October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

May 11th, 2017 by Elma Jane

Three Domain Secure (3-D Secure)

Visa is announcing a global plan to support 3-D Secure 2.0 to help protect e-commerce transactions.

3-D Secure (3DS) – stands for Three-Domain Secure. A messaging protocol to enable consumers to authenticate themselves with their card issuer when making card-not-present (CNP) e-commerce purchases. 3DS is an additional security layer that will help prevent unauthorized CNP transactions and protects the merchant from CNP exposure to fraud.

The three domains consist of:

The merchant/acquirer domain

Issuer domain

the interoperability domain (payment systems)

The purpose of the 3DS protocol within the payments community is to facilitate the exchange of data between the merchant, cardholder and card issuer. The objective is to benefit each of these parties by providing the ability to authenticate cardholders during a CNP e-commerce purchase, reducing fraud.

Visa currently offers its 3-D Secure service through the Verified by Visa program, which supports the existing 3-D Secure 1.0 specifications for consumer authentication.

Visa anticipates that early adoption of 3-D Secure 2.0 will begin in the second half of 2017.

Merchants that authenticate transactions using 3-D Secure are generally protected from issuer card-not-present fraud-related chargeback claims,1 and this rule will extend to merchant-attempted 3-D Secure 2.0 transactions after 12 April 2019, the global program activation date.

For Electronic Payment Set Up go to NationalTransaction.Com or call now 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card, card-not-present, cnp, data, e-commerce, electronic payment, merchant, payment, Security, transactions

April 4th, 2017 by Elma Jane

Customer Service Revolution A State Of Being!

Customer experience will overtake price and product as a key brand differentiator. Every single interaction a customer has factors into whether they remain loyal or switch to a competitor. Customer experience affects brand loyalty.

Common mistakes when engaging customers and how to avoid them:

Being unprepared

Poor interaction related to customer support means losing customer or sale. Don’t be passive when a customer calls for help. Familiarize yourself with a customer’s background.

To ensure that the customer is using the product to the fullest extent, jump into each interaction with personalized tips on specific features. If you come to each call proactively prepared, your customers are getting the most value from your product.

Failing to build a relationship

Avoid negative engagement with a customer, track customers engagement. Plan targeted, purposeful interactions to ensure they remain happy. Take the time to get to know your customers before any issues arise. Developing strong relationships with customers means they are more likely to talk to you not resort to extreme measures.

Making a useless call merely to check in

Don’t reach out to your customer blindly, consider these questions:

Are they happy using the product? Are they using the most advanced feature? Dive deep into customer data to better understand how customers are using the product and what they might need.

NTC uses a range of tools to collect data and gather insights about our customers and use that data to understand which customers may need more hand-holding and training to increase their level of engagement.

Learn more about your customer in advance; with all of this knowledge you can better address questions or concerns with specific tips or support.

That is NTC’s Customer Service!!!

Posted in Best Practices for Merchants Tagged with: customer, data, product

March 30th, 2017 by Elma Jane

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

February 13th, 2017 by Elma Jane

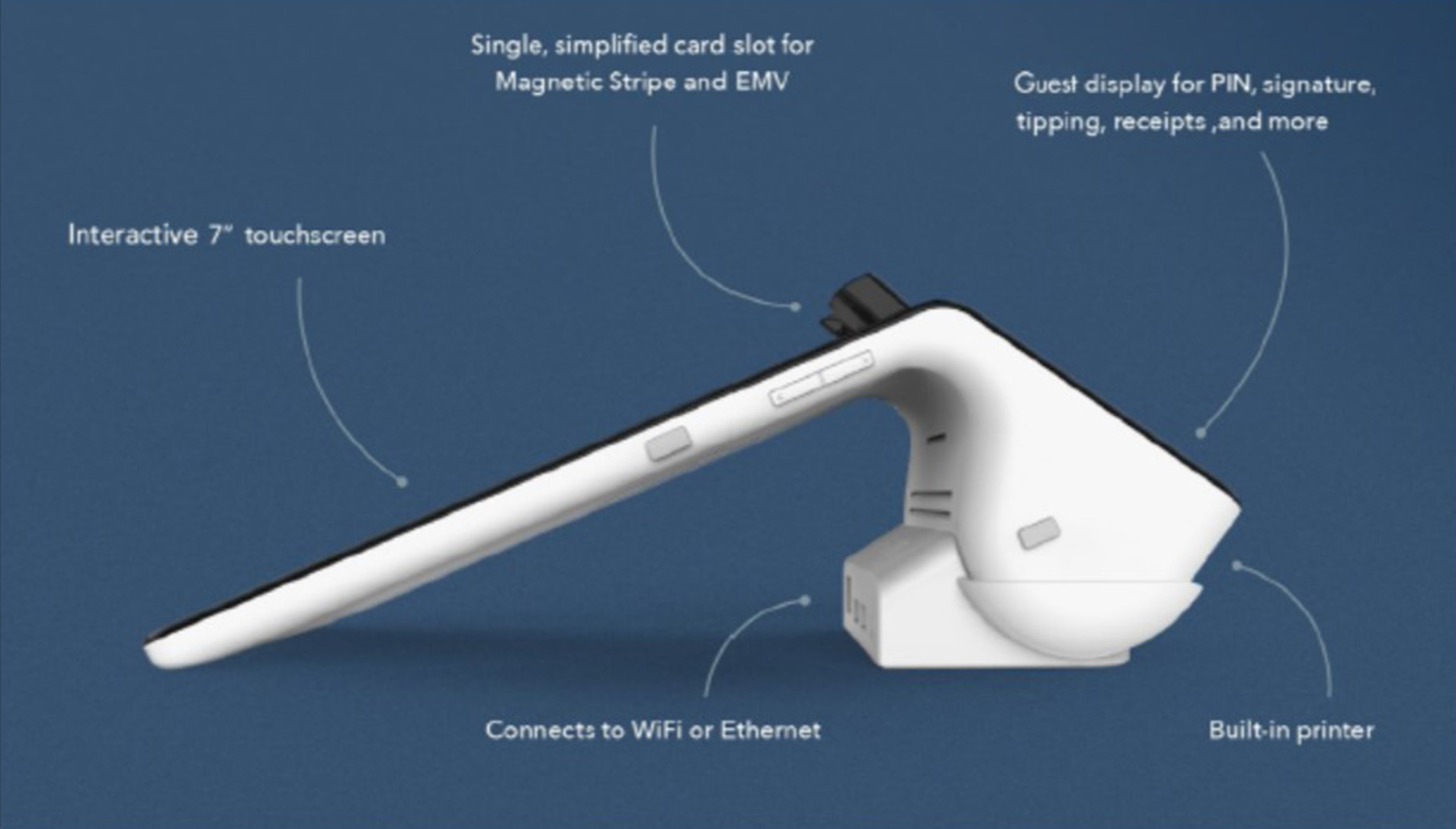

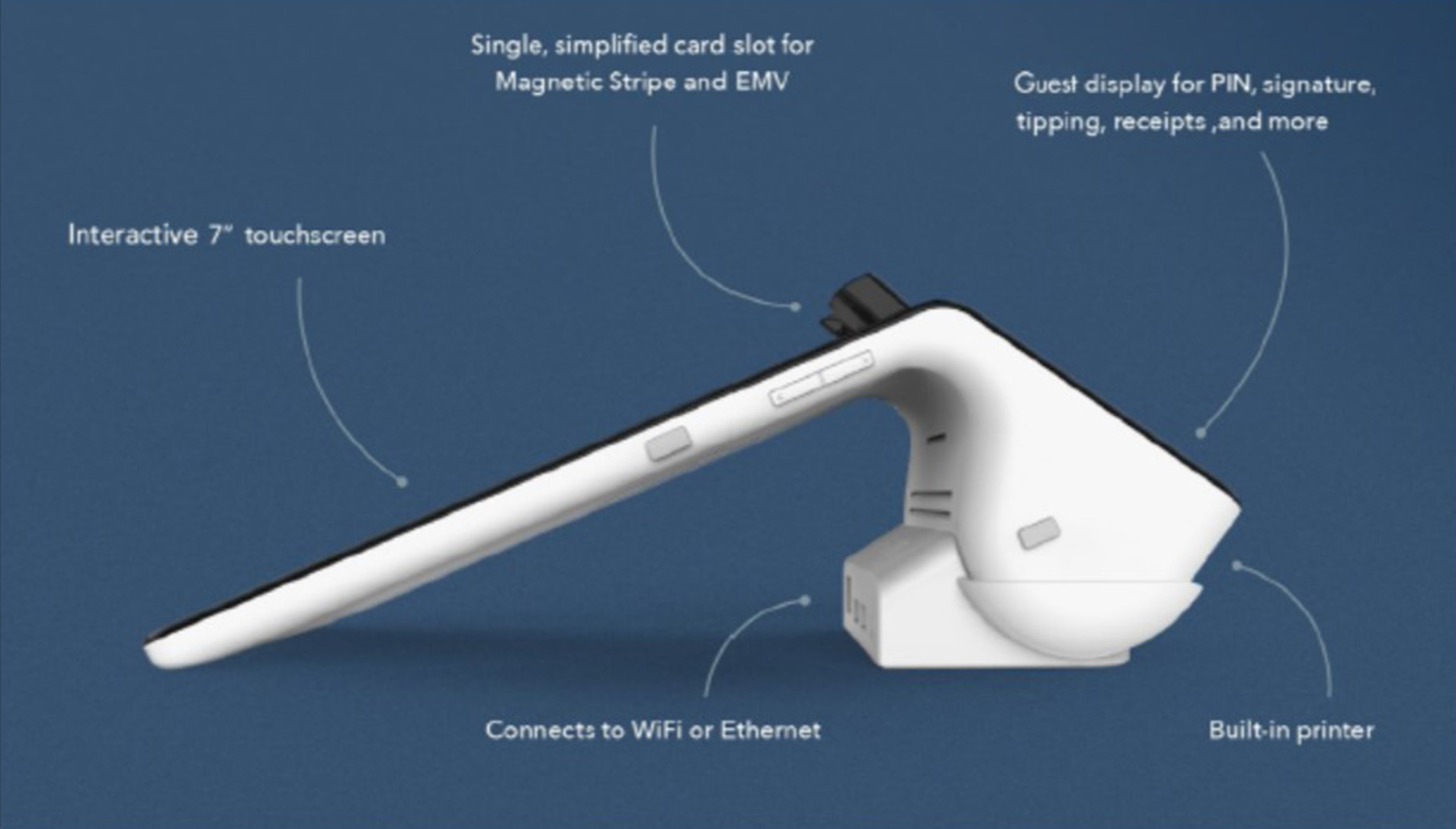

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

December 6th, 2016 by Elma Jane

The Process of Processing Electronic Payments

Today new technologies are emerging in electronic payment that allow merchants to collect valuable data on their customers; from emailing receipts to providing incentives to mention the merchant on social media.

So what’s behind the process of processing electronic payments? The heart of all your payment processing needs will most likely lie in a merchant account; with a merchant account you can deposit funds from ebt cards, debit cards, gift or loyalty cards and even checks into your bank account. If your business has never had its own merchant account, it’s probably missing out on some very valuable opportunities.

At National Transaction Corporation this process is simplified to a signature page and a voided check. We consult your business personally to establish the lowest rates and fees possible with your electronic payment processing. We ask detailed questions about how you process your transactions, and if you already process credit cards, we offer a free statement review where we determine your most common transaction types and how to lower their fees and rates.

How Much Will Electronic Payment Processing Cost?

There are three parts to the answer:

Up front or startup costs – include things like an application fee, an account setup fee and equipment fees. At NTC, we don’t have any application, setup or cancellation fees on our services. Our credit card readers and terminals are nonproprietary and will work with almost any merchant services provider and we sell them at cost to make it easier on our merchants.

When you buy a terminal from us you own it and are free to leave us at any time and use the terminal to process through another merchant account provider with no penalty payments at all.

Other startup costs might be:

- check readers,

- cash registers and receipt printers

- mobile point of sale software

- credit card swipe readers

- Accounting software (Intuit’s Quickbooks Pro or PeachTree)

If you already own any of this equipment we can integrate your existing hardware into our services.

Monthly service fees – depend on what services are required; included in the monthly fee detailed statements and reporting on transaction activity.

Transaction fees – MasterCard, Visa and American Express set what are called interchange rates. Interchange rates are a per transaction fee and/or a percentage rate based on the total of a sale. Interchange rates are very complex and consume hundreds of pages of different types of electronic transactions. These transactions are based on the type of business processing the transaction, the way the credit card data is input (like a credit card that is swiped in or manually keyed into a credit card terminal of some type) and the type of credit card used for the transaction (rewards card, corporate card, travel and entertainment credit cards, ebt cards and so on). With so many types of cards and businesses to process it’s impossible to give an accurate rate for all charges.

Again, we have no fees associated with applying for or setting up the merchant account and there is no penalty for cancellation so there are no risks in trying it out. We can do merchant rate review for free. Call us now 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit cards, customers, data, electronic payment, merchant account, merchants, mobile, payment processing, point of sale, services provider, terminal, transactions

November 18th, 2016 by Elma Jane

Tokenization and Encryption are completely different technologies when it comes to securing sensitive data, such as credit cards.

Encryption tools and techniques is to mask original data, then allow it to be decrypted. It uses an algorithm to scramble credit card information that makes the data unreadable to anyone.

Encryption is most often “end-to-end.”

Example: When someone enters card data into a web browser to buy an item and decrypted when the purchaser’s authorized credit card information reaches its intended destination, which is the merchant’s e-commerce database.

Encrypted card data is unreadable while it’s “at rest” in a database or “in motion” during a purchase transaction; and inaccessible until a key decrypts it. The chances of a hacker stealing the data is minimal. But, if card data passes through multiple internal systems en route to an acquiring bank or payment gateway, the encrypt/decrypt/re-encrypt process could open a wide security hole, thus creating vulnerabilities to hackers.

Tokenization have found to be cheaper, easier to use and more secure than end-to-end encryption.

Tokenization completely removes credit card data from internal networks and replaces it with a generated, unique “token”. Tokens have no meaning and are worthless to criminals if a company’s system is breached.

Merchants use only the token to retrieve, access, or maintain their customers’ credit card information.

Example: Actual credit card number was 3234 4567 8789 78910, it might become FHIW145BVE65478 when a token is generated. The token is randomly generated and there is no algorithm to regain the original card number. hackers can’t reverse-engineer the actual credit card number, even if they were to grab the tokens off the servers.

Using tokens doesn’t change a merchant’s payment processing experience. Only they’re much safer for a merchant than actual credit cards.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: card, credit cards, customers, data, encryption, gateway, merchants, payment, Security, token, tokenization, transaction

November 17th, 2016 by Elma Jane

Payment Card Industry

What is PCI DSS (Payment Card Industry Data Security Standards)? A set of requirements, founded by Amex, Discover, JCB, MasterCard and Visa; to facilitate industry-wide adoption of consistent data security measures on a global basis. Best practices for enhancing payment account data security.

Why does my business need to be PCI Compliant? You help protect your business

by reducing the risk of a costly breach of your customers’ payment card data. Payment card brands (Amex, Discover, JCB, MasterCard and Visa) mandate that all businesses processing payment cards must be compliant.

Once my business validates PCI-DSS compliance, does that prevent a security breach from happening? No. It helps prevent security breaches and loss of cardholder data but do not provide a guarantee to your business. Also, similar to the regularly required updates to anti-virus and firewall software; data security is also continually subject to new threats.

What happens to my business if I am not PCI Compliant? If you do not comply with the security requirements contained within PCI-DSS as mandated by the payment card networks; you put your organization at risk of a payment card compromise.

In the event that your business is compromised, you may also be subject to additional fines, fees, and assessments by the card brands. You may also lose your credit card acceptance privileges.

What am I required to do to validate PCI compliance? The minimum requirement for PCI Level 4 business is to complete a PCI-DSS Self-Assessment Questionnaire (SAQ) on an annual basis and achieve a passing status.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: card, credit card, customers, data, payment, PCI, Security