July 18th, 2024 by Elma Jane

The way we pay for goods and services has undergone a dramatic transformation. From bartering to coins to paper money, the journey of payment methods has been long and fascinating. But no shift has been as revolutionary as the rise of electronic payments. Let’s dive into this evolution and explore where this exciting technology might lead us next.

Early Days (1950s – 1970s):

- 1950: The Diners Club card emerges as the first multipurpose charge card, laying the foundation for modern credit card systems.

- 1958: American Express launches its charge card, initially paper-based, revolutionizing travel and expense tracking.

- 1966: Barclays Bank in London introduces the first Automated Teller Machine (ATM), allowing customers basic account access outside banking hours.

- 1970s: Electronic Funds Transfer (EFT) systems gain traction, enabling direct deposit of paychecks and automated bill payments.

Rise of Digital Networks (1980s – 1990s):

- 1979: Visa introduces the first electronic authorization system and point-of-sale (POS) terminal, paving the way for real-time transaction processing.

- 1983: Debit cards become more prevalent, allowing consumers to access funds directly from their bank accounts.

- 1994: First Virtual Holdings pioneers the first secure online payment system, marking the dawn of e-commerce.

- Late 1990s: Online banking explodes in popularity, offering customers convenient account management and payment options.

The Internet Age (2000s – Present):

- 1998: PayPal emerges, simplifying online transactions and boosting consumer confidence in online shopping.

- 2003: Mobile payments gain momentum in various countries, driven by the increasing adoption of mobile phones.

- 2010s: Near Field Communication (NFC) technology enables contactless payments, giving rise to mobile wallets like Apple Pay and Google Pay.

- 2020s: Biometric authentication adds another layer of security to electronic payments, using fingerprints and facial recognition. Real-time payment systems gain popularity, allowing for instant fund transfers.

The Future of Electronic Payments:

- Invisible Payments: Imagine a world where payments happen seamlessly in the background. Technology like Amazon Go is already showcasing this, with customers simply walking out of stores with their purchases.

- Cryptocurrency and Blockchain: While still in its early stages, the potential of cryptocurrencies and blockchain technology to disrupt traditional payment systems is enormous. Expect to see more integration and wider acceptance in the coming years.

- AI-Powered Payments: Artificial intelligence will play a crucial role in fraud prevention, personalized payment experiences, and the development of even more innovative payment solutions.

- Increased Financial Inclusion: Electronic payments have the potential to bring banking services to underserved populations, promoting financial inclusion on a global scale.

The evolution of electronic payments is an ongoing journey. As technology continues to advance, we can expect even more exciting developments that will reshape the way we transact and interact with the world around us.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

September 19th, 2016 by Elma Jane

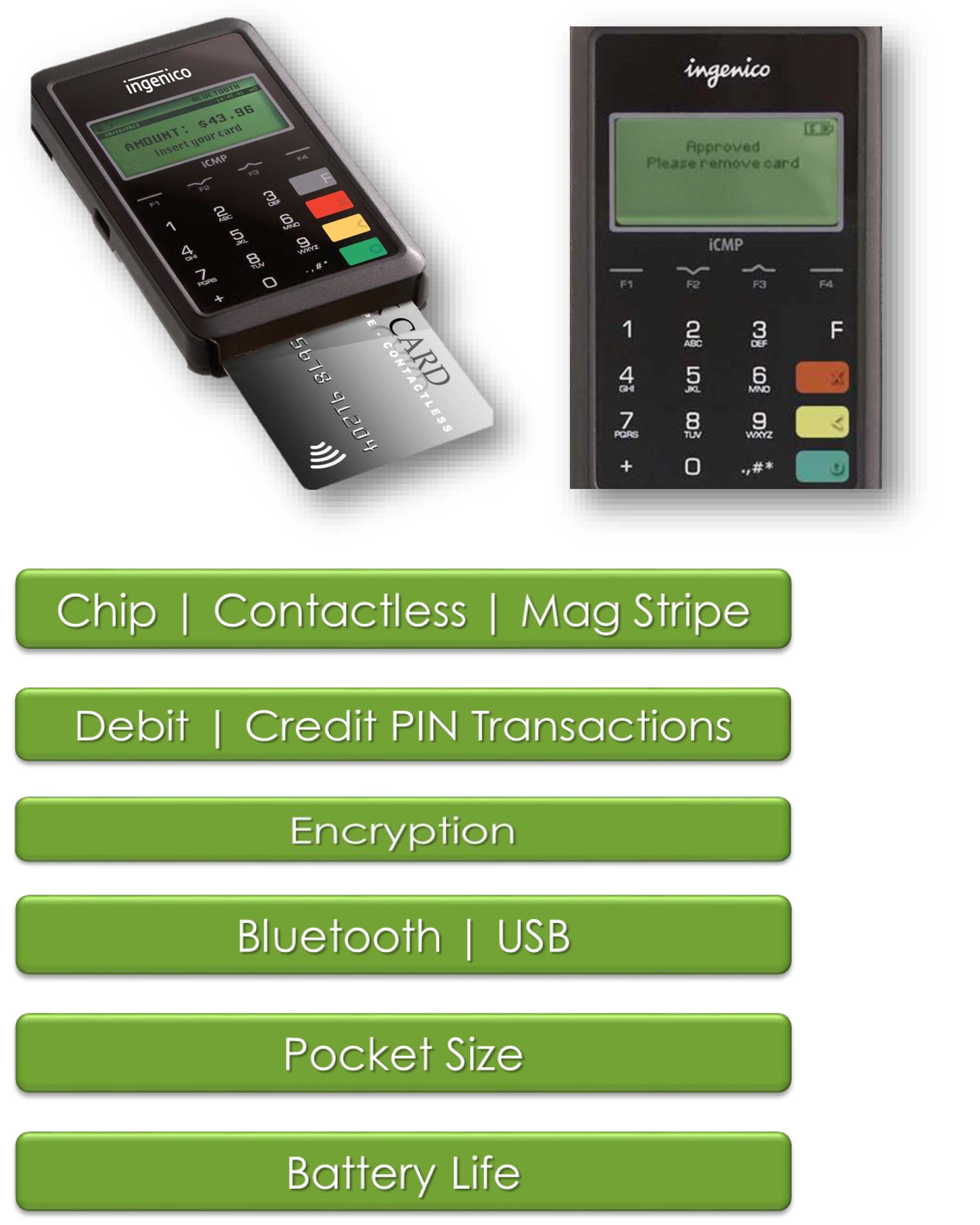

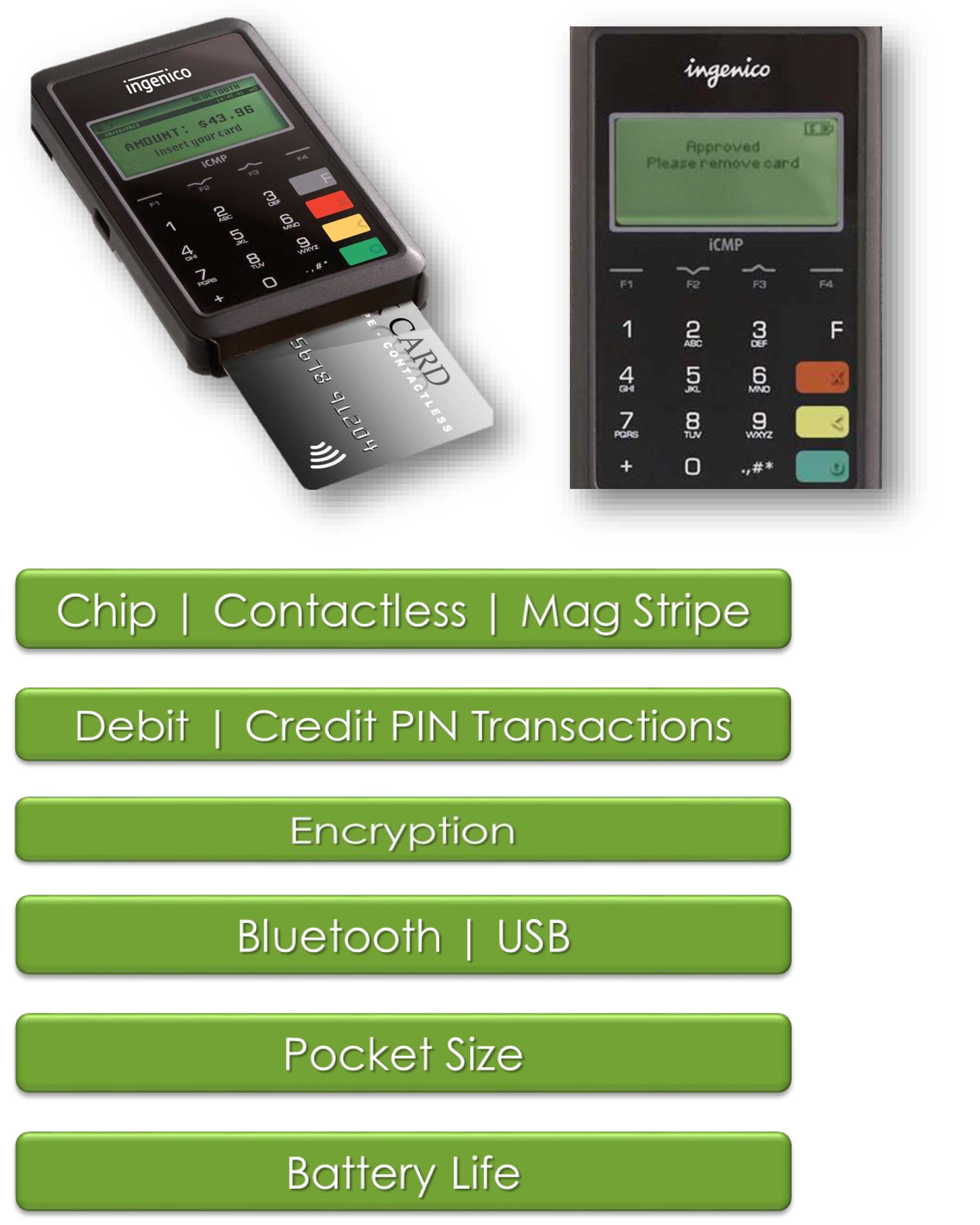

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a Point of Sale System.

Electronic Authorizations – merchants had the choice of calling in for an authorization or imprinting their transactions, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing transaction over the phone.

Manual Imprinters – are considered a great backup processing method. Although time consuming and did not offer the speed or instant transfer capabilities, this imprinters are still widely used.

Point of Sale Terminals: POS emerged in 1979, which was a turning point in the credit card processing industry. As a result,

Visa introduced a bulky electronic data capturing terminal. The first of credit card machine or terminal as we know them today. It has greatly reduced the time required to process a credit card.

In the same year, MasterCharge became MasterCard and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement.

Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa

June 6th, 2016 by Elma Jane

The roll out for EMV PIN Debit and Tip Adjust functionalities for the Ingenico Telium POS terminals through a gradual download process begins July 24, 2016. Customers will receive an automatic download following the July release date, or they can go to their appropriate website for instructions to manually update their terminal file.

What to Expect

- EMV PIN Debit support for Visa, MasterCard, and Discover common Debit AIDs. Note that customers will see new prompts based on how card issuers configure EMV-enabled debit cards.

- Tip Adjust functionality on the restaurant application.The tip at the time-of-sale prompt will be on by default and will work as it always has. However, if this prompt is bypassed, a blank tip line will print on the receipt. This allows consumers to write the tip amount on the receipt and our customers can adjust as needed.

- Tip Adjust is supported on credit card transactions only, including magnetic stripe, EMV, key-entered and contactless.

Posted in Best Practices for Merchants Tagged with: consumers, contactless, credit card, customers, debit, debit cards, EMV, PIN, terminal

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

April 27th, 2016 by Elma Jane

Near field communication is a contactless communication protocol between devices like (smartphones, tablets, smartwatches or even credit cards themselves) with a nearby NFC-enabled terminal by simply authorizing your device with a passcode or fingerprint authentication.

Both merchants and customers benefit from near field communication technology, by integrating credit cards, train tickets, and coupons all into one device. Faster payment transaction times and fewer physical cards to carry around.

If your smartphone has an integrated NFC chip, you can use a mobile wallet app like Apple Pay, Android Pay and Samsung Pay for items at retailers that support NFC transactions. Just load up your credit cards on your mobile device and wave or tap your device near an NFC compatible terminal to pay, no card swiping required.

As the technology keeps growing, more NFC compatible smartphones will be available and more businesses will offer NFC card readers for customer’s convenience.

Apple Pay, integrated into the newest generation of Apple mobile devices and incorporates NFC technology. If it becomes widely used by many iPhone users, perhaps merchants will be encouraged to more quickly adopt NFC technology.

Many major banks and credit cards are supporting NFC technology, issuing new cards with embedded NFC chips. This means that you may be able to tap or wave your card at the terminal instead of swiping, no phone required, in the next few years.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: cards, contactless, credit cards, customers, merchants, mobile wallet, Near Field Communication, nfc, payment, Smartphones, tablets, terminal, transaction

April 21st, 2016 by Elma Jane

Payment Acceptance

EMV Contact/Contactless

NFC Contacless

Mag Stripe

Premium NFC + EMV/PIN & Signature

Payment Acceptance

EMV Contact/Contactless

NFC Contactless

Mag Stripe

Basic NFC + EMV/PIN & Signature

For orders Plus Tax and Shipping If Applicable.

For more information give us a call at 888-996-273

Posted in Best Practices for Merchants Tagged with: chip, contactless, EMV, nfc, PIN

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 9th, 2016 by Elma Jane

Since the implementation of the EMV liability shift last year, consumers are still unsure whether to dip or swipe their payment cards at the checkout register, and transaction process itself is slower than a card swipe.

As the EMV process continues, can contactless register only help to make checkout process faster? With contactless register checkout only, consumers can just tap and pay with either card or mobile wallet.

Contactless like NFC is now a standard feature in most high-end smartphones, and most EMV-enabled point-of-sale terminals contain the necessary technology to accept contactless payments. So the idea of contactless register checkout only is something to test for some merchants in a certain retail sector.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Near Field Communication, Point of Sale Tagged with: cards, consumers, contactless, EMV, merchants, mobile, mobile wallet, nfc, payment, payment cards, point of sale, Smartphones, terminals, transaction