April 19th, 2016 by Elma Jane

Electronic Benefit Transfer (EBT) is an electronic system that allows a recipient to authorize a transfer of their government benefits from a Federal account to a retailer account to pay for products received. Very much similar to purchasing something using a credit card.

Posted in Best Practices for Merchants Tagged with: account, credit card, EBT, electronic, Electronic Benefit Transfer

April 14th, 2016 by Elma Jane

Accepting credit card payments is a must if you’re planning to start a business. It’s good to know what is out there and how it applies to your situation. So you need to learn about credit card processing machines, depending on your business.

Here are some of the different types of credit card processing machines:

Dial-Up Terminal – the grandfather of credit card processing machines. Dial-up terminals use a phone line to connect with a credit card processing company. The advantage is that they are normally inexpensive than some higher-end options. The disadvantage is slower processor speed.

IP Terminal – connect the merchant over a high-speed internet connection. The advantage of IP terminal over dial-up terminal is speed. IP machines can process transactions as fast as 3 seconds as opposed the 10 to 25 seconds that a dedicated dial-up machine might take. IP terminals now cost about the same as dial-up units and that a single DSL link can accommodate more than one credit card terminal.

Wireless Terminals – the priciest yet most convenient type is a wireless machine that runs on a wireless network, much like your mobile phone.

Virtual Terminal – virtual terminals are computers running credit card processing software connected to a credit card reader. Virtual terminals are a great addition to an office because they don’t require a standalone credit card processing terminal.

There are many options available for your business, whether you’re e-Commerce, MOTO, In-Store or Mobile there’s a credit card processing machine and platform out there that will fit your business.

Give us a call to know more at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce Tagged with: card reader, credit card, credit card processing, e-commerce, merchant, mobile, moto, payments, terminal, virtual terminal

March 24th, 2016 by Elma Jane

Dear Virtuoso:

I wanted to praise one of our Virtuoso partners, National Transactions.

We have found National Transactions to be a wonderful partner. We have gotten excellent rates and support for our National Transaction merchant account– but more than that, their employees have helped us improve our processes, and I can already see our productivity rising. We have begun a new, online payment portal. This is an excellent tool we highly recommend!

National Transaction’s Steve Garlenski assisted and John Barbieri custom-designed a fabulous landing page – with all of our terms and conditions, cancellation penalties and places to check to authorize — and automatic receipt sent to both us and the client.

We really appreciate all they have done to help us with this important tool. It is so much better, faster and easier for us than obtaining signed paper credit card authorizations.

Thank you, Steve & John and National Transactions!

————–

Eleanor Hardy

President

The Society of International Railway Travelers®

Proud members of Virtuoso®

#1 Sellers of Virtuoso® Adventure & Specialty Travel, 2012

Winner, 15 Magellan Awards for Excellence

Celebrating the World’s Top 25 Trains since 1983

We thrive on referrals. Please tell your friends.

Web: http://www.irtsociety.com

Facebook | IRT Blog, Track 25

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, merchant account, online payment, travel

March 17th, 2016 by Elma Jane

A bank in Mexico is the first in the world to publicly experiment with this technology. With their mobile wallet application, cardholders are able to use dynamic CVC/CVV codes, which are generated every twenty minutes.

If somebody is using credit card information stolen from a data intrusion and the merchant accepting payment online asks for the CVV, it likely would have changed by that time, they would enter the wrong CVV and the transaction would be declined.

Cards with CVV code display that randomly changes will ensure that users making orders online are who they say they are. Many e-Commerce sites already ask shoppers for the CVV code during online transactions or over the phone.

The technology is an intuitive solution, but costly to issuers. Cards with displays that enable a dynamic CVV code are 10 times more expensive than chip cards.

As mobile banking, e-commerce, and m-commerce is growing, something had to change sooner or later in the online payment industry.

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: bank, cardholders, cards, credit card, data, e-commerce, m-commerce, merchant, mobile, online, payment, payment industry, transaction, wallet

March 9th, 2016 by Elma Jane

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

March 7th, 2016 by Elma Jane

It is my pleasure to write this testimonial for National Transaction Company!

My travel agency has been associated with this organization since 2005 and I continue to believe they are the best solution for my home based operation’s credit card merchant transactions. The process is simple, efficient and it provides me a profitable way to accept client credit cards and manage my agency’s cash flow.

Their support team is the best!

Judy K

JMK TRAVEL INC.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, transactions, travel, travel agency

February 29th, 2016 by Elma Jane

True Stories of our Customers in Action

Travel Agency ~ An Independent Travel Firm had been using their bank as credit card processor. When they learned that Virtuoso and NTC were going to team up they jumped on the opportunity. Not only NTC has lowered their fees but NTC has streamlined their credit card processing. The manual type-in process before has been all automated batch process now which saves time. This is a great new partnership for Virtuoso and its members.

Wholesale Hardware Industry ~ Have been turned down his business loan by a traditional bank last year due to his bankruptcy few years ago. He has no option but to borrow using a Cash Advance, making daily payment with a very high-interest rate. NTC was able to get an approval for a Real Business Loan, with monthly payment with an annual rate.

Term loan amount: $85K – Line of credit: $75K

Another Travel Agency ~ NTC has great customer service, the support team will patiently guide you through the PCI compliance. The payments specialist will check whether they could reduce your rates (which they did successfully!). They will even follow up regularly with status updates. NTC is exemplary!

NTC has a lot to offer, from our e-Pay Service and other New Programs for ISO’s, and Options for your merchants. NTC, The Payments and Technology Expert! Visit us at www.nationaltransaction.com or call us at 888-996-2273.

Posted in Best Practices for Merchants, Credit card Processing, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: bank, Business Loan, card, cash advance, credit card, customers, loan, merchants, payment, PCI Compliance, processor, travel, travel agency

February 25th, 2016 by Elma Jane

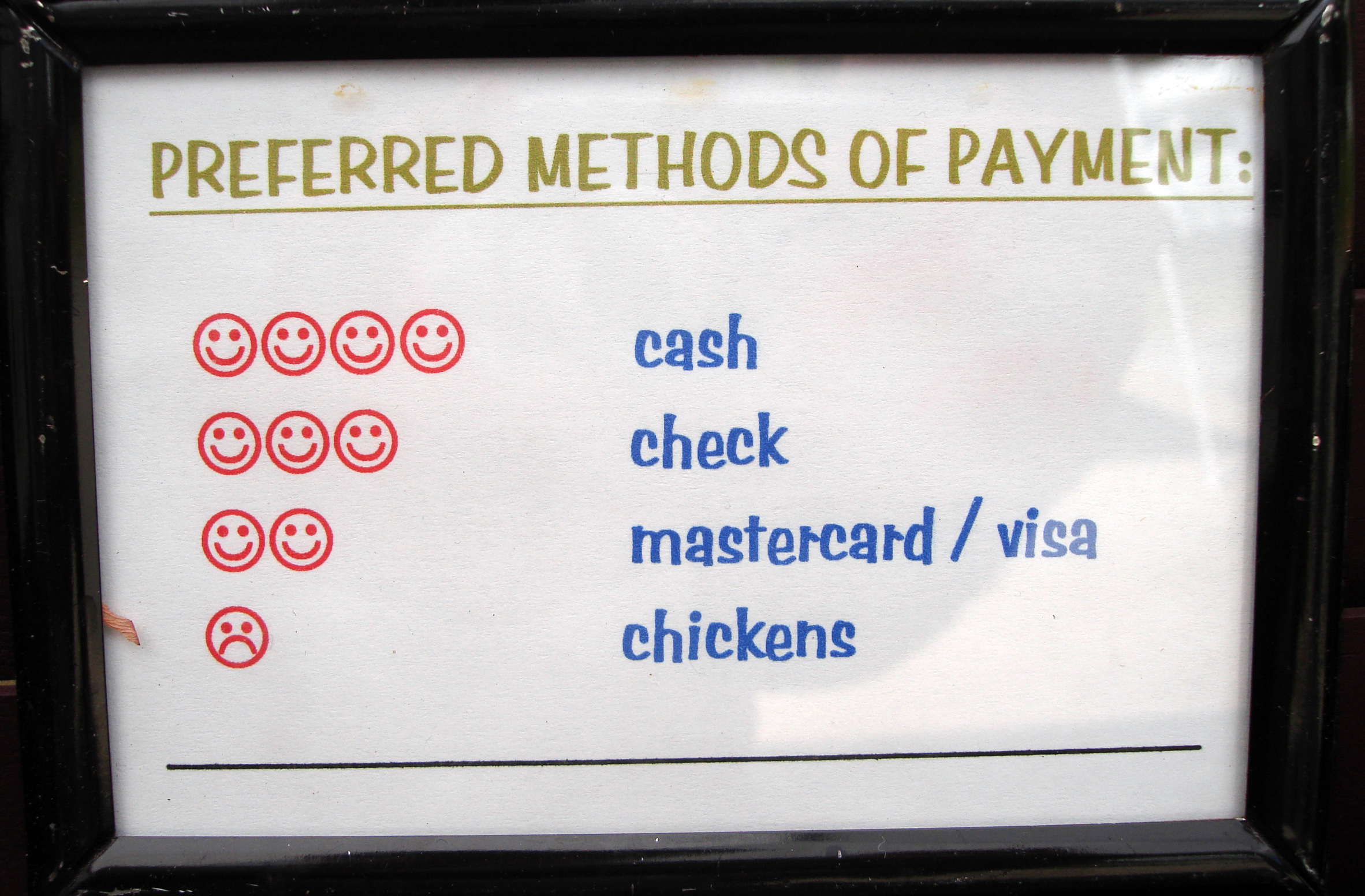

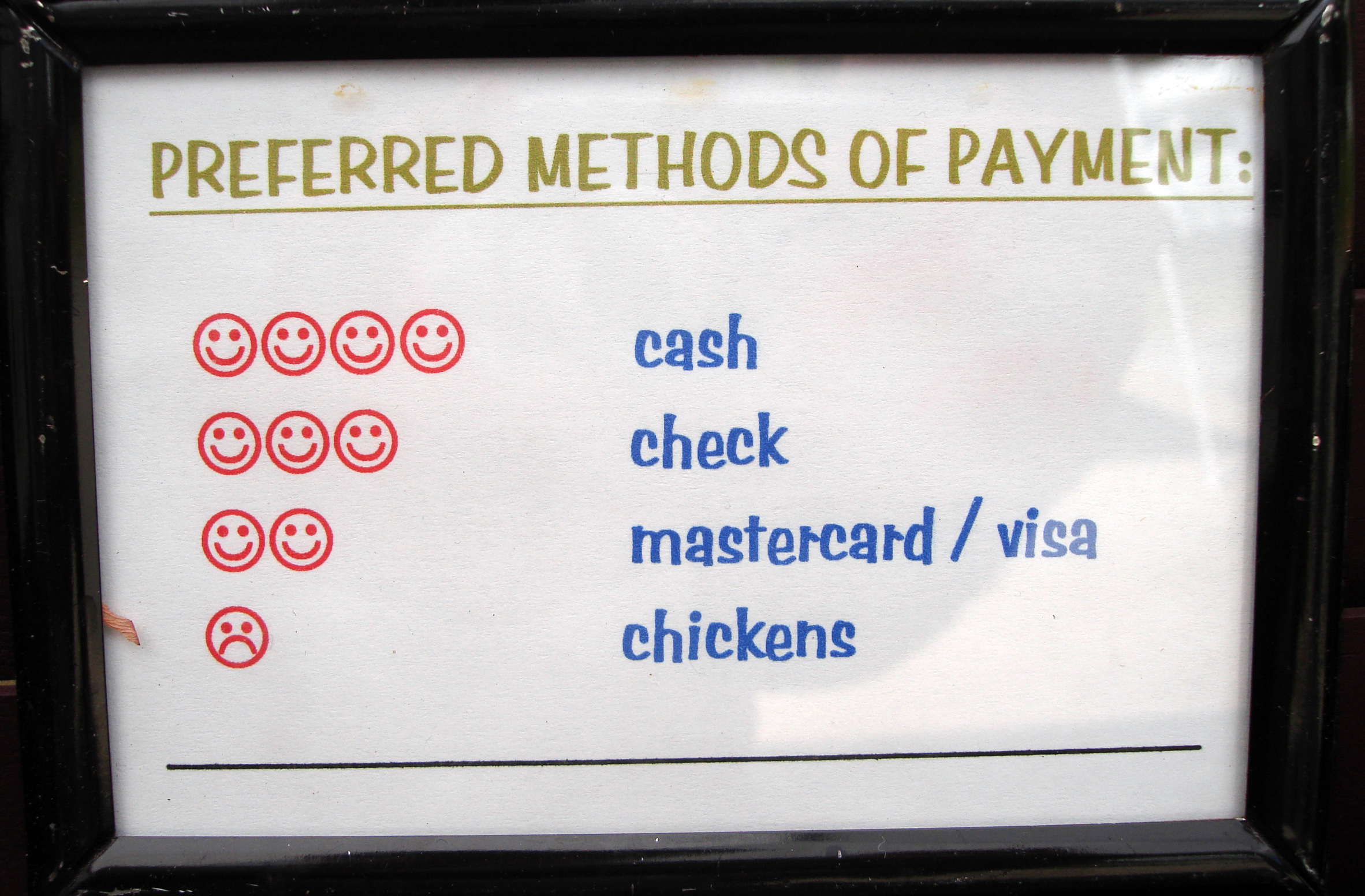

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 19th, 2016 by Elma Jane

This company is the best. If anyone, especially Travel Agents need to obtain a Credit Card Processing Company, this is the one to go with, ask for Megan. She is the Best!!!! Thank you for all your help….

Travel Agents,Travel,Credit Card Processing,Credit Card,Card

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments, Merchant Account Services News Articles, Travel Agency Agents Tagged with: card, credit card, credit card processing, travel, travel agents

February 16th, 2016 by Elma Jane

NTC ePay is an easy and effective way to process transactions for any Merchants.

National Transaction creates a custom link for your business, which you will use to send your customers an Electronic Invoice. Once your customer received the invoice, they will click on the link and pay the amount on the invoice.

The customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy before they can pay the invoice, this will protect you in a case of a Chargeback.

With this system in place, Credit Card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

Electronic Invoicing saves time and unnecessary costs. Documents don’t need to be scanned or email, all transactions are processed through the electronic invoice making it easy to keep track of.

Most of our Merchants using NTC ePay are in the Travel Industry, some are into boat Repair Business and Church Ministries. If you want to process securely, save time and unnecessary costs like our existing merchants, check out NTC ePay, The No Shopping Cart e-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce, Travel Agency Agents Tagged with: credit card, customers, e-commerce, Electronic Invoice, merchants, transactions, travel, travel industry