April 17th, 2024 by Elma Jane

Intelligent Use Of Big Data

In understanding Big Data for Merchants, NTC provided a general overview of how online merchants can use Big Data. Think about this application of big data as adopting a more intelligent use of data.

Keeping customers happy is the key to the travel industry, but customer satisfaction can be hard to gauge in a timely manner. Big data analytics gives these businesses the ability to collect customer data, apply analytics and immediately identify potential problems before it’s too late.

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex.

One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as a CRM and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter.

A business could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions.

In a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

A Virtual Terminal can capture email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected.

As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants. Application of big data is a more intelligent use of data.

You know WHO, WHAT, WHEN, AND WHERE a purchase took place.

NationalTransaction.Com 888-996-2273.

Posted in Best Practices for Merchants Tagged with: data, database, merchants, mobile, online, point of sale, virtual merchant, website

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

May 28th, 2015 by Elma Jane

No such thing as FREE, but with National Transaction, Customer Relationship Management Software can be! Take advantage of technology and use it for your business success.

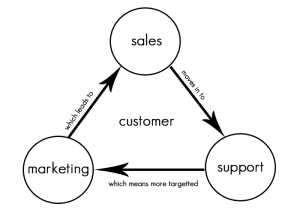

What is CRM? Customer relationship management is a system for managing a company’s interactions with current and future customers. It often involves using technology to organize, automate and synchronize sales, marketing, customer service and technical support.

Free CRM comes in two categories: FREE, but limited, and OPEN SOURCE.

Free, but limited versions – set caps on the amount of free users, contacts, storage, extra features, or some combination.

Open source – offers an unlimited, fully functional CRM to users, is extremely customizable. Most open source CRM companies also offer a preconfigured version and/or installation and support for a price.

There are a whole host of affordable CRM options you should be considering even though not free, may be the perfect fit for your organization.

Each CRM system is different and each one will serve some companies better than others. CRM is a category that’s very rich in free and open source programs.

Why is the value of CRM great for Merchants?

It allows you to register your leads and contacts. You need some basic categories to make your data efficient so that you can implement your CRM strategy to fulfill their needs. With a CRM you can store and manage hundreds of clients and let a computer system handle the task of memory and recall.

You can track all customer interaction – A customer relations management system put all the pertinent client information in one central location that was easy to update and easy to see when other’s updated. All communication can be kept in one spot, nothing gets lost and you can now see and share with the rest of your team. This history builds a long-time relationship. Emails should be in your system, and not in each person’s mailbox.

Every time you make a call, send an email, or contact that customer or prospect you can update your CRM with their current status.

It reveals possibilities. Most companies keep their current supplier until they are ignored. That’s why keeping them alive and kicking in your CRM database is so important. And if you have an opt-in newsletter or a great seminar plan, their business might be yours for the next quarter.

It makes your most valuable asset – the customer data – remain. People change jobs. Have you ever experienced someone leaving you, and nothing is left behind? The pipeline wasn’t up to date. The contacts wasn’t updated. The important contacts wasn’t registered – because all relevant information was stored locally. Don’t let it happen. Customer relations systems help keep all conversations in one place and make it easy for you to quickly look back in time and see how things have progressed. See for yourself the progression of a client and their communication as well as your company’s notes and responses. You’ll be able to save more customers from leaving by catching something you would have otherwise missed, and you can learn from your history.

Posted in Best Practices for Merchants Tagged with: crm, CRM database, customer data, customer service, data, database, merchants, open source

May 12th, 2015 by Elma Jane

Our company’s goal is to make our customer happy. Our Merchant is very important with us. At National Transaction it’s all about our customer service. Yet many customers would rather than not contact a company for support, and this is especially true in the tech world. Customer finds the support experience as frustrating and time-wasting exercise.

We know this is true because we are customers ourselves. We’ve all felt that palpable sense of dread when we have to call a toll-free support number, expecting a massive, circular phone tree followed by a seemingly endless wait, and possibly a clueless rep when (if!) we finally do reach a human being.

It doesn’t have to be that way, at National Transaction we manage customer support delivery because we know we have an obligation to make it work. NTC’s teamwork-focused strategy and effective application of technology and data, can help our customer service do their jobs better.

How it works:

Apply lessons learned to continuously improve service – Some issues customers raise are a one-off, but many times, patterns emerge that can deliver insights on how the company could improve service for everyone.

It can be difficult for a single agent or manager to identify patterns, which is why a customer support platform with robust reporting capabilities is crucial to enable continuous service improvement.

In a crowded marketplace, excellence in customer support can be a key differentiator for a business. When customers reach out for support, they’re usually already stressed out about something that’s not working as expected. Far too often, their stress level increases while they’re attempting to get help, due to poorly designed business processes.

If your customers are stressed out, you can change that by taking a new approach. Make sure you know who they are when they reach out, and allow them to contact you on their own terms. Access your company’s collective expertise to quickly resolve the customer’s problems.

Be honest with the customer – A good customer support agent really does want to make things right for the customer, and that’s admirable. However, it’s important to avoid making commitments you can’t keep, which will serve only to increase the customer’s dissatisfaction in the long run.

Always be honest with your customers. If you can’t solve their problem immediately, give them an accurate time frame for a resolution, and let them know what steps you’re taking to address the issue. Record the commitment on a customer database so colleagues are up-to-date on your activities.

Be honest about what you can and cannot do, and take a look at the big picture, so you can improve service not only for the customer on the line but for everyone else.

Give customers multiple channels to access help – Customers have unique needs and individual preferences, Give them choices.

Know who your customers are – There are few among us who haven’t experienced the frustration of a poorly designed phone tree and the indignity of being shuffled from agent to agent and asked for our name, account number, product type and current service issue over and over again. Stop doing that to your customers.

Deploy a technology platform that incorporates a customer database with product and inventory information. That way, you’ll know who your customers are and what products they use when they call, and if you have to transfer them to another agent for help, the next agent will have that information too.

Use teamwork to solve customer issues – Chances are, someone in your company is capable of solving any problem a customer brings to the support team, but that person might not be on the phone. That’s why collaboration is so important.

There are software solutions that make collaborating across business units simple, and enable agents to view notes about past customer issues for clues to solving current problems. This not only helps your company solve the problem at hand, but also allows you to manage the entire relationship.

By following these steps, you can reduce your customers’ stress level and your own.

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: account, customer service, customer support, data, database, merchant, software, transaction

All merchants that accepts, transmit or stores cardholder data are required to be PCI (Payment Card Industry) Compliant. Most believe that because they do not charge the credit cards themselves, they are exempt. Why all agencies are required to be complaint even when they don’t charge credit cards themselves, and some steps to ensure your agency is PCI compliant.

What is PCI compliance?

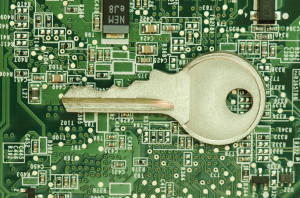

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to ensure that all companies that process, store or transmit credit card information maintain a secure environment. PCI applies to all organizations or merchants, regardless of size or number of transactions, that accepts, transmits or stores any cardholder data. Travel agents accepting, storing and transmitting credit card information to suppliers, are required to be compliant too. Suppliers reinforce this through their travel agent guidelines/contracts. Travel Agency must adhere to the applicable credit card company’s procedures for credit card transactions.

Consequences of Not Being PCI Compliant

If an agency is not PCI compliant, the agency can lose the ability to process credit card payments with that supplier. Not being able to pay with client credit cards can be a serious roadblock for agencies, and an inconvenience for clients.

If you have a merchant account and are found to be out of compliance, you can be fined.

How to be PCI Compliant

Don’t store the CCV security code from the client’s credit card. The client does not have the authority to grant you permission to store their CCV code. The credit card company explicitly forbid storage of the CCV code.

Make sure you securely store any client information, including their credit card number and expiration date. If you use a CRM, ensure that you have a strong password. If your CRM database is stored on your computer hard drive, encrypt it (there is a great encryption software that is free of charge). If you have an IT resource, talk to them about installing a firewall on your network, installing anti-virus and anti-malware protection, and any other steps that you can take to secure your client data even further.

If you keep paper copies of client information, keep it in a locked filing cabinet or desk drawer. When you no longer need their credit card information, cross shred it.

Home based businesses are arguably the most vulnerable simply because they are usually not well protected, according to the PCI Compliance Guide. Having strong passwords, encryption, a firewall, anti-virus and anti-malware protection are all inexpensive steps that you can take to protect your business and your clients’ sensitive data.

If you receive a courtesy call reminding you about PCI Compliance, don’t ignore it.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security Tagged with: cardholder, cardholder data, cards, CCV, CCV code, credit, credit card company, credit card number, credit card payments, credit card transactions, credit cards, crm, CRM database, data, database, encryption software, merchant account, Merchant's, network, Payment Card Industry, PCI, security code, transactions, travel agents

September 10th, 2014 by Elma Jane

If your businesses considering an iPad point-of-sale (POS) system, you may be up for a challenge. Not only can the plethora of providers be overwhelming, but you must also remember that not all iPad POS systems are created equal. iPad POS systems do more than process payments and complete transactions. They also offer advanced capabilities that streamline operations. For instance, they can eliminate manual data entry by integrating accounting software, customer databases and inventory counts in real time, as each transaction occurs. With these systems, you get 24/7 access to sales data without having to be in the store. The challenge, however, is knowing which provider and set of features offer the best iPad POS solution for your business. iPad POS systems vary in functionality far more than the traditional POS solutions and are often targeted at specific verticals rather than the entire market. For that reason, it’s especially important to compare features between systems to ultimately select the right system for your business.

To help you choose a provider, here are things to look for in an iPad POS system.

Backend capabilities

One of the biggest benefits of an iPad POS system is that it offers advanced features that can streamline your entire operations. These include backend processes, such as inventory tracking, data analysis and reporting, and social media integration. As a small business, two of the most important time saving and productivity-boosting features to look for are customer relationship management (CRM) capabilities and connectivity to other sales channels. You’ll want an iPad POS that has robust CRM and a customizable customer loyalty program. It should tell you which products are most and least frequently purchased by specific customers at various store locations. It should also be able to identify the frequent VIP shoppers from the less frequent ones at any one of your store locations, creating the ultimate customer loyalty program for the small business owner. If you own an online store or use a mobile app to sell your products and services, your iPad POS software should also be able to integrate those online platforms with in-store sales. Not only will this provide an automated, centralized sales database, but it can also help increase total sales. You should be able to sell effortlessly through online, mobile and in-store channels. Why should your customers be limited to the people who walk by your store? Your iPad POS should be able to help you sell your products through more channels, online and on mobile. E-commerce and mobile commerce (mCommerce) aren’t just for big box retailers.

Cloud-based

The functions of an iPad POS solution don’t necessarily have to stop in-store. If you want to have anytime, anywhere access to your POS system, you can use one of the many providers with advanced features that give business owners visibility over their stores, its records and backend processes using the cloud. The best tablet-based POS systems operate on a cloud and allow you to operate it from any location you want. An iPad POS provider, with a cloud-based iPad POS system, businesses can keep tabs on stores in real time using any device, as well as automatically back up data. This gives business owners access to the system on their desktops, tablets or smartphones, even when not inside their stores. Using a cloud-based system also protects all the data that’s stored in your point of sale so you don’t have to worry about losing your data or, even worse, getting it stolen. Because the cloud plays such a significant role, businesses should also look into the kind of cloud service an iPad POS provider uses. In other words, is the system a cloud solution capable of expanding, or is it an app on the iPad that is not dependent on the Internet? Who is the cloud vendor? Is it a premium vendor? The type of cloud a provider uses can give you an idea about its reliability and the functions the provider will offer.

Downtime and technical support

As a small business, you need an iPad POS provider that has your back when something goes wrong. There are two types of customer support to look for: Downtime support and technical support.

iPad POS systems are often cheaper and simpler than traditional systems, but that doesn’t mean you can ignore the product support needs. The POS is a key element of your business and any downtime will likely result in significant revenue loss. You could, for instance, experience costly downtime when you lose Internet connectivity. iPad POS systems primarily rely on the Web to perform their core functions, but this doesn’t mean that when the Internet goes down, your business has to go down, too. Many providers offer offline support to keep your business going, such as Always on Mode. The Always on Mode setting enables your business to continue running even in the event of an Internet outage. Otherwise, your business will lose money during a loss of connectivity. Downtime can also happen due to technical problems within the hardware or software. Most iPad POS providers boast of providing excellent tech support, but you never really know what type of customer service you’ll actually receive until a problem occurs.

Test the friendliness of customer service reps by calling or emailing the provider with questions and concerns before signing any contracts. This way, you can see how helpful their responses are before you purchase their solution. Your POS is the most important device in your store. It’s essentially the gateway to all your transactions, customer data and inventory. If anything happens to it, you’ll need to be comfortable knowing that someone is there to answer your questions and guide you through everything.

Grows with your business

All growing businesses need tech solutions that can grow right along with them. Not all iPad POS systems are scalable, so look for a provider that makes it easy to add on more terminals and employees as your business expands. Pay attention to how the software handles growth in sales and in personnel. As a business grows, so does it sales volume and the required software capabilities. Some iPad POS solutions are designed for very small businesses, offering very limited features and transactions. If you have plans for growth, look for a provider that can handle the changes in transactions your business will be going through. Find out about features and customization. Does the system do what you want it to do? Can it handle large volume? How much volume? What modules can you add, and how do you interface to third parties? You should also consider the impacts of physical expansion and adding on new equipment and employees. If there are plans in the future for you to open another store location, you’ll need to make sure that your point of sale has the capabilities of actually handling another store location without adding more work for you. If you plan on hiring more employees for your store, you’ll also want to know that the solution you choose can easily be learned, so onboarding new staff won’t take up too much of your time.

Security

POS cyber attacks have risen dramatically over the past couple of years, making it more critical than ever to protect your business. Otherwise, it’s not just your business information at risk, but also your reputation and entire operations. iPad POS system security is a bit tricky, however. Unlike credit card swipers and mobile credit card readers that have long-established security standards namely, Payment Card Industry (PCI) compliance — the criteria for the iPad hardware itself as a POS terminal aren’t quite so clear-cut. Since iPads cannot be certified as PCI compliant, merchants must utilize a point-to-point encryption system that leaves the iPad out of scope. This means treating the iPad as its own system, which includes making sure it doesn’t save credit-card information or sensitive data on the iPad itself. To stay protected, look for PCI-certified, encrypted card swipers.

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: (POS) systems, accounting, app, business, card, cloud-based, credit, credit card readers, credit-card, crm, customer, customer relationship management, customer support, data, data analysis, database, desktops, e-commerce, inventory, iPad Point-Of-Sale, loyalty program, mcommerce, mobile, mobile app, mobile commerce, online, online platforms, Payment Card Industry, payments, PCI, platforms, POS, POS solution, products, sales, Security, security standards, services, Smartphones, social media, software, tablets, terminal, transactions, web

August 11th, 2014 by Elma Jane

Tokenization technology has been available to keep payment card and personal data safer for several years, but it’s never had the attention it’s getting now in the wake of high-profile breaches. Still, merchants especially smaller ones haven’t necessarily caught on to the hacking threat or how tools such as tokenization limit exposure. That gap in understanding places ISOs and agents in an important place in the security mix, it’s their job to get the word out to merchants about the need for tokenization. That can begin with explaining what it is.

The biggest challenge that ISOs will see and are seeing, is this lack of awareness of these threats that are impacting that business sector. Data breaches are happening at small businesses, and even if merchants get past the point of accepting that they are at risk, they have no clue what to do next. Tokenization converts payment card account numbers into unique identification symbols for storage or for transactions through payment mechanisms such as mobile wallets. It’s complex and not enough ISOs understand it, even though it represents a potential revenue-producer and the industry as a whole is confused over tokenization standards and how to deploy and govern them.

ISOs presenting tokenization to merchants should echo what security experts and the Payment Card Industry Security Council often say about the technology. It’s a needed layer of security to complement EMV cards. EMV takes care of the card-present counterfeit fraud problem, while tokenization deters hackers from pilfering data from a payment network database. The Target data breach during the 2013 holiday shopping season haunts the payments industry. If Target’s card data had been tokenized, it would have been worthless to the criminals who stole it. It wouldn’t have stopped malware access to the database, but it would been as though criminals breaking into a bank vault found, instead of piles of cash, poker chips that only an authorized user could cash at a specific bank.

A database full of tokens has no value to criminals on the black market, which reduces risk for merchants. Unfortunately, the small merchants have not accepted the idea or the reality and fact, that there is malware attacking their point of sale and they are being exposed. That’s why ISOs should determine the level of need for tokenization in their markets. It is always the responsibility of those who are interacting with the merchant to have the knowledge for the market segment they are in. If you are selling to dry cleaners, you probably don’t need to know much about tokenization, but if you are selling to recurring billing or e-commerce merchants, you probably need a lot more knowledge about it.

Tokenization is critical for some applications in payments. Any sort of recurring billing that stores card information should be leveraging some form of tokenization. Whether the revenue stream comes directly from tokenization services or it is bundled into the overall payment acceptance product is not the most important factor. The point is that it’s an important value to the merchant to be able to tokenize the card number in recurring billing, but ISOs sell tokenization products against a confusing backdrop of standards developed for different forms of tokenization. EMVCo, which the card brands own, establishes guidelines for EMV chip-based smart card use. It’s working on standards for “payment” tokenization with the Clearing House, which establishes payment systems for financial institutions. Both entities were working on separate standards until The Clearing House joined EMVCo’s tokenization working group to determine similarities and determine whether one standard could cover the needs of banks and merchants.

Posted in Best Practices for Merchants Tagged with: account numbers, bank, billing, card, card brands, card number, card present, Clearing House, data, data breaches, database, e-commerce, EMV, emvco, fraud, ISOs, Malware, Merchant's, mobile wallets, network, payment, Payment Card Industry, Security, smart card, target, tokenization, transactions

May 5th, 2014 by Elma Jane

The Payment Card Industry (PCI) Data Security Standard (DSS) has come under criticism as high profile data breaches continue to expose flaws in retailers’ data security systems. But telecommunications firm Verizon Wireless concluded that the PCI DSS is working.

Some Responses to Criticisms

Nilson Report research from August 2013 that said card fraud cost the global payments market over $11 billion in 2012. Verizon added that the frequency of fraud schemes that the PCI DSS was designed to avoid is in fact growing. And yet most businesses are not fully compliant at the time of assessment. Only 51.1 percent of the companies it had audited had passed seven of the 12 requirements of the PCI DSS and only 11.1 percent of said companies had passed all 12.

Verizon addressed some of the criticisms leveled at the PCI DSS. One concern is that the standard promotes compliance as a test to be passed and forgotten, which distracts companies from focusing on improving security. Verizon responded by stating that breached businesses were less likely to be PCI DSS compliant than unaffected companies. It also said businesses improve their chances of not being breached by having the standard in place, and of minimizing the damage of a breach should one occur.

Another common complaint leveled at the standard is that it is too cumbersome and slow moving in relation to the quickly evolving threat landscape and nimble fraudsters ready to try new tactics. Verizon countered that the PCI DSS is meant to be a set of baseline security protocols. Achieving compliance with any standard is simply not enough, organizations must take responsibility for protecting both their reputation and their customers. Most attacks on networks are of the simple variety, with 78 percent of hacking techniques considered low or very low in sophistication. Data Breach Investigations Report (DBIR) research shows that while perpetrators are upping the ante, trying new techniques and leveraging far greater resources, less than 1 percent of the breaches use tactics rated as high on the VERIS (Verizon’s Data breach Analysis Database) difficulty scale for initial compromise.

Recommendations

There’s an initial dip in compliance whenever a major update to the standard is released, so organizations will have to put in additional effort to prepare for achieving compliance with DSS 3.0.

The newest version of the standard, PCI DSS 3.0, went into effect Jan. 1, 2014. Businesses have until Jan. 1, 2015, to implement it. The updated standard has new requirements and clarifications to version 2.0 that will take time for businesses to understand and implement, and this will result in more organizations being out of compliance.

To help businesses deal with their PCI DSS compliance obligations the firm offered five approaches:

Don’t leave compliance to information technology security teams, but enlist application developers, system administrators, executives and other staff in helping further along the process.

Embed compliance in everyday business practices so that it is sustainable.

Integrate compliance programs into enterprise-wide governance, risk and compliance strategies.

Learn how to reduce the scope of organizations’ compliance responsibilities, chiefly by figuring out how to store less data on fewer systems.

Think of compliance as an opportunity to improve overall business processes, rather than as a burden.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: attacks on networks, Breach, breached, business processes, compliance, compliant, data breach investigators, data breaches, data security systems, database, DSS, fraud schemes, global payments, hacking, information technology, Payment Card Industry, PCI, retailers, Security, security protocols, standard, system administrators, wireless

March 3rd, 2014 by Elma Jane

A solution for mobile commerce will be needed eventually, whether you’re an ecommerce merchant or you run a brick-and-mortar shop.

There are mobile payment platforms for digital wallets, smartphone apps with card-reader attachments, and services that provide alternative billing options. Here is a list of mobile payment solutions.

Boku enables your customers to charge their purchases directly to their mobile bill using just their mobile number. No credit card information, bank accounts or registration required. The Boku payment option can be added to a website, mobile site, or app. Price: Contact Boku for pricing.

Intuit GoPayment is a mobile credit card processing app from Intuit. It accepts all credit cards and can record cash or check payments. Intuit GoPayment transactions sync with QuickBooks and Intuit point-of-sale products. Intuit GoPayment works with iOS and Android devices and provides a free reader. Price: $12.95 per month and 1.75 percent per swipe, or 2.75 percent per swipe and 3.75 per keyed transaction.

iPayment MobilePay is a mobile payment solution from Flagship Merchant Services and ROAMpay. The service accepts all major cards and can record cash transactions. To help build your customer database, the app completes customer address fields for published landlines. The app can handle taxes, tips, and can record transactions offline. You can use the service month-to-month. The app and the reader are free. Price: $7.95 per month; Each transaction costs $0.19 plus a swipe fee maximum of 1.58 percent, or a key fee between 1.36 and 2.56 percent.

ISIS mobile commerce platform enables brick-and-mortar stores to collect payments (via an NFC terminal) from the mobile devices of their customers. Provide your customers with a simplified checkout process through the contactless transmission of payments, offers, and loyalty integrated in one simple tap. Price: Isis does not charge for payment transactions in the Isis Mobile Wallet. Payment transaction fees will not be increased by working with Isis.

LevelUp is mobile payment system that uses QR codes on smartphones to process transactions. Use LevelUp with a scanner through your POS system, or use a standalone scanner with a mobile device. You can also enter the transaction through the LevelUp Merchant App, using your smartphone’s camera to read the customer’s QR Code and entering the amount to complete the transaction. LevelUp also provides tools to utilize customer data. Price: LevelUp charges a 2 percent per transaction fee. Scanner is $50; tablet is $200.

MCX is a mobile application in development by a group of large retail merchants. Details on the solution are vague, but MCX is intended to offer a customizable platform that will be available through virtually any smartphone. MCX’s owner-members include a list of merchants in the big-box, convenience, drug, fuel, grocery, quick- and full-service dining, specialty-retail, and travel categories. Price: To be determined.

mPowa is a mobile payment app to process credit and debit card transactions, and record cash and check sales. mPowa will soon launch its PowaPIN chip and PIN reader for the EMV (“Europay, MasterCard, and Visa”) card standard. (Developed in Europe, EMV utilizes a chip embedded in a credit card, rather than a magnetic strip.) The EMV standard is likely to gain footing to combat credit card fraud. mPowa is a good solution for merchants with a global presence. Price: 2.95 percent per transactions, or .25 percent or $0.40 per transaction when used as a current processor’s point-of-sale system.

PayAnywhere is a solution to accept payments from your smartphone or tablet with a reader. It features an automatic tax calculation based on your current location, discounts and tips, inventories with product images and data, and more. Bilingual for English and Spanish users. PayAnywhere provides a free credit card reader and free app, available for iOS and Android. Price: 2.69 percent per swipe, 3.49 percent plus $0.19 per keyed transaction.

PayPal Here gives you a variety of options for accepting payments, including credit cards, PayPal, check, record cash payments, or invoice. With PayPal Here, you can itemize sales totals, calculate tax, offer discounts, accept tips, and manage payment email notifications. Available for iOS and Android. The app and reader are free. Price: 2.75 percent per swipe and 3.5 percent plus $0.15 per manually-entered transaction.

Square is a simple approach to mobile credit card processing. Square provides a free point of sale app and a free credit card reader for iPhones and iPads. Square offers a selection of tools to track sales, taxes, top-purchasing customers, and more. Square’s pricing is on the higher end, but with no monthly fee Square may be a good fit if you have infrequent mobile transactions. Price: 2.75 percent per swipe and 3.5 percent plus $0.15 per manually-entered transaction.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Internet Payment Gateway, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Small Business Improvement, Smartphone, Visa MasterCard American Express Tagged with: accepts all credit cards, alternative billing, Android, bank accounts, brick and mortar, check payments, contactless transmission, credit and debit transactions, credit card reader, credit-card, database, Digital wallets, ecommerce merchant, EMV, free app, iOS, itemize, keyed transaction, mobile commerce, mobile credit card processing, mobile payment platforms, mobile site, mobile transactions, nfc terminal, point of sale, process transactions, qr codes, record transactions offline, smartphone apps card-reader attachments, transactions

December 19th, 2013 by Elma Jane

NTC’s BIG DATA

Improving Collection and Analytics tools to Create Value from Relevant Data.

Big data is a popular term used to describe the exponential growth and availability of data, both structured and unstructured. And big data may be as important to business…and society… as the Internet has become. Why? More data may lead to more accurate analyses. More accurate analyses may lead to more confident decision making, and better decisions can mean greater operational efficiencies, cost reductions and reduced risk.

With NTC Virtual Merchant product, it captures email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected, and for future Marketing.

In understanding Big Data For Merchants, NTC’s President Mark Fravel, provided a general overview of how online merchants can use Big Data. Large amounts of seemingly random data from many sources…can be used to create competitive advantages.

Necessity of Analytical Tools

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex. One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as CRM software, AdWords, and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter. Making sense of it can be overwhelming without analytical tools. These tools facilitate the examination of large amounts of different types of data to reveal hidden patterns and correlations that are not otherwise easily discernible.

A good example is NTC, they could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions…they can monitor to eliminate what isn’t working and focus on what does. Some of the off-the-shelf analytic solutions are so finely tuned, they can tell a vendor whether it needs to offer a 25 percent discount or if a 15 percent discount will suffice for a particular customer.

Association rule learning is another analytics method that is a good fit with Big Data. This could be, for example, a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

Uses of Big Data Analytics:

Big Data can be most useful in analyzing a customer’s shopping and purchasing experience, which can help a merchant in the following four ways.

Become more efficient by alerting you to merchandising efforts that are ineffective, and products that are not selling.

Encourage more purchases by presenting existing customers with complementary items to what they’ve purchased previously.

Enhance inventory management by eliminating slow-moving items and increasing the supply of fast-moving merchandise.

Example: A top marketing executive at a sizable U.S. retailer recently found herself perplexed by the sales reports she was getting. A major competitor was steadily gaining market share across a range of profitable segments. Despite a counterpunch that combined online promotions with merchandising improvements, her company kept losing ground….The competitor had made massive investments in its ability to collect, integrate, and analyze data from each store and every sales unit and had used this ability to run myriad real-world experiments. At the same time, it had linked this information to suppliers’ databases, making it possible to adjust prices in real time, to reorder hot-selling items automatically, and to shift items from store to store easily. By constantly testing, bundling, synthesizing, and making information instantly available across the organization…the rival company had become a different, far nimbler type of business.

Increase conversion rates by better identification of successful sales transactions.

Is Big Data Analysis Affordable?

NTC Data Storage is also a good alternative for small ecommerce merchants because it is relatively inexpensive and is scalable it can expand as data requirements grow.

Relying on data-driven decision-making is crucial in industries in which profit margins are slim. Amazon, which earns increasingly thin profit margins, is one of the most effective users of data analytics. As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants, and investors are banking on it.

This is Big Data for NTC we know WHO, WHAT,WHEN, AND WHERE a purchase took place.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale, Visa MasterCard American Express Tagged with: analyses, analytic, big data, communications, competitive, consumer, cost, database, decision, ecommerce, email, internet, marketing, Merchant's, mobile, monitor, ntc, online, orgainizing, patterns, point of sale, POS, profit margins, promotions, risk, scalable, solutions, storing, text messages, virtual merchant, website