May 19th, 2024 by Elma Jane

NTC Product and Services

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 20 years of experience, National Transaction offers a variety of electronic payment services and technology for Retail and Ecommerce industries. From Travel, Medical Industry, Charitable Institution and Franchise.

Our services include:

Loans/Funding Program

Credit and Debit Card Processing

Currency Conversion

Electronic Checks

Electronic Invoicing

Gift and Loyalty Card Programs

Mobile and Online Solutions

Shopping Cart E-commerce Payment Gateway

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, nothing to integrate; secure and fast.

Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-996-2273

or visit Nationaltransaction.Com

Posted in Best Practices for Merchants, Credit card Processing, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Services Account Tagged with: debit card, ecommerce, electronic payment, loans, Loyalty Card, mobile, online, payment gateway, travel

March 9th, 2017 by Elma Jane

Merchant Cash Advance

A Merchant Cash Advance is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Merchants sell a specific amount of their business’ future credit and debit card receivables at a discount in exchange for the capital they can use for business. Payments are often more flexible as they are based on sales.

For your loans and funding needs call now at 888-996-2273 Extension 1159

Posted in Best Practices for Merchants Tagged with: cash advance, credit, debit card, loan, merchant, payments

March 6th, 2017 by Elma Jane

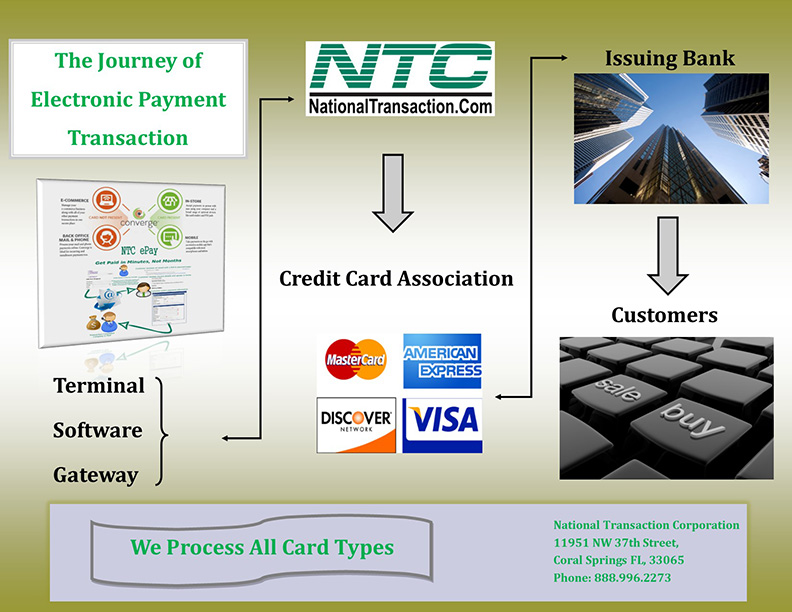

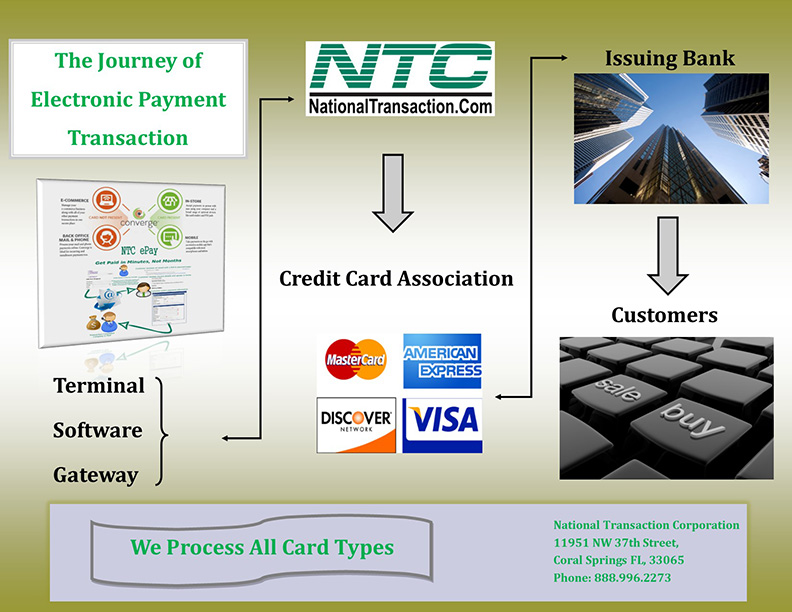

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

January 25th, 2017 by Elma Jane

PIN vs. Signature: What’s the Difference?

PIN Debit – PIN transactions are routed through what are known as (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

Signature Debit – Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, debit card, electronic, electronic funds transfer, online, payment, PIN, POS, terminal, transactions

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

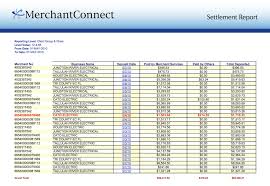

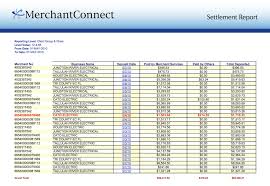

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

September 21st, 2016 by Elma Jane

PCI compliance applies to any company, organization or merchant of any size or transaction volume that either accepts, stores or transmits cardholder data.

Any merchant accepting payments directly from the customer via credit or debit card must be Compliant. The merchant themselves are therefore responsible for becoming Compliant, as the deadline for the merchant becomes overdue.

Understanding and knowing the details of Payment Card Industry Compliance can help you better prepare your business. Because failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms as part of the operating regulations. The regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, cardholder, compliance, credit, customer, data, debit card, Discover, jcb, MasterCard, merchant, Payment Card Industry, payments, PCI, transaction, visa

July 14th, 2016 by Elma Jane

PCI Compliance applies to every merchant who is accepting credit cards large or small. Refusing or delaying to become PCI Compliant can end up being a costly mistake.

If you accept any credit or debit card payment, you need to be PCI Compliant no matter the volume is.

PCI applies to any company, organization or merchant of any size or transaction volume that accepts, stores or transmits cardholder data. Any merchant accepting payments directly from the customer via credit or debit card must be PCI Compliant.

The merchant themselves are responsible for becoming PCI Compliant, as the deadline for merchants to become Compliant is long overdue

Understanding and knowing the details of PCI Compliance can help you better prepare your business. Failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms part of the operating regulations, the regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, credit cards, customer, data, debit card, merchant, payment, PCI Compliance, transaction

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service

February 23rd, 2016 by Elma Jane

Cardless ATM’s Could Help Push Mobile Wallet Adoption

The mobile wallet will be the payment method in five to 10 years.

Cardless ATM transactions is a great way to introduce smartphones as payments devices. It could help with the adoption of mobile payments and wallets. Mobile Smart Phones will become the piece of plastic and cards will be a thing of the past…

A multinational banking corporation intends to use (NFC) near-field communication for its service. It will let customers leverage NFC technology on their smartphones to authenticate at the bank’s ATM without a debit card.

An NFC cardless ATM transactions could be compatible with Apple Pay which uses NFC technology.

Benefits:

Speedier ATM cash withdrawal takes about 15 seconds without the debit card compared with 60 to 90 seconds with a debit card, whether it’s a chip or magnetic-stripe transaction.

Safer ATM transaction. No physical connection between the phone and ATM, skimming device to intercept the transaction is gone.

The barcode represents the time of day and what terminal the transaction is taking place at. Everything is tokenized.

Cardless ATM transactions are interesting and an appropriate evolution.

Posted in Best Practices for Merchants, Near Field Communication, Smartphone Tagged with: banking, cards, debit card, Mobile Payments, mobile wallet, Near Field Communication, nfc, payments, transactions