July 21st, 2014 by Elma Jane

European authorities dismantled a Romanian-dominated cybercrime network that used a host of tactics to steal more than EUR2 million. As a direct result of the excellent cooperation and outstanding work by police officers and prosecutors from Romania, France and other European countries, a key criminal network has been successfully taken down this week.

Hundreds of police in Romania and France, backed by the European Cybercrime Centre, carried out raids on 177 addresses, interrogating 115 people and detaining 65. Those held are suspected of participating in sophisticated electronic payment crimes, using malware to take over and gain access to computers used by money transfer services all over Europe. They are also accused of stealing card data through skimming, money laundering and drug trafficking.Proceeds of the crimes were invested in different types of property, deposited in bank accounts or transferred electronically, says the EC3. Large sums of money, luxury vehicles and IT equipment were seized during the raids.

Posted in Uncategorized Tagged with: accounts, bank, bank accounts, card, card data, cybercrime, data, electronic payment, host, Malware, money transfer, network, payment

February 3rd, 2014 by Elma Jane

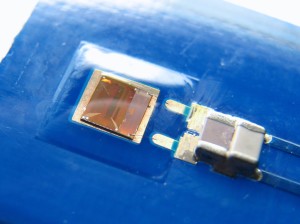

The migration to cards that use chips instead of magnetic strips, known as EMV technology, is well underway in the U.S. No government regulation is needed to make it happen. But the EMV migration and the Target breach are different things. It’s true that EMV chip cards can prevent criminals from producing counterfeit cards using stolen account numbers. But EMV doesn’t stop criminals using stolen cards online. So innovators are deploying new technologies to deter other forms of fraud.

Headline-grabbing events inevitably lead to calls for new laws. But in the case of our nation’s electronic payments systems, new government mandates would stifle marketplace innovations that hold great promise for providing consumer benefits and reducing criminal activities.

Financial institutions compete for customers by providing consumer protections even beyond requirements of current law. Many retailers also offer customers speedy transactions, such as “sign and go” and “swipe and go” for small transactions, while the payments industry ensures consumers still have zero liability. These protections and flexibility are why U.S. consumers are going cashless and carry more than one billion debit and credit cards. More than 70% of retail purchases are made with electronic payments, and our member companies process more than $4 trillion in electronic payments each year.

Fraud accounts for fewer than six cents of every $100 spent on payments systems – a fraction of a tenth of a percent. U.S. companies have made significant financial and technological investments, building sophisticated fraud tools that insulate consumers from liability. To build on this, Congress should foster greater international law enforcement cooperation to fight cybercrime, particularly in countries that harbor crime rings, and replace 46 divergent state breach notification laws with a uniform national standard.

The private sector is best positioned to address the constantly shifting tactics of criminals, and it is doing so without government mandates. Do Americans really want the government in charge of the security and monitoring of our payments?

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Visa MasterCard American Express Tagged with: counterfeit cards, cybercrime, data breach, debit and credit cards, electronic payment systems, electronic payments, emv chip cards, emv technology, fraud, liability, magnetic strips, migration, online, security and monitoring of our payments, small transactions