September 22nd, 2014 by Elma Jane

Consumers know how hard it is to obtain a credit card, if your credit score isn’t up to par. A bad credit score can prevent you from getting credit and make it hard to purchase your day to day necessities. People with poor credit don’t know their options. There are a number of ways to get a credit card if you have a poor credit score. There will likely be road blocks and limitations in your search. You won’t have the same options available as someone with pristine credit. But you will be able to get a line of credit if you look in the right place.

COSIGNED CREDIT CARDS If you get a cosigner, you will be able to obtain a card that would not be available to you otherwise. The cosigner has to have good credit, and they are responsible for your debt if you can’t pay. Make sure your cosigner fully recognizes their obligations and what will happen if you are unable to pay.

GIVE AN EXPLANATION FOR POOR CREDIT Explain the circumstances behind your poor credit. You can add a 100-word statement to your credit report such as the loss of a job. If you can tell your story and convince creditors you are on the road to increasing your credit score, they may believe you are more likely to pay back your debts. Divorce and illness are two other instances where individuals may see a drop in their credit score. Make sure whatever you list is true.

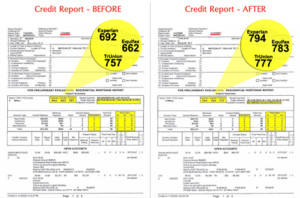

IMPROVE YOUR CREDIT One of the most difficult options. Poor credit can seem extremely hard to repair. But there are choices, it is just a process that will take a significant period of time. If you have poor credit, you can open bank accounts and pay off your loans and credit cards on time. If you pay off your debt in a timely manner, your credit score will improve over time and you will gain access to more credit card options.

RETAIL STORE CARDS Retail stores often have store credit cards they offer customers. Retail stores are generally more willing to approve applicants without a stellar credit score. But these cards usually come with extremely high interest rates and relatively low credit limits, so make sure you fully understand the terms of the card before applying.

SECURED CREDIT CARDS You deposit some money into an account, and then a creditor will provide you with a line of credit equal to your deposit. It is essentially a down payment, and if you don’t pay your credit card bill, your creditor is entitled to the money in the account. This might not sound like a favorable position, but remember that secured credit cards can be used as a valuable tool to rebuild your credit. Make sure the card you apply for reports to a credit reporting agency. This will help you start building a credit history. SELECT A CREDIT

CARD DESIGNED FOR THOSE WITH POOR CREDIT There are a number of credit cards offered by Visa and MasterCard designed for people with poor credit. These cards have low limits, a significant number of fees and high interest rates. But for some people, it may be their best option. Talk to your bank’s administrators or with your current credit card company to see if they offer a credit card that fits your personal needs.

SUBPRIME CREDIT CARDS Another option for those with poor credit, but they are ripe with fees that many people who are already short on cash may not be able to handle. Interest rates can be dangerously high for those with poor credit, so beware of these cards. They are often a last resort for individuals who need access to credit. However, like secured credit cards, they can be used to rebuild credit. Make sure you read the fine print and understand the applicable fees before you apply for a subprime credit card. Again, make sure the card reports to a credit reporting agency so you start building a credit history. Finding a line of credit doesn’t have to be a difficult endeavor. If you know what you are looking for, you can find a line of credit that fits your personal needs without breaking the bank. There are limitations, as well as pros and cons, to many of the forms of credit available to those with poor credit scores, such as secured credit cards or subprime credit cards. But those options do give people choices they otherwise may not have, and they help you build credit, so that eventually you will have a greater number of options.

Posted in Best Practices for Merchants Tagged with: account, applicants, card, consumers, COSIGNED CREDIT CARDS, credit, credit card bill, credit history, credit limits, credit report, credit score, credit-card, creditor, customers, deposit, down payment, good credit, interest rates, low credit limits, MasterCard, payment, poor credit, RETAIL STORE CARDS, retail stores, SECURED CREDIT CARDS, store credit cards, SUBPRIME CREDIT CARDS, visa, Visa and MasterCard

September 19th, 2014 by Elma Jane

CREDIT CARD NUMBER’S ANATOMY

The numbers on front of a credit card aren’t just random. They give away specific information about the card and where it comes from.

The first 6 digits of the credit card number is the Bank Identification number (BIN). This will tell the name of the credit card issuer.

Example: Travel or entertainment cards, such as American Express cards, begin with a 3 . All Visa credit cards start with a 4, MasterCard with a 5, and 6 is dedicated to Discover.

The first six digits of the card, including the Bank Identification number, represent the issuer identification number. This identifies the bank that issued the card.

Of course, there’s the personal account number. This is made up of the seventh digit on, everything except the last number on the card.

The final digit on the credit card is known as the check digit or checksum. This number is set by something called the Luhn formula, patented by an IBM scientist in 1960. It’s a formula that uses the numerals in your card’s account number to verify that it’s valid. Various combinations of the card’s digits must ultimately add up to a number divisible by 10.

The formula is mostly used to protect against input errors. Let’s say you enter in the wrong numbers on an online shopping site. The formula will compute that the digits don’t add up right, telling you you’ve entered an invalid card number. That last digit of your credit card makes sure the formula works like it’s supposed to.

Now you know that there’s a lot of information on that little card in the wallet.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: (BIN), account number, American Express cards, Bank Identification number, card, card issuer, card number, check digit or checksum, credit, credit card issuer, credit card number, credit-card, Discover, entertainment cards, issuer identification number, MasterCard, online shopping site, personal account number, Visa credit cards

September 18th, 2014 by Elma Jane

Americans love gift cards, but many of those pieces of plastic go partially or entirely unused. Some are lost or forgotten. Others simply are ignored once the balance drops to a few dollars or less.

A gift card’s unused value…known in industry parlance as spillage or breakage…long has meant big profits for the gift card industry .

But the Credit Card Accountability, Responsibility and Disclosure Act of 2009, better known simply as the Credit CARD Act, tightened rules on retailers, making it more difficult for stores to cancel unused cards or charge inactivity fees. That prevents retailers from quickly cashing in on breakage.

In addition, savvy consumers are catching on and appear to be finding ways to avoid losing breakage while getting the most out of their gift cards.

According to the most recent figures, about 1 percent of the total value of gift cards was predicted to go unused in 2013. That’s down from a record high of 10 percent in 2007. Some of the reduction in breakage is a result of growing cardholder realization that even though there’s only $2.12 on gift card, they got to find a way to use it.

However, even with the decline in breakage, around $1 billion worth of gift cards will be lost to fees and expiration dates or misplaced, shoved in a drawer or otherwise neglected this year. That’s a huge amount of money that consumers will not be able to use toward a new shirt, stuffed animal or bicycle.

Retailers love when people use gift cards because studies show that most customers spend more in the store than the card is worth. Breakage makes gift cards even more profitable: An estimated $127 billion in gift cards will be sold in 2014, even a small percentage of unused cards boost a company’s bottom line.

Those profits make it feasible for retailers to make some consumer-friendly moves, such as selling gift cards at a discount. However, most of the money goes toward other endeavors.

Wal-Mart may have a billion dollars (in unused gift cards) sitting there. Wal-Mart could go out and build 30 new superstores without borrowing a penny. They know those gift cards will come in eventually, but for now, they have the use of that money.

Ways to make sure you’re not ‘breakage’

The longer you let a card sit untapped, the less likely you are to use it. Here are eight ways to make sure your gift cards are not lost to breakage:

Give again. Instead of letting that last two bucks on a card go to waste, use it to make a donation. Stockpile cards and combine them into higher-value gift cards that are donated to the needy.

A Gift Card Giver founder, got the idea when he asked a group of acquaintances how many had unused gift cards sitting in their wallets. They literally started pulling out gift cards from their wallets, everyone had one.

The Gift Card Giver founder offered to redistribute the unused cards to the needy and a new nonprofit was born.

Give low-end cards as gifts. To make sure your gift card doesn’t languish in someone else’s wallet, consider purchasing cards at Walgreens and Wendy’s instead of Nordstrom and Saks. Practical gift cards, such as those for fast-food chains and discount retailers are used faster than cards to fine dining establishments and pricey department stores.

Corral your cards. Make sure you can quickly locate your cards by storing them all in the same place.

If you have too many cards to tuck into your wallet, stowing them in a durable plastic envelope. Or upgrade to a Card Cubby (about $24), which includes alphabetized tabs and is tiny enough to keep in a purse.

Plan your shopping ahead of time. Set up your e-mail program to send you a monthly reminder to use your gift cards. Think in terms of the week or month ahead, when will you be near the store? What items do you need there? Is there a gift you need for someone else? You are more likely to use the card if you know what you want ahead of time and can get in and out quickly.

Rethink general-purpose gift cards. Gift cards from credit card companies can be used anywhere you can use a credit card. But these cards also come with drawbacks.

Use-anywhere cards, known as open-loop cards are more likely to come with startup fees and monthly inactivity fees that chip away at your balance. Many of these gift cards also include a valid through or good through date stamped on the front. Your card’s underlying value will not expire after that date, but you will have to call customer service for a replacement card, and that raises the risk that you will simply toss the card and your remaining balance.

Read the fine print. The CARD Act prohibits gift card inactivity fees for the first year, and requires that gift cards cannot expire within five years of when activated. State lawsmay extend additional gift card protections. That gives you a big, but not permanent cushion of time to use the cards.

Trade or sell your cards. If you get a card you know you will not use, a Hot Topic gift card, for instance, when you are more of an L.L.Bean type, use one of the many card-swapping and card-selling sites to get what you really want.

That is because with a Wendy’s and a Walgreens on practically every corner, such lower-end cards simply are more convenient to use. They also offer more value for your card. If you give a Wal-Mart gift card to your mailman, there are plenty of things to use it on.

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: card-selling, card-swapping, cardholder, cards, consumers, Credit CARD Act, credit card companies, credit-card, customer service, customers, drawbacks, e-mail program, fees, gift card industry, Gift Cards, inactivity fees, lower-end cards, open-loop cards, retailers, startup fees, Wal-Mart gift card

September 16th, 2014 by Elma Jane

When plastic cards become digital tokens, they become virtual. So how do you say that the Card is Present or Not Present. The legendary regulatory difference that the cards industry has relied on to differentiate between interchange fees for Card Present and Card Not Present transactions.

Apple secured Card Present preferential rates for transactions acquired by iTunes on the basis that the card’s legitimacy is verified with the issuer at the time of registration and the token minimizes probability of fraud. If an API call to the issuing bank is sufficient to say that the Card is Present, who is to say that the same logic can’t apply to online merchants who also verify the authenticity of Cards on File when they tokenize them? How can one arbitrarily say that the transaction processed with token from an online merchant is Card Not Present, but the one processed with Apple Pay is Card Present even though both might have made the same API call to the bank to verify the card’s validity?

In the Apple case, a physical picture of the card is taken and used to verify that the person registering the card has it. It is not that hard for an online merchant to verify that the Card on File converted as a token does belong to the person performing an online transaction.

As we move towards chip and pin the card present merchants will spend substantial money upgrading their hardware and POS systems. That expense will be offset by that savings in losses due to fraud. MOTO and e-commerce transactions ( card NOT present ) will always have a higher cost because the nature of processing is NON face to face transactions. Of course the fraud and losses are higher when the card is manually entered or given to someone over the phone……Face to face will always have the lowest cost per transaction because it is usually the final step in the sale. Restaurants are low risk because you had the transaction AFTER you eat. If there is a dispute it happens before the merchant even sees the credit card.

In the long run, as cards become digital and virtual through tokens, we are all going to wonder if card is present or not present. May be some will say. Card is a ghost.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: (POS) systems, API call, Apple secured Card Present, bank, Card Not Present transactions, card present, card present merchants, cards, cards industry, chip, credit-card, digital and virtual, digital tokens, e-commerce transactions, fees, fraud, hardware, industry, interchange, interchange fees, issuer, issuing bank, low risk, Merchant's, moto, NON face to face transactions, online, online merchants, online transaction, PIN, Processing, Rates, token, transactions

September 10th, 2014 by Elma Jane

If your businesses considering an iPad point-of-sale (POS) system, you may be up for a challenge. Not only can the plethora of providers be overwhelming, but you must also remember that not all iPad POS systems are created equal. iPad POS systems do more than process payments and complete transactions. They also offer advanced capabilities that streamline operations. For instance, they can eliminate manual data entry by integrating accounting software, customer databases and inventory counts in real time, as each transaction occurs. With these systems, you get 24/7 access to sales data without having to be in the store. The challenge, however, is knowing which provider and set of features offer the best iPad POS solution for your business. iPad POS systems vary in functionality far more than the traditional POS solutions and are often targeted at specific verticals rather than the entire market. For that reason, it’s especially important to compare features between systems to ultimately select the right system for your business.

To help you choose a provider, here are things to look for in an iPad POS system.

Backend capabilities

One of the biggest benefits of an iPad POS system is that it offers advanced features that can streamline your entire operations. These include backend processes, such as inventory tracking, data analysis and reporting, and social media integration. As a small business, two of the most important time saving and productivity-boosting features to look for are customer relationship management (CRM) capabilities and connectivity to other sales channels. You’ll want an iPad POS that has robust CRM and a customizable customer loyalty program. It should tell you which products are most and least frequently purchased by specific customers at various store locations. It should also be able to identify the frequent VIP shoppers from the less frequent ones at any one of your store locations, creating the ultimate customer loyalty program for the small business owner. If you own an online store or use a mobile app to sell your products and services, your iPad POS software should also be able to integrate those online platforms with in-store sales. Not only will this provide an automated, centralized sales database, but it can also help increase total sales. You should be able to sell effortlessly through online, mobile and in-store channels. Why should your customers be limited to the people who walk by your store? Your iPad POS should be able to help you sell your products through more channels, online and on mobile. E-commerce and mobile commerce (mCommerce) aren’t just for big box retailers.

Cloud-based

The functions of an iPad POS solution don’t necessarily have to stop in-store. If you want to have anytime, anywhere access to your POS system, you can use one of the many providers with advanced features that give business owners visibility over their stores, its records and backend processes using the cloud. The best tablet-based POS systems operate on a cloud and allow you to operate it from any location you want. An iPad POS provider, with a cloud-based iPad POS system, businesses can keep tabs on stores in real time using any device, as well as automatically back up data. This gives business owners access to the system on their desktops, tablets or smartphones, even when not inside their stores. Using a cloud-based system also protects all the data that’s stored in your point of sale so you don’t have to worry about losing your data or, even worse, getting it stolen. Because the cloud plays such a significant role, businesses should also look into the kind of cloud service an iPad POS provider uses. In other words, is the system a cloud solution capable of expanding, or is it an app on the iPad that is not dependent on the Internet? Who is the cloud vendor? Is it a premium vendor? The type of cloud a provider uses can give you an idea about its reliability and the functions the provider will offer.

Downtime and technical support

As a small business, you need an iPad POS provider that has your back when something goes wrong. There are two types of customer support to look for: Downtime support and technical support.

iPad POS systems are often cheaper and simpler than traditional systems, but that doesn’t mean you can ignore the product support needs. The POS is a key element of your business and any downtime will likely result in significant revenue loss. You could, for instance, experience costly downtime when you lose Internet connectivity. iPad POS systems primarily rely on the Web to perform their core functions, but this doesn’t mean that when the Internet goes down, your business has to go down, too. Many providers offer offline support to keep your business going, such as Always on Mode. The Always on Mode setting enables your business to continue running even in the event of an Internet outage. Otherwise, your business will lose money during a loss of connectivity. Downtime can also happen due to technical problems within the hardware or software. Most iPad POS providers boast of providing excellent tech support, but you never really know what type of customer service you’ll actually receive until a problem occurs.

Test the friendliness of customer service reps by calling or emailing the provider with questions and concerns before signing any contracts. This way, you can see how helpful their responses are before you purchase their solution. Your POS is the most important device in your store. It’s essentially the gateway to all your transactions, customer data and inventory. If anything happens to it, you’ll need to be comfortable knowing that someone is there to answer your questions and guide you through everything.

Grows with your business

All growing businesses need tech solutions that can grow right along with them. Not all iPad POS systems are scalable, so look for a provider that makes it easy to add on more terminals and employees as your business expands. Pay attention to how the software handles growth in sales and in personnel. As a business grows, so does it sales volume and the required software capabilities. Some iPad POS solutions are designed for very small businesses, offering very limited features and transactions. If you have plans for growth, look for a provider that can handle the changes in transactions your business will be going through. Find out about features and customization. Does the system do what you want it to do? Can it handle large volume? How much volume? What modules can you add, and how do you interface to third parties? You should also consider the impacts of physical expansion and adding on new equipment and employees. If there are plans in the future for you to open another store location, you’ll need to make sure that your point of sale has the capabilities of actually handling another store location without adding more work for you. If you plan on hiring more employees for your store, you’ll also want to know that the solution you choose can easily be learned, so onboarding new staff won’t take up too much of your time.

Security

POS cyber attacks have risen dramatically over the past couple of years, making it more critical than ever to protect your business. Otherwise, it’s not just your business information at risk, but also your reputation and entire operations. iPad POS system security is a bit tricky, however. Unlike credit card swipers and mobile credit card readers that have long-established security standards namely, Payment Card Industry (PCI) compliance — the criteria for the iPad hardware itself as a POS terminal aren’t quite so clear-cut. Since iPads cannot be certified as PCI compliant, merchants must utilize a point-to-point encryption system that leaves the iPad out of scope. This means treating the iPad as its own system, which includes making sure it doesn’t save credit-card information or sensitive data on the iPad itself. To stay protected, look for PCI-certified, encrypted card swipers.

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: (POS) systems, accounting, app, business, card, cloud-based, credit, credit card readers, credit-card, crm, customer, customer relationship management, customer support, data, data analysis, database, desktops, e-commerce, inventory, iPad Point-Of-Sale, loyalty program, mcommerce, mobile, mobile app, mobile commerce, online, online platforms, Payment Card Industry, payments, PCI, platforms, POS, POS solution, products, sales, Security, security standards, services, Smartphones, social media, software, tablets, terminal, transactions, web

September 8th, 2014 by Elma Jane

One of the greatest mistake any merchants can do is deciding to lease or rent a credit card terminal rather than getting one for FREE. While the practice of leasing has declined in recent years in the US it is all they are doing in Canada whether the merchant is renting from a bank or leasing from a sales rep. In both the US and Canada some sales reps will still strive and persuade you that leasing is the perfect choice for you. You’re not obliged to pay any cash up front, or You’re assured a substitute terminal if yours breaks. Those selling statements may sound decent, but they’re not. A terminal lease will end up costing you hundreds, if not thousands of dollars more than what it’s worth. With the fees you’ll end up disbursing to lease a terminal, you could buy that same terminal in a matter of months. If you lease a terminal you could also be forced to buy equipment insurance, which is an additional expense. You may even have to give back the terminal at the end of your lease!

Why Purchasing a Credit Card Terminal is a Good Choice

A terminal lease brings with it a 48 month lease contract. That is a lengthy time to be giving for a terminal that doesn’t cost more than $300 today. Why not just buy one entirely? The cost of the purchase is absolutely tax deductible. Even if you can’t come up with the money to pay cash for your terminal, you can just put it on a business credit card. The interest given is still tax deductible, and let’s says you have a 19 percent credit card rate, if you pay the same amount of $/month toward your credit card balance that you would have paid toward your lease, you’ll have the terminal paid off in less than a year. That’s a savings that can be better channelled into budding and growing your company.

FREE Credit Card Terminal

For those of you, who feels that because of the ever changing technology, they do not want to continue buying new terminals, there are FREE Terminals offers all across Canada. So, with your FREE terminals, there is no out of pocket set up expense and your current processing rate can be the same or reduced significantly. If your terminal breaks or if there is a better technology that develops, the company automatically ships to you at no charge an upgraded terminal. So, if you can’t buy one, see if your credit card processor will give you one for FREE.

If you’re stuck in a lease, you most likely won’t able to end the contract. A lease term is usually 48 months, so you’ll have to look up when that term terminates before you can leave without a consequence. As an alternative, do your own research and analyze the total expense of leasing vs. purchasing. Better yet, strongly consider the benefits of not having to worry about anything, at one point is that FREE terminal usually has $25 minimum expense to the merchant. Mom taught you there was no free lunch didn’t she? If you decide to return the FREE terminal, you may find a RETURN EQUIPMENT FEE or an EARLY RETURN FEE of that FREE EQUIPMENT.

Posted in Best Practices for Merchants, Credit Card Reader Terminal Tagged with: bank, card, cash, credit, credit card processor, credit card terminal, credit-card, fees, Merchant's, processor, tax, terminal

September 2nd, 2014 by Elma Jane

While Apple doesn’t talk about future products,latest report that the next iPhone would include mobile-payment capabilities powered by a short-distance wireless technology called near-field communication or NFC. Apple is hosting an event on September 9th, that’s widely expected to be the debut of the next iPhone or iPhones. Mobile payments, or the notion that you can pay for goods and services at the checkout with your smartphone, may finally break into the mainstream if Apple and the iPhone 6 get involved.

Apple’s embrace of mobile payments would represent a watershed moment for how people pay at drugstores, supermarkets or for cabs. The technology and capability to pay with a tap of your mobile device has been around for years, you can tap an NFC-enabled Samsung Galaxy S5 or NFC-enabled credit card at point-of-sale terminals found at many Walgreen drugstores, but awareness and usage remain low. Apple has again the opportunity to transform, disrupt and reshape an entire business sector. It is hard to overestimate what impact Apple could have if it really wants to play in the payments market.

Apple won’t be the first to enter the mobile-payments arena. Google introduced its Google Wallet service in May 2011. The wireless carriers formed their joint venture with the intent to create a platform for mobile payments. Apple tends to stay away from new technologies until it has had a chance to smooth out the kinks. It was two years behind some smartphones in offering an iPhone that could tap into the faster LTE wireless network. NFC was rumored to be included in at least the last two iPhones and could finally make its appearance in the iPhone 6. The technology will be the linchpin to enabling transactions at the checkout.

Struggles

The notion of turning smartphones into true digital wallets including the ability to pay at the register, has been hyped up for years. But so far, it’s been more promise than results. There have been many technical hurdles to making mobile devices an alternative to cash, checks, and credit cards. NFC technology has to be included in both the smartphone and the point-of-sale terminal to work, and it’s been a slow process getting NFC chips into more equipment. NFC has largely been relegated to a feature found on higher-end smartphones such as the Galaxy S5 or the Nexus 5. There’s also confusion on both sides, the merchant and the customer, on how the tech works and why tapping your smartphone on a checkout machine is any faster, better or easier than swiping a card. There’s a chicken-and-egg problem between lack of user adoption and lack of retailer adoption. It’s one reason why even powerhouses such as Google have struggled. Despite a splashy launch of its digital wallet and payment service more than three years ago, Google hasn’t won mainstream acceptance or even awareness for its mobile wallet. Google hasn’t said how many people are using Google Wallet, but a look at its page on the Google Play store lists more than 47,000 reviews giving it an average of a four-star rating.

The Puzzle

Apple has quietly built the foundation to its mobile-payment service in Passbook, an app introduced two years ago in its iOS software and released as a feature with the iPhone 4S. Passbook has so far served as a repository for airline tickets, membership cards, and credit card statements. While it started out with just a handful of compatible apps, Passbook works with apps from Delta, Starbucks, Fandango, The Home Depot, and more. But it could potentially be more powerful. Apple’s already made great inroads with Passbook, it could totally crack open the mobile payments space in the US. Apple could make up a fifth of the share of the mobile-payment transactions in a short few months after the launch. The company also has the credit or debit card information for virtually all of its customers thanks to its iTunes service, so it doesn’t have to go the extra step of asking people to sign up for a new service. That takes away one of the biggest hurdles to adoption. The last piece of the mobile-payments puzzle with the iPhone is the fingerprint recognition sensor Apple added into last year’s iPhone 5S. That sensor will almost certainly make its way to the upcoming iPhone 6. The fingerprint sensor, which Apple obtained through its acquisition of Authentic in 2012, could serve as a quick and secure way of verifying purchases, not just through online purchases, but large transactions made at big-box retailers such as Best Buy. Today, you can use the fingerprint sensor to quickly buy content from Apple’s iTunes, App and iBooks stores.

The bigger win for Apple is the services and features it could add on to a simple transaction, if it’s successful in raising the awareness of a form of payment that has been quietly lingering for years. Google had previously seen mobile payments as the optimal location for targeted advertisements and offers. It’s those services and features that ultimately matter in the end, replacing a simple credit card swipe isn’t that big of a deal.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: app, Apple, card, card swipe, cash, checkout machine, checks, chips, credit, credit card swipe, credit-card, customer, debit card, Digital wallets, fingerprint recognition, fingerprint sensor, Galaxy S5, Google Wallet, iOS, Iphone, market, merchant, mobile, mobile device, mobile payment, mobile wallet, Near Field Communication, network, Nexus 5, nfc, payment, payment service, platform, point of sale, products, sensor, services, smartphone, software, statements, swiping card, terminals, transactions, wireless technology

August 27th, 2014 by Elma Jane

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

August 22nd, 2014 by Elma Jane

Turn Around Strip Down

There was a bit of confusion at a supermarket. When this senior was ready to pay for his groceries, the cashier said, Strip Down facing me.

Making a mental note to complain about excessive security running amok, the senior did just as the lady cashier had instructed.

When the hysterical shrieking and alarms finally subsided, he found out that the lady cashier was referring to his credit card, to turn around the card, strip down and swipe it.

The senior have been asked to shop elsewhere in the future.

Posted in Uncategorized Tagged with: card, credit, credit-card, swipe

August 21st, 2014 by Elma Jane

Accept Electronic Payments in Their Currency, Convert it to Yours. National Transaction helps you and your customers transact with confidence.

DCC provides convenient currency conversion service at the time of purchase benefiting both the credit card holder and merchants. Our solution provides a system where the Visa or MasterCard holder in a foreign country can shop on an American based website that displays prices in their own local currency. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied.Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line and making international transaction with confidence. We have diverse set of applications to enable various kinds of business models and financial frameworks.

Posted in Best Practices for Merchants Tagged with: Bank Reference, Card Recognition, conversion rate, credit-card, currency, Currency Conversion, customers, DCC, Dynamic Currency, electronic payments, exchange rate, financial, invoice, MasterCard, Merchant's, pricing, rate, receipt, transactions, visa, website