September 20th, 2024 by Elma Jane

Merchant Account Risks for Travel Agencies

The travel industry, with its high-value transactions and international clientele, faces unique challenges when it comes to credit card processing. While accepting plastic is crucial for smooth booking and customer convenience, travel agencies must be aware of the inherent risks and implement strategies to mitigate them. Here’s a breakdown of the key credit card processing risks and how to minimize them:

1. Chargebacks:

- The Problem: Travel plans change, flights get delayed, and unforeseen circumstances arise. This can lead to a higher rate of chargebacks, where customers dispute charges with their credit card company. Chargebacks can be costly, involving fees, lost revenue, and potential damage to your merchant account reputation.

- Mitigation:

- Clear Cancellation Policies: Crystal-clear terms and conditions regarding cancellations, refunds, and travel changes are essential. Ensure these are easily accessible during booking.

- Thorough Documentation: Maintain detailed records of all transactions, customer communications, and travel itineraries. This provides evidence in case of a dispute.

- Proactive Communication: Keep customers informed about any changes to their travel plans and address concerns promptly.

- Secure Payment Processing: Utilize 3D Secure (like Verified by Visa or Mastercard SecureCode) for added authentication and fraud prevention.

2. Fraud:

- The Problem: The travel industry is an attractive target for fraudsters due to high transaction values and the potential for anonymity. Fraudulent activities can include using stolen credit card details, booking fictitious trips, or exploiting vulnerabilities in online booking systems.

- Mitigation:

- Address Verification System (AVS): Verify the billing address provided by the customer against the address on file with the credit card company.

- Card Security Code (CVV): Always require the CVV code for card-not-present transactions.

- Fraud Detection Tools: Implement fraud screening tools that analyze transactions for suspicious patterns and flag potentially fraudulent activity.

- PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure handling of sensitive cardholder data.

3. Currency Fluctuations:

- The Problem: International travel often involves transactions in multiple currencies. Fluctuating exchange rates can impact your profit margins and create uncertainty in pricing.

- Mitigation:

- Dynamic Currency Conversion: Offer customers the option to pay in their home currency, providing transparency and potentially reducing chargebacks related to exchange rate discrepancies.

- Hedging Strategies: Explore financial instruments to mitigate currency risk, such as forward contracts or currency options.

4. High Processing Fees:

- The Problem: Travel agencies often face higher processing fees due to the perceived risk associated with the industry.

- Mitigation:

- Negotiate with Processors: Shop around and compare rates from different credit card processors. Don’t hesitate to negotiate for better terms, especially if you have a high volume of transactions.

- Consider Interchange-Plus Pricing: Opt for transparent pricing models like interchange-plus, which separates the interchange fee (charged by card networks) from the processor’s markup.

5. Technological Challenges:

- The Problem: Keeping up with evolving payment technologies and security standards can be challenging. Outdated systems can increase your vulnerability to fraud and data breaches.

- Mitigation:

- Invest in Secure Technology: Use a robust and secure online booking system that integrates with reputable payment gateways.

- Regular System Updates: Ensure your software and security protocols are regularly updated to address emerging threats.

- Partner with Reliable Providers: Choose payment processors and technology vendors with a strong track record of security and reliability.

By understanding and proactively addressing these credit card processing risks, travel agencies can protect their business, enhance customer trust, and navigate the exciting world of travel with greater financial security.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card-not-present, cardholder, chargeback, credit card, customer, fraud, high-risk merchants, merchant account, merchants, payment, processors, risk, transaction, travel, travel agencies, travel agency, travel agents

June 23rd, 2024 by Elma Jane

Merchant Aggregators, Merchants of Records and Payment Service Provider what’s the difference?

Payment Service Provider – is a company, which provides payment gateway and related services (like antifraud tools) to merchants. PSP is a representative of one or several acquiring banks. The merchant signs an agreement with the acquiring bank and PSP. The acquiring bank provides a merchant account and secures settlements for merchant’s transactions directly to the merchant’s bank account. Payment Service Provider secures delivery of the merchant’s transactions to the acquiring bank and some related services like fraud scrubbing and recurring transactions. The merchant has an own merchant account with this model.

Merchant Aggregator – is a company, which uses one merchant account to process transactions from many merchants. Merchants don’t have any agreements with an acquiring bank, but with the merchant aggregator. You get quick setup and get shut down quickly. Most aggregators are hard to get hold of, they don’t have human customer support. The problem with this model is, it’s not intended as a long-term, scalable solution to accepting payments and they can freeze your account or hold your money if anything unusual happens.

Merchants of Record – are a merchant, who use services of payment service provider (PSP) or merchant aggregators to accept payments on their websites for goods or services they sell. Merchant of record role requires an array of administrative responsibilities, such as managing a merchant account with a payment processor, paying associated credit card rates & fees for the transactions and other responsibilities like complying with PCI DSS Standards.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank account, credit card, customer, merchant, payment gateway, payment processor, Payment Service Provider, PCI, transactions

November 15th, 2018 by Admin

When you think of starting a business, you often think of making a huge investment: Office, marketing materials, furniture, inventory, etc. The reality is that not all companies need that and not all need an office to start. Here are ten businesses you can start from home now.

1. Web Design: If you have experience building websites or do it as a hobby, do it this one is for you. Website design is in high demand, and although there are Do-It-Yourself sites available, not everyone wants to spend the time doing it. This is where you come in, create a fantastic website, a portfolio with your best work and get started.

2. Virtual Assistant: If you have experience as an Administrative Assistant, Executive Assistant or you are just good at the computer this one is perfect for you. With many people working and managing the business online, it is only fit that many entrepreneurs look for virtual admins to help them with everyday tasks. Some might hire you for a short-term/one task kind of project, while others might want to hire you for the long term. Be sure you outline a plan to figure out which type of projects you want and which industries you would want to focus on.

3. eBay Seller: If you have been online, we are sure you or someone you know have heard of Gary Vaynerchuk and his flip challenge. Essentially, you would buy items at a garage sale that you know you can sell for more online. You can try this approach or start by selling books and other things you have already at home, and you don’t use. It is an easy and not complicated way start a side business. Just be sure to abide by their terms of service.

4. Accountant: Do you work as an accountant? Those online businesses and even brick and mortar businesses are always in need of an accountant. Find out competitive rates in your area and reach out to companies that might be in need of your services. Do a good job and good luck!

5. Copywriter: Marketing is significant for any business, writing good copy is essential for this part of the business, and you might be the person who makes a difference in the company’s advertising efforts.

6. Driver: With companies like Uber and Lyft offering ride services, it is easy to start your own ride service business. You can join either of them and get started. Do keep in mind that they do have guidelines when it comes to the vehicles. After all, they are the brand.

7. Consultant: If you are highly knowledgeable about a specific topic and you know there is a demand for this kind of information, you can sell your services as a consultant. Set up a rate and know who your customer will be and get started.

8. Coach: This is another one that pays off when you are good at a specific skill. People can coach in a variety of subjects like Business, Life, work, spirituality and more. For this one, we recommend you get the tools needed by becoming a certified coach, although it is not necessary.

9. Meal Delivery Service: Similar to the ride services, you can deliver food by joining companies like GrubHub, Uber Eats DoorDash. Many companies offer this service, and you can get started as soon as your application is accepted. The benefit, like Uber or Lyft, is that you make your schedule.

10. Social Media: If you are creative like to write and enjoy social media, this might be a good business to start. This is the kind of business that is needed and can compliment a good marketing strategy. Remember to stay on top of trends, news and be willing to learn as this industry changes quickly but can be a rewarding experience.

There are many more businesses you can start home that requires minimal to no investment; we hope this list gives you an idea to get started.

Posted in Uncategorized Tagged with: business, coach, consultant, copywriter, customer, data, driver, ebay, entrepreneur blog, entrepreneurship, lyft, mobile, social media, tips, uber, uber eats, virtual assistant, web design, work from home, writing

November 1st, 2018 by Admin

We are officially 55 days until Christmas, time to take all of the tricks out of your hat to promote your business. Since we know you will be using social media, here are 30 random holidays you can use to promote your business with their Hashtag.

November 1st:

#ExtraMileDay: Show your customers how you will go the extra mile for them.

November 2nd

#LoveYourLawyerDay: Need we say more? This one is perfect for lawyers or anyone working with them.

#FountainPenDay: If you sell promotional items, this one is for you. It can also work if you want to post the latest contract signed.

#SandwichDay: Even if you don’t own a sandwich shop, Sandwich day can be used to share a more laid back look of your company. Maybe sharing a picture of your last company picnic or lunch will do. Remember to have a good looking picture!

First Sunday of November

#ZeroTaskingDay If you work for a spa or anything that promotes relaxation, this one would be a good one for you!

November 5th

#LoveYourRedHairDay Hairdressers, time to get those finished looks and share them on social media!

#NachosDay Any day is a good day for Nachos, but on Nachos day you can show some humor as a way to connect to your customers. This one is great for restaurants.

November 8th

Guinness World Record Day: #GWRDay: Sharing a fun fact comes a long way in Social Media. Sharing a Guinness World Record that might relate to your industry can attract a new crowd online.

#CappuccinoDay: People love coffee, (search #CoffeeLover, and you’ll see) so why not share Cappuccino Day with your coffee loving crowd. Perfect for the coffee shop owner to the savvy consultant on the go.

November 10th

#SesameStreetDay: If you are in an industry that deals with children, this one is for you. Make the posts funny or just cute but remember you are targeting the parents at the end. Nostalgic posts work well too with this.

#VanillaCupcakeDay: Cupcake lovers beware, this hashtag might be for you. Perfect for the bakery owner and the all-time cupcake lover, there is no need to be a pastry chef to use this one.

November 11th

#origamiday This one might require some skill and imagination, but it can delight your online community and attract them more to what you do. If you use this one, be sure to send us a picture.

#SundaeDay Who doesn’t love Ice Cream Sundaes!

November 12th

#HappyHourDay Geared more for restaurants and bars, but with a bit of creativity, many can use this hashtag.

November 13th

#KindnessDay Show your kindness to others.

November 15th

#AmericaRecyclesDay We all need to take care for our planet. Show your support by sharing this with some facts and information about recycling.

November 18th

#PrincessDay: Pamper the princesses in your business or show appreciation of your customer.

#MickeyMouseDay Need we say more?

November 19th

International Men’s Day #MensDay: Men’s day is great to share information about current men’s health issues. Perfect for those in the healthcare industry

#PlayMonopolyDay: This one we feel is perfect for finance. “Don’t get caught in monopoly games and get your money safe” what do you think?

November 20th

#EntrepreneursDay Completely self-explanatory.

#NameYourPCDay Give some love to those PC users in your industry and have fun too.

November 21st

#HelloDay A great hashtag to introduce yourself and the team.

November 22nd

#GoForARideDay Whether it is a ride on a car or bike ride, many can use this hashtag if you are creative enough.

November 23rd

#FlossingDay perfect for those in the dental industry.

#EspressoDay Just like #CapuccinoDay, this hashtag can help greatly any account.

November 25th

#ShoppingReminderDay If you sell goods, this one is for you.

November 30th

#ComputerSecurityDay Technology always changes, this one can be an excellent reminder to keep online info safe.

All Month Long:

#PeanutButterLoversMonth When you ran out of ideas or inspiration this month, this hashtag can be a lifesaver. Remember that social media should entertain or educate and this one can help with that.

Bonus Holidays:

These might not be random but are always useful to add.

#Movember

#ThanksGiving

#CyberMonday

We hope these hashtags can help boost your business online presence and bring a little more creativity to your social media game. As always, have fun and use your to see if any of these can help your business.

Posted in Small Business Improvement Tagged with: account, business, capuccino, christmass, coffee, consumers, credit card, customer, customers, data, disney, e-commerce, Facebook, finance, fun, hairdressers, hashtags, holidays, Instagram, lawyers, merchants, payments, photography, restautrant, retail, Security, social media, transactions, twiter

October 10th, 2018 by Admin

Life has its ups and downs, and we all know of those times where you feel like giving up. These quotes will you motivated and ready for round two!

When you reminisce the past because it was “easier.”

1. Be loyal to your future, not to your past.

When people say you are not ready to start a business:

2. You are never too old to start an empire, or too old to chase a dream.

When you feel you are not moving in the right direction:

3. The difference between who you are and who want to be is what you do.

When the nay-sayers say you are spending too much time on your “little dream”:

4. I would much rather work 16hrs a day for myself, than 8 hours a day working for someone else.

When you need to get started:

5. If you want to achieve greatness stop asking for permission.

When you are not sure how to stay motivated:

6. Create a vision that makes you wanna jump out of bed in the morning.

When you are too scared of trying:

7. You have no idea what you are capable of until you try.

When you need to remember why you are doing it:

8. The goal isn’t more money. The goal is living life on your own terms.

When you are not sure if you are ready:

9. If you wait until you’re ready, you’ll be waiting for the rest of your life.

When you are ready to make a change:

10. You’re only one decision away from a totally different life.

Posted in Daily Inspiration Tagged with: boss, bossbabe, business, customer, e-commerce, entrepreneur, entrepreneurship, ideas, inspiration, inspire, motivation, quote, quote of the day, quotes, transaction

October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

April 23rd, 2018 by Admin

Have you ever had issues with your credit card processing provider only to get turned around and around by the rep on the phone? IF you can even get someone on the phone. You hang up feeling frustrated, angry, and without any answers.

Have you ever had issues with your credit card processing provider only to get turned around and around by the rep on the phone? IF you can even get someone on the phone. You hang up feeling frustrated, angry, and without any answers.

Sometimes it’s a small problem, but what happens when they “misplace” your money, or there’s a problem with your account and you can’t receive any payments – and no amount of calling, emailing, or “chatting” seems to help you resolve anything?

There’s a better alternative to credit card payment processing, a company that’s been around for a long time, and is backed by one of the biggest banks in the country. National Transaction Corporation. And we have live, knowledgeable, friendly advisors waiting to pick up your calls and help you with your questions – no runaround, no excuses, no delays.

That’s the NTC way: Help when you need it, on a human level.

You may have had to make a lot of phone calls about chargebacks if you are using one of the more familiar service providers like PayPal, Stripe or Square. Chargebacks are a primary cause of business owners’ complaints with these companies, because these services will usually side with the cardholder in the event of a dispute as they arbitrate the chargeback themselves.

NTC does business fairly and sensibly. When you process your credit card sales through NTC, you will be dealing with Visa, MasterCard, American Express or other credit card companies directly.

When you work with those other service providers, you may be worried about where your money might end up – especially if you’ve read all the nightmarish complaints that business owners like you have posted on trusted sites like the Better Business Bureau and Consumer Affairs.

Imagine you’ve processed a credit card transaction, and the cash seems to disappear? You call and you write and you chat, but no one has anything helpful to offer you and you wonder just where your money went, and what will happen to it now.

NTC knows that’s not how you build trust with your customers. We pride ourselves on our outstanding customer support, ease of use of our services, and the confidence and integrity that comes from being backed by one of the biggest banks in the country, US Bank.

National Transaction Corporation aims to make growing your business easier and more profitable by tailoring our services to your specific needs. We do this because we like you to establish a long-term partnership with us.

Whether you are a florist, a restaurant, or any other kind of merchant, remember to look beyond just the advertised rate when looking for the best credit card payment processing service provider.

If after reading this article and you would like to speak to one of our live customer service representatives, simply call NTC today at 888-996-2273.

Posted in Credit card Processing Tagged with: consumers, credit card, customer, customers, electronic payment, merchant account, Security

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

August 17th, 2017 by Elma Jane

How Do Credit Cards Work?

Paying with a credit card seems like a simple process. You charge the customer, they swipe their card, and then they walk out the door.

But behind the scenes, it’s a bit more complicated.

A credit card payment involves four parties.

- The Merchant

- The Customer

- The Issuing Bank

- The Merchant Services Provider

You know who the Merchant and Customer are – that’s the easy part.

The Issuing Bank is the institution that lends money to the Customer.

When the Customer swipes their card, the Issuing Bank lends them the sale amount. This loan is given with the understanding that the Customer will pay the amount back within 30 days or repay it with interest.

Before the Merchant sees any of that money, it goes through the Merchant Services Provider. In exchange for their credit card processing services, they take out a fee before paying that money to the Merchant.

These fees vary between Merchant Services Providers, but one thing is certain: The Merchant always receives less money than the Customer paid them.

This might seem like a raw deal. However, accepting credit cards can lead to more sales than if you only accept cash.

On our next article we will discuss how to start accepting credit card payments and understanding the processing fees….so stand by for more information about Electronic Payment Processing.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments Tagged with: bank, credit card, customer, electronic payment, loan, merchant, payment

April 6th, 2017 by Elma Jane

Payment types and it’s categories

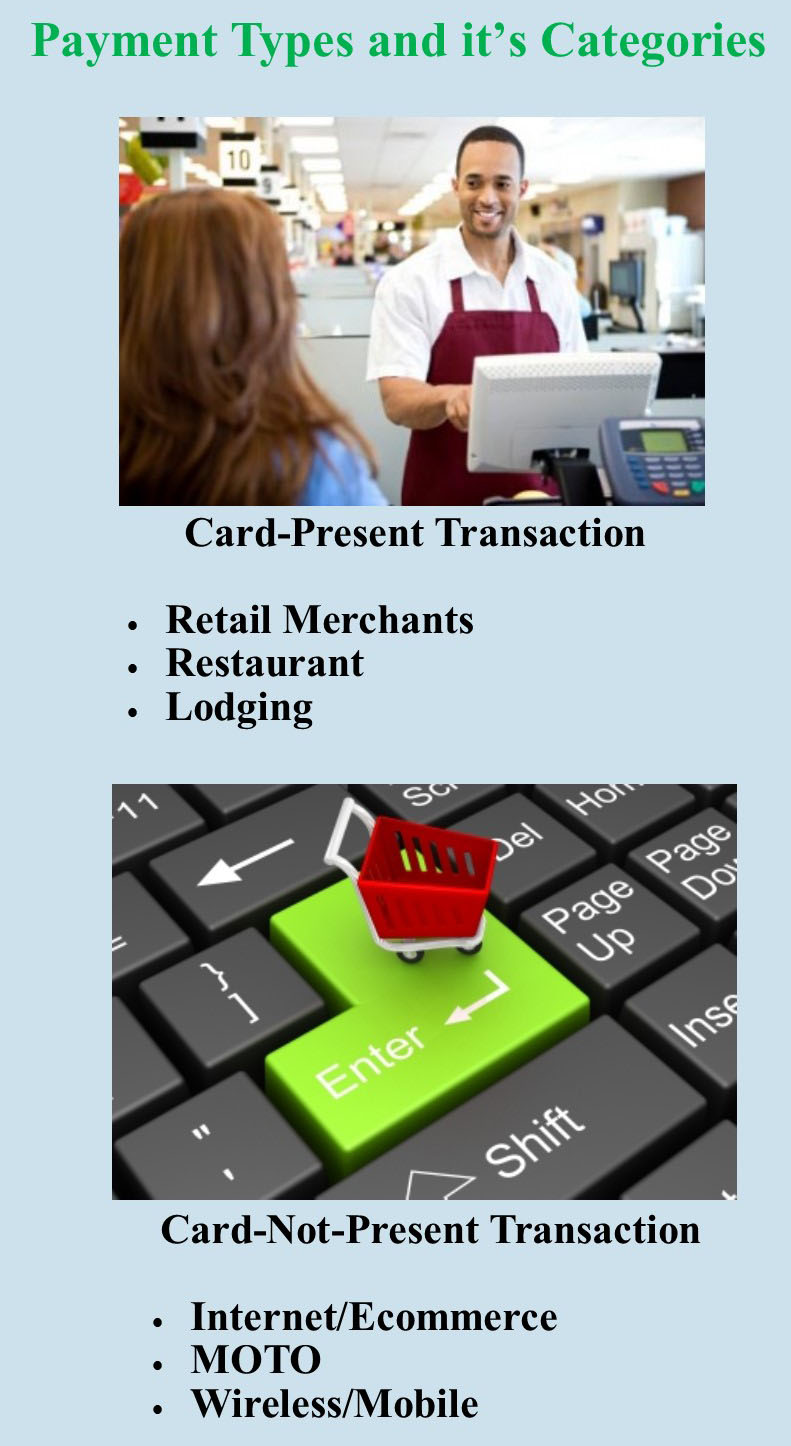

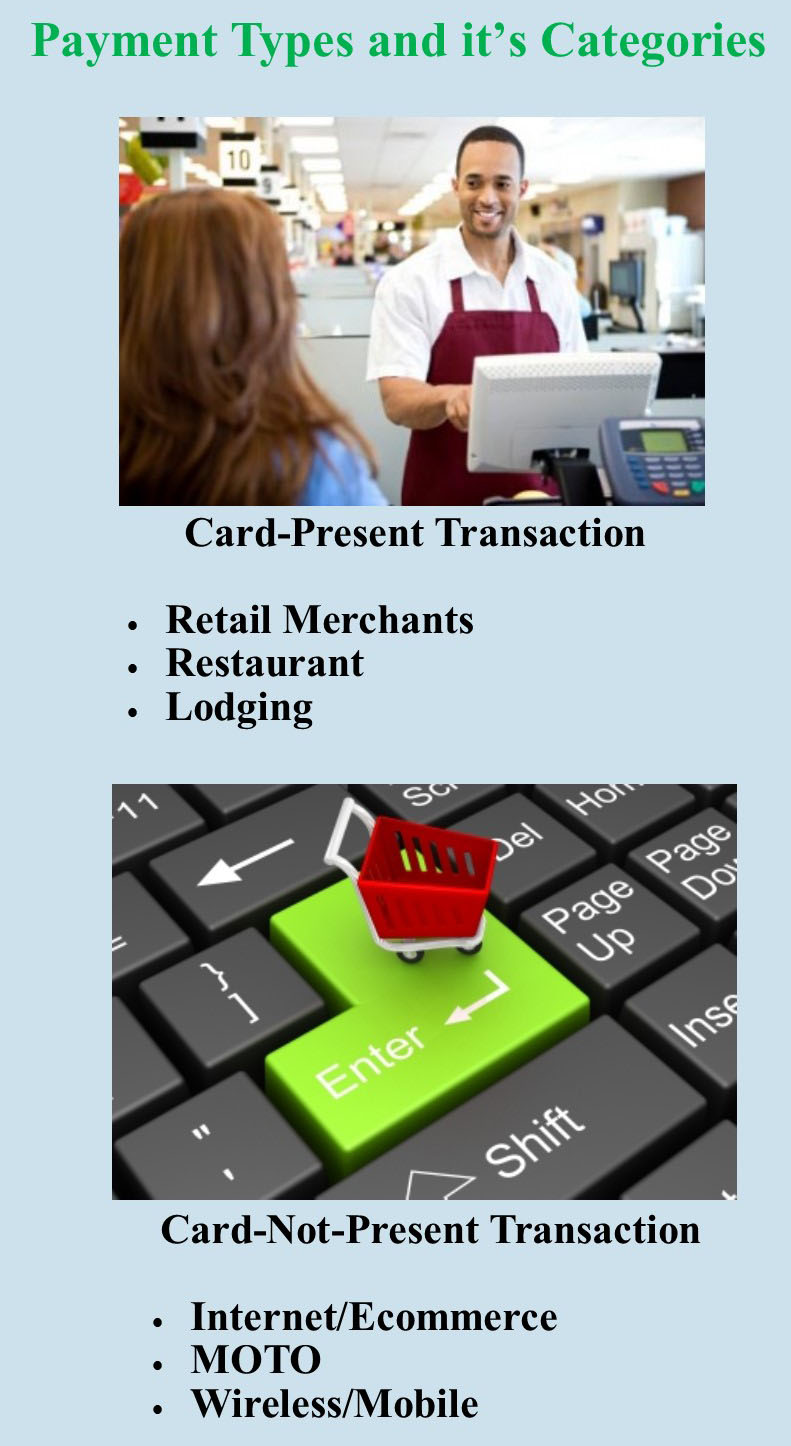

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal