December 15th, 2014 by Elma Jane

Every business knows how crucial sales are to keeping a company going. Without paying customers, there’s no money coming in, which means no profits to help the business grow. But convincing people to buy something isn’t always an easy task for a sales person, and many entrepreneurs still struggle with selling.

It’s not about giving a rundown of the facts and features of a product, it’s about communicating the ways in which it can help the buyer. Stop thinking from the sales perspective. Think about what it will do for others. Take your elevator pitch and transcend it to other people’s perspective and solve their problems.

Five key components to a successful sales presentation.

A call to action. Ask someone to take action at the end of a sales presentation. If you don’t ask for the sale, they probably won’t go through with it. Always approach sales from a helping perspective. Instead of putting pressure on sales reps to make the sale, focus on what the product means to the buyer.

If your sales team focus on how to communicate effectively and help the person, it takes pressure off and puts the focus and energy where it needs to be. A superior salesperson inspires the buyer to feel the benefits of what they have.

A grabber. This is a mutual point of agreement where sales person connect with the buyer. This is usually established in a face-to-face conversation (the person nods in agreement when sales reps speak to them), but if you’re not able to see the person, you need to start off with the mind-set that he or she agrees with what you’re saying.

A point of difference. Explain to the buyer what’s different about your product, and why it occupies a unique space in the market.

A solution to a problem. Consumers purchase products that they believe will solve a problem they have. Your product may be the perfect solution, but they won’t know that unless sales reps explain the problem and how they can solve it. Stating the problem you solve and talking about it as much as if not more than the solution.

WSGAT. (What’s So Great About That?) is all about demonstrating the benefits of using your product. When discussing your product’s features, a sales person can’t just spout facts. You need to understand why a buyer should care about that feature, and how it contributes to solving the problem you outlined.

Posted in Best Practices for Merchants Tagged with: consumers, customers, product, sales

December 1st, 2014 by Elma Jane

Few Americans will likely remember the life and work of Martin Cooper, largely because most Americans have no idea who Martin Cooper is. Without Martin Cooper much of what we identify as normal life for the last two decades would not have been possible, as without his invention we would still be looking for pay phones, dropping off film to be developed, printing out boarding passes and contemplating a future where a plastic rectangle was the height of payments technology.

Anyone reading this has a phone with internet access which means no one has to guess, with a few taps on a smartphone most readers who didn’t already know were able to find out that Martin Cooper invented the handheld mobile phone and by so doing changed the lives of not just Americans, but people all over the world.

Mobile has integrated so seamlessly into our life that we didn’t realize it was changing everything we do.

Here are the list of all of the ways that mobile has improved life for us all.

We All Get To Know Everything All The Time, with just a smartphone. Impulse buy is a thing of the past because consumers just don’t buy on impulse as much anymore. A new intentionality has taken hold of shopping. Many Americans have the money and the will to spend. But they are time-pressed and deal savvy, visiting stores only when they run out of items like cereal or toilet paper and after doing extensive research on purchases online and with friends. They buy what they came for and then leave. Plus consumers are harder to fool, they know if they are being overcharged because they can look it up in real time while they are in the showroom.

Full Price Is A Notion Utterly Without Meaning. There are sites like Groupon, LivingSocial and a thousand imitators offer coupons pretty much across every retailer that mean no matter where one is shopping or eating they’re probably a few button taps away from paying less for the type of service they are out for. And then there are the retailer rewards programs all bent on giving consumers more stuff for free as long as they use their mobile coupons.

We All Think Way More About Privacy And Digital Security Than We Used To. Twenty years ago one’s largest security concern was probably that their home or car would be broken into, followed closely by their wallet being stolen. Now we wait for Russian cybercriminals to steal our cards by hacking into POS systems and lifting the data. Or for cybercriminals to hack our phones and upload naked pictures of us to the internet (celebrity readers only). Or for Nigerian princes to trick our grandparents into wiring them money. In short, while we still fear for our physical possessions as much as we ever did, the mobile world gave us something entirely new to worry about, the integrity of our data and who could use our phones, cards and email accounts as a backdoor into our entire personal and financial lives.

We Want It All, And We Want It Now. Anyone with a phone in their pocket can, in one way or another, buy it on the spot. Which has given rise to the push for same-day delivery, consumers who can buy it now, also want to be able to get it now, or as close to now as possible.

We Also Want It Later. Maybe the consumer likes going to the store, enjoys the Christmas lights, wants to eat at a mall food court, they just don’t want to stand inline. And now, through the magic of omnichannel commerce, they may not have to do. Through the magic of multi-device shopping an instore pick-up, consumers are increasingly getting used to finding something on their mobile, paying on their computer and picking up in store. Or some combination thereof.

Mobile has made commerce less a race between the e-markets and the brick-and-mortars, and more a race to offer the most seamless commerce experience. Mobile has taught ever one to care less about where they buy, and more about what the total buying experience is.

We Pay For Access Instead Of Objects. Ten years ago when your family set about its early experiments in binge watching television with the first season of Lost, odds are everyone gathered round and watched a DVD set or maybe a Blue Ray, if your family happened to be full of early adopters.

This weekend, when entire families are sitting down to watch How To Get Away With Murder, more likely than not they are streaming it through Hulu. Unless they don’t want to watch that, in which case, they are watching something else on Netflix on their phone while sitting in the same room with their family. Unless of course this is a football family, in which case you are paying the NFL for access to every football game played everywhere in America tomorrow and a cable company to watch in HD.

We Want To Use A Phone To Access Everything. It’s almost now quaint to refer to a time when phones were used primarily to talk. With the rapidly emerging internet of things, it will soon be quaint to talk about a phone as a tool used primarily for communicating and shopping.

The smartphone is already heading toward being the key interface between connected devices and products (The Internet of Things) and their users. Among other things, people will use the device to remotely control household appliances, interact with screens and automatically adjust car settings to their preferences.

We Kinda Hope The Phone Might Keep Us Alive. With the release of Apple Pay, also came the release of Apple Health that has widely been reported as ushering in the age of mobile device as wellness guru. Smartphones can already help people lead healthier lives by providing information, recommendations and reminders based on data gathered through sensors embedded in users’ clothing (shoes, wristbands, etc.) or through other phone capabilities (motion detectors, cameras, etc.).

And, even if you don’t listen to your phone and put your health at risk, it will still probably save you. Internet-enabled mobile devices are becoming important tools in broadening access to health care, diagnosing diseases and saving lives in crisis situations.

Making Life A Lot Better For Everyone. Small merchants can do something now that they couldn’t do en masse twenty years ago. Take credit card payments and use a tablet to do that and run their business. With the emergence of mobile, came thousands of the other mPOS solutions and platforms exploding all over the world. This has not only changed the way these small businesses operate, it has changed their entire pitch to their customers.

Mobile has made life easier for many consumers, but for some businesses and many people mobile has made mainstream financial participation possible.

Posted in Best Practices for Merchants, Smartphone Tagged with: (POS) systems, brick-and-mortars, cards, consumers, credit card payments, customers, data, e-markets, email accounts, mobile, mobile coupons, mobile device, mPOS solutions, omnichannel commerce, pay phones, payments technology, platforms, Small merchants, smartphone, tablet

October 15th, 2014 by Elma Jane

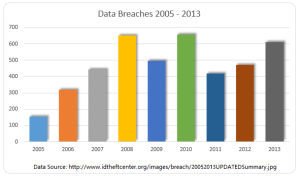

Another day, another corporate data breach. Business owners are now aware that cyber criminals are becoming increasingly smart and sophisticated in their hacking methods, and they can target just about anyone. But smaller companies that think, It can’t happen, or they are too small for hackers to notice, may be setting themselves up for a devastating data breach.

Large corporations typically have a lot more money and resources to invest in IT security, whereas small to medium businesses do not have the IT staffing, resources, money or know-how to put effective security measures into place to combat security vulnerabilities.

If a small business owner is responsible for security practices, it’s going to fall to the lower end of the priority list. The business will have less protections in place and hackers recognize that. Criminals are looking for unlocked doors.

Recent research found that more than half of all small and midsize businesses have been hacked at some point, and nearly three-quarters weren’t able to restore all the lost data. The two most common methods of attack are phishing, gathering sensitive information by masquerading as a trusted website and watering holes. Installing malware on commonly used websites of a target group. These tactics, grant cyber criminals access to the information that leads to identity theft and stolen credit card information.

A credit card breach is fairly easy to recognize once customers of a certain company all begin reporting fraudulent charges. But by that point, a breach has already done a significant amount of damage, not just to the consumers but to the company they trusted to protect their data.

A computer that appears to have been tampered with.If you turned off your computer when you left work and it’s on or has windows and programs running when you return, someone may have been trying to steal important information. This is an especially likely scenario with internal data theft, such as the AT&T breach. Keeping your machines password-protected and encrypting any sensitive data can prevent unauthorized individuals from accessing the information.

Locked-out accounts. If you’ve ever been locked out of your email or social media accounts, you know it’s usually because you typed the wrong login credentials one too many times. If you receive a lock-out message the first time you try to access an account (and you know you’ve typed your password correctly), you might have been hacked. This can mean that someone is attempting to brute force an account, or that an account has already been compromised and the password changed.

Unusually slow Internet or computers. This could be a sign of a compromised machine that is sending out lots of traffic, or that malware or a virus is on the machine. You should also look for pop-up ads (especially if you have an activated blocker) or websites that don’t load properly.

In all of these instances, minor inconveniences that most people might ignore if the problem seems to resolve itself could be signs of a much more serious problem. Both experts advised keeping your antivirus software, firewalls and device operating systems up-to-date, and always remaining alert for any suspicious activity.

Posted in Best Practices for Merchants Tagged with: consumers, credit card breach, credit card information, customers, data, data breach, device, Security, website

October 8th, 2014 by Elma Jane

When the PCI Security Standards Council (PCI SSC) launched PCI DSS v3.0 in January 2014, businesses were given one year to implement the updated global standard. Now that the deadline is fast approaching, interest is picking up in what v3.0 entails. On Jan. 1, 2015, version 3.0 of the Payment Card Industry (PCI) Data Security Standard (DSS) will reach year one of its three-year lifecycle.

Trustwave, a global data security firm, is on the frontlines of helping secure the networks of merchants and other businesses on the electronic payments value chain against data breaches. As an approved scanning vendor, Trustwave is used by businesses to achieve and validate PCI DSS compliance.

PCI DSS v3.0 is business as usual for the most part, except for a few changes from v2.0 that considers impactful for large swaths of merchants. The top three changes involve e-commerce businesses that redirect consumers to third-party payment providers. The expansion of penetration testing requirements and the data security responsibilities of third-party service providers.

Penetration testing

Penetration testing is the way in which merchants can assess the security of their networks by pretending to be hackers and probing networks for weaknesses. V3.0 of the PCI DSS mandates that merchants follow a formal methodology in conducting penetration tests, and that the methodology goes well beyond what merchants can accomplish using off-the-shelf penetration testing software solutions.

Merchants that are self assessing and using such software are going to be surprised by the rigorous new methodology they are now expected to follow.

Additionally, penetration testing requirements in v3.0 raises the compliance bar for small merchants who self assess. Those merchants could lower the scope of their compliance responsibilities by segmenting their networks, which essentially walls off data-sensitive areas of networks from the larger network. In this way merchants could reduce their compliance burdens and not have to undergo penetration testing.

Not so in v3.0. If you do something to try to reduce the scope of the PCI DSS to your systems, you now need to perform a penetration test to prove that those boundaries are in fact rigid.

Redirecting merchants

The new redirect mandate as affecting some, but not all, e-commerce merchants that redirect customers, typically when they are ready to pay for online purchases to a third party to collect payment details. If you are a customer and you are going to a website and you add something to your shopping cart, when it comes time to enter in your credit card, this redirect says I’m going to send you off to this third party.

The redirect can come in several forms. It can be a direct link from the e-commerce merchant’s website to another website, such as in a PayPal Inc. scenario, or it can be done more silently.

An example of the silent method is the use of an iframe, HTML code used to display one website within another website. Real Estate on the merchant’s website is used by the third-party in such a way that consumers don’t even know that the payment details they input are being collected and processed, not by the e-commerce site, but by the third party.

Another redirect strategy is accomplished via pop-up windows for the collection of payments in such environments as online or mobile games. In-game pop-up windows are typically used to get gamers to pay a little money to purchase an enhancement to their gaming avatars or advance to the next level of game activity.

For merchants that employ these types of redirect strategies, PCI DSS v3.0 makes compliance much more complicated. In v2.0, such merchants that opted to take Self Assessment Questionnaires (SAQs), in lieu of undergoing on-site data security assessments, had to fill out the shortest of the eight SAQs. But in v3.0, such redirect merchants have to take the second longest SAQ, which entails over 100 security controls.

The PCI SSC made this change because of the steady uptick in the number and severity of e-commerce breaches, with hackers zeroing in on exploiting weaknesses in redirect strategies to steal cardholder data. Also, redirecting merchants may be putting themselves into greater data breach jeopardy when they believe that third-party payment providers on the receiving end of redirects are reducing merchants’ compliance responsibilities, when that may not, in fact, be the case.

Service providers

Service provider is any entity that stores, processes or transmits payment card data. Examples include gateways, web hosting companies, back-up facilities and call centers. The update to the standard directs service providers to clearly articulate in writing which PCI requirements they are addressing and what areas of the PCI DSS is the responsibility of merchants.

A web hosting company may tell a merchant that the hosting company is PCI compliant. The merchant thought, they have nothing left to do. The reality is there is still always something a merchant needs to do, they just didn’t always recognize what that was.

In v3.0, service providers, specifically value-added resellers (VARs), also need to assign unique passwords, as well as employ two-factor authentication, to each of their merchants in order to remotely access the networks of those merchants. VARs often employ weak passwords or use one password to access multiple networks, which makes it easier for fraudsters to breach multiple systems.

The PCI SSC is trying to at least make it more difficult for the bad guys to break into one site and then move to the hub, so to speak, and then go to all the other different spokes with the same attack.

Overall, v3.0 is more granular by more accurately matching appropriate security controls to specific types of merchants, even though the approach may add complexity to merchants’ compliance obligations. On the whole a lot of these changes are very positive.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (PCI SSC), call centers, cardholder data, consumers, credit-card, customers, data breaches, data security assessments, Data Security Standard, e-commerce breaches, e-commerce businesses, e-commerce merchant's website, electronic payments, global data security, global standard, Merchant's, merchant’s website, mobile, networks, payment, payment card data, Payment Card Industry, payment providers, PCI Security Standards Council, PCI-DSS, Penetration testing, Service providers, shopping cart, software solutions, web hosting, website

October 1st, 2014 by Elma Jane

Approximately $350 billion in housing rent is written out on checks or given in cash annually and until now more than 90 million renters in the U.S. didn’t have an option to use their credit or debit card to pay their rent. RadPad wants to be that option. The service works by allowing users to sign up and link their debit or credit card to their account, then asks for the Landlords mailing address and email, which presumably allows to mail the check to the Landlord. By saving the payments to the customers RadPad profile, Renters Can conceivably improve their credit score. Moreover, it allows roommates or others who split rent to pay communally. They can get both terms to go mainstream by letting people pay their rent by phone.

Posted in Best Practices for Merchants, Mobile Payments Tagged with: card, cash, checks, credit, credit score, customers, debit, debit card, email, housing rent, payments, phone, renters

September 29th, 2014 by Elma Jane

If your retail business products sells only in-store, then you’re falling behind. Consumers in the digital age expect options when they shop, and if you’re not offering those choices, your customers may pass you by for a more tech-savvy competitor. Consumers go into stores, evaluate products and buy online, or research online and go into the store for purchase. The two worlds have merged, if you’re not covering both spectrums, you’re missing out.

Recent research by UPS showing 40 percent of today’s shoppers use a combination of online and in-store interactions to complete their purchases. The days of physical stores being separated from online shopping are over. They’re no longer channels that are happening on their own. The UPS survey found that a large chunk of online shoppers cross channels during their shopping path. Be present on both channels and take advantage of that.

It’s not always possible or economic for an online-only retailer to open up a physical storefront, but existing brick-and-mortar stores or wholesalers can easily introduce an e-commerce component to their sales to expand their customer reach. Online sales help reach consumers that may not otherwise be able to purchase your products. Even if your company’s main focus is creating a personalized in-store experience, there are still ways to capture the online shopper market. In addition to giving consumers a way to research your products before coming in-store to purchase your offerings, you can offer people a way to conveniently buy items they already know they want.

For all the advantages a multi-channel sales strategy can give a retailer, there are still some challenges to this approach. Managing inventory versus cash flow and ensuring even demand on both channels have been company’s two greatest challenges in balancing in-store and online sales. Creating demand is how companies set themselves apart from competition. The secret sauce. The challenge is making sure that retail operations have a turnover ratio that works for the shipping schedules from the main warehouse. This isn’t a problem for e-commerce businesses, because product can be packaged and shipped as fast as it gets produced. But an omnichannel company has to take retail and e-commerce into account when stocking a warehouse.

There are a few different strategies retailers can use to help keep their sales operations well-balanced. Offering different items online versus in-store, to avoid inventory competition (i.e., selling seasonal or discontinued items online and current items in-store). Requiring a minimum order for online purchases or grouping products together rather than selling them individually to make e-commerce more worth your while.

The best way to balance a multi-channel sales strategy is to take a unified view of consumers online and offline by connecting their on- and offline behaviors via technology. Some of the retailers questions have is how to connect a person offline with what they buy online, how to recognize who they are in the store and know what they look at on your website, because people are switching back and forth. Link behaviors online with a unique ID through email or a mobile app, since 66% of customers use smartphones in-store.

Even if your business can’t actually sell and ship products via e-commerce,it’s still important to be in tune and up-to-date with the way customers want to interact with you on the Web. People are on the go, researching on phones and tablets. If you’re not savvy to what’s happening out there and don’t have the best-in-class SEO, you’ll miss out. You still need to engage in the digital world, even if it’s not always obvious.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: brick and mortar, business products, consumers, customers, digital world, e-commerce, email, mobile app, multi-channel sales, online and in-store, online shoppers, online shopping, phones, products, retail business, SEO, shoppers, Smartphones, tablets, web

September 23rd, 2014 by Elma Jane

Home Depot, US retail chain says that 56 million payment cards are at risk following a malware-laden cyber-attack on eftpos tills across its stores in the US and Canada.

The investigation into a possible breach began on September 2nd,Tuesday morning, immediately after Home Depot received reports from its banking partners and law enforcement that criminals may have breached its systems.

According to Home Depot’s security partners, the malware had not been seen previously in other attacks.

Criminals used unique, custom-built malware to evade detection. The cyber-attack is estimated to have put payment card information at risk for approximately 56 million unique payment cards, after lurking in the company’s eftpos tills for four months between April and September.

While the breach has been seen as a further proof-point in the US push to adopt Chip and PIN at the point-of-sale, the fact that the outbreak also hit the home improvement chain’s Canadian stores, where the EMV standard has been implemented, leaves pause for thought. Nonetheless, the retailer has committed to installing 85,000 PIN pads at its US outlets, well ahead of the national 2015 deadline.

Home Depot has set aside $65 million to cover the cost to investigate the data breach, provide credit monitoring services to its customers, increase call center staffing, and pay legal and professional services. Approximately $27 million of the projected outlay will be covered by the company’s insurance.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: banking partners, Breach, call center, card information, cards, Chip and PIN, credit monitoring, credit monitoring services, customers, cyber-attack, data breach, EMV, EMV standard, Malware, payment, payment card information, payment cards, PIN pads, point of sale, risk

September 22nd, 2014 by Elma Jane

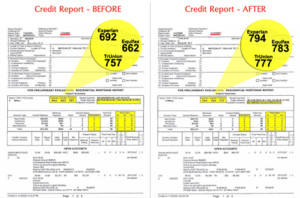

Consumers know how hard it is to obtain a credit card, if your credit score isn’t up to par. A bad credit score can prevent you from getting credit and make it hard to purchase your day to day necessities. People with poor credit don’t know their options. There are a number of ways to get a credit card if you have a poor credit score. There will likely be road blocks and limitations in your search. You won’t have the same options available as someone with pristine credit. But you will be able to get a line of credit if you look in the right place.

COSIGNED CREDIT CARDS If you get a cosigner, you will be able to obtain a card that would not be available to you otherwise. The cosigner has to have good credit, and they are responsible for your debt if you can’t pay. Make sure your cosigner fully recognizes their obligations and what will happen if you are unable to pay.

GIVE AN EXPLANATION FOR POOR CREDIT Explain the circumstances behind your poor credit. You can add a 100-word statement to your credit report such as the loss of a job. If you can tell your story and convince creditors you are on the road to increasing your credit score, they may believe you are more likely to pay back your debts. Divorce and illness are two other instances where individuals may see a drop in their credit score. Make sure whatever you list is true.

IMPROVE YOUR CREDIT One of the most difficult options. Poor credit can seem extremely hard to repair. But there are choices, it is just a process that will take a significant period of time. If you have poor credit, you can open bank accounts and pay off your loans and credit cards on time. If you pay off your debt in a timely manner, your credit score will improve over time and you will gain access to more credit card options.

RETAIL STORE CARDS Retail stores often have store credit cards they offer customers. Retail stores are generally more willing to approve applicants without a stellar credit score. But these cards usually come with extremely high interest rates and relatively low credit limits, so make sure you fully understand the terms of the card before applying.

SECURED CREDIT CARDS You deposit some money into an account, and then a creditor will provide you with a line of credit equal to your deposit. It is essentially a down payment, and if you don’t pay your credit card bill, your creditor is entitled to the money in the account. This might not sound like a favorable position, but remember that secured credit cards can be used as a valuable tool to rebuild your credit. Make sure the card you apply for reports to a credit reporting agency. This will help you start building a credit history. SELECT A CREDIT

CARD DESIGNED FOR THOSE WITH POOR CREDIT There are a number of credit cards offered by Visa and MasterCard designed for people with poor credit. These cards have low limits, a significant number of fees and high interest rates. But for some people, it may be their best option. Talk to your bank’s administrators or with your current credit card company to see if they offer a credit card that fits your personal needs.

SUBPRIME CREDIT CARDS Another option for those with poor credit, but they are ripe with fees that many people who are already short on cash may not be able to handle. Interest rates can be dangerously high for those with poor credit, so beware of these cards. They are often a last resort for individuals who need access to credit. However, like secured credit cards, they can be used to rebuild credit. Make sure you read the fine print and understand the applicable fees before you apply for a subprime credit card. Again, make sure the card reports to a credit reporting agency so you start building a credit history. Finding a line of credit doesn’t have to be a difficult endeavor. If you know what you are looking for, you can find a line of credit that fits your personal needs without breaking the bank. There are limitations, as well as pros and cons, to many of the forms of credit available to those with poor credit scores, such as secured credit cards or subprime credit cards. But those options do give people choices they otherwise may not have, and they help you build credit, so that eventually you will have a greater number of options.

Posted in Best Practices for Merchants Tagged with: account, applicants, card, consumers, COSIGNED CREDIT CARDS, credit, credit card bill, credit history, credit limits, credit report, credit score, credit-card, creditor, customers, deposit, down payment, good credit, interest rates, low credit limits, MasterCard, payment, poor credit, RETAIL STORE CARDS, retail stores, SECURED CREDIT CARDS, store credit cards, SUBPRIME CREDIT CARDS, visa, Visa and MasterCard

September 18th, 2014 by Elma Jane

Americans love gift cards, but many of those pieces of plastic go partially or entirely unused. Some are lost or forgotten. Others simply are ignored once the balance drops to a few dollars or less.

A gift card’s unused value…known in industry parlance as spillage or breakage…long has meant big profits for the gift card industry .

But the Credit Card Accountability, Responsibility and Disclosure Act of 2009, better known simply as the Credit CARD Act, tightened rules on retailers, making it more difficult for stores to cancel unused cards or charge inactivity fees. That prevents retailers from quickly cashing in on breakage.

In addition, savvy consumers are catching on and appear to be finding ways to avoid losing breakage while getting the most out of their gift cards.

According to the most recent figures, about 1 percent of the total value of gift cards was predicted to go unused in 2013. That’s down from a record high of 10 percent in 2007. Some of the reduction in breakage is a result of growing cardholder realization that even though there’s only $2.12 on gift card, they got to find a way to use it.

However, even with the decline in breakage, around $1 billion worth of gift cards will be lost to fees and expiration dates or misplaced, shoved in a drawer or otherwise neglected this year. That’s a huge amount of money that consumers will not be able to use toward a new shirt, stuffed animal or bicycle.

Retailers love when people use gift cards because studies show that most customers spend more in the store than the card is worth. Breakage makes gift cards even more profitable: An estimated $127 billion in gift cards will be sold in 2014, even a small percentage of unused cards boost a company’s bottom line.

Those profits make it feasible for retailers to make some consumer-friendly moves, such as selling gift cards at a discount. However, most of the money goes toward other endeavors.

Wal-Mart may have a billion dollars (in unused gift cards) sitting there. Wal-Mart could go out and build 30 new superstores without borrowing a penny. They know those gift cards will come in eventually, but for now, they have the use of that money.

Ways to make sure you’re not ‘breakage’

The longer you let a card sit untapped, the less likely you are to use it. Here are eight ways to make sure your gift cards are not lost to breakage:

Give again. Instead of letting that last two bucks on a card go to waste, use it to make a donation. Stockpile cards and combine them into higher-value gift cards that are donated to the needy.

A Gift Card Giver founder, got the idea when he asked a group of acquaintances how many had unused gift cards sitting in their wallets. They literally started pulling out gift cards from their wallets, everyone had one.

The Gift Card Giver founder offered to redistribute the unused cards to the needy and a new nonprofit was born.

Give low-end cards as gifts. To make sure your gift card doesn’t languish in someone else’s wallet, consider purchasing cards at Walgreens and Wendy’s instead of Nordstrom and Saks. Practical gift cards, such as those for fast-food chains and discount retailers are used faster than cards to fine dining establishments and pricey department stores.

Corral your cards. Make sure you can quickly locate your cards by storing them all in the same place.

If you have too many cards to tuck into your wallet, stowing them in a durable plastic envelope. Or upgrade to a Card Cubby (about $24), which includes alphabetized tabs and is tiny enough to keep in a purse.

Plan your shopping ahead of time. Set up your e-mail program to send you a monthly reminder to use your gift cards. Think in terms of the week or month ahead, when will you be near the store? What items do you need there? Is there a gift you need for someone else? You are more likely to use the card if you know what you want ahead of time and can get in and out quickly.

Rethink general-purpose gift cards. Gift cards from credit card companies can be used anywhere you can use a credit card. But these cards also come with drawbacks.

Use-anywhere cards, known as open-loop cards are more likely to come with startup fees and monthly inactivity fees that chip away at your balance. Many of these gift cards also include a valid through or good through date stamped on the front. Your card’s underlying value will not expire after that date, but you will have to call customer service for a replacement card, and that raises the risk that you will simply toss the card and your remaining balance.

Read the fine print. The CARD Act prohibits gift card inactivity fees for the first year, and requires that gift cards cannot expire within five years of when activated. State lawsmay extend additional gift card protections. That gives you a big, but not permanent cushion of time to use the cards.

Trade or sell your cards. If you get a card you know you will not use, a Hot Topic gift card, for instance, when you are more of an L.L.Bean type, use one of the many card-swapping and card-selling sites to get what you really want.

That is because with a Wendy’s and a Walgreens on practically every corner, such lower-end cards simply are more convenient to use. They also offer more value for your card. If you give a Wal-Mart gift card to your mailman, there are plenty of things to use it on.

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: card-selling, card-swapping, cardholder, cards, consumers, Credit CARD Act, credit card companies, credit-card, customer service, customers, drawbacks, e-mail program, fees, gift card industry, Gift Cards, inactivity fees, lower-end cards, open-loop cards, retailers, startup fees, Wal-Mart gift card

September 17th, 2014 by Elma Jane

Commuters using the London tube network can now tap their contactless bank cards on the ticket barriers to pay for their journeys, further displacing cash on the capital’s transit system.

Fares are cheaper than cash, with users being charged adult pay as you go fares and benefiting from daily and Monday to Sunday fare capping. Customers without bank cards will continue to benefit from cheaper fares through Transport for London’s Oyster card.

This is not the end of Oyster and it’s not the end of cash, but it is a significant dent in the market for cash.

The move follows the abolition of cash on London’s buses and covers all tube, overground, DLR, tram and National Rail services that accept Oyster.

The shift to contactless has future-proofed the capital’s transit system for up-and-coming innovations in payments. You can already use your mobile phones to make your payments and tap and go through the tube turnstiles, and in the future it will open up many other connected devices as well, whether that’s smart wristbands or smart watches.

An incredible response to the launch of contactless payments on London Buses with nearly 19 million Visa contactless journeys made since it launched in 2012. Today’s launch will be another major boost to contactless usage leading to the three-fold increase expected in the next year. To coincide with the rollout, Londoners are invited to sign up for 10,000 free bPay contactless payments bands. Its wearable device will let commuters pay for their journeys with a wave of their wrists and help avoid card clash.

Posted in Best Practices for Merchants Tagged with: bank, card clash, cards, contactless bank cards, contactless payments, customers, devices, mobile, mobile phones, network, payments, phones, smart watches, smart wristbands, Visa contactless journeys, wearable device