October 17th, 2013 by Elma Jane

You find a good deal online, and as you hastily proceed through the checkout, something goes wrong.

After typing in your name, address and credit card number, you mis-key a digit of your credit card number. The transaction doesn’t go through. The screen seems to yell at you. START OVER. You feel like yelling back.

You have to get to a meeting, so you close your browser and vow to revisit the process later or – worse – try booking the flight on another travel site.

Cart abandonment is a well-known problem for merchants trying to sell goods to online shoppers, and it is even more pronounced when the shopper is using a mobile device.

Travelocity was seeing far too much of it, so the online travel booking site turned to Jumio for a solution.

Travelocity’s deployment of Netswipe, Jumio’s credit card scanning and validation tool, provided the basis for discussion in a recent webinar, “How Travelocity Increased Conversion, Engagement on its Mobile Apps,” sponsored by Jumio and hosted by Mobile Payments Today.

The best webinars look at use cases, said Anthony Lanham, Jumio senior vice president for North American sales, and Travelocity’s experience with Netswipe provides a great example.

Travelocity’s problem was straightforward, the online travel agency’s director of engineering. The site is a common destination for people looking for just-in-time bookings, he said. They need it right now.

And with shoppers increasingly accessing the site from mobile devices, there was this pattern. The user doing a last-minute booking is in a hurry. When you’re in a hurry with a small screen, there’s a decent tendency to ‘fat-finger’ and make key-entry errors. The transaction fails, and that becomes frustrating for the user in a hurry.

A Jumio consumer mobile insight study found that a majority of respondents find it too difficult to fill out forms from a mobile device. And if a purchase doesn’t go through, they almost never go back to try again.

They may come back and finish later, but if it’s Travelocity, the door is now open to go to Expedia and book that flight or hotel.”

Netswipe is designed to remove the burden of entering card details. The solution lets users snap a photo of their card with the camera on their mobile device and present it at checkout, removing the need to self-enter.

In the case of Travelocity, when users reach the mobile site’s checkout page, they see an “autoscan with camera” option in the billing header. They hold the card in front of the camera, which scans it and provides the necessary details to the site. The process takes about five seconds.

To test the solution, Travelocity first implemented it on its sister site, LastMinute.com. Adding the software development kit to the LastMinute.com app was simple and early adoption was larger than the company anticipated. That early success led to quick integration of the app on the flagship Travelocity site.

Checkout conversion rates there also increased much more quickly than anticipated. Over two months, customers using the card scan feature converted at 52 percent, compared to 9 percent for other customers. “The data made it clear that ease of entering payment information was the main reason.”

Though Travelocity’s challenge centered on customer conversion and engagement, Netswipe also acts as a fraud deterrent.

Fraudsters always take the path of least resistance and any decent fraudster can get their hands on the name and number and expiration date that match. But once you get to the point of asking that fraudster to put a bona fide card in front of a camera, you are going to instantly cut out a huge swath of fraudsters. For them to take that information and actually translate it on a physical card that would pass muster for the checks that we do is an enormous task. They can go monetize those fraudulent credentials elsewhere easily.

Moharil offered a few lessons from the integration. First, he said, it’s important to measure, and to continue measuring often. For example, are users checking out the feature out of curiosity or are they using it to complete transactions? And it’s important to plan for backward compatibility – making sure earlier versions of the Jumio SDK and Travelocity app don’t have glitches.

Moharil advised rolling out a new solution along the simplest path, in a small use case, early results for Travelocity have been so good, he only wishes the solution were implemented sooner.

The webinar concluded with a short question-and-answer session. The free webinar is now available for Online Replay, and will remain on the Mobile Payments Today site for 12 months.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Travel Agency Agents, Visa MasterCard American Express Tagged with: autoscan with camera, billing, booking, cart, checkout, conversion, credit-card, data, device, digit, fraudster, key-entry, merchant, mis-key, mobile, online, shoppers, site, transaction, travel, travel agency's, travelocity, webinar

October 15th, 2013 by Elma Jane

Banking and payments technology provider FIS and City National Bank, a private and business bank, have partnered to pilot FIS’s Cardless Cash Access at City National ATMs in Los Angeles, New York City and San Francisco. The solution lets consumers stage an ATM transaction from their mobile devices.

City National plans to introduce the emerging technology to clients in its three largest markets early next year, according to an FIS announcement, continuing FIS’ rollout of the solution at banks and ATMs in key U.S. locations.

FIS said Cardless Cash Access securely authenticates a user on his or her smartphone. The consumer then uses the phone to select the account and amount of the withdrawal. At the ATM, the consumer scans a QR code on the ATM screen and, within seconds, the cash is dispensed and an e-receipt is sent to the phone.

Consumers continue to look for innovative new ways to engage with their financial institutions via mobile devices, FIS Mobile, said in the release. At the same time, they demand additional security to keep their information safe. Information from Cardless Cash Access is maintained in the cloud, so card data cannot be accessed if the consumer’s phone is lost or stolen – making this a faster, safer, more secure way to make a withdrawal.”

To decrease fraud, FIS said, security within Cardless Cash Access is provided through the app’s authentication and registration of a user’s smartphone, which the company said eliminates card skimming risk and fraud incidents for banks and their clients.

With the proliferation of debit and access to cash at the point of sale, financial institutions are looking for ways to expand the utility of the ATM,” Senior vice president and head of product strategies, Vince Hruska, City National Bank, said in the release. “Cardless Cash Access not only provides a secure and easy way to obtain cash from an ATM, but introduces to the client a new way of looking at ATM use.

Posted in Financial Services Tagged with: account, amount, atm, authenticates, banking, banks, card, cardless, cash, data, e-receipt, emerging, financial, Mobile Devices, national, payments, QR code, securely, Security, Skimming, smartphone, transaction

October 11th, 2013 by Elma Jane

(Moto) Mail Order/Telephone Order Merchant – In the realm of credit card processing is defined as a merchant who manually keys in over 50% of their transactions and an Internet Merchant is one who accepts transactions over the Internet via an E-Commerce store with an online gateway or who submits transactions manually through a Virtual Terminal.

Qualified Transaction Conditions (For MOTO/Internet merchants the Mid-Qualified Rate is essentially the Qualified rate as these merchants never swipe a credit card through a terminal.)

One electronic authorization request is made per transaction and the transaction date is equal to the shipping date. The authorization response data must also be included in the settled transaction.

Additional data (sales tax and customer code) is required in the settled transaction on all commercial (business) cards at non-Travel & Entertainment (T&E) locations.

The authorization request message must include Address Verification Service (AVS), which verifies the street address and the zip code of the card holder. NOTE: The only way this happens is if your software is set up to do this, or, if you are using a terminal, then if you capture the AVS information at the time of keying in your transaction.

The settled transaction amount must equal the authorized amount.

The settled transaction must include the business’s customer service telephone number, order number, and total authorized amount.

The transaction is electronically deposited (batch transmitted) on or 1 day after authorization date.

The transaction/shipping date must be within 7 calendar days of authorization date.

Non-Qualified Transaction Conditions

One or more of the Qualified or Partially Qualified conditions were not met.

Commercial Card without the additional data.

The transaction was not electronically authorized or the authorization response data was not included in the settled transaction.

The transaction was electronically deposited (batch transmitted) greater than 1 day from transaction/shipping/authorization date, or:

The VISA Infinite card was accepted.

Commercial Card Additional Data

MasterCard

Corporate Data Rate II (Purchasing cards): Sales Tax and customer Code (supplied by cardholder at point of sale) Corporate Data Rate II (Business and Corporate cards): Sales Tax International Corporate Purchasing Data Rate II: Sales Tax and Customer Code (supplied by cardholder at point of sale)

The following information must also be provided: Merchant’s Federal Tax ID; Merchant Incorporation Status; and Owner’s full name if the merchant is a sole proprietor.

Visa

Purchasing cards: Sales Tax and Customer Code (supplied by cardholder at point of sale) Corporate and Business cards: Sales Tax

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mail Order Telephone Order Tagged with: address verification service, authorization, avs, batch, business, corporate, credit card processing, data, e-commerce, electronically, entertainment, fax order, gateway, internet, internet merchant, keying, mail order, moto, phone order, qualified, settle, store, telephone order, transactions, transmit, travel, virtual terminal

October 3rd, 2013 by Admin

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

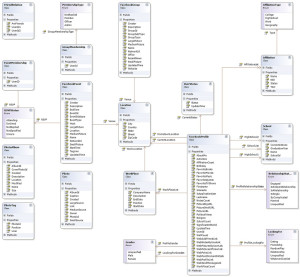

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet