August 12th, 2014 by Elma Jane

With so much competition in today’s marketplace, it can often be a challenge to turn first-time customers into repeat customers. Providing good customer service isn’t always enough to keep consumers coming back. To create loyal customers, businesses need to be prepared to make their customers feel special and wanted.

Improve customer loyalty with the following:

Be quick to resolve issues. Not all products work perfectly and sometimes, paid services don’t meet expectations. Accept when customers’ expectations haven’t been met and work hard to make sure the issues are resolved to their satisfaction. They will remember this and will feel like their purchases are safe with you next time.

Keep in touch. Gather contact data on your customers when you can. Reach out to them with special offers and new products and services or just send them a birthday card. Use any excuse to keep your company in their minds.

Provide great service. Customer loyalty wanes when customer service is lacking. Make sure the customer is attended to promptly, courteously and efficiently. Listen to their needs and meet them as efficiently as possible. Customers will remember this, but they will remember bad service even more.

Reward loyalty. Once in a while, you should treat a loyal customer with a free product or special discount just for being loyal. You’ll be surprised at the loyalty this will generate.

Thank your customers. Chances are, you have competitors in your category and that means your customers have options. The fact that they chose you whether it’s because of your pricing, reputation or convenience is something that you appreciate, so show it. Thank them every time for choosing you and let them know in words and deeds how important your business is to them, regardless of whether they’re your smallest customer or your largest.

Posted in Best Practices for Merchants Tagged with: competitors, consumers, contact data, Customer loyalty, customer service, customers, data, free product, products, purchases, services, special discount

August 11th, 2014 by Elma Jane

Tokenization technology has been available to keep payment card and personal data safer for several years, but it’s never had the attention it’s getting now in the wake of high-profile breaches. Still, merchants especially smaller ones haven’t necessarily caught on to the hacking threat or how tools such as tokenization limit exposure. That gap in understanding places ISOs and agents in an important place in the security mix, it’s their job to get the word out to merchants about the need for tokenization. That can begin with explaining what it is.

The biggest challenge that ISOs will see and are seeing, is this lack of awareness of these threats that are impacting that business sector. Data breaches are happening at small businesses, and even if merchants get past the point of accepting that they are at risk, they have no clue what to do next. Tokenization converts payment card account numbers into unique identification symbols for storage or for transactions through payment mechanisms such as mobile wallets. It’s complex and not enough ISOs understand it, even though it represents a potential revenue-producer and the industry as a whole is confused over tokenization standards and how to deploy and govern them.

ISOs presenting tokenization to merchants should echo what security experts and the Payment Card Industry Security Council often say about the technology. It’s a needed layer of security to complement EMV cards. EMV takes care of the card-present counterfeit fraud problem, while tokenization deters hackers from pilfering data from a payment network database. The Target data breach during the 2013 holiday shopping season haunts the payments industry. If Target’s card data had been tokenized, it would have been worthless to the criminals who stole it. It wouldn’t have stopped malware access to the database, but it would been as though criminals breaking into a bank vault found, instead of piles of cash, poker chips that only an authorized user could cash at a specific bank.

A database full of tokens has no value to criminals on the black market, which reduces risk for merchants. Unfortunately, the small merchants have not accepted the idea or the reality and fact, that there is malware attacking their point of sale and they are being exposed. That’s why ISOs should determine the level of need for tokenization in their markets. It is always the responsibility of those who are interacting with the merchant to have the knowledge for the market segment they are in. If you are selling to dry cleaners, you probably don’t need to know much about tokenization, but if you are selling to recurring billing or e-commerce merchants, you probably need a lot more knowledge about it.

Tokenization is critical for some applications in payments. Any sort of recurring billing that stores card information should be leveraging some form of tokenization. Whether the revenue stream comes directly from tokenization services or it is bundled into the overall payment acceptance product is not the most important factor. The point is that it’s an important value to the merchant to be able to tokenize the card number in recurring billing, but ISOs sell tokenization products against a confusing backdrop of standards developed for different forms of tokenization. EMVCo, which the card brands own, establishes guidelines for EMV chip-based smart card use. It’s working on standards for “payment” tokenization with the Clearing House, which establishes payment systems for financial institutions. Both entities were working on separate standards until The Clearing House joined EMVCo’s tokenization working group to determine similarities and determine whether one standard could cover the needs of banks and merchants.

Posted in Best Practices for Merchants Tagged with: account numbers, bank, billing, card, card brands, card number, card present, Clearing House, data, data breaches, database, e-commerce, EMV, emvco, fraud, ISOs, Malware, Merchant's, mobile wallets, network, payment, Payment Card Industry, Security, smart card, target, tokenization, transactions

August 8th, 2014 by Elma Jane

Visa Inc., the global leader in payments, is helping U.S. fuel retailers prevent credit and debit card fraud at the pump with intelligent analytics that identify higher-risk transactions that may be fraudulent. Visa Transaction Advisor uses sophisticated analytics based on the breadth and scale of VisaNet data to flag the riskiest transactions by working with fuel companies to understand their needs, creating a new service that builds on Visa’s predictive analytics capabilities, providing fuel merchants with more intelligence to prevent fraud and improve their bottom line. While global fraud rates across the Visa payment system remain near historic lows, less than 6 cents for every $100 transacted – fuel pumps can be targets for criminals because they are often self-service terminals. The new solution, Visa Transaction Advisor (VTA), enables merchants to use real-time authorization risk scores to identify transactions that could involve lost, stolen or counterfeit cards. A pilot test of the new service showed a 23 percent reduction in the rate of fraudulent transactions – all without costly infrastructure upgrades or disruption of the customer experience.

How It Works

After a cardholder inserts the card at the pump, Visa analyzes multiple data sets such as past transactions, whether the account has been involved in a data compromise and nearly 500 other pieces of data to create a risk score. This allows merchants to identify those transactions with a higher risk of fraud and perform further cardholder authentication before gas is pumped. The time and costs associated with resolving fraudulent transactions can be substantial for both merchants and financial institutions and inconvenient for cardholders, which is one of the reasons why fraud prevention is critical. Visa’s solution is easy to implement, using existing message fields and formats as well as pump software or hardware to ensure minimal impact to merchants and acquirers. Several fuel merchants who piloted the technology over the last several months noticed a decrease in fraud, without negatively impacting their consumers’ experience. VTA as a tool help mitigate fraudulent transactions. A 23 percent reduction in the rate of fraudulent chargebacks during a pilot program in Los Angeles. This was done with minimal impact to the customer experience, making secure payment at the pump as convenient as possible. Providing fuel to millions of customers each month through approximately 15,000 service stations in the United States, said US Credit Card Operations Manager, from Shell, considering new solutions and technology it has to have a clear business benefit, be customer-centric and easy to implement. With no infrastructure investment, testing VTA as part of proactive fraud prevention tool-set to better identify fraudulent card activity earlier in the transaction cycle, without inconveniencing customers.

Visa Transaction Advisor is available to merchants through participating U.S. acquirers. Visa has partnered with Vantiv and is also working with other acquirers to offer the service to its fuel clients. Ease of implementation is a critical requirement whenever talking about a new merchant service. Visa Transaction Advisor builds on existing payment infrastructure, is easy to implement and flexible enough to allow customization by merchants.

Posted in Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, acquirers, analytics, authorization, card, cardholder, counterfeit cards, credit, Credit Card Operations, customer, data, debit, financial institutions, fraud, higher-risk transactions, Merchant's, payments, Rates, retailers, terminals, transactions, visa, Visa payment, Visa Transaction, Visa Transaction Advisor, VisaNet, VTA

August 7th, 2014 by Elma Jane

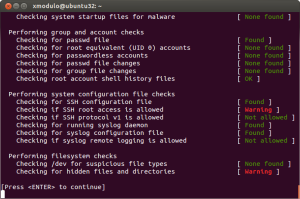

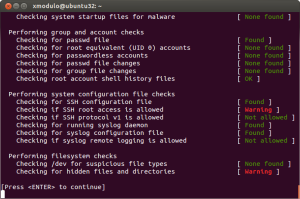

Recent high-profile cyberattacks at retail giants like Target and Neiman Marcus have highlighted the importance of protecting your business against point-of-sale (POS) security breaches. Often, the smallest merchants are the most vulnerable to these types of cyberthreats. The latest of these POS attacks is known as Backoff, a malware with such brute force that the U.S. Department of Homeland Security (DHS) has gotten involved. The DHS recently released a 10-page advisory that warns retailers about the dangers of Backoff and tells them how they can protect their systems. Backoff and its variants are virtually undetectable low to zero percent by most antivirus software, thus making it more critical for retailers to make sure their networks and POS systems are secure.

How Backoff works

Backoff infiltrates merchant computer systems by exploiting remote desktop applications, such as Microsoft’s Remote Desktop, Apple Remote Desktop, Chrome Remote Desktop, Splashtop 2 and LogMeIn, among others. Attackers then use these vulnerabilities to gain administrator and privileged access to retailer networks. Using these compromised accounts, attackers are able to launch and execute the Backoff malware on POS systems. The malware then makes its way into computer and network systems, gathers information and then sends the stolen data to cybercriminals. The advisory warns that Backoff has four capabilities that enable it to steal consumer credit card information and other sensitive data: scraping POS and computer memory, logging keystrokes, Command & Control (C2) communication, and injecting the malware into explorer.exe. Although Backoff is a newly detected malware, forensic investigations show that Backoff and its variants have already struck retailers three times since 2013, the advisory revealed. Its known variants include goo, MAY, net and LAST.

Prevent a Backoff attack

To mitigate and prevent Backoff malware attacks, the DHS’ recommendations include the following:

Configure network security. Reevaluate IP restrictions and allowances, isolate payment networks from other networks, use data leakage and compromised account detection tools, and review unauthorized traffic rules.

Control remote desktop access. Limit the number of users and administrative privileges, require complex passwords and two-factor authentication, and automatically lock out users after inactivity and failed login attempts.

Implement an incident response system. Use a Security Information and Event Management (SIEM) system to aggregate and analyze events and have an established incident response team. All logged events should also be stored in a secure, dedicated server that cannot be accessed or altered by unauthorized users.

Manage cash register and POS security. Use hardware-based point-to-point encryption, use only compliant applications and systems, stay up-to-date with the latest security patches, log all events and require two-factor authentication.

Posted in Point of Sale Tagged with: (POS) systems, antivirus software, Apple Remote Desktop, Backoff, cash register, Chrome Remote Desktop, credit-card, cyber attacks, cybercriminals, data, data leakage, Department of Homeland Security, desktop applications, DHS, goo, LAST, LogMeIn, Malware, MAY, Merchant's, Microsoft's, Neiman Marcus, net, network security, network systems, networks, payment networks, point of sale, point-to-point encryption, POS, remote, retailer networks, retailers, security breaches, Splashtop 2, target

July 22nd, 2014 by Elma Jane

An Android tablet is a great tool for work, but not every Android app was made for tablets. In fact, most Android apps were made for smaller smartphone displays. While those apps will run just fine on your tablet, they don’t do anything to take advantage of the extra screen space, and while smartphone apps are forced to hide options deep in menus, tablet apps have more room to put those controls front and center. Plus, phone apps just don’t look very good on a tablet. The interface is usually stretched and skewed to fill the larger screen. With that in mind, here are apps that will help you get to work on your Android tablet.

Android Device Manager (Free) – a good tool to help you find a lost or stolen Android device. Keeping it installed on your Android tablet will enable you to quickly locate your business phone if it’s ever misplaced. The app can force your phone to ring even if it’s in silent mode. Lock it to prevent thieves from accessing private or confidential business data and even locate your phone using its built-in GPS sensor. Using Android Device Manager on a tablet gives you plenty of space to view and pan around the map while you’re pinpointing the location of your phone. As a last resort, you can use the app to remotely wipe all the data from your smartphone.

Evernote (Free) – is a great app for taking notes, making to-do lists and saving photos and it’s even better on a tablet. The biggest difference between the smartphone and tablet version of Evernote is that the latter features a persistent sidebar that lets you quickly flip between notes, notebooks and tagged items. It has large buttons that let you create a new note, snap a photo or quickly dictate a voice memo. Those options are hidden in a slide-out menu in the smartphone app. You also get more space to view each individual note, which means you can see your entire memo or list at once with less scrolling and swiping.

Google Docs (Free) – Let’s face it: a word processor like Google Docs isn’t all that useful on your smartphone. Sure, it can come in handy when you need to make a few tweaks to an existing document, but you’ll need a bigger display to get much work done. The Google Docs app was really made for tablets, especially when you pair your slate with a Bluetooth keyboard to use it like a laptop computer. Not only do you get a better view of your entire document on the tablet, but you also get quick access to formatting options at the top of the interface, letting you change fonts, colors, text alignment and more. Those options are tucked away in several layers of menus in the smartphone app. Google’s Sheet spreadsheet editor and Slides presentation maker are also better suited for a large tablet display than a smartphone.

Google Drive (Free) – is a solid cloud storage platform for Android users, and a large tablet screen makes it easier to navigate your file library, thanks to a persistent sidebar that lets you jump to any folder with one tap. It also helps you search through shared and starred documents, or jump to a view of your recently uploaded files. But the best reason to use Google Drive on your tablet is that it lets you open those documents on the tablet version of Google Docs, which is much more functional on a large screen than on a smartphone.

Google Keep (Free) – is a minimalist productivity app that lets you quickly capture notes, voice memos and photos, then view all items in a colorful pinboard-style layout. It works fine on smartphones, but on tablets the app scales beautifully to fill the entire screen, letting you view more notes and photos at once. Otherwise, the app offers identical functionality on smartphones and tablets. In addition to pinning new notes to your board, you can create a to-do list and check items off with one tap. You can also set reminders for any item on your tablet and receive an alert on your smartphone when the time comes.

Hangouts (Free) – is an all-in-one messaging app that combines text messaging and videoconferencing functionality. The app imports your contacts from your Google account to let you create new conversations quickly and the ability to add and remove participants in the middle of a conversation helps it stand out from other messaging apps. You can start a video chat session at any time by tapping the video call button during a Hangouts session. That comes in handy when you need to meet with an employee, colleague or client, but can’t meet face-to-face. Hangouts works fine on a smartphone, but it’s better on a tablet. A persistent sidebar makes it easier to browse through your past conversations, and a larger touch-screen keyboard makes it easier to type out messages.

Informant 3 ($9.99) – is a powerful productivity app that combines a business calendar and task manager in a single location. The calendar automatically imports all your events and appointments from the stock Android calendar, so getting started with Informant 3 is easy. Once it’s set up, you can view your agenda at a glance. Change the view to get the optimal view of your day, week or month and add, move and delete items with a few taps. Meanwhile, the task manager lets you add items to a dynamic to-do list, set reminders and alerts, sort tasks by importance and more. Informant 3 works best on a tablet. Browsing your calendars and lists is easier and more comfortable on a larger display. The app also features a special tablet mode with a sidebar that lets you quickly jump between calendar dates.

Posted in Uncategorized Tagged with: Android, Android Device Manager, app, Bluetooth keyboard, computer, data, evernote, Google Docs, google drive, Google Keep, hangouts, Informant 3, laptop, notebooks, notes, phone apps, platform, smartphone, tablet

July 21st, 2014 by Elma Jane

European authorities dismantled a Romanian-dominated cybercrime network that used a host of tactics to steal more than EUR2 million. As a direct result of the excellent cooperation and outstanding work by police officers and prosecutors from Romania, France and other European countries, a key criminal network has been successfully taken down this week.

Hundreds of police in Romania and France, backed by the European Cybercrime Centre, carried out raids on 177 addresses, interrogating 115 people and detaining 65. Those held are suspected of participating in sophisticated electronic payment crimes, using malware to take over and gain access to computers used by money transfer services all over Europe. They are also accused of stealing card data through skimming, money laundering and drug trafficking.Proceeds of the crimes were invested in different types of property, deposited in bank accounts or transferred electronically, says the EC3. Large sums of money, luxury vehicles and IT equipment were seized during the raids.

Posted in Uncategorized Tagged with: accounts, bank, bank accounts, card, card data, cybercrime, data, electronic payment, host, Malware, money transfer, network, payment

July 15th, 2014 by Elma Jane

Businesses only stand to benefit by making themselves accessible via mobile devices. With a mobile website or mobile app, businesses can boost sales, retain loyal customers and expand their reach. The question is, which type of mobile presence is best for your business Or should you have both? Both mobile websites and mobile apps let customers find and access your business from devices they use the most, but a mobile website and mobile app are not the same thing. To help you decide, check out the differences between the two and how they can benefit your business.

Mobile App – is a smartphone or tablet application. Unlike a mobile website, a mobile app must be downloaded and installed, typically from an app marketplace, such as the Apple App Store or Android’s Google Play store.

Mobile Website – is designed specifically for the smaller screens and touch-screen capabilities of smartphones and tablets. It can be accessed using any mobile devices Web browser, like Safari on iOS and Chrome on Android. Users simply type in the URL or click on a link to your website, and the website automatically detects the mobile device and redirects the viewer to the mobile version of your website.

Mobile website’s benefits

The primary benefit of a mobile website is that it makes regular websites more accessible for mobile users. It can have all the same elements as the regular version of the website, such as its look and feel, pages, images and other content, but it features a mobile-friendly layout that offers improved readability and functionality when viewed on a smartphone or tablet. By having a mobile website, customers can access your website anytime, anywhere using any device, without compromising the user experience.

Mobile app’s benefits

Although a mobile app functions a lot like a mobile website, a mobile app gives businesses the advantage of having their own corner on a customer’s device, because users have to download and install the app, businesses have more control over their presence on a device than they would with a mobile website. For instance, a mobile app can be closed or inactive, but still work in the background to send geo-targeted push notifications and gather data about customer’s preferences and behaviors. Moreover, mobile apps make it easy to deploy loyalty programs and use mobile payments using a single platform. It’s also much easier to access a mobile app than a mobile website all it takes is one tap, versus having to open a Web browser then type in a URL.

Mobile website and Mobile app features

Although mobile websites and mobile apps aren’t the same thing, they generally offer the same features that can help grow your business by making it easier for customers to find and reach you.

Features include the following:

Click-to-map: Users can use their devices’ GPS to locate your business and instantly get directions, without having to manually input your address.

Mobile commerce: Take your online store mobile with e-commerce-capable mobile websites and apps, such as with Buy Now buttons and mobile carts.

One-click calling: Users can call your business simply by tapping on your phone number from your website or app.

Social sharing: This feature integrates social media apps and websites to enable users to easily share content with friends and followers.

Mobile marketing: This lets users sign up for marketing lists and loyalty programs while enabling businesses to easily launch location-based text-message marketing and email marketing campaigns.

How to build a mobile app

Just like the options available for building a mobile website, businesses can either hire an app developer to build a mobile app or take the budget-friendly DIY mobile app maker route.

How to build a mobile website

To build a mobile website, one option is to hire a mobile Web developer to create one from scratch or convert an existing website into a mobile-friendly one. A more affordable option is to build one yourself with a free DIY mobile website builder, which uses a drag-and-drop platform that doesn’t require programming or Web design skills.

Posted in Uncategorized Tagged with: Android's Google Play, Apple App, Chrome, customers, data, devices, e-commerce, email marketing, GPS, iOS, mobile, mobile app, mobile carts, Mobile Devices, mobile website, platform, programs, Safari, smartphone, tablet, URL, Web browser

June 19th, 2014 by Elma Jane

Analytics versus Intuition:

Human behavior plays a big role in sales forecasting. We have a number to shoot for, and often we try to figure out ways to make it, regardless of the soundness of our reasoning. So we assume deals are going to close even if it means we have to ignore telltale signs of trouble until its too late. Using modeling and analytics to evaluate your company’s position in each deal. The model could tell you the warning signs, because analytics would reveal how closely any deal fit with the model’s known history of success. As with weather forecasting, there would be no value judgement, just a probability of rain. Managers would still need to apply their reasoning, but armed with this kind of knowledge, sales people up and down the organization could evaluate scenarios constructed to make their deals match up with the ideal.

Cloudy With 30 Percent Chance Of Sale

Take a more scientific approach. The sales process stage is one of the variables in the model that the company uses to evaluate deals. More importantly, the busisness applies analytics to the deal data rather than expecting managers to review all of it. Analytics would have no trouble spotting the incomplete deal stage and would downgrade the forecast appropriately. A report then would show the variance between the forecast and the model. If you apply this logic to every deal in the forecast, then you have a range of probabilities similar to those weather people rely on to tell you about Saturday’s conditions. More importantly and unlike a weather report, the forecast is also prescriptive because it shows you how you can improve it. Get that meeting with the decision maker if you want to close the deal. Everyone complains about the weather but no one does anything about it. If you’re tired of complaints about sales forecast accuracy, consider building an accurate model and applying analytics. It works for the weather.

Posted in Best Practices for Merchants Tagged with: analytics, data, deals, sales

June 12th, 2014 by Elma Jane

QR: The Bridge to the Modern World

Involvement devices have come a long way from the time of Clearinghouse mailings, where you would peel off a label and stick it onto another page before dropping it back in the mail.

Today, print’s best involvement device is the QR code. It works as a portal or bridge into the mobile online world where the cataloger’s brand lives and breathes in real time. Even better, it can lead the customer from the catalog page to the checkout button on their smartphone within minutes.

The printed catalog delivers rich colors and a personal, tactile experience still not attainable through any mobile device. In many ways, though, it is a vestige of a bygone era, and an expensive one at that. Catalogers know this. Even the U.S. Postal Service also knows this. That’s why the USPS is running a postage discount promotion for the second year in a row this summer to encourage the use of QR codes by direct mailers.

Let’s take a quick look at the way a few catalogers are using QR codes.

Anthropologie

Anthropologie’s marketing strategy is more about selling a lifestyle than selling products. That explains why making it easy for customers to move toward actually buying something doesn’t seem like such a big priority in their catalog. They did not include a QR code anywhere. The closest they came was one line next to the address: For store information, go to www.anthropologie.com. Their 800 number, they do take phone orders is printed only once in tiny type, so having no QR code seems to fit in with their attempts to play hard to get. Marketing critique aside, by not using a QR code on their catalog, they are missing the opportunity to draw customers into closer involvement with their brand, whether or not they intend to make an immediate sale.

Best Practices

With these few examples in mind, it’s time to look at best practices for using QR codes in catalogs, which can be a two-sided equation. There is the technical aspect and the branding/selling aspect. As far as the technical side goes, customers need to use their smartphone to scan the code successfully, and the destination on the other end must be optimized for mobile access. Sometimes the hardest part is organizing the resources required to execute the backend side of things, especially if the goal is to make an immediate sale.

The main thing to consider is that QR codes work as a bridge and that bridge is a smartphone, iPad, or some other tablet with all their usual constraints (screen size, internet connection, quality of camera, QR reader app, user proficiency, etc.). Also, don’t assume that everyone has a QR reader or even knows what a QR code is. Especially in catalogs, where customers have been seeing postal service barcodes for years, people may assume that the pixelated square thing is just something else for the USPS to lose money on. Instead, including a brief call to action to scan the QR code should do the trick.

Crossing the Bridge

Getting customers to scan the QR code is only half the battle. Now you need to make sure they feel it was worth their while to scan. It’s all about the next steps in your customer relationship. If you have an Apple or Android app, then that’s where to send people if you know that you can convert sales successfully on mobile devices. Sending them to your Facebook fan page is an option too, but not a big win if a majority of your customers are already fans.

Special promotions, optimized for mobile access, will certainly earn your QR its keep. If your goal is to inspire a trip to one of your stores, then do what Brookstone does and send customers to a Google map with all store locations within a hundred miles. It’s also possible to send scanners to a dedicated page, again, optimized for mobile where you give them a number of options: Facebook, shop, app, etc.

Delia’s

By appealing to fashion-hungry American teens via retail stores, web, and catalog, Delia’s sold over $220 million in 2011. In the single catalog we looked at, Delia’s had a QR code on its back cover. When scanned, the code points to Delia’s Facebook page. That’s certainly one way to build involvement with the Delia’s brand, but it may not be the best. Delia’s has an Apple app with full e-commerce capabilities, so Delia’s could be missing out on the opportunity to help the customer cut to the chase and get straight to their virtual shopping bag. Still, at least they’re using the code.

King Schools

Unless you’re a pilot in training or know one fairly well, you have probably never heard of King Schools. They offer more than 90 flight training courses, plus all sorts of accessories for pilots-in-training. They have no retail stores, but that’s all the more reason to mention them here, retailers can learn a lot from King Schools about how to use QR codes in their catalogs.

In the one catalog, King used a QR code on the front cover and the back cover. Now, the iPad shows enormous potential for use in general and commercial aviation, so King is smart to use their QR codes to point customers directly toward their mobile apps and offerings. In fact, King Schools uses QR codes on the Take Courses on Your iPad landing page itself.

In most cases it seems counterintuitive to display a QR code on a website for people to scan. After all, they’re already there. It’s a smart use of codes in this case, for two reasons. First, the codes lead the customer directly to the Apple app store, so it actually makes sense to scan the codes even though the customer is already on their website. The customer is now just a few clicks away from buying and installing the app. Second, there is one QR code for their app store in general, and then there are unique codes for individual apps.

Technicalities

The content in a QR code tops out at 4,296 alphanumeric characters, but catalogers only need a fraction of that to get the customer to where they want them. However, even when the character count is down to a few dozen, size does matter, because QR codes with more data embedded in them are more complex visually. This means that even smartphones with the latest and greatest optics will have trouble reading densely populated codes. Make sure the QR code is big enough. Even the simplest codes will frustrate the scanning process if they are too small or if there isn’t enough white space around them. Maybe a QR code isn’t the most photogenic thing in the world, so it’s a good challenge for catalog art directors to incorporate it into the design without shrinking it into oblivion.

More sophisticated catalogers will want to use personalized QR codes. Today, even local printers are likely to have the means to print unique QR codes for each recipient in a mailing. This creates the ability to track scans back to the individual, a marketer’s dream when it comes to one-to-one marketing relationships.

Innovation can get you traction within the social media realm and that’s money in the bank. Whether you’re a major catalog player or using QR for something completely different, always consider getting the marketing and PR people involved to leverage any novelty aspects of the application.

The benefits pile up quickly to those catalogers who take the time to get smart about QR codes. Thick catalog books can be thinned down a bit if QR codes succeed in pulling customers from the page and onto their site or apps, cutting postal costs for the millions of mailings every year. And, even if the cataloger doesn’t go to the extreme of printing unique QR codes, the branding value of offering that connection from the old-style printed piece to the dynamic world of interactive mobile technology makes it well worth the effort.

The ink needed to print a QR code on a major retailer’s catalog might weigh only a fraction of an ounce, but when used right, it’s worth its weight in gold. Too bad the majority of catalogs seem to be squandering the opportunity by underutilizing the code or worse, not including any at all. In a world where an integrated multi-channel approach is a must-have for any retailer to survive, the stakes of leveraging every opportunity for interaction are higher than ever.

Posted in Best Practices for Merchants, Smartphone Tagged with: Android app, Anthropologie, app, Apple, bank, barcodes, Best Practices, Brookstone, clearinghouse, code, commercial aviation, Crossing the Bridge, customer relationship, data, data embedded, Delia’s, e-commerce, Facebook, google, Google map, interactive mobile technology, ipad, King Schools, marketing, mobile, mobile access, mobile device, mobile online, mobile technology, multi-channel, phone, portal, Postal Service, QR code, QR reader, retail stores, scan, scanners, smartphone, social media, tablet, USPS, virtual shopping, web, website

June 5th, 2014 by Elma Jane

The days of salespeople peddling point of sale terminals by simply pulling hardware out of a box are numbered. That model is being replaced by integrated payments from software developers who add payment capabilities to applications that run at the point of sale, in the back office or on mobile devices.

Integrated payments are becoming common in the restaurant industry, where systems are developed to combine payment acceptance with the ability to manage orders, tables and food delivery. As integrated payments become more common, companies working in the payments industry will seek ways to offer marketing analytics. You tie that type of data to the payment mechanism and you can learn more about your business and your customers.

There is a place in the ecosystem for traditional payment acceptance, but today, when a retailer shops for a point of sale terminal or other business solutions, they expect payments to be part of the integrated bundle. Many of these systems are now delivered in a software-as-a-service model or through tablets, making them cost-effective for businesses of any size.

Integrated commerce includes mobile acceptance, offers, coupons and loyalty. It enables a merchant to buy a point of sale system for the physical store, website and mobile environment at the same time. Then the merchant can send out offers and begin running a loyalty program, while accepting NFC transactions all at once. Merchants can also review transactions from all channels directly from their offices to monitor against data breaches. With those integrated services becoming more readily available for merchants, it is not surprising that the topic comes up when executives discuss their company’s goals.

Relationships with merchants through integrated payments tend to be sticky because it is an embedded solution. You tend to get better pricing because it’s not necessarily an acquiring decision but a POS software/hardware decision and acquiring is part of that package. Payments as a service will be an important global product, selling a terminal now means selling data security, warranty and service, and numerous merchant tools.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Point of Sale Tagged with: breaches, coupons and loyalty, data, data breaches, data security, global product, integrated bundle, Integrated commerce, integrated payments, integrated services, loyalty program, marketing analytics, merchant, merchant tools, mobile, Mobile Devices, NFC transactions, payment, payment mechanism, payments industry, point of sale, POS software/hardware, Security, tablets, terminal, terminals, traditional payment, warranty and service, website and mobile environment