April 11th, 2014 by Elma Jane

Of the 17 percent of consumers who reported having had their credit card declined during a card-not-present (CNP) transactions. As many as one-third of those declines were unnecessary. The result is consumer aggravation, increased operational costs for banks and credit card companies and as much as $40 billion in lost revenue for online retailers.

TrustInsight which helps establish trusted relationships between financial institutions, merchants and online consumers conducted study. A report and infographic detailing the findings of the study found that avoidable online credit card declines lead to loss of trust for consumers, sales for merchants and increased operational costs for credit card companies and issuing banks.

Study also revealed that consumers handle credit card declines in a variety of ways all of which carried negative economic impact to at least one party in the transaction, resulting in unnecessary operating costs for banks, decreased loyalty for the credit card company and lost revenue for all. Almost half call their issuer immediately when their card is unexpectedly declined. This is a natural response. 34 percent of consumers try again another credit card, other use a different payment method and 24 percent will skip the purchase altogether or shop at a different online retailer.

No one wants to turn away business, and no one wants their business declined. The frustration and impact of wrongful declines is a real problem especially as more and more transactions occur in non-face-to-face situations.

Impact of consumer action in the face of a decline can have real and measurable effects on all parties, including credit card companies, banks and merchants manifesting itself in lost customer loyalty, lost fees and lost revenues. Creating a standard for online trust that enables credit card companies, merchants and issuing banks to better recognize trusted digital consumers and reduce the number of wrongly declined consumers avoiding unnecessary losses.

In a world where people are increasingly reliant on a variety of Internet-connected devices for everything from banking to shopping to entertainment and media, creating friction-free customer experiences and preventing online fraud are constant business challenges.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Merchant Services Account, Small Business Improvement, Visa MasterCard American Express Tagged with: banking, consumers, credit-card, decline, declined, declines, different payment method, digital, digital consumers, financial, frustrate, internet-connected devices, issuing banks, loyalty, Merchant's, online credit card declines, online fraud, online retailers, shopping, transactions, wrongful declines, wrongly declined

April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

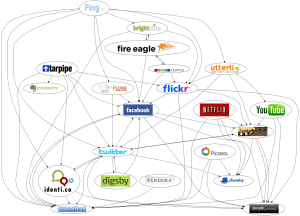

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter