September 10th, 2020 by Admin

There are few moments like now where American consumers are collectively open to the idea of new payment methods – especially contactless ones such as mobile wallets. This is good news for businesses since mobile wallets offer a safer payment alternative to credit cards and drastically reduce customer wait times at checkout.

Mobile wallets (such as Apple Pay and PayPal) use authentication, monitoring and data encryption to secure and transmit personal information, and the level of security associated with them has payment card issuers backing their use. This is certainly helping drive consumer adoption, as does convenience.

In fact, global mobile wallet transaction value is estimated to reach nearly $14 trillion by 20201 – and that is a pre-COVID-19 estimate. New estimates are higher and point to further rapid adoption given the current need for touch-free payment options. According to a recently published Visa Back to Business report,* 70 percent of consumers surveyed in June 2020 have used a new shopping or payment method for the first time this year.

A rapid shift has begun and the numbers tell the storySo what is holding back business adoption of mobile wallets? Until recently, it just wasn’t a priority for many small- and medium-size businesses to enable it or educate their employees on its use. The lack of preferential demand didn’t make it a pressing topic. But that is changing. Consider this:

- According to Forbes,2 by 2026, digital natives will be 59 percent of the consumers in the U.S. market.

- Of this, 45 percent will be specifically Millennials and Gen Z, representing the largest purchasing power.

- As Gen Z move into becoming the largest generation cohort, their purchasing power will be $143 billion.

But it’s not just what lies ahead that SMBs should be focused on now.

According to Visa’s Back to Business report, shoppers are now putting COVID-19 safety measures at the top of their shopping lists and they will reward stores that do the same. In fact, if all other factors were equal (price, selection, location), nearly 63 percent of consumers surveyed would switch to a new store that installed contactless payment options, such as mobile wallets.3

What does this mean for you? Now is the time to connect with customers to make sure they are fully contactless capable and have the technology in place to accept many of the most popular mobile wallets.

1Payments Industry Intelligence, “The rise of digital and mobile wallet: Global usage statistics from 2018,” November 25, 2018.

2Forbes, January 2020

3Visa Back to Business report 2020

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Uncategorized Tagged with: business, digital payment, digital payments, Digital Wallet, Digital wallets, mobile, mobile commerce, Mobile Devices, mobile payment, Mobile Payments, mobile wallet, mobile wallets, payment, payments

January 27th, 2016 by Elma Jane

MasterPass To Make Booking Travel Experience Even Easier For JetBlue

MasterCard today added JetBlue as its latest merchant to accept digital payments with MasterPass. MasterPass will be available later this year on the airline’s website and mobile app, giving customers the opportunity to speed up their booking travel experience, according to a press release.

With MasterPass, shoppers can pay for the things they want at thousands of merchants with the security they demand, anywhere online or in app, using any device. The wallet securely stores shoppers’ preferred payment and shipping information which is readily accessible when they click on the “Buy with MasterPass” button and sign into their account.

U.S. consumers can sign up for a MasterPass account by visiting the MasterPass website or through a participating bank. Launched in 2013, MasterPass by MasterCard is free, easy to set up, and available anywhere you see the Buy with MasterPass button. It is currently available in 29 countries and is accepted at 250,000 merchants globally.

Accepting MasterPass by MasterCard on JetBlue’s online and in-app properties expands the relationship between the two companies. JetBlue announced in October 2015 that MasterCard would be its network partner for its co-brand portfolio.

Posted in Travel Agency Agents Tagged with: bank, customers, digital payments, merchant, mobile, mobile app, online, payments, Security, travel

December 21st, 2015 by Elma Jane

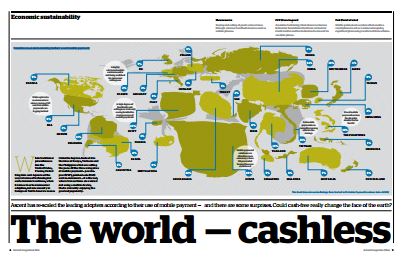

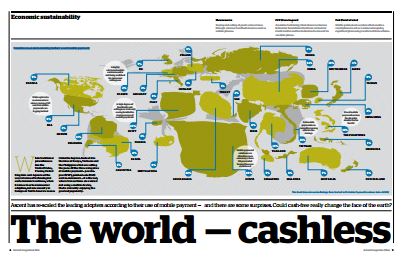

You will think United States or China are the two world’s biggest market when it comes to digital payments and other cashless spending systems. But according to a study, the answer is a less likely source: Sweden is actually on its way to becoming a fully cashless society.

Several factors have come together to give the Swedes an unexpected edge, a combination of IT awareness, and a growing number of useful mobile payments solutions.

The entire country currently only has about 80 billion Swedish crowns in circulation, and as users more often turn to mobile payment systems, the need for cash only declines. About 20 percent of all purchases made in cash in Swedish retail, and that number is falling off almost daily.

Some transactions can only be carried out by digital payments, since the mobile apps are convenient, free to use, and generally regarded as secure, there’s not much impediment for users to turn to such systems.

A truly cashless society is probably a bridge too far; there will always be those who’d rather handle cash. Only time will tell if the market shapes up looking like this, but even with lower actual results than projected, that’s still a lot of people turning to mobile payment and other cashless payment systems. There will still be a huge majority trending toward cashless society.

http://paymentweek.com/2015-12-18-world-leader-in-cashless-trading-an-unexpected-source-9182/

Posted in Best Practices for Merchants Tagged with: digital payments, mobile payment systems, Mobile Payments, mobile payments solutions, payment systems, payments solutions

December 7th, 2015 by Elma Jane

Most payments will probably be made with apps in phones or smartwatches in less than a decade from now, using NFC, biometrics or other mechanisms that don’t involve swiping or using plastic cards.

If your mobile device has an integrated NFC chip, you can use a mobile wallet app like Apple Pay and Android Pay to pay for items that support NFC transactions at a retail store. Simply wave your device near an NFC compatible terminal to pay, no card swiping required.

Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

In some countries, it’s easy for consumers to get credit cards with imbedded NFC chips. This means that you may be able to wave your card at the terminal instead of swiping, no phone required. In America, though, because NFC hasn’t caught on until recently, analysts expect that NFC via smartphone and smartwatch services such as Apple Pay and Android Pay will dominate contactless transactions in the next few years.

Just as credit cards replaced cash, credit cards will be replaced by digital payments which will continue to rely on the credit infrastructure but will obscure the plastic card itself.

As consumers, we love to see better products. When it comes to payments, we need Standards and Reliability.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: biometrics, cards, contactless transactions, credit cards, digital payments, mobile wallet, nfc, NFC chip, payments, smartphone, terminal

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

August 27th, 2014 by Elma Jane

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

February 18th, 2014 by Elma Jane

Payment Tokenization Standards

Tokenization is the process of replacing a traditional card account number with a unique payment token that is restricted in how it can be used with a specific device, merchant, transaction type or channel. When using tokenization, merchants and digital wallet operators do not need to store card account numbers; instead they are able to store payment tokens that can only be used for their designated purpose. The tokenization process happens in the background in a manner that is expected to be invisible to the consumer.

EMVCo – which is collectively owned by American Express, Discover, JCB, MasterCard, UnionPay and Visa – has announced that it is expanding its scope to lead the payments industry’s work to standardize payment tokenization. EMVCo says that the new specification will help provide the payments community with a consistent, secure and interoperable environment to make digital payments when using a mobile handset, tablet, personal computer or other smart device.

Key elements of EMVCo’s work include adding new data fields to provide richer industry information about the transaction, which will improve transaction efficiency and enhance the consumer and merchant payment experience by helping to prevent fraudulent card account use. EMVCo will also create a consistent approach to identify and verify the valid use of a token during payment processing including authorization, capture, clearing and settlement.

EMVCo’s announcement follows an earlier joint announcement from MasterCard, Visa and American Express that proposed an initial framework for industry collaboration to standardize payment tokenization. EMVCo says it will now build on this framework with collective input from all of its members and the industry as a whole.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, authorization, capture, card account numbers, clearing, data fields, device, digital payments, Digital Wallet, Discover, EMV, emvco, fraudulent card account, interoperable, jcb, MasterCard, merchant, mobile handset, payment, payment processing, payment token, secure, security standards, settlement, smart device, specification, standardize, tablet, token, tokenization, transaction, visa

Credit cards have become so ubiquitous in our daily lives we barely notice when we use them to complete a transaction. An alternative currency is stretching its wings to give those credit cards a run for their money, but will it win out? What will credit look like over the next decade or two. With new technology, digital payments are changing the way we view transactions. Read more of this article »

Posted in Electronic Payments Tagged with: alternative currency, credit card statement, credit cards, digital payments, Digital wallets, electronic currency, Electronic Currency Proliferate, electronic wallet, multiple electronic wallets, new technology, payment platform, software