February 5th, 2016 by Elma Jane

Businesses and banking institutions must require consumers to use other types of authentication methods, like biometrics, mobile verification codes and geo-location.

Merchants and banks can expect more hackers to breach customer accounts that rely only on usernames and passwords for online authentication.

This type of fraud will only grow more as hackers recognize and take advantage of the opportunity presented by on-file accounts protected by weak authentication.

Many online users use the same username and password for multiple accounts, once those credentials are compromised, criminals can use them to access accounts on different websites.

With the ease and simplicity of password vaults and safes that are easy and efficient to use and user education, this problem finds a solution.

A stronger authentication that goes far beyond username and password, is a powerful tool in effort to prevent data breaches.

Posted in Best Practices for Merchants Tagged with: banking institutions, banks, biometrics, consumers, customer, data, data breaches, fraud, merchants, mobile, online

December 28th, 2015 by Elma Jane

Major data breaches were acknowledged by another hotel chain and another brand popular with kids.

Hyatt discovered the intrusion on Nov. 30, which targeted Hyatt-managed properties (not those owned by franchisees), but did not disclose exactly how many properties were affected or how many records may have been exposed. The malware used in the attack targeted payment-card information including cardholder names, PANs, expiration date and CVV/CVC information.

Separately, a security researcher discovered a leaked database from Sanrio, the Japanese company that designs, licenses and produces the popular hello Kitty character. The database reportedly contains account data for 3.3 million users of Sanriotown.com and other Sanrio-owned Websites including hellokitty.com. The company has not yet acknowledged the extent of the breach publicly but said it is investigating.

If so, it is the second network intrusion made public putting the personal information of young people at risk after the Vtech Toy Company Data Breached. Almost 5 million parents and more than 200,000 kids was exposed. The hacked data includes names, email addresses, passwords, and home addresses of 4,833,678 parents who have bought products sold by VTech.

Posted in Best Practices for Merchants Tagged with: card, card information, data, data breaches, payment

October 23rd, 2015 by Elma Jane

Every merchants, small, medium or large, should put in some effort to protect their sensitive data. Many breaches of data could have been prevented by implementing stronger security controls and employing safety best practices in the workplace.

Weak or stolen usernames and passwords are one of the top causes of data breaches, and more than 75 percent of attacks on corporate networks are due to weak passwords. Almost half of all instances of hacking is due to stolen passwords, which are obtained through the theft of password lists. This indicates that there is no organization in any industry that is not vulnerable to a breach of data.

Studies across the board indicate that weak usernames and passwords are one of the top causes of data breaches. A strong password is the first line of defense against scammers and hackers, and to help keep your data safer.

There are risks associated with relying on weak usernames and passwords to restrict the access of data. Data breaches could have been stopped if a stronger, better password was used. Experts, including the IT team of companies, can offer assistance to employees seeking to improve their passwords and reduce risk.

Weak password means data breaches! The best passwords are long and varied, with symbols, letters and numbers. These passwords should not be obvious, such as the name of a company, address or company motto. It is difficult to enact policies for improved passwords in the workplace because employees are not informed of the facts.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: data, data breaches, merchants

October 8th, 2014 by Elma Jane

When the PCI Security Standards Council (PCI SSC) launched PCI DSS v3.0 in January 2014, businesses were given one year to implement the updated global standard. Now that the deadline is fast approaching, interest is picking up in what v3.0 entails. On Jan. 1, 2015, version 3.0 of the Payment Card Industry (PCI) Data Security Standard (DSS) will reach year one of its three-year lifecycle.

Trustwave, a global data security firm, is on the frontlines of helping secure the networks of merchants and other businesses on the electronic payments value chain against data breaches. As an approved scanning vendor, Trustwave is used by businesses to achieve and validate PCI DSS compliance.

PCI DSS v3.0 is business as usual for the most part, except for a few changes from v2.0 that considers impactful for large swaths of merchants. The top three changes involve e-commerce businesses that redirect consumers to third-party payment providers. The expansion of penetration testing requirements and the data security responsibilities of third-party service providers.

Penetration testing

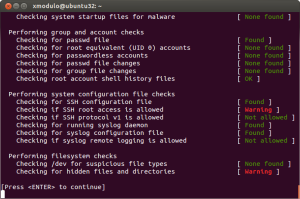

Penetration testing is the way in which merchants can assess the security of their networks by pretending to be hackers and probing networks for weaknesses. V3.0 of the PCI DSS mandates that merchants follow a formal methodology in conducting penetration tests, and that the methodology goes well beyond what merchants can accomplish using off-the-shelf penetration testing software solutions.

Merchants that are self assessing and using such software are going to be surprised by the rigorous new methodology they are now expected to follow.

Additionally, penetration testing requirements in v3.0 raises the compliance bar for small merchants who self assess. Those merchants could lower the scope of their compliance responsibilities by segmenting their networks, which essentially walls off data-sensitive areas of networks from the larger network. In this way merchants could reduce their compliance burdens and not have to undergo penetration testing.

Not so in v3.0. If you do something to try to reduce the scope of the PCI DSS to your systems, you now need to perform a penetration test to prove that those boundaries are in fact rigid.

Redirecting merchants

The new redirect mandate as affecting some, but not all, e-commerce merchants that redirect customers, typically when they are ready to pay for online purchases to a third party to collect payment details. If you are a customer and you are going to a website and you add something to your shopping cart, when it comes time to enter in your credit card, this redirect says I’m going to send you off to this third party.

The redirect can come in several forms. It can be a direct link from the e-commerce merchant’s website to another website, such as in a PayPal Inc. scenario, or it can be done more silently.

An example of the silent method is the use of an iframe, HTML code used to display one website within another website. Real Estate on the merchant’s website is used by the third-party in such a way that consumers don’t even know that the payment details they input are being collected and processed, not by the e-commerce site, but by the third party.

Another redirect strategy is accomplished via pop-up windows for the collection of payments in such environments as online or mobile games. In-game pop-up windows are typically used to get gamers to pay a little money to purchase an enhancement to their gaming avatars or advance to the next level of game activity.

For merchants that employ these types of redirect strategies, PCI DSS v3.0 makes compliance much more complicated. In v2.0, such merchants that opted to take Self Assessment Questionnaires (SAQs), in lieu of undergoing on-site data security assessments, had to fill out the shortest of the eight SAQs. But in v3.0, such redirect merchants have to take the second longest SAQ, which entails over 100 security controls.

The PCI SSC made this change because of the steady uptick in the number and severity of e-commerce breaches, with hackers zeroing in on exploiting weaknesses in redirect strategies to steal cardholder data. Also, redirecting merchants may be putting themselves into greater data breach jeopardy when they believe that third-party payment providers on the receiving end of redirects are reducing merchants’ compliance responsibilities, when that may not, in fact, be the case.

Service providers

Service provider is any entity that stores, processes or transmits payment card data. Examples include gateways, web hosting companies, back-up facilities and call centers. The update to the standard directs service providers to clearly articulate in writing which PCI requirements they are addressing and what areas of the PCI DSS is the responsibility of merchants.

A web hosting company may tell a merchant that the hosting company is PCI compliant. The merchant thought, they have nothing left to do. The reality is there is still always something a merchant needs to do, they just didn’t always recognize what that was.

In v3.0, service providers, specifically value-added resellers (VARs), also need to assign unique passwords, as well as employ two-factor authentication, to each of their merchants in order to remotely access the networks of those merchants. VARs often employ weak passwords or use one password to access multiple networks, which makes it easier for fraudsters to breach multiple systems.

The PCI SSC is trying to at least make it more difficult for the bad guys to break into one site and then move to the hub, so to speak, and then go to all the other different spokes with the same attack.

Overall, v3.0 is more granular by more accurately matching appropriate security controls to specific types of merchants, even though the approach may add complexity to merchants’ compliance obligations. On the whole a lot of these changes are very positive.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (PCI SSC), call centers, cardholder data, consumers, credit-card, customers, data breaches, data security assessments, Data Security Standard, e-commerce breaches, e-commerce businesses, e-commerce merchant's website, electronic payments, global data security, global standard, Merchant's, merchant’s website, mobile, networks, payment, payment card data, Payment Card Industry, payment providers, PCI Security Standards Council, PCI-DSS, Penetration testing, Service providers, shopping cart, software solutions, web hosting, website

September 4th, 2014 by Elma Jane

EMV, which stands for Europay, MasterCard and Visa, and is slated to be mandated across the United States starting in October 2015 and automated fuel dispensers have until October 2017 to comply. Unlike magnetic swipe cards, EMV chip cards encrypt data and authenticate communication between the card and card reader. Additionally, chip card user is prompted for a PIN for authentication.

Why are those dates important? Companies lose $5.33 billion to fraud today, with card issuers and merchants incurring 63 and 37 percent of these losses, respectively. Under the EMV mandate, merchants who do not process chip cards will bear the burden of the issuer loss. By accepting chip card transactions, merchants and issuers should see a reduction in fraud.

Overcoming Barriers to EMV Adoption

Given the significant barriers to EMV adoption, it may be tempting for merchants to meet minimum requirements for accepting EMV payments. However, medium to large retailers should also consider the bigger picture of customer security and peace of mind.

Some key critical success factors for a payment initiative of this size include:

Business Continuity Architecture: As with all payment systems, it is imperative to have the EMV system running at all times. The solution should preferably have Active-Active architecture across multiple data centers and have a low Recovery Point Objective (the point in time to which the systems and data must be recovered after an outage).

Cost Benefit Analysis: Take a top down approach and decide accordingly on the scope of the analysis. This will ensure that decisions on scope are made on basis of quantitative data and not just qualitative arguments.

Phased Approach: To overcome time or cost overage in a project of this scope and complexity, retailers should try using an iterative approach for development. The rollout can be divided into multiple releases of six to seven months, which will provide the opportunity to review, capture lessons learnt, and improve subsequent releases.

Proactive Monitoring Alerts: Considering the criticality of business function carried out by EMV, tokenization and payment gateway, a vigorous supervising environment must be defined to perform proactive and reactive monitoring. It should take into consideration the monitoring targets, tools, scope and methods. This will provide advance visibility to the failure points and better ensuring maximum system availability.

Resilience Testing: Typically in a software project, the testing is limited to the unit, integration, performance and user acceptance. However, due to the critical nature of the applications and systems involved, robust resiliency testing is vital. This will ensure that there are no single points of failure and the system remains available when running in error conditions.

Stakeholder Identification: This is a key step to ensure that you have varied perspectives from all departments and their support. It will keep your organization from being blindsided and reduce the risk of disagreements in later stages of the program. Key stakeholders should include Store Operations, Card Accounting, Loss Prevention, Contact Center and IT & Data Security.

Organizations should adopt a five step approach to implement a secure, robust and industry-leading payment solution:

Encryption – Point to point encryption will ensure card data is secure and encrypted from the point of capture to the processor. Usually, merchants use data encryption that is not point to point, rendering their organization vulnerable to data breaches. Software encryption is the most common form of encryption, as it is easily installed and quires little or no hardware upgrades; however, it is less secure, may expose encryption keys, and is prone to memory scanning attacks. Hardware encryption is considered more secure but requires more costly terminal upgrades. Hardware encryption is designed to self-destruct the keys if tampered, but is not well-defined as very limited headway has been made in this space.

Tokenization – Build a Card Data Environment (CDE) that will host a centralized card data storage solution. Only limited applications with firewall access and capability to mutually authenticate via certificates can access CDE and receive card data. The rest of the applications will have tokens which are random numbers. This architecture will ease the merchant’s burden with existing and emerging PCI Data Security Standards.

Payment Gateway – Perform a risk assessment on the current payment gateway and identify gaps in functionality, manageability, compliance, scalability, speed to market and best practices. Determine the alternatives to mitigate the risks. Some of the important aspects of a leading payment gateway solution are support for all forms of credit, debit, gift cards and check transactions. Its ability to work with any acquirer, in-built encryption abilities, support for settlement and reconciliation must also be kept into consideration.

Settlement, Funding and Reconciliation – A workflow-based system to handle chargebacks and the automation of chargeback processing will greatly reduce labor-intensive work and enhance the quality of data used for settlement and reconciliation. Upgrades to the existing receipt retrieval system may be needed.

Card fraud is on the rise in the U.S., and merchants are the primary target for stealing information. With the EMV deadline just over a year away, the responsible retailer must take steps to prepare now. Although EMV implementation might seem overwhelming to merchants, they should start their journey to secure payments rather than wait for a looming deadline. Solutions such as data encryption and tokenization should be used in combination with EMV to implement a robust payment solution to better protect merchants against fraud. By proactively adopting EMV payment solutions, merchants can stay ahead of the regulatory curve and better protect their customers from fraud.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, automation, card, card data, Card Data Environment, card fraud, card issuers, card transactions, CDE, chargeback, chargeback processing, check, check transactions, chip, chip cards, credit, customer, customer security, data, data breaches, data encryption, data security, debit, EMV, emv chip cards, EuroPay, fraud, gateway, Gift Cards, host, integration, magnetic swipe cards, MasterCard, Merchant's, payment, payment gateway, payment solution, payment systems, PCI, PCI Data Security Standards, PIN, processor, retailers, Security, software, swipe, terminal, tokenization, tools, visa

August 27th, 2014 by Elma Jane

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

August 11th, 2014 by Elma Jane

Tokenization technology has been available to keep payment card and personal data safer for several years, but it’s never had the attention it’s getting now in the wake of high-profile breaches. Still, merchants especially smaller ones haven’t necessarily caught on to the hacking threat or how tools such as tokenization limit exposure. That gap in understanding places ISOs and agents in an important place in the security mix, it’s their job to get the word out to merchants about the need for tokenization. That can begin with explaining what it is.

The biggest challenge that ISOs will see and are seeing, is this lack of awareness of these threats that are impacting that business sector. Data breaches are happening at small businesses, and even if merchants get past the point of accepting that they are at risk, they have no clue what to do next. Tokenization converts payment card account numbers into unique identification symbols for storage or for transactions through payment mechanisms such as mobile wallets. It’s complex and not enough ISOs understand it, even though it represents a potential revenue-producer and the industry as a whole is confused over tokenization standards and how to deploy and govern them.

ISOs presenting tokenization to merchants should echo what security experts and the Payment Card Industry Security Council often say about the technology. It’s a needed layer of security to complement EMV cards. EMV takes care of the card-present counterfeit fraud problem, while tokenization deters hackers from pilfering data from a payment network database. The Target data breach during the 2013 holiday shopping season haunts the payments industry. If Target’s card data had been tokenized, it would have been worthless to the criminals who stole it. It wouldn’t have stopped malware access to the database, but it would been as though criminals breaking into a bank vault found, instead of piles of cash, poker chips that only an authorized user could cash at a specific bank.

A database full of tokens has no value to criminals on the black market, which reduces risk for merchants. Unfortunately, the small merchants have not accepted the idea or the reality and fact, that there is malware attacking their point of sale and they are being exposed. That’s why ISOs should determine the level of need for tokenization in their markets. It is always the responsibility of those who are interacting with the merchant to have the knowledge for the market segment they are in. If you are selling to dry cleaners, you probably don’t need to know much about tokenization, but if you are selling to recurring billing or e-commerce merchants, you probably need a lot more knowledge about it.

Tokenization is critical for some applications in payments. Any sort of recurring billing that stores card information should be leveraging some form of tokenization. Whether the revenue stream comes directly from tokenization services or it is bundled into the overall payment acceptance product is not the most important factor. The point is that it’s an important value to the merchant to be able to tokenize the card number in recurring billing, but ISOs sell tokenization products against a confusing backdrop of standards developed for different forms of tokenization. EMVCo, which the card brands own, establishes guidelines for EMV chip-based smart card use. It’s working on standards for “payment” tokenization with the Clearing House, which establishes payment systems for financial institutions. Both entities were working on separate standards until The Clearing House joined EMVCo’s tokenization working group to determine similarities and determine whether one standard could cover the needs of banks and merchants.

Posted in Best Practices for Merchants Tagged with: account numbers, bank, billing, card, card brands, card number, card present, Clearing House, data, data breaches, database, e-commerce, EMV, emvco, fraud, ISOs, Malware, Merchant's, mobile wallets, network, payment, Payment Card Industry, Security, smart card, target, tokenization, transactions

June 5th, 2014 by Elma Jane

The days of salespeople peddling point of sale terminals by simply pulling hardware out of a box are numbered. That model is being replaced by integrated payments from software developers who add payment capabilities to applications that run at the point of sale, in the back office or on mobile devices.

Integrated payments are becoming common in the restaurant industry, where systems are developed to combine payment acceptance with the ability to manage orders, tables and food delivery. As integrated payments become more common, companies working in the payments industry will seek ways to offer marketing analytics. You tie that type of data to the payment mechanism and you can learn more about your business and your customers.

There is a place in the ecosystem for traditional payment acceptance, but today, when a retailer shops for a point of sale terminal or other business solutions, they expect payments to be part of the integrated bundle. Many of these systems are now delivered in a software-as-a-service model or through tablets, making them cost-effective for businesses of any size.

Integrated commerce includes mobile acceptance, offers, coupons and loyalty. It enables a merchant to buy a point of sale system for the physical store, website and mobile environment at the same time. Then the merchant can send out offers and begin running a loyalty program, while accepting NFC transactions all at once. Merchants can also review transactions from all channels directly from their offices to monitor against data breaches. With those integrated services becoming more readily available for merchants, it is not surprising that the topic comes up when executives discuss their company’s goals.

Relationships with merchants through integrated payments tend to be sticky because it is an embedded solution. You tend to get better pricing because it’s not necessarily an acquiring decision but a POS software/hardware decision and acquiring is part of that package. Payments as a service will be an important global product, selling a terminal now means selling data security, warranty and service, and numerous merchant tools.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Point of Sale Tagged with: breaches, coupons and loyalty, data, data breaches, data security, global product, integrated bundle, Integrated commerce, integrated payments, integrated services, loyalty program, marketing analytics, merchant, merchant tools, mobile, Mobile Devices, NFC transactions, payment, payment mechanism, payments industry, point of sale, POS software/hardware, Security, tablets, terminal, terminals, traditional payment, warranty and service, website and mobile environment

May 5th, 2014 by Elma Jane

The Payment Card Industry (PCI) Data Security Standard (DSS) has come under criticism as high profile data breaches continue to expose flaws in retailers’ data security systems. But telecommunications firm Verizon Wireless concluded that the PCI DSS is working.

Some Responses to Criticisms

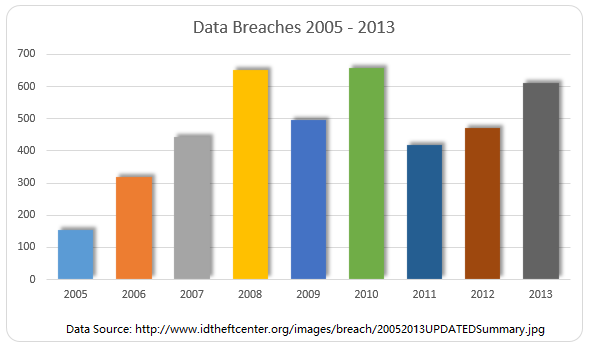

Nilson Report research from August 2013 that said card fraud cost the global payments market over $11 billion in 2012. Verizon added that the frequency of fraud schemes that the PCI DSS was designed to avoid is in fact growing. And yet most businesses are not fully compliant at the time of assessment. Only 51.1 percent of the companies it had audited had passed seven of the 12 requirements of the PCI DSS and only 11.1 percent of said companies had passed all 12.

Verizon addressed some of the criticisms leveled at the PCI DSS. One concern is that the standard promotes compliance as a test to be passed and forgotten, which distracts companies from focusing on improving security. Verizon responded by stating that breached businesses were less likely to be PCI DSS compliant than unaffected companies. It also said businesses improve their chances of not being breached by having the standard in place, and of minimizing the damage of a breach should one occur.

Another common complaint leveled at the standard is that it is too cumbersome and slow moving in relation to the quickly evolving threat landscape and nimble fraudsters ready to try new tactics. Verizon countered that the PCI DSS is meant to be a set of baseline security protocols. Achieving compliance with any standard is simply not enough, organizations must take responsibility for protecting both their reputation and their customers. Most attacks on networks are of the simple variety, with 78 percent of hacking techniques considered low or very low in sophistication. Data Breach Investigations Report (DBIR) research shows that while perpetrators are upping the ante, trying new techniques and leveraging far greater resources, less than 1 percent of the breaches use tactics rated as high on the VERIS (Verizon’s Data breach Analysis Database) difficulty scale for initial compromise.

Recommendations

There’s an initial dip in compliance whenever a major update to the standard is released, so organizations will have to put in additional effort to prepare for achieving compliance with DSS 3.0.

The newest version of the standard, PCI DSS 3.0, went into effect Jan. 1, 2014. Businesses have until Jan. 1, 2015, to implement it. The updated standard has new requirements and clarifications to version 2.0 that will take time for businesses to understand and implement, and this will result in more organizations being out of compliance.

To help businesses deal with their PCI DSS compliance obligations the firm offered five approaches:

Don’t leave compliance to information technology security teams, but enlist application developers, system administrators, executives and other staff in helping further along the process.

Embed compliance in everyday business practices so that it is sustainable.

Integrate compliance programs into enterprise-wide governance, risk and compliance strategies.

Learn how to reduce the scope of organizations’ compliance responsibilities, chiefly by figuring out how to store less data on fewer systems.

Think of compliance as an opportunity to improve overall business processes, rather than as a burden.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: attacks on networks, Breach, breached, business processes, compliance, compliant, data breach investigators, data breaches, data security systems, database, DSS, fraud schemes, global payments, hacking, information technology, Payment Card Industry, PCI, retailers, Security, security protocols, standard, system administrators, wireless

March 14th, 2014 by Elma Jane

Merchant and Consumer Groups Seek Senate Support To Forego EMV Chip and Signature As Breach Concerns Rise

There’s no shortage of answers in trying to put a stop to hackers set on throwing chaos into the way consumers transact at the point of sale, or online for that matter. Yesterday, the Banking, Housing and Urban Affairs subcommittee on national security and international trade and finance got its chance to hear some of them.

During the hearing, William Noonan, deputy special agent in charge, U.S. Secret Service, noted the advances in computer technology and greater access to personally identifiable information online, which have created a virtual marketplace for transnational cyber criminals to share stolen information and criminal methodologies. As a result, the Secret Service has observed a marked increase in the quality, quantity, and complexity of cyber crimes targeting private industry and critical infrastructure. These crimes include network intrusions, hacking attacks, malicious software, and account takeovers leading to significant data breaches affecting every sector of the world economy.

The recently reported data breaches of Target and Neiman Marcus represent only the most recent, well-publicized examples of this decade-long trend of major data breaches perpetrated by cyber criminals intent on targeting the nation’s retailers and financial payment systems. The increasing level of collaboration among cyber-criminals allows them to compartmentalize their operations, greatly increasing the sophistication of their criminal endeavors and allowing for development of expert specialization. These specialties raise both the complexity of investigating these cases, as well as the level of potential harm to companies and individuals.

So how should the industry react to prevent further breaches? Those opinions provided during testimony at the hearing varied widely, though both consumer and merchant groups would like the card networks to give up requiring only signatures for smart card purchases at the point of sale.

Consumer program director at the U.S. Public Interest Research Group, called for myriad of changes, citing that the greater risk from the recent breaches is less related to identity theft than it is to fraud on existing accounts, and he said it’s time for players on both sides of the transaction to focus more on protecting consumers than on managing their own risk.

Until now, both banks and merchants have looked at fraud and identity theft as a modest cost of doing business and have not protected the payment system well enough. They have failed to look seriously at harms to their customers from fraud and identity theft -including not just monetary losses and the hassles of restoring their good names, but also the emotional harm that they must face as they wonder whether future credit applications will be rejected due to the fraudulent accounts.

As a first step, Congress should institute the same fraud cap, $50, on debit/ATM cards that exists on credit cards, or eliminate the $50 cap entirely, since it is never imposed because of the zero-liability policies issuers have voluntarily have imposed. Congress also should provide debit and prepaid card customers with the stronger billing-dispute rights and rights to dispute payment for products that do not arrive or do not work as promised, just as many credit card users enjoy.

Congress should endorse a specific technology, such as EMV smart cards and if it does, require the use of PINs when initiating smart card transactions. The current pending U.S. rollout of chip cards will allow use of the less-secure chip-and-signature cards rather than the more-secure chip-and-PIN cards. Why not go to the higher-and-PIN authentication standard immediately and skip past chip and signature? There is still time to make this improvement.”

Retailers have spent billions of dollars on card-security measures and upgrades to comply with PCI card security requirements, but it hasn’t made them immune to data breaches and fraud. The card networks have made those decisions for merchants, and the increases in fraud demonstrate that their decisions have not been as effective as they should have been.

The card networks should forego chip and signature and go straight to chip and PIN. To do otherwise would mean that merchants would spend billions to install new card readers without they or their customers obtaining PINs’ fraud-reducing benefits. We would essentially be spending billions to combine a 1990’s technology chips with a 1960’s relic signature in the face of 21st century threats.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Small Business Improvement, Visa MasterCard American Express Tagged with: banking, Breach, card networks, card-security, chip and signature, chip cards, chip-and-PIN cards, computer technology, credit applications, credit cards, critical infrastructure, cyber crimes, cyber-criminals, data breaches, debit atm cards, EMV, hackers, hacking attacks, international trade and finance, malicious software, managing risk, merchant, national security, netwrok intrusions, new card readers, online, payment system, pci card security requirements, PIN, point of sale, prepaid card customers, smart card transactions, technology chips, the secret service, transnational cyber criminals, virtual marketplace, world economy