July 11th, 2024 by Elma Jane

Travel agencies are viewed as high-risk merchants. As such, you need a merchant solution that best suits a travel merchant needs.

You want an account that eliminates the complexities of a typical shopping cart. Ideally, it allows you to request payment from clients without the need of setting up booking engines and carts.

This post is going to guide you on how to use a payment solution NTCePay and other merchant solutions to ensure a seamless operation of your business.

Leveraging the NTC e-Pay Service

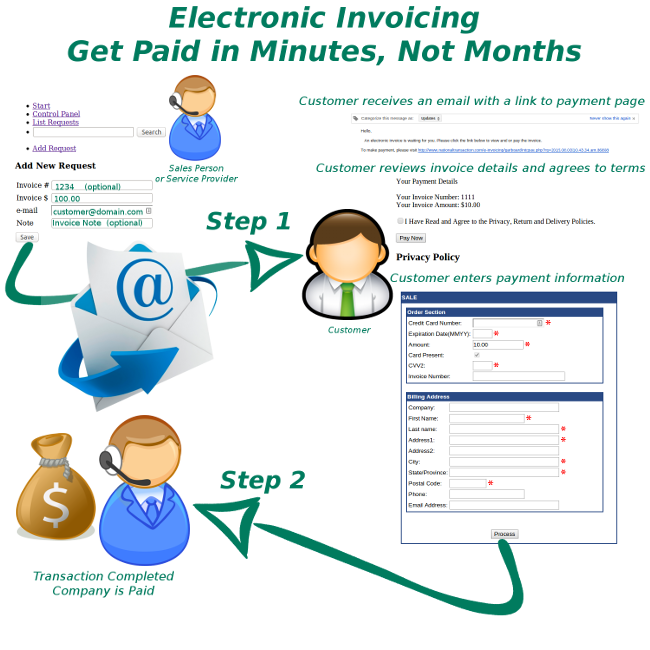

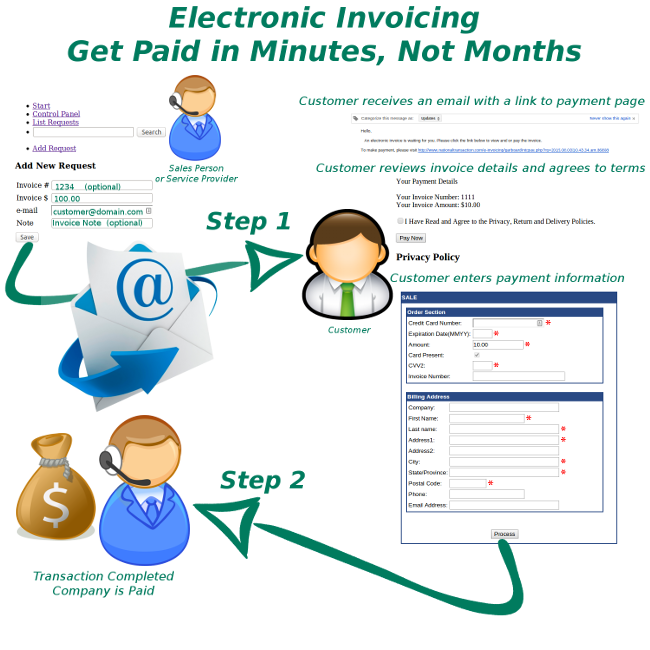

Payment solution e-Pay allows you to eliminate the complexities of integrating payment processing into your point-of-sale or an accounting system.

With this payment method, you only need to send a payment request to your customers via email. You don’t need to send invoices via snail mail or fax any forms to your customers. Plus, NTC ePay doesn’t need you to take orders over the phone.

With this service, you can create a “BUY” button for any transaction amount in seconds. You also don’t need a website to you use this service. NTCePay allows you to generate a digital link that you can email to clients.

The service allows you to customize the process to make everything simple for your customers. After the customer pays the specified amount, a receipt is generated, and the amount is sent to your account.

Tomorrow we are going to discuss on how to understand your Travel Merchant Account….So standby to learn more.

For NTCePay Set Up call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: customers, merchants, payment, transaction, travel, travel agencies

Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

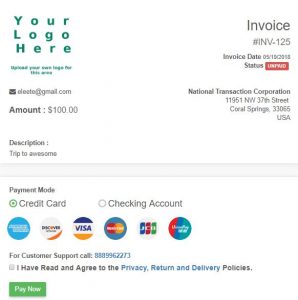

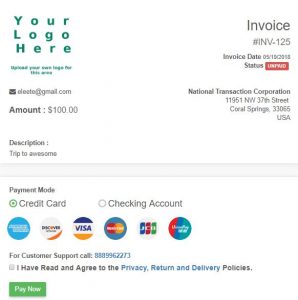

NTCePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Things flow better when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not your business, as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the e-commerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now, when you run a social media campaign you can leverage our NTCePay technology to help you increase sales. Use our ePay links to post vacation travel packages or special sales and have customers pay in two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel

November 1st, 2018 by Admin

We are officially 55 days until Christmas, time to take all of the tricks out of your hat to promote your business. Since we know you will be using social media, here are 30 random holidays you can use to promote your business with their Hashtag.

November 1st:

#ExtraMileDay: Show your customers how you will go the extra mile for them.

November 2nd

#LoveYourLawyerDay: Need we say more? This one is perfect for lawyers or anyone working with them.

#FountainPenDay: If you sell promotional items, this one is for you. It can also work if you want to post the latest contract signed.

#SandwichDay: Even if you don’t own a sandwich shop, Sandwich day can be used to share a more laid back look of your company. Maybe sharing a picture of your last company picnic or lunch will do. Remember to have a good looking picture!

First Sunday of November

#ZeroTaskingDay If you work for a spa or anything that promotes relaxation, this one would be a good one for you!

November 5th

#LoveYourRedHairDay Hairdressers, time to get those finished looks and share them on social media!

#NachosDay Any day is a good day for Nachos, but on Nachos day you can show some humor as a way to connect to your customers. This one is great for restaurants.

November 8th

Guinness World Record Day: #GWRDay: Sharing a fun fact comes a long way in Social Media. Sharing a Guinness World Record that might relate to your industry can attract a new crowd online.

#CappuccinoDay: People love coffee, (search #CoffeeLover, and you’ll see) so why not share Cappuccino Day with your coffee loving crowd. Perfect for the coffee shop owner to the savvy consultant on the go.

November 10th

#SesameStreetDay: If you are in an industry that deals with children, this one is for you. Make the posts funny or just cute but remember you are targeting the parents at the end. Nostalgic posts work well too with this.

#VanillaCupcakeDay: Cupcake lovers beware, this hashtag might be for you. Perfect for the bakery owner and the all-time cupcake lover, there is no need to be a pastry chef to use this one.

November 11th

#origamiday This one might require some skill and imagination, but it can delight your online community and attract them more to what you do. If you use this one, be sure to send us a picture.

#SundaeDay Who doesn’t love Ice Cream Sundaes!

November 12th

#HappyHourDay Geared more for restaurants and bars, but with a bit of creativity, many can use this hashtag.

November 13th

#KindnessDay Show your kindness to others.

November 15th

#AmericaRecyclesDay We all need to take care for our planet. Show your support by sharing this with some facts and information about recycling.

November 18th

#PrincessDay: Pamper the princesses in your business or show appreciation of your customer.

#MickeyMouseDay Need we say more?

November 19th

International Men’s Day #MensDay: Men’s day is great to share information about current men’s health issues. Perfect for those in the healthcare industry

#PlayMonopolyDay: This one we feel is perfect for finance. “Don’t get caught in monopoly games and get your money safe” what do you think?

November 20th

#EntrepreneursDay Completely self-explanatory.

#NameYourPCDay Give some love to those PC users in your industry and have fun too.

November 21st

#HelloDay A great hashtag to introduce yourself and the team.

November 22nd

#GoForARideDay Whether it is a ride on a car or bike ride, many can use this hashtag if you are creative enough.

November 23rd

#FlossingDay perfect for those in the dental industry.

#EspressoDay Just like #CapuccinoDay, this hashtag can help greatly any account.

November 25th

#ShoppingReminderDay If you sell goods, this one is for you.

November 30th

#ComputerSecurityDay Technology always changes, this one can be an excellent reminder to keep online info safe.

All Month Long:

#PeanutButterLoversMonth When you ran out of ideas or inspiration this month, this hashtag can be a lifesaver. Remember that social media should entertain or educate and this one can help with that.

Bonus Holidays:

These might not be random but are always useful to add.

#Movember

#ThanksGiving

#CyberMonday

We hope these hashtags can help boost your business online presence and bring a little more creativity to your social media game. As always, have fun and use your to see if any of these can help your business.

Posted in Small Business Improvement Tagged with: account, business, capuccino, christmass, coffee, consumers, credit card, customer, customers, data, disney, e-commerce, Facebook, finance, fun, hairdressers, hashtags, holidays, Instagram, lawyers, merchants, payments, photography, restautrant, retail, Security, social media, transactions, twiter

October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

April 23rd, 2018 by Admin

Have you ever had issues with your credit card processing provider only to get turned around and around by the rep on the phone? IF you can even get someone on the phone. You hang up feeling frustrated, angry, and without any answers.

Have you ever had issues with your credit card processing provider only to get turned around and around by the rep on the phone? IF you can even get someone on the phone. You hang up feeling frustrated, angry, and without any answers.

Sometimes it’s a small problem, but what happens when they “misplace” your money, or there’s a problem with your account and you can’t receive any payments – and no amount of calling, emailing, or “chatting” seems to help you resolve anything?

There’s a better alternative to credit card payment processing, a company that’s been around for a long time, and is backed by one of the biggest banks in the country. National Transaction Corporation. And we have live, knowledgeable, friendly advisors waiting to pick up your calls and help you with your questions – no runaround, no excuses, no delays.

That’s the NTC way: Help when you need it, on a human level.

You may have had to make a lot of phone calls about chargebacks if you are using one of the more familiar service providers like PayPal, Stripe or Square. Chargebacks are a primary cause of business owners’ complaints with these companies, because these services will usually side with the cardholder in the event of a dispute as they arbitrate the chargeback themselves.

NTC does business fairly and sensibly. When you process your credit card sales through NTC, you will be dealing with Visa, MasterCard, American Express or other credit card companies directly.

When you work with those other service providers, you may be worried about where your money might end up – especially if you’ve read all the nightmarish complaints that business owners like you have posted on trusted sites like the Better Business Bureau and Consumer Affairs.

Imagine you’ve processed a credit card transaction, and the cash seems to disappear? You call and you write and you chat, but no one has anything helpful to offer you and you wonder just where your money went, and what will happen to it now.

NTC knows that’s not how you build trust with your customers. We pride ourselves on our outstanding customer support, ease of use of our services, and the confidence and integrity that comes from being backed by one of the biggest banks in the country, US Bank.

National Transaction Corporation aims to make growing your business easier and more profitable by tailoring our services to your specific needs. We do this because we like you to establish a long-term partnership with us.

Whether you are a florist, a restaurant, or any other kind of merchant, remember to look beyond just the advertised rate when looking for the best credit card payment processing service provider.

If after reading this article and you would like to speak to one of our live customer service representatives, simply call NTC today at 888-996-2273.

Posted in Credit card Processing Tagged with: consumers, credit card, customer, customers, electronic payment, merchant account, Security

December 22nd, 2016 by Elma Jane

What is a Merchant Account?

If you want to remain competitive virtually, every business needs access to a merchant account to accept card payments from their customers. “Merchant” is another word for a seller or business owner. Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. This allows a merchant to receive funding for the credit transaction. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for payment providers or processors; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Merchant account helps facilitate the complex interactions that need to occur between your business and your customer, the credit card networks (Amex, Discover, MasterCard, Visa) and your payment provider every time you receive a card payment. It helps to ensure that you receive funding as quickly as possible, that the banks are protected from losses, and that buyers are protected from scams. Everyone is held accountable based on the rules of the credit card processing agreement with a merchant account.

There’s cost associated in taking credit cards, but it’s much easier and more secure to open a merchant account than it is to keep a book of credit accounts for all of your customers!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: amex, card, credit, customers, Discover, loan, MasterCard, merchant account, payment provider, payments, transaction, visa

December 12th, 2016 by Elma Jane

Wireless Freedom with Smart Terminal!

Point-of-sale with WiFi capabilities. Now customers can take advantage of total mobility within their location when accepting payments, and managing their business either in-store or remotely. The device is NFC enabled for contactless transactions, and also designed to be easily transported due to its rechargeable battery.

Perfect for Pay at the Table!

Intended to provide cardholders with the ability to pay from anywhere within a business, the Smart Terminal is the ideal solution for processing transactions (and tips) tableside. Other benefits for this service include:

- 8 hour battery life on a single charge.

- Customer screen displays for PIN, Signature, tips, and receipts (via paper/email/text).

- Cardholders have the ability to complete transactions quicker, increasing profitability.

- Enhances the customer service experience.

Available for Retail and Restaurant customers only.

Posted in Best Practices for Merchants Tagged with: cardholders, customers, nfc, payments, POS, terminal, transactions

December 6th, 2016 by Elma Jane

The Process of Processing Electronic Payments

Today new technologies are emerging in electronic payment that allow merchants to collect valuable data on their customers; from emailing receipts to providing incentives to mention the merchant on social media.

So what’s behind the process of processing electronic payments? The heart of all your payment processing needs will most likely lie in a merchant account; with a merchant account you can deposit funds from ebt cards, debit cards, gift or loyalty cards and even checks into your bank account. If your business has never had its own merchant account, it’s probably missing out on some very valuable opportunities.

At National Transaction Corporation this process is simplified to a signature page and a voided check. We consult your business personally to establish the lowest rates and fees possible with your electronic payment processing. We ask detailed questions about how you process your transactions, and if you already process credit cards, we offer a free statement review where we determine your most common transaction types and how to lower their fees and rates.

How Much Will Electronic Payment Processing Cost?

There are three parts to the answer:

Up front or startup costs – include things like an application fee, an account setup fee and equipment fees. At NTC, we don’t have any application, setup or cancellation fees on our services. Our credit card readers and terminals are nonproprietary and will work with almost any merchant services provider and we sell them at cost to make it easier on our merchants.

When you buy a terminal from us you own it and are free to leave us at any time and use the terminal to process through another merchant account provider with no penalty payments at all.

Other startup costs might be:

- check readers,

- cash registers and receipt printers

- mobile point of sale software

- credit card swipe readers

- Accounting software (Intuit’s Quickbooks Pro or PeachTree)

If you already own any of this equipment we can integrate your existing hardware into our services.

Monthly service fees – depend on what services are required; included in the monthly fee detailed statements and reporting on transaction activity.

Transaction fees – MasterCard, Visa and American Express set what are called interchange rates. Interchange rates are a per transaction fee and/or a percentage rate based on the total of a sale. Interchange rates are very complex and consume hundreds of pages of different types of electronic transactions. These transactions are based on the type of business processing the transaction, the way the credit card data is input (like a credit card that is swiped in or manually keyed into a credit card terminal of some type) and the type of credit card used for the transaction (rewards card, corporate card, travel and entertainment credit cards, ebt cards and so on). With so many types of cards and businesses to process it’s impossible to give an accurate rate for all charges.

Again, we have no fees associated with applying for or setting up the merchant account and there is no penalty for cancellation so there are no risks in trying it out. We can do merchant rate review for free. Call us now 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit cards, customers, data, electronic payment, merchant account, merchants, mobile, payment processing, point of sale, services provider, terminal, transactions

December 1st, 2016 by Elma Jane

The All in One Smart Terminal!

Finally, a dynamic all-in-one smart terminal that offers a turnkey solution for customers to immediately implement in their place of business. Think of it also like a smart phone for accepting payments.

Function meets Form

Enables the speed of business with a modern, engaging design. Here are a few highlights:

- Dual, interactive touchscreens for the customer and cardholder.

- Built-in intuitive software, PIN pad and also signature pad, and printer.

- Charging dock station that includes extra USB ports.

- One card slot for EMV/MSR transactions.

- NFC enabled to accept contactless transactions, for example ApplePay.

- Mobile and web applications to help owners manage their business from anywhere.

- Ability to print, email and also send SMS receipts.

Sleek modern device that delivers an incredible customer experience, therefore a great option for retailers, coffee shops, and pop-up shops.

It comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: ApplePay, cardholder, contactless transactions, customers, EMV, mobile, nfc, payments, PIN pad, smart phone, terminal, transactions

November 30th, 2016 by Elma Jane

Understanding Interchange Rates & Fees

Credit card processing involves three separate cost components:

For vendors who choose to accept this type of payment, from customers for goods or services.

The same cost components apply to debit cards. Only one cost component is negotiable.

The first component is an interchange fee, which is payable to the card holder’s issuing bank. It is a combination of a transaction volume percentage fee and a flat-rate transaction fee. Interchange fees are collectively agreed upon through Visa and MasterCard by a card’s issuing bank and are fixed costs.

Interchange fees take into consideration various information about a card. Types of cards include debit and credit, while categories of cards refer to commercial and reward cards. Processing methods include whether a card is swiped or manually keyed. Swiping a card is usually more economical for vendors.

The second component is an assessment fee, charged by the card’s brand holder. Brand holders include Visa, MasterCard and Discover. Assessment fees are also fixed costs. Additionally, Visa charges a monthly fee.

The final charge is known as a processing fee. Processing fees vary among processors and is negotiable. Vendors are charged a processing fee, which can cause a difference in cost from one vendor to another.

For your electronic payments need give us a call 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, credit card, customers, debit cards, electronic payments, payment, reward cards, transaction