March 17th, 2023 by Admin

Best Practices for Merchants to Get The Lowest Rates Possible.

Overview

When you settle your transactions each day, National Transaction’s network routes them to the respective Card Associations (Visa, MasterCard, Discover) and debit networks through Interchange. Every transaction is assigned an Interchange category based on card type (credit, debit, rewards, purchasing) industry type (retail, e-commerce, etc) and qualification elements (swiped card, key entered, etc).

When you settle your transactions each day, National Transaction’s network routes them to the respective Card Associations (Visa, MasterCard, Discover) and debit networks through Interchange. Every transaction is assigned an Interchange category based on card type (credit, debit, rewards, purchasing) industry type (retail, e-commerce, etc) and qualification elements (swiped card, key entered, etc).

What is Interchange?

Interchange is the system where transactions are submitted for payment from the Acquirer or Merchant Processor to the Card Issuer or Debit Network. The Card Associations and Debit Networks establish the rules and manage the Interchange of all transactions. Read more of this article »

Posted in Best Practices for Merchants Tagged with: Discover, key entered, MasterCard, POS device, swiped card, Visa MasterCard American Express

December 22nd, 2016 by Elma Jane

What is a Merchant Account?

If you want to remain competitive virtually, every business needs access to a merchant account to accept card payments from their customers. “Merchant” is another word for a seller or business owner. Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. This allows a merchant to receive funding for the credit transaction. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for payment providers or processors; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Merchant account helps facilitate the complex interactions that need to occur between your business and your customer, the credit card networks (Amex, Discover, MasterCard, Visa) and your payment provider every time you receive a card payment. It helps to ensure that you receive funding as quickly as possible, that the banks are protected from losses, and that buyers are protected from scams. Everyone is held accountable based on the rules of the credit card processing agreement with a merchant account.

There’s cost associated in taking credit cards, but it’s much easier and more secure to open a merchant account than it is to keep a book of credit accounts for all of your customers!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: amex, card, credit, customers, Discover, loan, MasterCard, merchant account, payment provider, payments, transaction, visa

September 21st, 2016 by Elma Jane

PCI compliance applies to any company, organization or merchant of any size or transaction volume that either accepts, stores or transmits cardholder data.

Any merchant accepting payments directly from the customer via credit or debit card must be Compliant. The merchant themselves are therefore responsible for becoming Compliant, as the deadline for the merchant becomes overdue.

Understanding and knowing the details of Payment Card Industry Compliance can help you better prepare your business. Because failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms as part of the operating regulations. The regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, cardholder, compliance, credit, customer, data, debit card, Discover, jcb, MasterCard, merchant, Payment Card Industry, payments, PCI, transaction, visa

December 18th, 2015 by Elma Jane

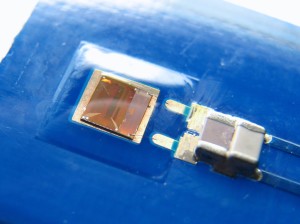

A leading provider of mobile point of sale and mobile payment technology, published today the EMV Migration Tracker.

Many merchants have deployed EMV capable terminals while cardholders have received cards with EMV chips, but not much data has been published about the real world use of EMV chip card technology in the U.S. Most published statistics rely on surveys or forecasts rather than real transactional data.

The EMV Migration Tracker shows new data and insights since the October 1 liability shift, including:

- Over 50% of all cards in use now have EMV chips on them. From October to November, the percent grew 5% as banks and card issuers accelerated their rollout of new chip cards.

- Over 83% of American Express cards have EMV chips, while Discover lags at 40%

- Over 63% of the cards used in Hawaii have EMV chips, but Mississippi sees just 11% penetration of chip cards.

While EMV chip card technology has been implemented in Europe years ago, the rollout of EMV in the U.S is just beginning. The rollout came earlier this year with the October 1 liability shift in card present transaction, meaning that merchants who have not upgraded their POS system can become liable for counterfeit card fraud losses that occur at their stores. This is an early step in an ongoing process that the Payments Security Task Force predicts will lead to 98 percent of U.S. credit and debit cards containing EMV chips by the end of 2017.

http://www.finextra.com/news/announcement.aspx?pressreleaseid=62506

Posted in Best Practices for Merchants Tagged with: American Express, banks, card issuers, card present, card technology, cardholders, chip cards, credit, data, debit, Discover, EMV, EMV chips, merchants, mobile payment, mobile point of sale, payment technology, point of sale, POS, provider

October 9th, 2015 by Elma Jane

Credit card fraud is much more difficult to prevent in a card-not-present transaction. In a face-to-face setting the merchant can inspect the card to ensure that it is valid and can verify that the cardholder is an authorized user on the account. None of these actions can be performed when the payment is submitted online or accepted by phone. As we moved in adopting EMV Technology, majority of fraud is going to migrate away from counterfeit and stolen cards towards the card-not-present transaction as happened in other countries.

A combination of best practices and fraud prevention tools can provide card-not-present merchants with strong fraud prevention capabilities.

Steps to avoid fraud and protect your business for a card-not-present transaction:

- Email Verification: Send a message to the email address provided by the customer requesting that the customer verify the email address is correct, you can ensure that the email is associated with the other information provided.

- Maintain PCI compliance:All merchants accepting card payments are now required to be compliant with the requirements of the PCI DSS (Payment Card Industry Data Standard) which sets the rules for data security management, policies, procedures, network architecture, software design and other protective measures.

- Security Code Verification. Requesting the three digit security code on the back of a credit card. Visa (CVV2), MasterCard (CVC 2) and Discover (CID) cards, and the 4-digit numbers located on the front of American Express (CID) cards. Card Security Codes help verify that the customer is in a physical possession of a valid card during a card-not-present transaction.

- Use an Address Verification Service (AVS): Enables you to compare the billing address provided by your customer with the billing address on the card issuer’s file before processing a transaction. AVS is good protection against card information obtained through means like phishing and malware because fraudster might not know the billing address.

- Use 3D Secure Service: MasterCard and Verified by Visa enable cardholders to authenticate themselves to their card issuers through the use of personal passwords they create when they register their cards with the programs. The liability of any fraudulent charges through the 3D service is picked up by the issuer, not the merchant.

- Verify the phone number and transaction information.Prior to shipping your products, call the phone number provided by the customer and verify the transaction information. Criminals may be unable to verify such information, because in their haste to max out the credit line before the fraud is discovered, they often order at random and do not keep records.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: American Express, card-not-present, card-security, cardholder, cnp, credit card, Discover, EMV, MasterCard, merchant, Payment Card Industry, payments, PCI, visa

September 24th, 2014 by Elma Jane

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

September 19th, 2014 by Elma Jane

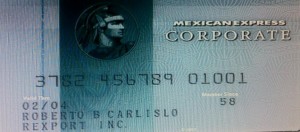

CREDIT CARD NUMBER’S ANATOMY

The numbers on front of a credit card aren’t just random. They give away specific information about the card and where it comes from.

The first 6 digits of the credit card number is the Bank Identification number (BIN). This will tell the name of the credit card issuer.

Example: Travel or entertainment cards, such as American Express cards, begin with a 3 . All Visa credit cards start with a 4, MasterCard with a 5, and 6 is dedicated to Discover.

The first six digits of the card, including the Bank Identification number, represent the issuer identification number. This identifies the bank that issued the card.

Of course, there’s the personal account number. This is made up of the seventh digit on, everything except the last number on the card.

The final digit on the credit card is known as the check digit or checksum. This number is set by something called the Luhn formula, patented by an IBM scientist in 1960. It’s a formula that uses the numerals in your card’s account number to verify that it’s valid. Various combinations of the card’s digits must ultimately add up to a number divisible by 10.

The formula is mostly used to protect against input errors. Let’s say you enter in the wrong numbers on an online shopping site. The formula will compute that the digits don’t add up right, telling you you’ve entered an invalid card number. That last digit of your credit card makes sure the formula works like it’s supposed to.

Now you know that there’s a lot of information on that little card in the wallet.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: (BIN), account number, American Express cards, Bank Identification number, card, card issuer, card number, check digit or checksum, credit, credit card issuer, credit card number, credit-card, Discover, entertainment cards, issuer identification number, MasterCard, online shopping site, personal account number, Visa credit cards

May 7th, 2014 by Elma Jane

NTC’s New Approach On Payment Processing brings Client Satisfaction

About NTC (National Transaction Corporation)

NTC is a credit card processing company that was built uniquely. Combining leading edge technology with passion for customer service, as well as service to help customers maximize the value of their merchant service program. NTC provides sales agents, financial institutions and merchants with benefits not available from other providers, such as next day funding with a late cut-off time and unparallel graphical and web-based reporting.

To learn more visit http://www.nationaltransaction.com or call 888-996-2273.

Marking a 65% increase over 2012 NTC now serves approximately 15,000 businesses.

This rapid growth was driven by the many unique benefits that NTC offers its merchants and sales partners, ranging from best technology to superior customer service.

The major differentiators made possible by NTC’s proprietary back-end processing system is the Next Day Funding Service. Because NTC connects directly to the following: Amex, Discover, MasterCard and VISA. This way sales partners and merchants are able to avoid the middleman and go straight to the source of all their processing needs. This also means that the merchants can batch out their terminal POS with one of the latest cut-off times in the industry by as late as 11:00 pm Eastern.

NTC’s another appealing factor to new sales partners and merchants is its merchant connect online reporting system. It provides 24/7 access to graphical account information through a system that is fast easy and secure. Merchants are now able to clearly see and understand their payment processing costs. ISO’s have access to sugar CRM to make notes and see Merchant Marketing Data. Card Numbers are secure on the banks server so our faculty has credentials to access the bank servers.

Independent sales organizations (ISOs) and Merchant sales professionals continue to choose NTC as their payment processing partner to obtain these unique benefits. In addition to industry-leading technology, NTC offers its merchants and sales partners a level of personalized support that is not easily found among other credit card processing companies. They get round the clock account and terminal support. Collective hard work and determination helped NTC grow faster in the industry, resulted in more loyal ISO sales partners who are submitting more applications. Looking forward for continued success for NTC, its sales partners and merchants.

Posted in Credit card Processing, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, nationaltransaction.com, Point of Sale, Visa MasterCard American Express Tagged with: amex, back-end processing, bank, bank servers, card, card numbers, credit card processing, credit-card, customer service, Discover, financial institutions, marketing data, MasterCard, merchant, merchant connect, merchant service, next day funding, payment processing, POS, provider's, sales agents, sales partners, sugar CRM, terminal, visa, web-based

February 18th, 2014 by Elma Jane

Payment Tokenization Standards

Tokenization is the process of replacing a traditional card account number with a unique payment token that is restricted in how it can be used with a specific device, merchant, transaction type or channel. When using tokenization, merchants and digital wallet operators do not need to store card account numbers; instead they are able to store payment tokens that can only be used for their designated purpose. The tokenization process happens in the background in a manner that is expected to be invisible to the consumer.

EMVCo – which is collectively owned by American Express, Discover, JCB, MasterCard, UnionPay and Visa – has announced that it is expanding its scope to lead the payments industry’s work to standardize payment tokenization. EMVCo says that the new specification will help provide the payments community with a consistent, secure and interoperable environment to make digital payments when using a mobile handset, tablet, personal computer or other smart device.

Key elements of EMVCo’s work include adding new data fields to provide richer industry information about the transaction, which will improve transaction efficiency and enhance the consumer and merchant payment experience by helping to prevent fraudulent card account use. EMVCo will also create a consistent approach to identify and verify the valid use of a token during payment processing including authorization, capture, clearing and settlement.

EMVCo’s announcement follows an earlier joint announcement from MasterCard, Visa and American Express that proposed an initial framework for industry collaboration to standardize payment tokenization. EMVCo says it will now build on this framework with collective input from all of its members and the industry as a whole.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, authorization, capture, card account numbers, clearing, data fields, device, digital payments, Digital Wallet, Discover, EMV, emvco, fraudulent card account, interoperable, jcb, MasterCard, merchant, mobile handset, payment, payment processing, payment token, secure, security standards, settlement, smart device, specification, standardize, tablet, token, tokenization, transaction, visa

December 12th, 2013 by Elma Jane

The Consumer Financial Protection Bureau is reviewing whether credit card rewards program are misleading to credit card users.

Results of the review may be new. Strict rules about the transparency of rewards programs, including details about cash back offers, mileage awards and how these rewards must be redeemed.

In an email to Bloomberg News, CFPB Director Richard Cordray said, we will be reviewing whether rewards disclosures are being made in a clear and transparent manner, and we will consider whether additional protections are needed.

Credit card issuers like American Express, Bank of America, Chase, Citi and Discover rely on rewards programs to attract new customers as well as increasing the use of their cards by existing cardholders. Rewards are the No. 1 reason why customers select the card, and there’s almost a battle to provide the highest rewards.

What we’ve learned over time is, our best customers value rewards. Their spend behaviour changes based on rewards, said Edward Gilligan, the President of American Express.

The CFPB’s restrictions could put a damper on each company’s ability to draw in new cardholders.

While there are no apparently abuse issues with rewards programs at this time, the CFPB is taking the initiative to catch a problem before it happens.

Keep an eye out for notices from your credit card issuer about changes in your rewards program. Changes, or at least clarifications, could come as a result of this examination.

Posted in Gift & Loyalty Card Processing, Visa MasterCard American Express Tagged with: American Express, Bank of America, cardholders, Chase, Citi, consumer, credit-card, Discover, financial, issuer, protection, rewards