May 28th, 2015 by Elma Jane

No such thing as FREE, but with National Transaction, Customer Relationship Management Software can be! Take advantage of technology and use it for your business success.

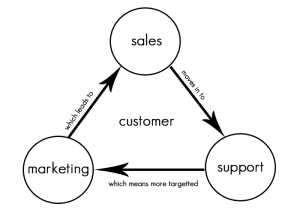

What is CRM? Customer relationship management is a system for managing a company’s interactions with current and future customers. It often involves using technology to organize, automate and synchronize sales, marketing, customer service and technical support.

Free CRM comes in two categories: FREE, but limited, and OPEN SOURCE.

Free, but limited versions – set caps on the amount of free users, contacts, storage, extra features, or some combination.

Open source – offers an unlimited, fully functional CRM to users, is extremely customizable. Most open source CRM companies also offer a preconfigured version and/or installation and support for a price.

There are a whole host of affordable CRM options you should be considering even though not free, may be the perfect fit for your organization.

Each CRM system is different and each one will serve some companies better than others. CRM is a category that’s very rich in free and open source programs.

Why is the value of CRM great for Merchants?

It allows you to register your leads and contacts. You need some basic categories to make your data efficient so that you can implement your CRM strategy to fulfill their needs. With a CRM you can store and manage hundreds of clients and let a computer system handle the task of memory and recall.

You can track all customer interaction – A customer relations management system put all the pertinent client information in one central location that was easy to update and easy to see when other’s updated. All communication can be kept in one spot, nothing gets lost and you can now see and share with the rest of your team. This history builds a long-time relationship. Emails should be in your system, and not in each person’s mailbox.

Every time you make a call, send an email, or contact that customer or prospect you can update your CRM with their current status.

It reveals possibilities. Most companies keep their current supplier until they are ignored. That’s why keeping them alive and kicking in your CRM database is so important. And if you have an opt-in newsletter or a great seminar plan, their business might be yours for the next quarter.

It makes your most valuable asset – the customer data – remain. People change jobs. Have you ever experienced someone leaving you, and nothing is left behind? The pipeline wasn’t up to date. The contacts wasn’t updated. The important contacts wasn’t registered – because all relevant information was stored locally. Don’t let it happen. Customer relations systems help keep all conversations in one place and make it easy for you to quickly look back in time and see how things have progressed. See for yourself the progression of a client and their communication as well as your company’s notes and responses. You’ll be able to save more customers from leaving by catching something you would have otherwise missed, and you can learn from your history.

Posted in Best Practices for Merchants Tagged with: crm, CRM database, customer data, customer service, data, database, merchants, open source

September 9th, 2014 by Elma Jane

The use of customer data can help you make smarter decisions that can improve your store, enhance the shopper experience, and increase conversions. When used incorrectly, however, data can waste resources and alienate your visitors.

Ways that ecommerce merchants commonly misuse data.

Collecting Unnecessary Data

Big Data analytics and reporting tools can put a lot of information in your hands, but that doesn’t mean you should collect and track every single metric. Don’t waste space and bandwidth collecting information that is not essential in your business. Unnecessary data can create noise that slows down the analytics process. Gathering and analyzing information you don’t need can distract you from the metrics that matter. Collecting too much data can create security headaches. The best defense against breaches is to not have data to steal. If you don’t need it, don’t collect it.

Determine your store’s key performance indicators before collecting any information. A good way of doing this is to examine each metric and ask yourself whether it’s just nice to know or is something that you can actually act on. While it may be nice to know that a particular customer has a high Klout Score, that metric probably won’t do anything for your bottom line. It’s better to not bother with it. Key metrics vary from one business to the next. For most ecommerce sites, the important metrics usually include conversion rate, traffic sources, and on-site browsing activities.

Creeping-out Shoppers

Most retailers do this inadvertently when they’re trying to customize the shopper experience. A certain amount of personalization can provide value and convenience to users, but you also have to draw the line between cool personalization and creepy. Sending emails with tailored product recommendations is a good way to increase conversions. But you have to be careful with how you execute it, so that you don’t appear too intrusive. The same goes for remarketing banner ads.

Ignoring Qualitative Information

Numbers can produce many insights, but focusing solely on that data can create an incomplete view of your company. Best data strategies make use of both quantitative and qualitative information. Go beyond the numbers to get the pulse of your customers by collecting feedback through social interactions, customer service logs, surveys with open-ended questions and more. Qualitative information can complement and validate the hard numbers.

Using Data to Justify a Decision or Hypothesis

When it comes to data collection, many merchants fall into the confirmation bias trap, wherein they interpret the information to confirm their existing beliefs or to justify their decisions. Using data this way causes you to ignore information or results that aren’t in line with your beliefs and could result in you missing opportunities. Say a company has so much faith in its new marketing strategy that when website traffic improves, the staff deems the campaign a success without looking at the conversion or retention rates. If the staff had ignored initial biases and looked at the big picture instead, they could have identified flaws and found ways to correct them. The key to addressing this is to have an open mind when interpreting information. This can be difficult, especially when you’re too close to your business. Consider a third-party specialist who can remain objective, to help make the right decisions.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: breaches, business, conversion rate, customer, customer data, customer service, data, ecommerce, ecommerce merchants, Merchant's, rate, retention rates, Security, sources, tools, traffic

June 13th, 2014 by Elma Jane

A couple of teenage boys spent one school lunch break last week hacking into a Bank of Montreal cash machine.

After finding an old ATM service manual online, Matthew Hewlett and Caleb Turon decided to head to their nearest BMO machine at a Safeway store in their hometown of Winnipeg, when the boys tried to get into the system they were asked for a password. Taking a punt on a commonly used default, they were shocked to see their attempt work. Instead of trying to clear the machine out, the pair made their way to the nearest BMO branch to flag the security risk but, staff did not believe them. So both went back to the ATM and got into the operator mode again, then started printing off documentation like how much money is currently in the machine, how many withdrawals have happened that day and how much it’s made off surcharges. The teenagers even changed the machine’s greeting screen from Welcome to the BMO ATM to Go away. This ATM has been hacked. When they returned to the BMO branch with documentation of their hack, the branch manager vowed to contact security. The bank has since taken steps to prevent a repeat but insists that customer data was never at risk.

Posted in Credit Card Security, Payment Card Industry PCI Security Tagged with: atm, Bank of Montreal, cash machine, customer data, hacking, password, Security, security risk