February 2nd, 2016 by Elma Jane

Businesses continue to struggle with the prohibited storage of unencrypted customer payment data. The Payment Card Industry Data Security Standard (PCI DSS), merchants are instructed that, Protection methods are critical components of cardholder data protection in PCI DSS Requirement.

PCI DSS applies to every company that stores, processes or transmits cardholder information. Regardless of the size or type of business you operate, the number of credit card transactions you process annually or the method you use to do so, you must be PCI compliant.

Data breach is not a limited, one-time occurrence. This is why PCI compliance is required across all systems used by merchants.

Encryption and Tokenization is a strong combination to protect cardholder at all points in the transaction lifecycle; in use, in transit and at rest.

National Transaction’s security solutions provide layers of protection, when used in combination with EMV and PCI-DSS compliance.

Encryption is ideally suited for any businesses that processes card transactions in a face to face or card present environment. From the moment a payment card is swiped or inserted at a terminal featuring a hardware-based, tamper resistant security module, encryption protects the card data from fraudsters as it travels across various systems and networks until it is decrypted at secure data center.

Tokenization can be used in card not present environments (travel merchants) such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments. Tokens can reside on your POS/PMS or within your e-commerce infrastructure at rest and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions in use. Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions.

The sooner businesses implement encryption and tokenization the sooner stored unencrypted data will become a thing of the past.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card data, card present, cardholder, compliance, credit card, customer, data, data breach, data security, e-commerce, EMV, encryption, Mail Order/Telephone Order, merchants, moto, payment, Payment Card Industry, PCI-DSS, POS, secure data, Security, terminal, tokenization, tokens, travel, travel merchants

January 12th, 2016 by Elma Jane

Can we securely store card data for recurring billing?

PCI DSS discourages businesses from storing credit card data, Merchants feel the practice is necessary in order to facilitate recurring payments.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

In order for the electronic storage of cardholder data to be PCI Compliant, appropriate encryption must be applied to the primary account number (PAN). In this situation, the numbers in the electronic file should be encrypted.

All PCI controls would apply to the environment in which the cardholder data is transmitted and stored. Tokenization can be implemented for recurring and/or delayed transactions. Travel Merchants and or Storage Facility could use this feature to help reduce the need for electronically stored cardholder data while still maintaining current business processes.

The best thing you can do for your business is to not store any cardholder data or personally identifiable information.

Tomorrow let’s tackle Encryption and Tokenization a strong combination to protect card data while reducing the cost of compliance!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security, Travel Agency Agents, Visa MasterCard American Express Tagged with: cardholder data, credit card, data, merchants, payments, Security, tokenization, transactions, travel

January 7th, 2016 by Elma Jane

National Transaction is now offering Apple Pay to Canadian Merchants.

Apple Pay works with NTC’s EMV-contactless point of sale terminals in Canada.

Security and privacy is at the core of Apple Pay, and when a consumer adds a credit card to Apple’s mobile wallet, the actual card numbers are not stored on the device, or on Apple servers.

Apple Pay will create a unique Device Account Number that is assigned, encrypted and securely stored in the secure element on the device, the same way it operates in the U.S. Each transaction is authorized with a one-time unique dynamic security code.

To pay, consumers simply hold their mobile device near the contactless reader, exactly as they would a contactless card today. The payment information is then passed to the POS system once the consumer confirms the transaction using Touch ID on their device.

Bringing Apple Pay to NTC terminals addresses an increasing consumer demand for contactless payments, while also allowing Canadian businesses to offer customers the convenience of paying through an iPhone, iPad or Apple Watch.

American Express is Apple’s issuing partner in Canada.

Posted in Best Practices for Merchants Tagged with: Contactless card, contactless point of sale, contactless reader, credit card, EMV, merchants, mobile device, mobile wallet, payment, POS system, security code, terminals

December 17th, 2015 by Elma Jane

Mobile Payments – It is bound to see more actions with tech giants Apple, Google and Samsung in mobile payment trends. We will also see new technologies like smartwatches, bracelets and rings that will give us the ability to provide payment options.

NFC – Near Field Communication, another familiar face among the payment trends. NFC, however, goes way beyond making payments using smartphones. These speed up POS payment processing quickly and easily without requiring a PIN or signature. While there are other POS payment methods, such as QR codes, NFC will come out on top. Merchants should ensure they have an overview of the current Point-of-Sale options and should, if needed, upgrade to the latest technology.

Security: Tokenization and biometric authentication will have a strong influence on the payment industry.

Tokenization – when applied to data security, is an extremely interesting method of securing credit card data. As the credit card numbers are substituted by tokens that has no value, then no harm can be done if tokens are stolen, which makes tokenization a secure process.

There are several new inventions when it comes to payment processing authentication such as password, PIN, and fingerprint methods. But they are weak so two-factor authentication is increasingly used to improve security.

Biometrics Authentication – like finger print scan, facial recognition, voice recognition, and pulse recognition are set to become increasingly significant. This will increase both security and convenience.

International E-Commerce – It’s important that merchants offer shoppers their preferred local payment method. Merchants who are looking for e-commerce success will need to create an international strategy. Merchants should also consider checking with their payment service providers. Providers know their way around to alternative payment methods.

Cash on the Retreat – Cashless Society? Some countries in Europe are certainly cutting down on the usage of cash. In Sweden, it is now almost impossible to use cash to pay for bus tickets. Acceptable payment methods include customer cards, credit cards, and payments via smartphone apps. Traditional cash-based bakeries no longer exist and instead, now display signs requesting that customers use cashless payment methods for even the smallest amounts. The situation in Denmark is similar; the government is currently debating whether or not to release smaller retailers from the obligation of having to accept cash as a payment method. Cash is on the retreat, and alternative payment methods are advancing. However, cash is still on the list.

Real-Time Payments (Instant Payments) – The European Central Bank (ECB) will bring instant payments strongly in the near future. Instant or real-time payments are a trend which will be with us for a long time to come.

Regulatory Changes – The first Payment Services Directive (PSD) from 2007 is still currently implemented domestically. After a tough two-year negotiation period, the EU has now, finally, agreed on a second payment services directive (PSD2). The European Banking Authority (EBA) is set to develop more detailed guidelines and regulatory standards for various industries. Payment industries should begin preparing themselves now for implementation, doing this will allow them to be ready for the appropriate steps necessary in 2016/2017.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: Apple, biometric, credit card, data security, e-commerce, google, merchants, Mobile Payments, Near Field Communication, nfc, payment industry, payment methods, payment options, payment processing, payment service providers, payment services, payment trends, payments, PIN, point of sale, POS, qr codes, real-time payments, Samsung, tokenization

December 3rd, 2015 by Elma Jane

Industry professionals agree that mobile payments technology has surpassed e-commerce as the trend in the daily spending behavior of modern retail customers.

E-commerce’s impact on consumer spending has actually decreased, but it seems that the ability to pay with mobile devices has finally swayed consumers away from their computers.

The payments outlook has changed rapidly with the increasing availability of mobile technologies to the average retail consumer within the last year. Products like Apple Pay, Android Pay and Samsung Pay have totally altered the landscape of payment options.

Small Businesses will have to adapt in order to keep up with the rapid pace of technological developments. The evolution of payments technologies not only alters how consumers spend their money, but how that money is processed during a transaction.

There are still some concerns over cyber risks and data security, which led 58 percent of surveyed professionals to agree that point-of-sale debit and credit card transactions were still the safest form of payment, while mobile payments garnered 20 percent of support. But hypothetical worries over security aren’t real enough to slow mobile payments’ momentum moving forward.

Mobile payments transaction value is expected to hit $8.71 billion by the end of 2015. That figure will triple to $27.05 billion in comparison to 2016, according to new research; as a bigger base of consumers begin to use their phones for point-of-sale transactions and a wider range of merchants begin to accept mobile payments. By 2019, essentially all mobile payment transactions will be done on smartphones.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Point of Sale Tagged with: credit card, credit card transactions, debit, e-commerce, merchants, Mobile Payments, payments technologies, point of sale

November 17th, 2015 by Elma Jane

Within the payment processing industry, Merchant accounts are categorized according to how they process their transactions.

There are two primary merchant account categories:

Swiped (Card Present) and Keyed (Card-Not-Present).

Swiped or Card-Present Transactions: Are those in which both the card and the cardholder are present at the time the payment is processed, they physically swipe their customers credit card through a terminal or point-of-sale system.

The sub-categories within this group include:

Retail Merchants – Normally conduct their business in an actual storefront or office space. They primarily use counter-top terminals or Point-of-Sale systems. Restaurant Merchants – Requires a special set-up that allows for tips to be added to the final sale amount by settling the transaction with an adjusted price that will include the tip amount.

Wireless / Mobile Merchants – They use wireless terminals or mobile phones to run these transactions in Real-Time. Have the ability to accept credit cards transactions wherever they are located out on the road.

Hotel / Lodging Merchant – Will authorize a customer’s credit card for a certain sale amount.

Card-Present Transactions also include grocery stores, department stores, movie theaters, etc. Card acceptance settings where cardholders use unattended point-of-sale (POS) terminals, such as gas stations, are also defined as card-present transactions.

Keyed-In or Card-Not-Present Transactions: Whenever the transaction is completed and the cardholder (or his or her credit card) is not physically present to hand to the seller.

The sub-categories within this group include:

Mail Order / Telephone Order (MOTO) – The customers card information is gathered via over the phone, fax, email or internet and then manually key-entered into a terminal or payment gateway software. Once the transaction is approved and completed, the product is then shipped to the customer for delivery.

eCommerce / Internet – Conduct ALL of their business over the internet through a web site. So all credit card transactions are processed online via a payment gateway in real-time. The payment gateway is integrated into the web sites shopping cart. The cardholders card is charged instantly.

Travel Merchants is one example of Keyed or Card-Not-Present Transactions.

Start processing credit card payments today whether Swiped or Keyed.

Give us a call now at 888-996-2273 so more details!

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone, Travel Agency Agents Tagged with: Card Not Present transactions, card present, card-not-present, card-present transactions, cardholder, credit card, credit card payments, credit card transaction, ecommerce, keyed, Lodging Merchant, mail order, merchant accounts, merchants, mobile merchants, moto, payment gateway, payment processing, point of sale, POS terminals, Restaurant Merchants, Retail Merchants, shopping cart, swiped, telephone order, terminal, transactions, travel merchants

November 13th, 2015 by Elma Jane

It’s important for merchants to understand the basic of how a credit card terminal works. It is the channel through which the process flows and the merchants can choose the right one for their processing needs, whether they use a point-of-sale (POS) countertop model, a cardreader that attaches to a smartphone or mobile device, a sleek handheld version for wireless processing or a virtual terminal for e-commerce transactions.

A credit card terminal’s function is to retrieve the account data stored on the payment card’s EMV microchip or a magnetic stripe and pass it along to the payment processing company (also known as merchant account provider).

For card-not-present (CNP) – mail order, telephone order and online transactions – the merchant enters the information manually using a keypad on the terminal, or the e-commerce shopper enters it on the website’s payment page. The back half of the process remains the same.

The actual data transmission goes from the terminal through a phoneline or Internet connection to a Payment Processing Company, which routes it to the bank that issued the credit card for authorization.

In card-present transactions where the card and cardholder are physically present, the card is connected to the reader housed in the POS terminal. The data is captured and transmitted electronically to the merchant account provider, who handles the authorization process with the issuing bank and credit card networks.

A POS retail terminal with a phone or Internet connection works best in a traditional retail setting that deals exclusively in card present transactions. For a business with a mobile sales, a mobile credit card processing option like Virtual Merchant Converge Mobile relies on a downloadable app to transform a smartphone or tablet into a credit card terminal equipped with a USB cardreader.

Wireless Terminals are compact, allowing you to accept credit cards in the field without relying on a phone connection. If you process debit cards, you’ll need a PIN pad in addition to your terminal so cardholders can enter their personal identification number to complete the sale.

Selecting the right terminal for your credit card processing needs depends largely on the type of business you run and the sorts of transactions you process. Terminals are highly specialized and provide different services. At National Transaction we offer a broad range of terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC/Contactless payment transactions at your business. An informed business decision benefits your bottom line. Start accepting credit cards today with National Transaction.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Point of Sale Tagged with: Android Pay, Apple Pay, card-not-present, card-present transactions, cardholder, cardreader, cnp, contactless payment, Converge Mobile, credit card, credit card networks, credit card terminal, debit cards, e-commerce, EMV, magnetic stripe, mail order, merchant account provider, merchants, microchip, mobile credit card processing, mobile device, Near Field Communication, nfc, online transactions, payment processing company, PIN pad, point of sale, POS, POS terminal, smartphone, telephone order, virtual merchant, virtual terminal, wireless processing

November 12th, 2015 by Elma Jane

Here are some tips for protecting gifts cards to accessing them via phone and replacing gift cards that don’t work:

Remedy for gift cards that don’t work.

You need the activation receipt, they just don’t activate them correctly. With that slip of paper, a gift card giver can at least prove the card was activated and they can take it back.

Returning a malfunctioning gift card? Deal with the company that issued it, that means if it’s a store gift card, take it back to the store, and if it’s a bank-branded gift card, call the toll-free number on the back of the card.

Shield some gift cards from theft and loss.

In the past, if lost or stolen, they were gone permanently. These days, with bank-branded cards, you can register the cards with the issuer to get protection from loss or theft. The funds will be replaced if it’s lost or stolen.

It works for some retail gift cards, too. To register a gift card, call the toll-free number or visit the website listed on the back of the card. You’ll supply the card number, and likely the PIN and expiration date of the card, along with your name and address.

Storing gift cards on a phone is becoming more common.

More and more gift cards are being redeemed through mobile technology. Some apps allow shoppers to take a picture of the front of the card and store it, along with the recorded balance.

Stretch more out of gift cards.

When is a $50 gift card worth more than $50? When you use it online to score a discount or free shipping.

If you’re making a purchase with a gift card, shop both the brick-and-mortar location and the store’s website to see if one of them will offer a discount, free delivery or free shipping. Most retailers have moved to this digital-and-physical environment.

Want to boost the value of that gift card you just received? Snag a coupon to go with it. With a few minutes of searching, you could increase your gift-buying power by 10 or 20 percent.

There are two kinds of gift cards and (generally) two menus of fees.

With cards that carry a credit card brand name, you often pay a purchase fee. In return, you can use them any place that accepts that card brand.

Buy a gift card at or for a particular retailer, and you pay only the face value of the card. But you can only use it at that specified retailer, and sometimes at affiliated businesses.

Majority of retailer gift cards don’t have expiration dates, activation fees or dormancy fees.

Under the federal Credit CARD Act of 2009, gift cards have to be good for at least five years from the purchase date, but the best advice is to spend them as soon as possible.

Treat them gently.

Plastic gift cards still use magnetic stripes, like pre-chip credit cards. Those stripes can occasionally get demagnetized.

Some gift cards include a scratch-off panel. If you use something too sharp you can accidently remove the numbers underneath, then it’s no good to you.

Some gift cards are made of paper or thin cardboard, another reason to put them in a separate envelope.

According to research from the National Retail Federation, gift cards are the No. 1 requested present 9 years in a row.

Posted in Uncategorized Tagged with: card, credit card, Gift Cards

November 2nd, 2015 by Elma Jane

Delivering Paperless, Next-Day Deposits for Health Insurance Payments.

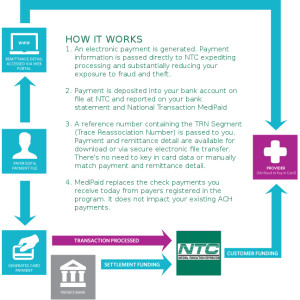

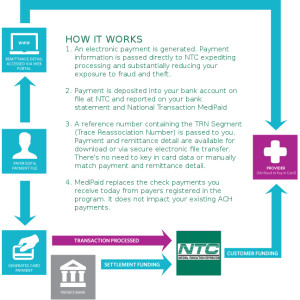

NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance payments. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: checking account, credit card, electronic payments, health insurance, healthcare provider's, medical insurance, MediPaid, merchant accounts, payments, provider's

October 30th, 2015 by Elma Jane

National Transaction Corporation is the preferred Credit Card Processing Agent for many National Travel Agencies & Associations. We are the preferred merchant account service provider for ASTA, OSSN, ARTA, HBTA,Vacation.com, Travel Leaders, Trams and many more. We are also affiliated with JaxFax, Travel weekly, TRO / Travel Research Online and other travel agency associations in the travel agent industry.

Benefits of our Merchant Account Services for Travel Agencies.

Competitive credit card processing rates & fees for travel agents

Faster deposits (as quick as 24 hrs from transaction)

No holds on funding

Trams Credit Card Merchant Account Integration

Sabre Red Merchant Account Integration

Booking Software Processing Integration

Lower Processing Rates & Fees

Swiped Rates for face to face credit card processing

ecommerce for shopping cart credit card processing

National Transaction Corporation has a proven track record with many of the Largest Travel Agency Associations in the U.S. and Canada. In fact for several of those, we are the preferred credit card processing merchant account services provider for their members. We can take your business to the next level with integration into Trams, Sabre, Sabre Red or off the shelf accounting programs like QuickBooks and Peachtree Accounting.

We are more than happy to provide you with a free merchant account rate review and go over your current credit card processing details and show you how we can save you money and get deposits even faster. We also offer industry leading technical support around the clock, you call, we answer. Simple as that. We can assist errant transactions, chargebacks, terminal messages and much more. Find out why National Transaction Corporation is the preferred merchant account services provider for travel agents & agencies.

Call us now and put us to the test. 888-472-7112

American Society of Travel Agents, Vacation.com, ASTA, Trams, Virtuoso, Travel Leaders, Association of Retail Travel Agents, Specialty Travel Agent Association, Cruise Holidays Credit Card Processing.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: chargebacks, credit card, credit card processing, ecommerce, merchant account, Merchant Account Services, National Travel Agencies, shopping cart, travel agencies, travel agency, travel agent