October 23rd, 2015 by Elma Jane

Every merchants, small, medium or large, should put in some effort to protect their sensitive data. Many breaches of data could have been prevented by implementing stronger security controls and employing safety best practices in the workplace.

Weak or stolen usernames and passwords are one of the top causes of data breaches, and more than 75 percent of attacks on corporate networks are due to weak passwords. Almost half of all instances of hacking is due to stolen passwords, which are obtained through the theft of password lists. This indicates that there is no organization in any industry that is not vulnerable to a breach of data.

Studies across the board indicate that weak usernames and passwords are one of the top causes of data breaches. A strong password is the first line of defense against scammers and hackers, and to help keep your data safer.

There are risks associated with relying on weak usernames and passwords to restrict the access of data. Data breaches could have been stopped if a stronger, better password was used. Experts, including the IT team of companies, can offer assistance to employees seeking to improve their passwords and reduce risk.

Weak password means data breaches! The best passwords are long and varied, with symbols, letters and numbers. These passwords should not be obvious, such as the name of a company, address or company motto. It is difficult to enact policies for improved passwords in the workplace because employees are not informed of the facts.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: data, data breaches, merchants

October 19th, 2015 by Elma Jane

If you’re a merchant accepting credit cards, you’re probably aware that things are changing. As of October 1st, 2015, merchants are now liable for any fraudulent activity that occurs as a result of non-EMV-compliant. For those Merchants who haven’t yet updated their POS terminal, you need to talk with your processor to get a new equipment.

Things Merchant should know to be EMV ready:

What is EMV Chip Cards? Chip Cards are standard bank cards that are embedded with a micro-computer chip. Some may require a PIN instead of a signature to complete the transaction process. The new cards will still have magnetic stripes, at least for the time being, so you technically can continue to process payments with the same old equipment you’ve been using for years. But by refusing to upgrade your hardware, you are taking on responsibility for any fraud that might have otherwise been prevented with the new technology.

How does EMV Chip Cards Work? Instead of swiping your card, you are going to do what is called card dipping, which means inserting your card into a terminal slot and waiting for it to process.

When a Chip Card or EMV Card is dipped, data flows between the card chip and the issuing financial institution to verify the card’s legitimacy and create the unique transaction data.

This process isn’t as quick as a magnetic-stripe swipe. It will take a little longer for that transmission of data.

What Must a Merchant Do? For merchants and financial institutions, the switch to EMV chip cards means adding new in-store technology and internal processing systems, and complying with new liability rules. Merchants who have not yet purchased new POS Terminal may be held liable for fraud as of October 1st, 2015. Implementing EMV technology isn’t an option, it’s a necessity. If you are one of those in the retail business or retailers using mobile payment devices who missed the Oct. 1st deadline, you are already at risk. Upgrading should be a top priority.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: bank cards, chip cards, credit cards, data, EMV, financial institutions, magnetic stripes, merchant, mobile payment, PIN, POS terminal, processor, retail business, terminal slot

October 19th, 2015 by Elma Jane

Small merchants don’t consider themselves at risk for a cyberattack. But Cybercriminals thrive on data about employees, customers, bank accounts and many other types of information any small business would carry, with fewer resources than large firms, small businesses are especially at risk for attacks.

Here are Steps to find out to make your business more cybersecure:

Employ best practices on payment cards – Credit card companies are now shifting from magnetic-strip payment cards to safer, more secure chip card EMV Technology. Are you ready for the shift? Now is the time, you should work with your banks and processors to ensure you’re using the most trusted and validated anti-fraud services. You may also have additional security obligations pursuant to agreements with your bank or processor. You should isolate payment systems from other, less secure programs and don’t use the same computer to process payments and surf the Internet.

Educate employees about cyberthreats – Educate your employers about online threats and how to protect your organization’s data, including safe use of social networking sites.

Protect against viruses, spyware, and other malicious code – Make sure all of your organization’s computers are equipped with antivirus software and antispyware and update regularly. Such software is readily available online from a variety of vendors. All software vendors regularly provide patches and updates to their products to correct security problems and improve functionality. Configure all software to install such updates automatically.

Require employees to use strong passwords and to change them often – Consider implementing multifactor authentication that requires additional information beyond a password to gain entry. Check with your vendors that handle sensitive data, especially financial institutions, to see if they offer multifactor authentication for your account.

Secure your networks – Safeguard your Internet connection by using a firewall and encrypting information. If you have a Wi-Fi network, make sure it is secure and hidden. To hide your Wi-Fi network, set up your wireless access point or router so it does not broadcast the network name, known as the Service Set Identifier (SSID). Password protect access to the router.

No one can guarantee your safety from a cyberattack, appropriate planning makes a big difference. By using these tips and resources, you can help promote the safety of your employees, customers, and the future success of your small business.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: bank accounts, banks, chip card, credit card, data, EMV, magnetic strip, merchants, payment cards, payment systems, processors

September 24th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Questions to ask to help you decide about terminal upgrade.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: chip, credit card reader, credit cards, data, EMV, emv cards, EuroPay, magnetic stripe cards, MasterCard, merchants, Mobile Devices, Near Field Communication, nfc, payments, point of sale, POS terminal, visa

July 30th, 2015 by Elma Jane

Converge Powers Potential

Over the next several weeks, we’ll focus on a series of topics to hopefully provide a better understanding of the payment capabilities

Converge can bring you customers. In this article, we’ll zoom in on the card-present product enhancements of Converge first, including bringing EMV and mobile wallet capabilities to in-person payments, and ultimately VirtualMerchant Mobile later this year.

New Peripherals Added to Converge – Ingenico iSC250 and Star Micronics TSP650II Printer

Ingenico iSC250 Signature-Capture PIN Pad – is a signature-capture PIN pad offering the ability to accept PIN-based transactions, like debit card and Electronic Benefit Transfer (EBT), as well as EMV chip card and mobile wallet payments.

The iSC250 will initially ship EMV-capable meaning it’s physically configured with a slot to accept an EMV chip card, but it does not yet have the EMV application to process a chip card transaction.

A simple download process later in the year will allow customers to accept chip cards. The good news is customers can accept NFC contactless payments right away, including Apple Pay and Google Wallet.

Key features of the Ingenico iSC250 include:

- EMV-capable smart card reader to support EMV chip cards; EMV-enabled with a download later in the year

- NFC-enabled for contactless cards and Apple Pay and Google Wallet mobile wallets

- Magnetic stripe capture for all standard mag stripe cards

- Encryption technology to help secure cardholder data at point of entry and throughout the payment network

- Signature Area Display for signature capture with electronic stylus

- Bright color 4.3″ display and backlit key pad for ease of use

Star Micronics TSP650III:

In addition to the new iSC250PIN pad, a new USB printer were also added to the lineup of Converge supported peripherals, the Star Micronics TSP650II receipt printer. Now customers have two options for thermal receipt printing!

ConvergeConnect Makes Device Setup a Snap

A new peripheral and device management software called ConvergeConnect to make it easier for your customers to setup their devices quickly as well as add additional peripherals as their business needs grow. It will be the go-forward device management application, and we’ll be able to bring more and more EMV and NFC devices to market faster, giving our customers even more in-store payment processing options.

Legacy peripherals, like magnetic stripe card readers, check imagers and the Epson ReadyPrint T20 printer will continue to be managed using the Device Assistant.

Customers may have to use both ConvergeConnect and Device Assistant depending on their peripheral configuration.

A new Peripheral Device Installation and Setup Guide was developed to help customers install and manage their peripherals for both applications.

Converge Mobile with EMV on the Horizon

Work continues on the new VirtualMerchant Mobile app to be branded as Converge Mobile, and releasing the Ingenico iCMP in the third quarter. The Ingenico iCMP accepts EMV and NFC transactions, including contactless cards and mobile wallets, like Apple Pay. Stay tuned as more information becomes available.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication Tagged with: card-present product, cardholder, chip card, contactless payments, data, debit card, EBT, Electronic Benefit Transfer, EMV, mag stripe cards, mobile wallet, nfc, NFC transactions, payment network, payments, PIN pad, PIN-based transactions, smart card reader, VirtualMerchant Mobile

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

May 28th, 2015 by Elma Jane

No such thing as FREE, but with National Transaction, Customer Relationship Management Software can be! Take advantage of technology and use it for your business success.

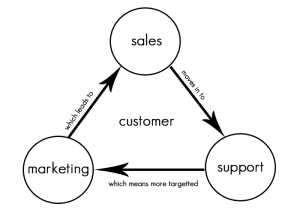

What is CRM? Customer relationship management is a system for managing a company’s interactions with current and future customers. It often involves using technology to organize, automate and synchronize sales, marketing, customer service and technical support.

Free CRM comes in two categories: FREE, but limited, and OPEN SOURCE.

Free, but limited versions – set caps on the amount of free users, contacts, storage, extra features, or some combination.

Open source – offers an unlimited, fully functional CRM to users, is extremely customizable. Most open source CRM companies also offer a preconfigured version and/or installation and support for a price.

There are a whole host of affordable CRM options you should be considering even though not free, may be the perfect fit for your organization.

Each CRM system is different and each one will serve some companies better than others. CRM is a category that’s very rich in free and open source programs.

Why is the value of CRM great for Merchants?

It allows you to register your leads and contacts. You need some basic categories to make your data efficient so that you can implement your CRM strategy to fulfill their needs. With a CRM you can store and manage hundreds of clients and let a computer system handle the task of memory and recall.

You can track all customer interaction – A customer relations management system put all the pertinent client information in one central location that was easy to update and easy to see when other’s updated. All communication can be kept in one spot, nothing gets lost and you can now see and share with the rest of your team. This history builds a long-time relationship. Emails should be in your system, and not in each person’s mailbox.

Every time you make a call, send an email, or contact that customer or prospect you can update your CRM with their current status.

It reveals possibilities. Most companies keep their current supplier until they are ignored. That’s why keeping them alive and kicking in your CRM database is so important. And if you have an opt-in newsletter or a great seminar plan, their business might be yours for the next quarter.

It makes your most valuable asset – the customer data – remain. People change jobs. Have you ever experienced someone leaving you, and nothing is left behind? The pipeline wasn’t up to date. The contacts wasn’t updated. The important contacts wasn’t registered – because all relevant information was stored locally. Don’t let it happen. Customer relations systems help keep all conversations in one place and make it easy for you to quickly look back in time and see how things have progressed. See for yourself the progression of a client and their communication as well as your company’s notes and responses. You’ll be able to save more customers from leaving by catching something you would have otherwise missed, and you can learn from your history.

Posted in Best Practices for Merchants Tagged with: crm, CRM database, customer data, customer service, data, database, merchants, open source

May 19th, 2015 by Elma Jane

We’re now nearly midway through 2015, and payment security still remains a topic that stirs up great concern and confusion. While there is seemingly unanimous agreement on the need for heightened security, there’s uncertainty about those who are tasked with actually implementing it. Let’s dig deeper into EMV, P2PE and tokenization. How each will play a part in the next generation of securing payments, and how without properly working together they might just fall short.

Europay, MasterCard, and Visa (EMV) – A powerful guard against credit card skimming. EMV also uses cryptography to create dynamic data for every transaction and relies on an integrated chip embedded into the card.

Downside: For Independent Software Vendor (ISVs), the biggest downside of EMV is the complexity of creating an EMV solution. ISVs interested in certifying PINpads with a few processors face up to 22 months of costly work, and because there are a large number of pending certifications, processors will be backed up over the next few years.

It’s not impossible for an ISV to build EMV solutions in-house, but it’s difficult and unnecessary when there are plug-and-play EMV solutions available. These solutions include pre-packaged and pre-certified APIs that remove most of the need for research, the complexity and the burden of time and cost.

Point to Point Encryption (P2PE) – Secures devices, apps and processes using encrypted data with cryptographic keys only known to the payment company or gateway from the earliest point of the transaction, from tech-savvy criminals, jumping at their chance to intercept POS systems and scrape the memory from Windows machines.

How does a key get into card reader? Through an algorithm called derived unique key per transaction (DUKPT), or “duck putt.” DUKPT generates a base key that’s shared with device manufacturers securely, where output cardholder data is rendered differently each time a card is swiped, making it impossible to reverse engineer the card data. P2PE not only benefits the cardholders, but also the ISVs and merchants. PA-DSS certification was designed to address the problems created with cardholder data which is not encrypted.

Downside: P2PE isn’t cheap if an organization wants to do it in-house. The secure cryptographic device needed to manage the keys, Hardware Security Module (HSM), can cost $30-40,000 but when it’s built out, that total cost can jump to $100,000.

TOKENIZATION – The best way to protect cardholder data when it’s stored is using tokenization, a process which the PCI Security Standards Council describes as one where the primary account number is replaced with a surrogate value a token. For merchants dealing with recurring billing, future payments, loyalty programs and more, tokenization is critical.

Downside: Tokenization doesn’t prevent malware that’s remotely installed on POS devices. It’s possible, as seen with recent retail card breaches, for data to be stolen before it is tokenized. That’s why it’s essential to group tokenization together with P2PE and EMV to offer optimal security.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: (POS) systems, account number, billing, card, card breaches, card reader, cardholder, cardholder data, chip, credit card, data, DSS, EMV, EuroPay, gateway, Independent Software Vendor, ISVs, MasterCard, merchants, p2pe, payment company, payment security, payments, PCI, PINpads, point-to-point encryption, POS devices, processors, Security, security standards council, token, tokenization, transaction, visa

May 14th, 2015 by Elma Jane

The way customers Pay In Stores Is Changing.

Chip cards are here to provide advanced security with every transaction. Accepting chip cards could be as simple as changing your payment terminal.

What do you need to know about Chip Card and EMV? Chip cards are payment cards that have an embedded chip, which offers advanced security when you use the card to pay in store. Chip cards are based on a global card payment standard called EMV (Europay, MasterCard and VISA) currently used in more than 80 countries.

Why Is it More Secured? Chip card transactions offer you advanced security for in store payments by making every transaction unique, and, more difficult to counterfeit or copy. If the card data and the one-time code are stolen, the information cannot be used to create counterfeit cards and commit fraud.

How do you know if a customer has a Chip Card? The customer’s card will have chip on the front of it, magnetic stripe remains on the back.

How to use Chip Card at the POS? Swipe the card as they normally would and follow the prompts. If the terminal is chip-enabled, it will prompt them to insert it instead. The customer should insert their card with chip toward terminal, facing up. The chip card should not be removed until the customer is prompted.

Customer will provide their signature or PIN as prompted by the terminal.

Some transactions may not require either.

When the terminal says the transaction is complete, the customer can remove their card.

Chip-enabled terminals will still accept magnetic stripe card payments for customers who do not have a chip card.

What does a chip-enabled terminal look like? They have all of the features you are used to with a payment terminal, with the addition of a slot for the customer to insert their card. The slot is typically located at the bottom or the top of the payment terminal.

How will you know if a terminal accepts chip card? During the transition to chip, customers are being told to swipe their card as they normally would and follow the prompts. If the terminal is chip-enabled, it will prompt them to insert it instead. If you have chip-enabled terminals, you can tell your customer to insert their card for a chip transaction, if a customer has a chip card.

How can you get a chip-enabled terminal? Contact your acquirer or merchant service provider.

Show your customers that you care about their information security by making the move to chip. This will ensure that your business and your customers are protected from fraud. Start accepting chip cards!

You may be liable for fraud if you don’t make the change from chip terminal. Starting October 2015, rules are changing. Merchants that accept chip will be protected from fraud losses resulting from in store counterfeit magnetic stripe card transactions just as you are today. However, liability will shift from issuers to merchants if their payment terminals are not chip-enabled for in store transactions. Fraud liability for lost or stolen cards varies by payment network. Contact your acquirer or payment services providers for more information.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Point of Sale Tagged with: card data, cards, chip cards, Chip-enabled terminals, data, EMV, EuroPay, magnetic stripe, MasterCard and VISA, merchant service provider, Merchant's, payment, payment cards, payment network, payment terminal, POS, Security, terminal, transaction

May 12th, 2015 by Elma Jane

Our company’s goal is to make our customer happy. Our Merchant is very important with us. At National Transaction it’s all about our customer service. Yet many customers would rather than not contact a company for support, and this is especially true in the tech world. Customer finds the support experience as frustrating and time-wasting exercise.

We know this is true because we are customers ourselves. We’ve all felt that palpable sense of dread when we have to call a toll-free support number, expecting a massive, circular phone tree followed by a seemingly endless wait, and possibly a clueless rep when (if!) we finally do reach a human being.

It doesn’t have to be that way, at National Transaction we manage customer support delivery because we know we have an obligation to make it work. NTC’s teamwork-focused strategy and effective application of technology and data, can help our customer service do their jobs better.

How it works:

Apply lessons learned to continuously improve service – Some issues customers raise are a one-off, but many times, patterns emerge that can deliver insights on how the company could improve service for everyone.

It can be difficult for a single agent or manager to identify patterns, which is why a customer support platform with robust reporting capabilities is crucial to enable continuous service improvement.

In a crowded marketplace, excellence in customer support can be a key differentiator for a business. When customers reach out for support, they’re usually already stressed out about something that’s not working as expected. Far too often, their stress level increases while they’re attempting to get help, due to poorly designed business processes.

If your customers are stressed out, you can change that by taking a new approach. Make sure you know who they are when they reach out, and allow them to contact you on their own terms. Access your company’s collective expertise to quickly resolve the customer’s problems.

Be honest with the customer – A good customer support agent really does want to make things right for the customer, and that’s admirable. However, it’s important to avoid making commitments you can’t keep, which will serve only to increase the customer’s dissatisfaction in the long run.

Always be honest with your customers. If you can’t solve their problem immediately, give them an accurate time frame for a resolution, and let them know what steps you’re taking to address the issue. Record the commitment on a customer database so colleagues are up-to-date on your activities.

Be honest about what you can and cannot do, and take a look at the big picture, so you can improve service not only for the customer on the line but for everyone else.

Give customers multiple channels to access help – Customers have unique needs and individual preferences, Give them choices.

Know who your customers are – There are few among us who haven’t experienced the frustration of a poorly designed phone tree and the indignity of being shuffled from agent to agent and asked for our name, account number, product type and current service issue over and over again. Stop doing that to your customers.

Deploy a technology platform that incorporates a customer database with product and inventory information. That way, you’ll know who your customers are and what products they use when they call, and if you have to transfer them to another agent for help, the next agent will have that information too.

Use teamwork to solve customer issues – Chances are, someone in your company is capable of solving any problem a customer brings to the support team, but that person might not be on the phone. That’s why collaboration is so important.

There are software solutions that make collaborating across business units simple, and enable agents to view notes about past customer issues for clues to solving current problems. This not only helps your company solve the problem at hand, but also allows you to manage the entire relationship.

By following these steps, you can reduce your customers’ stress level and your own.

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: account, customer service, customer support, data, database, merchant, software, transaction