are similar in a physical store.

Step ahead out of the conventional methods and adapt prevailing trends by embracing innovation so you can offer something new to your customer.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: business, consumer, customer, data, e-commerce, internet, merchant, mobile, online, payments

Biometrics Market To Reach $14.9 Billion by 2024

The Biometrics market currently sits at $2 billion, by 2024, it will reach $14.9 billion, with a cumulative total revenue of $67.8 billion. This is being driven by new advancements in Biometrics Hardware and Software that are not only transforming payments, but also serving as frictionless alternatives to security in a myriad of use cases.

For consumer facing security, Biometrics can be deployed at a low price-point for high-volume authentication. Think an iris scan or finger swipe for quickly unlocking a mobile device like an iPhone 6 or Samsung Galaxy S6.

The forecast goes over use cases that spans from Point-of-Sale transactions, to voter identification, making the case for Biometrics embedding itself into a vast number of aspects in everyday life.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: biometrics, consumer, device, mobile, mobile device, payments, point of sale, Security, swipe, transactions

January 26th, 2015 by Elma Jane

Accept Electronic Payments in Their Currency,

Convert it to Yours

DCC or Dynamic Currency Conversion is a system where the Visa or MasterCard holder in a foreign country can shop on an American based web site that displays prices in their own local currency. The web site can offer multiple choices as to which country the shopper is based in and the shopper can be immediately familiar with the pricing of goods and services.

Exchange rates are in constant flux. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. Even if the shopper does not choose the correct currency, at the time the card information is presented, the system automatically recognizes that the card is foreign and applies the appropriate currency and exchange rate.

At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied. In today’s global business environment, this level of convenience to the customer insures they are comfortable with the transaction from shopping cart to the door. Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line.

On the merchant end, all transactions are settled in $USD. Reporting mechanisms can display the consumers pricing and the exchange rate they paid for analysis and cost reduction.

Currency Conversion

- Accept currencies from other nations.

- Convert funds to US Dollars.

- Set prices in local currency to avoid confusion or calculation.

- Works with e-commerce as well as Mail Order / Phone Order.

- Ease the sales process for your customers.

- Increase customer familiarity.

- Immediately convert currency to avoid value gaps.

Posted in Best Practices for Merchants, Electronic Payments Tagged with: Bank Reference Table, Card Recognition Table, consumer, conversion rate, currency, customer, Dynamic Currency Conversion, e-commerce, electronic payments, exchange rate, invoice, MasterCard, Merchant's, receipt, shopping cart, transactions, visa