April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

April 8th, 2016 by Elma Jane

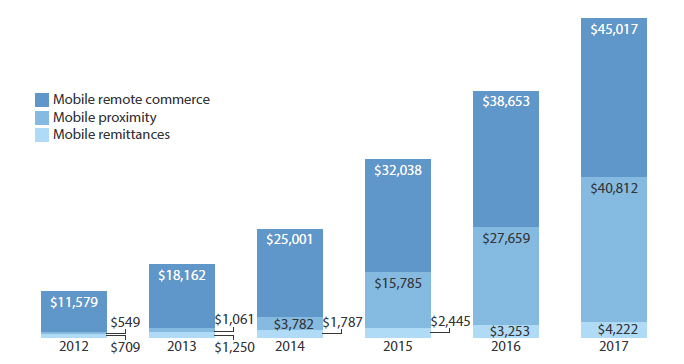

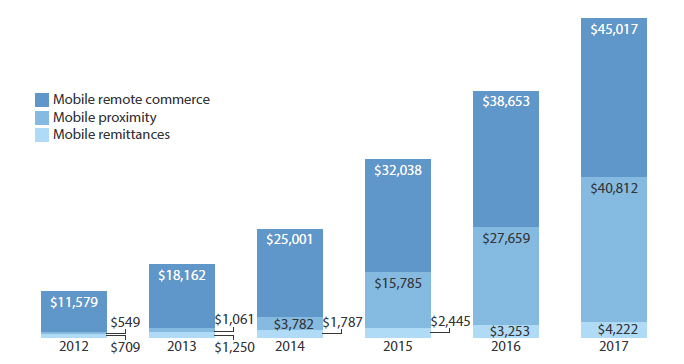

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

April 4th, 2016 by Elma Jane

Accept Payments Your Way – In-Person, Online, and On The Go

Keeping up with customer demands and growing your business can be challenging. With NTC’s payments platform, you can process payments from customers quickly and securely, whether in-person, online or on the go. NTC can help you manage it all in one place, easily, securely and cost effectively.

Posted in Best Practices for Merchants Tagged with: customer, online, payments

March 23rd, 2016 by Elma Jane

Mar 21, 2016 at 2:14 AM

Hi Gloria, Cathy & Bill,

I want to thank the National Transaction Corp team for Gloria’s excellent help last week regarding a repeatedly declined transaction – which the customer insisted should go through. With Gloria’s assistance and information, our customer finally acknowledged there were insufficient funds and gave us a new card to run instead. The joy of dealing with the public!

In the bigger picture, her help that day is typical of the wonderful service your whole team consistently provides. When I call periodically, it’s because there’s a problem… and it’s usually about money… and it’s usually “the other guy’s” fault!

Your team always goes to bat cheerfully and gets results for us. In this age of electronic switchboards and giant financial institutions, I’m amazed at the personal attention and speedy resolution your team always delivers.

We get cold calls from banks or card processors almost every week promising better rates or some “great deal” to handle our transactions. Before they can explain their offer, I tell them I’m already working with friends in the business and hang up as quickly as possible.

You’ve earned my business and loyalty and I can’t say enough good things about your service. Thank you for all you do!

Sincerely, George

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, customer, service

March 23rd, 2016 by Elma Jane

A data breach can occur from inside a business just as much as it can externally. The one common element between both is “Opportunity.” It doesn’t matter whether a business is a multi-national corporation or a small single-location.

Attacks from criminals can range in sophistication. While the sophistication of some attacks may be low, experts note that criminals continue to evolve their techniques and now they are becoming more sophisticated than ever.

While large corporations may have millions of customer records, they also maintain the resources to protect their sensitive information from the average criminal. It may take weeks, months, or even years for a criminal to penetrate the defenses of one large corporation. This is why attacks on small business are becoming so attractive to criminals.

It all goes back to the “Opportunity.” The average small business lacks the resources to properly protect their business from the variety of attacks at the disposal of criminals. Or worse, they may believe their business is of no interest to criminals. The fact is, they are less secure than larger businesses. These are all issues for the average small business owner, and more importantly, their customers.

So what can a small business do to protect themselves from the growing threat of a data compromise?

- Background checks on employees.

- Have someone monitor the network activity.

- Protect business with proper network security protocols.

- Protect your payment’s environment by using a layered approach that includes EMV, encryption and tokenization to help prevent sensitive payment card data from being stolen.

These are all fairly simple and inexpensive ways for businesses to help protect themselves and their customers from being a victim of a costly data compromise.

Posted in Best Practices for Merchants, Credit Card Security, Travel Agency Agents Tagged with: card, customer, data, data breach, EMV, encryption, payment, Security, tokenization

February 25th, 2016 by Elma Jane

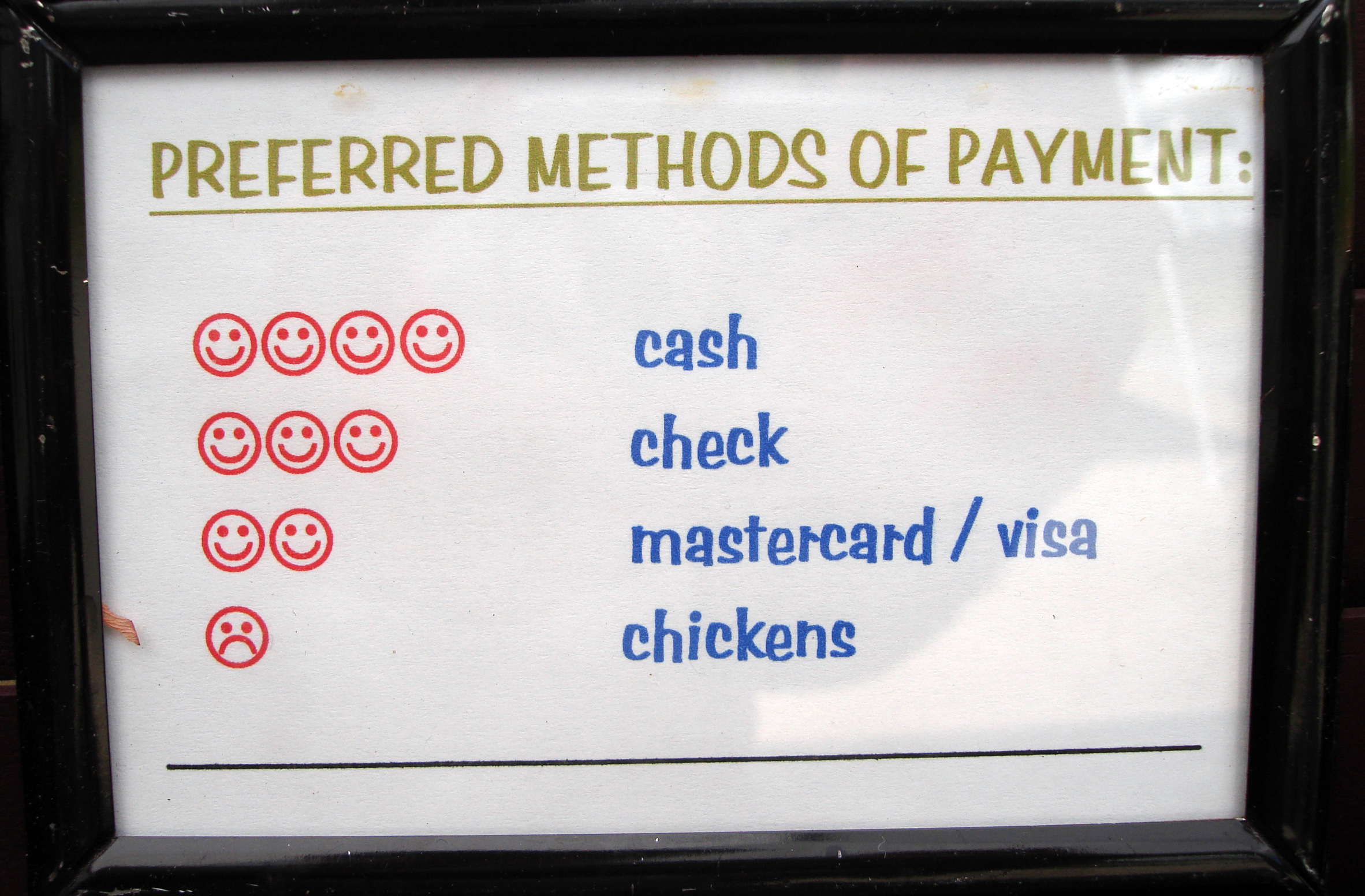

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 11th, 2016 by Elma Jane

E-commerce is a virtual platform, where we can get products and services and make payments through the internet.

E-commerce trend is constantly changing, it is necessary for a merchant to watch out for the upcoming Trends in this industry for a business to success.

To help boost your conversion rates here are the trends to be followed:

Contextual Commerce – The next big thing in payments and e-commerce. Providing complete description with images and videos to help your customer decide to purchase a product. Customization is an important factor as well to convince about the products or services.

Fast Delivery Shipping – Customer wants to receive the products after purchasing as soon as possible. So Reliable, Timely shipping means a lot.

Mobile Shopping – getting your online store ready for mobile shoppers is not an optional feature, it’s a mandatory part of a strategy.

Multiple Channels For Shopping – optimization is a great experience for shoppers. Having online store presence in different technology gadgets is a must.

Real Time Analytics – analyzing consumer behavior based on data entered into a system less than one minute before the actual time of use. Finds out why a customer leaves the store and prevents customer loss.

Virtual Sales Force – Hiring virtual salesforce, utilizing pop-ups and live chat who will help customers which are similar in a physical store.

Step ahead out of the conventional methods and adapt prevailing trends by embracing innovation so you can offer something new to your customer.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: business, consumer, customer, data, e-commerce, internet, merchant, mobile, online, payments

February 5th, 2016 by Elma Jane

Businesses and banking institutions must require consumers to use other types of authentication methods, like biometrics, mobile verification codes and geo-location.

Merchants and banks can expect more hackers to breach customer accounts that rely only on usernames and passwords for online authentication.

This type of fraud will only grow more as hackers recognize and take advantage of the opportunity presented by on-file accounts protected by weak authentication.

Many online users use the same username and password for multiple accounts, once those credentials are compromised, criminals can use them to access accounts on different websites.

With the ease and simplicity of password vaults and safes that are easy and efficient to use and user education, this problem finds a solution.

A stronger authentication that goes far beyond username and password, is a powerful tool in effort to prevent data breaches.

Posted in Best Practices for Merchants Tagged with: banking institutions, banks, biometrics, consumers, customer, data, data breaches, fraud, merchants, mobile, online

February 2nd, 2016 by Elma Jane

Businesses continue to struggle with the prohibited storage of unencrypted customer payment data. The Payment Card Industry Data Security Standard (PCI DSS), merchants are instructed that, Protection methods are critical components of cardholder data protection in PCI DSS Requirement.

PCI DSS applies to every company that stores, processes or transmits cardholder information. Regardless of the size or type of business you operate, the number of credit card transactions you process annually or the method you use to do so, you must be PCI compliant.

Data breach is not a limited, one-time occurrence. This is why PCI compliance is required across all systems used by merchants.

Encryption and Tokenization is a strong combination to protect cardholder at all points in the transaction lifecycle; in use, in transit and at rest.

National Transaction’s security solutions provide layers of protection, when used in combination with EMV and PCI-DSS compliance.

Encryption is ideally suited for any businesses that processes card transactions in a face to face or card present environment. From the moment a payment card is swiped or inserted at a terminal featuring a hardware-based, tamper resistant security module, encryption protects the card data from fraudsters as it travels across various systems and networks until it is decrypted at secure data center.

Tokenization can be used in card not present environments (travel merchants) such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments. Tokens can reside on your POS/PMS or within your e-commerce infrastructure at rest and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions in use. Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions.

The sooner businesses implement encryption and tokenization the sooner stored unencrypted data will become a thing of the past.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card data, card present, cardholder, compliance, credit card, customer, data, data breach, data security, e-commerce, EMV, encryption, Mail Order/Telephone Order, merchants, moto, payment, Payment Card Industry, PCI-DSS, POS, secure data, Security, terminal, tokenization, tokens, travel, travel merchants

January 26th, 2015 by Elma Jane

Accept Electronic Payments in Their Currency,

Convert it to Yours

DCC or Dynamic Currency Conversion is a system where the Visa or MasterCard holder in a foreign country can shop on an American based web site that displays prices in their own local currency. The web site can offer multiple choices as to which country the shopper is based in and the shopper can be immediately familiar with the pricing of goods and services.

Exchange rates are in constant flux. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. Even if the shopper does not choose the correct currency, at the time the card information is presented, the system automatically recognizes that the card is foreign and applies the appropriate currency and exchange rate.

At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied. In today’s global business environment, this level of convenience to the customer insures they are comfortable with the transaction from shopping cart to the door. Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line.

On the merchant end, all transactions are settled in $USD. Reporting mechanisms can display the consumers pricing and the exchange rate they paid for analysis and cost reduction.

Currency Conversion

- Accept currencies from other nations.

- Convert funds to US Dollars.

- Set prices in local currency to avoid confusion or calculation.

- Works with e-commerce as well as Mail Order / Phone Order.

- Ease the sales process for your customers.

- Increase customer familiarity.

- Immediately convert currency to avoid value gaps.

Posted in Best Practices for Merchants, Electronic Payments Tagged with: Bank Reference Table, Card Recognition Table, consumer, conversion rate, currency, customer, Dynamic Currency Conversion, e-commerce, electronic payments, exchange rate, invoice, MasterCard, Merchant's, receipt, shopping cart, transactions, visa