September 22nd, 2014 by Elma Jane

Consumers know how hard it is to obtain a credit card, if your credit score isn’t up to par. A bad credit score can prevent you from getting credit and make it hard to purchase your day to day necessities. People with poor credit don’t know their options. There are a number of ways to get a credit card if you have a poor credit score. There will likely be road blocks and limitations in your search. You won’t have the same options available as someone with pristine credit. But you will be able to get a line of credit if you look in the right place.

COSIGNED CREDIT CARDS If you get a cosigner, you will be able to obtain a card that would not be available to you otherwise. The cosigner has to have good credit, and they are responsible for your debt if you can’t pay. Make sure your cosigner fully recognizes their obligations and what will happen if you are unable to pay.

GIVE AN EXPLANATION FOR POOR CREDIT Explain the circumstances behind your poor credit. You can add a 100-word statement to your credit report such as the loss of a job. If you can tell your story and convince creditors you are on the road to increasing your credit score, they may believe you are more likely to pay back your debts. Divorce and illness are two other instances where individuals may see a drop in their credit score. Make sure whatever you list is true.

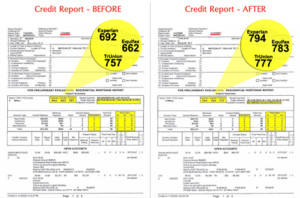

IMPROVE YOUR CREDIT One of the most difficult options. Poor credit can seem extremely hard to repair. But there are choices, it is just a process that will take a significant period of time. If you have poor credit, you can open bank accounts and pay off your loans and credit cards on time. If you pay off your debt in a timely manner, your credit score will improve over time and you will gain access to more credit card options.

RETAIL STORE CARDS Retail stores often have store credit cards they offer customers. Retail stores are generally more willing to approve applicants without a stellar credit score. But these cards usually come with extremely high interest rates and relatively low credit limits, so make sure you fully understand the terms of the card before applying.

SECURED CREDIT CARDS You deposit some money into an account, and then a creditor will provide you with a line of credit equal to your deposit. It is essentially a down payment, and if you don’t pay your credit card bill, your creditor is entitled to the money in the account. This might not sound like a favorable position, but remember that secured credit cards can be used as a valuable tool to rebuild your credit. Make sure the card you apply for reports to a credit reporting agency. This will help you start building a credit history. SELECT A CREDIT

CARD DESIGNED FOR THOSE WITH POOR CREDIT There are a number of credit cards offered by Visa and MasterCard designed for people with poor credit. These cards have low limits, a significant number of fees and high interest rates. But for some people, it may be their best option. Talk to your bank’s administrators or with your current credit card company to see if they offer a credit card that fits your personal needs.

SUBPRIME CREDIT CARDS Another option for those with poor credit, but they are ripe with fees that many people who are already short on cash may not be able to handle. Interest rates can be dangerously high for those with poor credit, so beware of these cards. They are often a last resort for individuals who need access to credit. However, like secured credit cards, they can be used to rebuild credit. Make sure you read the fine print and understand the applicable fees before you apply for a subprime credit card. Again, make sure the card reports to a credit reporting agency so you start building a credit history. Finding a line of credit doesn’t have to be a difficult endeavor. If you know what you are looking for, you can find a line of credit that fits your personal needs without breaking the bank. There are limitations, as well as pros and cons, to many of the forms of credit available to those with poor credit scores, such as secured credit cards or subprime credit cards. But those options do give people choices they otherwise may not have, and they help you build credit, so that eventually you will have a greater number of options.

Posted in Best Practices for Merchants Tagged with: account, applicants, card, consumers, COSIGNED CREDIT CARDS, credit, credit card bill, credit history, credit limits, credit report, credit score, credit-card, creditor, customers, deposit, down payment, good credit, interest rates, low credit limits, MasterCard, payment, poor credit, RETAIL STORE CARDS, retail stores, SECURED CREDIT CARDS, store credit cards, SUBPRIME CREDIT CARDS, visa, Visa and MasterCard

September 18th, 2014 by Elma Jane

Americans love gift cards, but many of those pieces of plastic go partially or entirely unused. Some are lost or forgotten. Others simply are ignored once the balance drops to a few dollars or less.

A gift card’s unused value…known in industry parlance as spillage or breakage…long has meant big profits for the gift card industry .

But the Credit Card Accountability, Responsibility and Disclosure Act of 2009, better known simply as the Credit CARD Act, tightened rules on retailers, making it more difficult for stores to cancel unused cards or charge inactivity fees. That prevents retailers from quickly cashing in on breakage.

In addition, savvy consumers are catching on and appear to be finding ways to avoid losing breakage while getting the most out of their gift cards.

According to the most recent figures, about 1 percent of the total value of gift cards was predicted to go unused in 2013. That’s down from a record high of 10 percent in 2007. Some of the reduction in breakage is a result of growing cardholder realization that even though there’s only $2.12 on gift card, they got to find a way to use it.

However, even with the decline in breakage, around $1 billion worth of gift cards will be lost to fees and expiration dates or misplaced, shoved in a drawer or otherwise neglected this year. That’s a huge amount of money that consumers will not be able to use toward a new shirt, stuffed animal or bicycle.

Retailers love when people use gift cards because studies show that most customers spend more in the store than the card is worth. Breakage makes gift cards even more profitable: An estimated $127 billion in gift cards will be sold in 2014, even a small percentage of unused cards boost a company’s bottom line.

Those profits make it feasible for retailers to make some consumer-friendly moves, such as selling gift cards at a discount. However, most of the money goes toward other endeavors.

Wal-Mart may have a billion dollars (in unused gift cards) sitting there. Wal-Mart could go out and build 30 new superstores without borrowing a penny. They know those gift cards will come in eventually, but for now, they have the use of that money.

Ways to make sure you’re not ‘breakage’

The longer you let a card sit untapped, the less likely you are to use it. Here are eight ways to make sure your gift cards are not lost to breakage:

Give again. Instead of letting that last two bucks on a card go to waste, use it to make a donation. Stockpile cards and combine them into higher-value gift cards that are donated to the needy.

A Gift Card Giver founder, got the idea when he asked a group of acquaintances how many had unused gift cards sitting in their wallets. They literally started pulling out gift cards from their wallets, everyone had one.

The Gift Card Giver founder offered to redistribute the unused cards to the needy and a new nonprofit was born.

Give low-end cards as gifts. To make sure your gift card doesn’t languish in someone else’s wallet, consider purchasing cards at Walgreens and Wendy’s instead of Nordstrom and Saks. Practical gift cards, such as those for fast-food chains and discount retailers are used faster than cards to fine dining establishments and pricey department stores.

Corral your cards. Make sure you can quickly locate your cards by storing them all in the same place.

If you have too many cards to tuck into your wallet, stowing them in a durable plastic envelope. Or upgrade to a Card Cubby (about $24), which includes alphabetized tabs and is tiny enough to keep in a purse.

Plan your shopping ahead of time. Set up your e-mail program to send you a monthly reminder to use your gift cards. Think in terms of the week or month ahead, when will you be near the store? What items do you need there? Is there a gift you need for someone else? You are more likely to use the card if you know what you want ahead of time and can get in and out quickly.

Rethink general-purpose gift cards. Gift cards from credit card companies can be used anywhere you can use a credit card. But these cards also come with drawbacks.

Use-anywhere cards, known as open-loop cards are more likely to come with startup fees and monthly inactivity fees that chip away at your balance. Many of these gift cards also include a valid through or good through date stamped on the front. Your card’s underlying value will not expire after that date, but you will have to call customer service for a replacement card, and that raises the risk that you will simply toss the card and your remaining balance.

Read the fine print. The CARD Act prohibits gift card inactivity fees for the first year, and requires that gift cards cannot expire within five years of when activated. State lawsmay extend additional gift card protections. That gives you a big, but not permanent cushion of time to use the cards.

Trade or sell your cards. If you get a card you know you will not use, a Hot Topic gift card, for instance, when you are more of an L.L.Bean type, use one of the many card-swapping and card-selling sites to get what you really want.

That is because with a Wendy’s and a Walgreens on practically every corner, such lower-end cards simply are more convenient to use. They also offer more value for your card. If you give a Wal-Mart gift card to your mailman, there are plenty of things to use it on.

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: card-selling, card-swapping, cardholder, cards, consumers, Credit CARD Act, credit card companies, credit-card, customer service, customers, drawbacks, e-mail program, fees, gift card industry, Gift Cards, inactivity fees, lower-end cards, open-loop cards, retailers, startup fees, Wal-Mart gift card

September 11th, 2014 by Elma Jane

Online retailers are finding the bricks-and-clicks strategy to be an effective way to serve and engage shoppers. Perhaps that is why an increasing number of ecommerce merchants are setting up shop offline. It’s important to note, however, that a bricks-and-clicks business isn’t just about having a physical store and an ecommerce site. For this model to be effective, each channel must complement and add value to the other.

Guidelines to execute a bricks-and-clicks strategy:

Allow Access to Online Account Information in Physical Store

Bridge the gap between bricks and clicks by giving your customers and physical-store staff access to online account information. Doing so can enhance shopping experiences and drive sales.

Integrate Online and Offline Inventory, Fulfillment

Offer click-and-collect services that allow shoppers to buy merchandise online and pick it up at a local retail branch or service station. Many consumers would rather forgo the shipping costs and wait time and instead pick up their items at a time and place that’s convenient for them. Also, use your brick-and-mortar inventory when an item is out of stock online.

Use Online Data for Offline Selling, and Vice Versa

Data pertaining to online sales and traffic won’t just help you optimize your ecommerce site. It can also apply to offline decisions. For instance, if you see an increase in sales for a particular product on your website, you should consider promoting it offline, as well, to your brick-and-mortar shoppers.

Also pay attention to social media data such as Facebook likes and Pinterest pins. What’s trending on social sites can help with merchandising and marketing. Consider something similar in your brick-and-mortar business. Take note of the most liked, viewed, and pinned items online and then leverage that information when making decisions regarding product displays, inventory and more.

You can also use offline information to enhance your ecommerce site. Utilize in-store analytics tools, such as people counters and sensors, to better understand how your offline customers behave and then compare that with online behavioral data to spot patterns and opportunities.

Qualitative information, such as shoppers’ common questions and concerns, can also be used to improve your online shop. For instance, if your physical store associates keep getting the same questions about a particular product, there’s a good chance that online shoppers have similar queries. So you may want to include the answer in that item’s product description page.

Use Smartphone Beacons in Physical Stores

Beacons are Bluetooth-enabled devices that let brick-and-mortar merchants send customized offers and recommendations to their shoppers via their smartphones based on where the shoppers are in the store. For example, if a shopper is in the footwear department, the retailer can use its store beacons to send the shopper a coupon for shoes. Bricks-and-clicks businesses can also use the technology to send tailored offers to shoppers based on their online behavior.

Posted in Best Practices for Merchants Tagged with: account, Beacons, bluetooth, brick and mortar, business, consumers, coupon, customers, data, devices, ecommerce, Facebook, inventory, marketing, merchandising, Merchant's, Online Account Information, Online Data, pinterest, product, sales, shoppers, site, smartphone, social sites, store, website

August 20th, 2014 by Elma Jane

The latest version of Microsoft’s smartphone operating system, already packs tons of new productivity-boosting features. Now, the first update for Windows Phone 8.1 is nearly ready to launch, with extra functionality that makes it even better for work. Features come on top of additions that already arrived with the initial release of Windows Phone 8.1, such as Cortana, a voice-activated virtual assistant. Windows Phone8.1 Update 1 was released to developers this month, and will roll to consumers in the coming months.

App Corner – gives you better control over how employees use company-owned smartphone. You can manage which apps are installed on a phone and even save and export your app settings to other devices to quickly configure company phones. That way, employees can’t accidentally install applications that could compromise company data.

Folders – Staying organized is one way to boost your productivity. Now, Windows Phone 8.1 gives you better control over your smartphone’s home screen with the addition of folders. Just drag one app over the top of another to group them into a folder, then tap a folder to see which apps it includes.

VPN support – is a secure, private network that lets employees wirelessly access company resources while on the go, including files, apps and printers. Windows Phone 8.1Update 1 adds VPN support to the mobile OS for the first time. Users will be able to toggle the VPN on or off easily, or set a device to automatically connect to a VPN when a particular Web domain is accessed. You can also turn on encryption to secure all traffic between your smartphone and the work network.

Posted in Smartphone Tagged with: app, consumers, data, encryption, network, smartphone, windows

August 19th, 2014 by Elma Jane

In response to the third-party threat, the PCI Security Standards Council has published a guide to help organizations and their business partners reduce risk by better understanding their respective roles in securing card data.

The Third-Party Security Assurance Information Supplement provides guidance practical recommendations to help businesses and their partners protect data, including:

Conduct due diligence and risk assessment when engaging third party service providers to help organizations understand the services provided and how PCI DSS requirements will be met for those services.

Develop appropriate agreements, policies and procedures with third-party service providers that include considerations for the most common issues that arise in this type of relationship.

Implement an ongoing process for maintaining and managing third-party relationships throughout the lifetime of the engagement, including the development of a robust monitoring program.

Implement a consistent process for engaging third-parties that includes setting expectations, establishing a communication plan, and mapping third-party services and responsibilities to applicable PCI DSS requirements.

One of the big focus areas in PCI DSS 3.0 is security as a shared responsibility. This guidance is an excellent companion document to the standard in helping merchants and their business partners work together to protect consumers’ valuable payment information.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: card, card data, consumers, data, Merchant's, payment, PCI, Service providers

August 18th, 2014 by Elma Jane

As a small business, you may have ignored Facebook, but it turns out that by not having a presence on Facebook, you could be missing out on a huge business opportunity. The social networking site has a huge influence on what products and services people buy. More specifically, Facebook significantly influences millennial shoppers’ opinions of small businesses, including their decisions to purchase items not just online, but in-store as well. Nearly 60 percent of consumers ages 18 to 29 engage with Facebook ads at least once per week before buying an item in-store from a small business. Additionally, 62 percent believe Facebook is the most useful social media outlet for researching small businesses before visiting a store in person. That’s considerably higher than the 11 percent who feel the same about Twitter and the 12 percent who believe Pinterest is the best site for researching small businesses. Overall, 59 percent of millennial consumers visit the Facebook pages of small businesses at least once a week. To succeed both online and offline small businesses must first understand consumers’ online-to-offline shopping behaviors and invest at least a portion of their digital marketing dollars into the right technology and tools to create precisely targeted, relevant and personalized experiences.

The true value of Facebook, doesn’t lie in simply driving likes and adding new fans. It lies in using personalized content to convert digital hunters into loyal, repeat in-store buyers. The study discovered that by increasing the deals they offer on Facebook, businesses have the potential to make an immediate impact on their bottom line. Nearly 85 percent of the shoppers surveyed said local deals and offers on Facebook are important in their decision to purchase an item in-store. Forty percent of those surveyed said they think Facebook offers that can be redeemed in local stores are most likely to influence their decision to visit the website of a small business. With so many consumers constantly turning to Facebook when making purchasing decisions, business owners especially those in the restaurant, spa/beauty and education industries need to come to terms with the fact that Facebook is a highly important marketing tool that needs to be actively attended to and not just something they check in on every now and then.

Posted in Best Practices for Merchants, Small Business Improvement Tagged with: consumers, digital marketing, Facebook, marketing, marketing tool, millennial consumers, networking, pinterest, products, purchasing, services, shoppers, social media, social networking, twitter, website

August 14th, 2014 by Elma Jane

To make a strong first impression on consumers, businesses need an impactful logo. Despite the importance of a logo, businesses with just a handful of employees often struggle to design a memorable one with their limited budgets. Fifteen percent of small businesses with five employees or less have no logo at all, with 56 percent of businesses having designed their own logos without any professional help.

A standout logo and impressive Web presence are important parts of building a brand even at the very early stages of building a business. The research revealed that more than a quarter of small businesses are planning on changing their logo in the next few months, and when thinking about logo design, it’s best to keep it simple.

Small business owners should choose a design that has staying power, but it’s important to be open to small iterations over time. Brands may need to refresh their logo as the company evolves, expands, and takes on new audiences just don’t lose sight of what makes your brand recognizable whether it’s a signature color or graphical element.

Here are some tips to help small businesses refresh their logo.

Ask your audience. Social media makes it easy to communicate directly with customers. Engage customers in the process by asking for input and even allowing them to judge potential designs.

Communicate the change. To avoid confusion, the refresh should be consistent at every touch point for customers. Ensure a seamless experience by communicating the change with employees and updating marketing materials.

Keep it simple. A complete brand overhaul may alienate customers, so less is more when it comes to a refresh. Focus on one or two elements and make subtle changes.

Posted in Uncategorized Tagged with: business owners, businesses, consumers, customers, marketing, social media

August 12th, 2014 by Elma Jane

With so much competition in today’s marketplace, it can often be a challenge to turn first-time customers into repeat customers. Providing good customer service isn’t always enough to keep consumers coming back. To create loyal customers, businesses need to be prepared to make their customers feel special and wanted.

Improve customer loyalty with the following:

Be quick to resolve issues. Not all products work perfectly and sometimes, paid services don’t meet expectations. Accept when customers’ expectations haven’t been met and work hard to make sure the issues are resolved to their satisfaction. They will remember this and will feel like their purchases are safe with you next time.

Keep in touch. Gather contact data on your customers when you can. Reach out to them with special offers and new products and services or just send them a birthday card. Use any excuse to keep your company in their minds.

Provide great service. Customer loyalty wanes when customer service is lacking. Make sure the customer is attended to promptly, courteously and efficiently. Listen to their needs and meet them as efficiently as possible. Customers will remember this, but they will remember bad service even more.

Reward loyalty. Once in a while, you should treat a loyal customer with a free product or special discount just for being loyal. You’ll be surprised at the loyalty this will generate.

Thank your customers. Chances are, you have competitors in your category and that means your customers have options. The fact that they chose you whether it’s because of your pricing, reputation or convenience is something that you appreciate, so show it. Thank them every time for choosing you and let them know in words and deeds how important your business is to them, regardless of whether they’re your smallest customer or your largest.

Posted in Best Practices for Merchants Tagged with: competitors, consumers, contact data, Customer loyalty, customer service, customers, data, free product, products, purchases, services, special discount

June 10th, 2014 by Elma Jane

Local businesses with brick-and-mortar stores have not been early adopters of ecommerce. But, with the proliferation of mobile devices and with changes in how consumers research and buy products, most local businesses now have websites, many of them mobile optimized. Smart brick-and-mortar retailers invest in local search engine optimization to ensure that their stores are found when a local shopper searches on products that they sell. More aggressive retailers also invest in pay-per-click advertising on Google to ensure that their store names, phone numbers, and addresses are visible to a local shopper that is researching on a smartphone. Google is by far the primary search engine used by mobile shoppers. Google favors mobile friendly online stores and rewards mobile sites with high search rankings. The next logical step for local retailers is investing in on online store.

There are several reasons:

1. Having an online store will help local retailers optimize Google rankings for specific products and brands.

2. Being able to show that an item is in stock may eliminate competitive shopping.

3. Eventually local retailers could sell products to consumers outside the retailers’ immediate area, and thus expand their business.

Many local businesses are hesitant to open an online store. Here is why:

1. Local businesses are typically unfamiliar with running an ecommerce business.

2. Have little ability to ship or fulfill online orders.

3. Cannot accommodate sales tax collection outside their local area.

4. Avoid the investment required.

To be sure, adding an online store is not for every local business. But, if a local retailer offers a unique set of products, she may want to evaluate the concept.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: brands, brick and mortar, brick-and-mortar stores, consumers, ecommerce, google, Mobile Devices, mobile optimized, mobile sites, online orders, online stores, pay-per-click, products, sales tax, search engine, search engine optimization, smartphone, websites

June 6th, 2014 by Elma Jane

In business, Your website is often the first place consumers will go to find you. Your site is your chance to make a good first impression on potential leads and bring back existing customers, it’s important to make sure your website keeps its visitors interested and engaged.

Most brands are aware of the need to create an engaging Web presence, but smaller ones typically don’t think they have the time or resources to create a website at all. A trend among smaller business is to create just a Facebook page with no website. This is a great place to start, but to gain “customer trust”, having a website is important. It shows you’re an established company. A company’s website can be its “number 1” driver of business with the right tools and strategies. Building a great website doesn’t have to be expensive or time-consuming.

Optimize your Web presence for maximum customer engagement

Make your website experience match your customer-service experience.Consumers have come to expect the same type of experience with a brand online as they would in-store, enabling features on your website that allow visitors to complete as many interactions as possible for a seamless customer-service experience. These features can include detailed descriptions of each of your products and services, easy-to-access contact and purchase information, and a way for customers to reach you quickly, such as a live-chat function or links to your social media pages.

Personalize your website in ways that make sense for your business.Enhance customers’ experience on your website by customizing it to their needs. Use personalization tactics that make sense for you. Big Data analytics and voluntary surveys can help you send customized offers based on consumers’ past shopping habits and preferred contact methods which can help with sales conversions.

Use social media as a communication tool.The role of social media for businesses has evolved considerably. A way to share and promote content on your website, social media can and should be used as an extension of your customer service. Your website should be the focal point for your brand’s information. If you can get beyond that, social media should be a way to reach out to clients in a cost-effective way. By using Facebook, Twitter and other sites as a line of communication between your brand and your customers, you can drive them to your website in unique ways, such as by sharing a blog post that will help answer a customer’s question.

Posted in Small Business Improvement Tagged with: big data, Big Data analytics, blog, communication tool, consumers, customer service, customers, Data analytics, Facebook, leads, live-chat, products and services, resources, sales conversions, social media, tool, tools, twitter, website