September 8th, 2015 by Elma Jane

A card not present transaction (CNP, MO/TO, Mail Order / Telephone Order, MOTOEC) is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant’s visual examination at the time that an order is given and payment effected, such as for mail-order transactions by mail or fax, or over the telephone or Internet.

The Card Associations created this term to help identify these Transactions, because CNP situations tend to be where the majority of fraudulent activity occurs; it is difficult for a merchant to verify that the actual cardholder is indeed authorizing a purchase.

The card security code system has been set up to reduce the incidence of credit card fraud arising from CNP.

Types of Security codes:

CVC1 or CVV1, encoded on track 2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for Card Not Present Transactions occurring by mail, fax, telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless cards and chip cards may supply their own electronically-generated codes, such as iCVV or Dynamic CVV.

Code Location

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card.

American Express Cards have a four-digit code printed on the front side of the card above the number.

Diners Club, Discover, JCB, MasterCard, and Visa Credit and Debit Cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: card transaction, card-not-present, cardholder, chip cards, cnp, contactless cards, credit card, debit cards, magnetic stripe, merchant, moto, security code

September 3rd, 2015 by Elma Jane

Today, there are numbers of dedicated invoicing software solutions to choose from, but also, specifically built to handle all aspects of invoicing. Whether you send out invoices in the mail, electronically or both. NTC’s Cloud-based invoicing software is a way to simplify your invoicing processes.

National Transaction help merchants consider making the switch to online invoicing methods.

If you’re considering making the transition, check National Transaction’s Electronic Invoice.

Once the transaction is approved a confirmation email is sent to the merchant and consumer.

Benefits of Electronic Invoicing:

Ease of use – Merchants only needs to enter the email address and the amount of sale to complete order.

Better security – Card Holder enters credit card data directly into an acquiring bank system. Bank stores such sensitive information in an encrypted format on remote servers. This reduces your liability and makes it so you won’t lose all your important data if your server gets hacked or destroyed.

Collect useful sales information – Most invoicing software has reporting capabilities which let you track payments, projected income and client history.

Get paid faster – E-Invoice can be paid the same day. The sooner you send your invoices, the sooner you are likely to get paid. With NTC Electronic Invoice, you can schedule invoices to be sent out ASAP, which means faster, more reliable income for your business.

Look more professional – Invoicing software typically includes professional-looking invoice templates, which you can customize with your business name and logo.

Emailing clients invoices instead of mailing them printed bills, is approximately 10 times cheaper than paper invoicing.

Send invoices from anywhere – Cloud-based invoicing software can be accessed from anywhere with an internet connection. This means you can easily invoice customers or access your business’s billing information wherever you are in the world, and even from your phone if you need to.

Interested in Electronic Invoicing? Give us a call 888-996-2273 or go to our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: bank, card, card data, credit card, Electronic Invoice, invoicing, merchants

August 24th, 2015 by Elma Jane

How can you protect your business if its card-not-present or keyed-in transactions?

Get to know your customer – Before processing large card-not-present transactions, make sure you know your customer. Be sure to check their ID and make sure the information on it matches the payment information they give you.

Have delivery confirmation – If shipping your product, make sure to request tracking information and a delivery receipt. If you are sending a large order, you will want to request a signature confirmation at delivery.

Match the billing and shipping zip codes – When shipping your product, you want to check to see if the billing zip code given for the payment matches the shipping address zip code. If the zip codes don’t match, ask your customer why. If their answer doesn’t make sense to you, or sound plausible – don’t accept the payment.

Obtain a signature – This is especially important for large transactions. Make your customer sign an invoice, a contract that states your refund policies and gives you authorization to take the payment or a credit card authorization form. Once signed, keep this document on file.

Request card information – Make sure customers can give you the name on the credit card, the card number, the expiration date, the CVV2 security code and the correct billing address if you are keying in a payment without a card.

A tip from National Transaction Corporation 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: card-not-present, credit card, keyed-in transactions, payment

August 18th, 2015 by Elma Jane

NFC stands for near-field communication, it allows two devices to share data.

You’ve likely used it already, even if you haven’t realized it. It’s embedded in computer cards, print ads, smart cards and it is featured in many Android phones, Windows phones and the new iPhone.

NFC works in two ways:

The first is two-way communication, where two devices can read and write each other – like transferring contacts or photos from one device to another. The second is one-way communication where a device can read and write to an NFC chip – similar to using an NFC enabled card to pay for something using an NFC terminal.

Sure there are other technologies, like Bluetooth, that can do things similar to NFC, but NFC uses less power and is better for your smartphone’s battery life. NFC is also less complicated to use than Bluetooth and doesn’t need to be paired with anything.

NFC is extremely secure. Intercepting payment information from an NFC device is very difficult because of how the process works. To use NFC for payments, the payment application is first launched on a phone that is then tapped on a terminal. The customer then enters a code or scans a fingerprint to approve the transaction. A secure element (SE) then authorizes the payment and sends the information to the NFC modem. The payment is then processed like a credit card swipe.

NFC is likely to continue to grow in popularity in the mobile payments space, to learn more about NFC payments and how you can prepare your business with National Transaction Corporation, visit www.nationaltransaction.com or give us a call at 1-888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: credit card, Mobile Payments, Near Field Communication, nfc, NFC payments, payments, swipe, terminal

August 13th, 2015 by Elma Jane

The credit card processing industry, have been working towards including EMV technology in all of the point of sale systems.

Many processors have sent out EMV capable devices that will need to be adjusted before they can start accepting EMV card transactions.

See which category you fall into so you are prepared when October 1 rolls around.

First, check and see if your credit card machine has the slot to accept EMV cards (it’s either a slot in front, or on the top of, the unit). If you don’t, you need to contact your processors or sales agent to update your equipment .

If you do have the slot for EMV cards, you’ll need to contact National Transaction to see if your EMV capable machine has been enabled to accept EMV cards.

What is the difference between EMV capable and EMV enabled?

- EMV Capable – EMV capable means that your credit card machine is equipped with the hardware (i.e. the slot) and has the capability to do a transaction, but first you’ll have to update the application to enable you to process the cards. At National Transaction, we have a support specialist to assist you with step-by-step instructions to switch your credit card Point-of-Sale System, from EMV capable to EMV enabled.

- EMV Enabled – When your machine is EMV enabled, your terminal is ready to accept EMV transactions. According to MasterCard, 73 percent of consumers say owning a chip card would encourage them to use their card more often. In addition, 75 percent of consumers expect to use their chip card at the merchants where they shop today. Keeping these numbers in mind, it only makes sense to equip your business with an EMV enabled credit card POS system.

What makes EMV technology so important?

EMV is a global payment system that adds a microprocessor chip into credit cards and debit cards, and reduces the chance a transaction is being made with a stolen or copied credit card. Unlike traditional magnetic-stripe cards, anytime you use an EMV card, the chip in the card creates a unique transaction sequence that can’t be replicated. Because the number will never be valid again, it makes it hard for hackers to fake these cards. If they attempt to use the copied EMV card, the transaction would be denied.

The rollout of EMV technology is ongoing, but even with the October 1 deadline, it’s estimated that only 70 percent of credit cards and 40 percent of debit cards in the U.S. will support EMV. Despite these numbers, that doesn’t mean you shouldn’t update your equipment.

Following the deadline, card present fraud liability will shift to whoever is the least EMV compliant party in a fraudulent transaction.

Make sure that’s not you!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: card present, card transactions, chip, chip card, credit card, credit card processing, debit cards, EMV, EMV capable, EMV enabled, emv technology, magnetic stripe cards, merchants, payment system, point of sale, POS, processors, terminal

July 17th, 2015 by Elma Jane

Turn Around Strip Down

There was a bit of confusion at a supermarket. When this senior was ready to pay for his groceries, the cashier said, Strip Down facing me.

Making a mental note to complain about excessive security running amok, the senior did just as the lady cashier had instructed.

When the hysterical shrieking and alarms finally subsided, he found out that the lady cashier was referring to his credit card, to turn around the card, strip down and swipe it.

The senior have been asked to shop elsewhere in the future.

Posted in Best Practices for Merchants Tagged with: card, credit card, swipe

July 7th, 2015 by Elma Jane

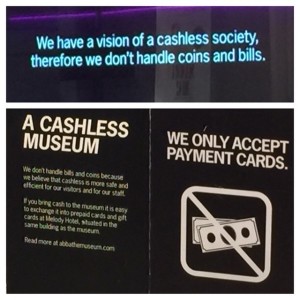

Cashless society is about to happen, hard to believe for some. We are all unable to decide on the edge of a new, cashless world where mobile payments reign supreme. If so, is this a bad thing? For some people yes, because for them change can be scary.

Every revolution needs a good crisis in order to grow its seed. The cashless revolution is the same. Current global financial conditions serves as the potential crisis, and truly the cashless revolution is upon us. Society is on the brink of great economic change, which will likely usher in a new era of worldwide, electronic currencies. The cashless society is coming.

Advances in mobile payment options as evidence of this impending cashless society, consider the practical benefits of mobile payments for the consumer. The most obvious is convenience. Many people prefer to swipe their smartphone atop a scanner to carrying around a stack of cash. Electronic payments are traceable, which is useful for tracking one’s spending and can add a sense of security. Also, carrying around large stacks of cash isn’t always feasible or safe.

Mobile payments also offer interested individuals a way to incorporate social media into their purchases; they can check-in to a site and tell all their friends about an exciting new product they bought, or announce their presence at a new coffee shop, all with that same initial swipe of an NFC-enabled phone. Add to this the many practical benefits of mobile payments as far as business owners are concerned, and it’s easy to see why so the technology is becoming so widespread.

And yet for all the benefits of mobile payments and point of sale technology, the two don’t necessarily exclude cash. Other company focuses on blending cash transactions with POS. This allows technologically savvy businesses to incorporate POS and mobile payment technology into their business, without excluding potential customers who prefer to use cash.

We aren’t necessarily evolving towards a cashless society, but towards a society with a plethora of payment options. POS technology is all about options. Want to pay with a swipe of your credit card? Swipe your credit card. Want to tap your NFC-enabled phone against a console. Tap and go. Want to pull a crisp twenty-dollar bill from your wallet and walk away from the counter with milk and eggs in your hand and a handful of coins jingling in your pocket? Go for it.

The question is: Will we ever become a truly cashless society? Maybe, maybe not, but as mobile payments become increasingly common, cash may very well fall into the retro category.

Posted in Best Practices for Merchants, Mobile Payments, Near Field Communication, Point of Sale Tagged with: credit card, electronic currencies, electronic payments, Mobile Payments, nfc, point of sale, POS, swipe

June 25th, 2015 by Elma Jane

A product or service using a credit card or debit card should be efficient, fast and most importantly safe. There are a lot of regulations in place to make sure that the processing of payments using a card is safe and secure. One of the way is the EMV (Europay, MasterCard and Visa) technology, where payment cards used in an ATM and POS Terminals have been embedded with microchips. This form of payment technology has long been in use and is widely accepted in many regions such as Europe, Canada and Asia Pacific. The US, which is considered to be the largest number of plastic card users is one of the countries that have not yet fully optimized this otherwise global standard.

Advantages Of EMV – EMV embedded chip is a lot more secure than the traditional magnetic stripe, especially when it comes to face-to-face credit/debit card transactions. Credit card fraud is rampant, but using this embedded chip has added another layer of protection against consumer fraud. Once the card has been inserted into a terminal, the payment will then be authenticated and processed using the EMV network. The chip within the card is hard to duplicate.

What Does This Mean For Your Business? – You will create more credibility and garner more customers in the market place by utilizing this more safe and secure payment method. There will be increased in consumer confidence.

What Happens When You Don’t Upgrade? – There is a Liability Shift. Currently, If a payment processing transaction has been approved and it turns out to be fraud, it’s the card issuer loss. With the new rule, liability shifts to merchants who has not implemented the EMV technology. When fraud happens, the responsibility falls on the business owner who makes the transaction.

How To Prepare Your Business For EMV? – Upgrade your terminal. Contact National transaction and we’ll help you prepare your business for the EMV migration.

Upgrading your current payment processing system is easy with NTC.

Give Us A Call Now! 888-996-2273

Check our website http://nationaltransaction.com click Demos and Videos to learn more!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: atm, card, chip, credit card, Credit card fraud, debit card, Debit Card transactions, EMV, EMV migration, EMV network, EuroPay, magnetic stripe, MasterCard and VISA, merchants, microchips, payment, payment cards, payment processing, payment technology, payments, POS terminals, terminal

June 16th, 2015 by Elma Jane

When you own a travel agency, a merchant account can take the worry out of the financial side of your business. Since many people prefer to pay for their vacation services with a credit card, your Merchant Account will ensure that you’re able to process those payments as easily and efficiently as possible.

Merchant accounts generally work in real time. Payment processing occurs immediately, with quick authorization, you and your customer will know right away that the payment has gone through. These types of accounts allow your business to accept almost every major brand of credit card. This further benefits your customers by allowing them to pay through the cards that they have.

You can also offer your customers advanced payment processing solutions that include more than simple credit card payments. That’s important in this economic climate, when many people are turning from credit cards to other methods of payment.

Debit cards, checks, pre-paid cards, and electronic transfers are all available through Merchant Accounts.

Debit cards are somewhat treated like credit cards when you have a Merchant Account, ensuring that you’ll receive the promised funds before your client sets foot on their cruise ship or the airplane.

New business should lead to repeat business, and with a loyalty program set up through your Merchant Account, it will! Your merchant account provider can customize a loyalty program for you.

Creating a loyalty program will bring repeat business, increase the amount of money that customers spend with you, attract new customers to your business and, most importantly, keep them coming back.

Online payments are another benefit you’ll enjoy when you set up a Merchant Account. With online payments, your customers can click on your website, set up their own vacation itineraries, and pay for their trips simply by entering their payment data into a secure online form. The payments will be validated instantly, so your customers will know that their vacation has been authorized within seconds, and you will have access to those funds by the following day.

Finally, one of the best things about a merchant account is that the funds will be available to you the next day. Your customer pays you today and you can access the funds tomorrow. This improves your cash flow and makes it possible for you to take care of your business expenses in a timely manner. And, as you know, paying for things on time usually means those things cost you less money.

You’ll save money and time by setting up a merchant account, and you can do it today with National Transaction! (888)-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, Merchant Account Services News Articles, Travel Agency Agents Tagged with: checks, credit card, credit card payments, debit cards, electronic transfers, loyalty program, merchant account, merchant account provider, online payments, payment data, payment processing, payments, pre-paid cards

May 19th, 2015 by Elma Jane

We’re now nearly midway through 2015, and payment security still remains a topic that stirs up great concern and confusion. While there is seemingly unanimous agreement on the need for heightened security, there’s uncertainty about those who are tasked with actually implementing it. Let’s dig deeper into EMV, P2PE and tokenization. How each will play a part in the next generation of securing payments, and how without properly working together they might just fall short.

Europay, MasterCard, and Visa (EMV) – A powerful guard against credit card skimming. EMV also uses cryptography to create dynamic data for every transaction and relies on an integrated chip embedded into the card.

Downside: For Independent Software Vendor (ISVs), the biggest downside of EMV is the complexity of creating an EMV solution. ISVs interested in certifying PINpads with a few processors face up to 22 months of costly work, and because there are a large number of pending certifications, processors will be backed up over the next few years.

It’s not impossible for an ISV to build EMV solutions in-house, but it’s difficult and unnecessary when there are plug-and-play EMV solutions available. These solutions include pre-packaged and pre-certified APIs that remove most of the need for research, the complexity and the burden of time and cost.

Point to Point Encryption (P2PE) – Secures devices, apps and processes using encrypted data with cryptographic keys only known to the payment company or gateway from the earliest point of the transaction, from tech-savvy criminals, jumping at their chance to intercept POS systems and scrape the memory from Windows machines.

How does a key get into card reader? Through an algorithm called derived unique key per transaction (DUKPT), or “duck putt.” DUKPT generates a base key that’s shared with device manufacturers securely, where output cardholder data is rendered differently each time a card is swiped, making it impossible to reverse engineer the card data. P2PE not only benefits the cardholders, but also the ISVs and merchants. PA-DSS certification was designed to address the problems created with cardholder data which is not encrypted.

Downside: P2PE isn’t cheap if an organization wants to do it in-house. The secure cryptographic device needed to manage the keys, Hardware Security Module (HSM), can cost $30-40,000 but when it’s built out, that total cost can jump to $100,000.

TOKENIZATION – The best way to protect cardholder data when it’s stored is using tokenization, a process which the PCI Security Standards Council describes as one where the primary account number is replaced with a surrogate value a token. For merchants dealing with recurring billing, future payments, loyalty programs and more, tokenization is critical.

Downside: Tokenization doesn’t prevent malware that’s remotely installed on POS devices. It’s possible, as seen with recent retail card breaches, for data to be stolen before it is tokenized. That’s why it’s essential to group tokenization together with P2PE and EMV to offer optimal security.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: (POS) systems, account number, billing, card, card breaches, card reader, cardholder, cardholder data, chip, credit card, data, DSS, EMV, EuroPay, gateway, Independent Software Vendor, ISVs, MasterCard, merchants, p2pe, payment company, payment security, payments, PCI, PINpads, point-to-point encryption, POS devices, processors, Security, security standards council, token, tokenization, transaction, visa