October 11th, 2013 by Elma Jane

(Moto) Mail Order/Telephone Order Merchant – In the realm of credit card processing is defined as a merchant who manually keys in over 50% of their transactions and an Internet Merchant is one who accepts transactions over the Internet via an E-Commerce store with an online gateway or who submits transactions manually through a Virtual Terminal.

Qualified Transaction Conditions (For MOTO/Internet merchants the Mid-Qualified Rate is essentially the Qualified rate as these merchants never swipe a credit card through a terminal.)

One electronic authorization request is made per transaction and the transaction date is equal to the shipping date. The authorization response data must also be included in the settled transaction.

Additional data (sales tax and customer code) is required in the settled transaction on all commercial (business) cards at non-Travel & Entertainment (T&E) locations.

The authorization request message must include Address Verification Service (AVS), which verifies the street address and the zip code of the card holder. NOTE: The only way this happens is if your software is set up to do this, or, if you are using a terminal, then if you capture the AVS information at the time of keying in your transaction.

The settled transaction amount must equal the authorized amount.

The settled transaction must include the business’s customer service telephone number, order number, and total authorized amount.

The transaction is electronically deposited (batch transmitted) on or 1 day after authorization date.

The transaction/shipping date must be within 7 calendar days of authorization date.

Non-Qualified Transaction Conditions

One or more of the Qualified or Partially Qualified conditions were not met.

Commercial Card without the additional data.

The transaction was not electronically authorized or the authorization response data was not included in the settled transaction.

The transaction was electronically deposited (batch transmitted) greater than 1 day from transaction/shipping/authorization date, or:

The VISA Infinite card was accepted.

Commercial Card Additional Data

MasterCard

Corporate Data Rate II (Purchasing cards): Sales Tax and customer Code (supplied by cardholder at point of sale) Corporate Data Rate II (Business and Corporate cards): Sales Tax International Corporate Purchasing Data Rate II: Sales Tax and Customer Code (supplied by cardholder at point of sale)

The following information must also be provided: Merchant’s Federal Tax ID; Merchant Incorporation Status; and Owner’s full name if the merchant is a sole proprietor.

Visa

Purchasing cards: Sales Tax and Customer Code (supplied by cardholder at point of sale) Corporate and Business cards: Sales Tax

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mail Order Telephone Order Tagged with: address verification service, authorization, avs, batch, business, corporate, credit card processing, data, e-commerce, electronically, entertainment, fax order, gateway, internet, internet merchant, keying, mail order, moto, phone order, qualified, settle, store, telephone order, transactions, transmit, travel, virtual terminal

October 10th, 2013 by Elma Jane

Amazon has launched a service that enables its customers to pay on other e-commerce sites via their Amazon account data. Called ‘Login and Pay with Amazon,’ the service sells payment processing for participating retailers.

Amazon has more than 215 million active customer accounts. The Amazon payment service works on personal computers, smartphones and tablets. Site developers employ Amazon widgets and APIs, or application programming interfaces.

Login and Pay with Amazon enables companies to make millions of customers by inviting online shoppers with Amazon credentials to access their account information safely and securely with a single login. Login and Pay with Amazon helps replace guest checkouts with recognized customers, leading to improved services which could include: managing and tracking orders, purchase history detail, special discounts, instant access to shipping addresses and payment methods.

Amazon previously called its payment service Checkout by Amazon, but rebranded it Amazon Payments. In May, Internet Retailer wrote about Autoplicity.com’s experiences adding the Amazon payment tool.

Amazon says it will not share customers’ credit card information gained via the payment tool, and that it will cover purchases made through the service in the same way purchases are covered from Amazon.com.

“This [newly launched] service is more of a repackaging of Checkout by Amazon than as something new,” says a payments industry analyst. “Amazon has been a challenger to PayPal for some time in the Internet payments arena, but PayPal has the dominant market share. One key reason is that PayPal is not viewed as a direct competitor to the merchants it serves while Amazon often is.”

PayPal, part of eBay, is the clear leader in so-called alternative payments, used by 84% of consumers who pay online with alternatives to payment cards, according to a report earlier this year from Javelin Strategy & Research. The report, based on a 2012 survey, also showed that 42% of consumers pay with credit cards when making online retail and travel purchases, up from 40% in the 2011 survey, and 29% pay with debit cards, down from 30%.

The new Amazon service is a “great deal” more than a warmed-over Checkout.

He points out that the number of Amazon’s active accounts is much more than the active users of all eBay’s payment services. Including consumers with PayPal or Bill Me Later accounts, that base totaled 132.4 million in the second quarter, up nearly 17% from 113.2 million a year earlier, according to eBay. And Amazon’s customers trust the security of making payments through the e-retailer, and have grown accustomed to the convenience of doing so. Amazon is No. 1 in the Internet Retailer.

For e-retailers, it’s yet another payment method they might want to evaluate. “Amazon is a damn big brand. If you bring that many users along with [the payment service], then e-retailers will give it serious consideration. It will give PayPal some competition.

Posted in e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: Amazon, amazon.com, api, application programming interface, checkout, credit cards, customers, debit cards, e-commerce, e-retailer, ebay, internet retailer, online, orders, payment methods, payment processing, payment service, PayPal, purchase, shoppers, travel purchases

October 3rd, 2013 by Admin

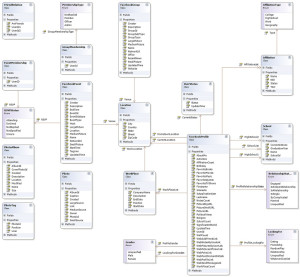

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet

October 1st, 2013 by Elma Jane

Google announced Wednesday that it is opening its Google Shopping Express service to shoppers in the entire San Francisco Bay Area, marking the official launch and first big expansion of the company’s same-day delivery service. Google began testing the retail delivery service this year among a limited set of invited consumers in a few areas within the Bay Area, but the new announcement extends the service to anyone in an expanded region ranging from San Francisco to San Jose. With the service, online shoppers can place online orders from several chain stores and have those products delivered within the day.

Also on Wednesday Google released an app for iOS and Android that allows users to browse the shopping sites and order products directly from their smartphones. New users who sign up before the end of the year can get six months of free, unlimited delivery service; it costs $4.99 per store order.

Race to Deliver

Google is not the only company to experiment with the same day delivery offerings. Walmart and eBay are both testing similar services…eBay now even offers the delivery within an hour, although consumers can only shop from a single store. Amazon is also following in the footsteps of companies like Fresh Direct and rolling out same-day deliveries on groceries to consumers in Los Angeles and Seattle. Google understands that it will have tough competition in the space and can afford to take a loss on the service at first, which is why it is offering the service for free for new users, said an e-commerce consultant. It is evident from the low price and free sign-up offer that Google is not interested in making money in the short term, that will come once there is a widespread adoption of their service…

A Lot of Challenges Ahead

Although Google is not a retail hub at its core, the company has other strenghts that could help it gain an advantage over its competitiors. Being a default search provider for many millions of users on all platforms, from desktops to tablets right through to mobile phones, can give Google an edge over Amazon and eBay.

Still the key element to a successful e-commerce platform is logistics. Google might have deep pockets and effective algorithms, but it has a a lot of cathing up to do to make sure its delivery service could compete with those of companies like Amazon and eBay, which have years of experience delivering products to consumer worlwide.

“Google certainly has the stamina and budget to give it a good run, but there are a lot of moving parts”. Being a big data company doesn’t automatically mean you’ll be good at the logistics, so they’re going to have a lot of challenges ahead.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Merchant Account Services News Articles Tagged with: Amazon, Android, app, delivery, desktops, e-commerce, ebay, google, iOS, mobile phones, online, platforms, shopping, tablets, walmart

September 30th, 2013 by Elma Jane

Facebook this week began testing a new feature dubbed “Autofill with Facebook” that aims to simplify mobile purchases by filling in customers’ credit card information for them, thus eliminating the need to type it in each time. This “Autofill with Facebook gives people the option to use their payment information already stored on Facebook to populate the payment form when they make a purchase in a mobile app,” Facebook spokesperson told the E-Commerce Times. “The app then processes and completes the payment.” The feature “is designed to make it easier and faster for people to make a purchase in a mobile app by simply pre-populating your payment information.”During the test period, which began Monday evening, the feature will show up only to Facebook users who have already provided credit card information to the social network — in other words, those who have made in-game purchases or bought gifts for friends.

Facebook has partnered with PayPal, Braintree and Stripe as financial partners on the service, which is initially available only on the e-commerce iOS apps JackThreads and Mosaic.

Ironing Out the Wrinkles Autofill with Facebook isn’t a move to compete with PayPal and credit card companies, but to complement payment services by adding a layer for convenience, much the way Facebook, Google and Amazon have created a single login that works across a network of websites.

“Facebook is not interested in being a payments company,” an analyst, told the E-Commerce Times. “Instead, it is aiming to be the entity that irons out bumps in the payment process — something it is well-positioned to do. “With Autofill, Facebook will act as the lubricant that makes the commerce experience more seamless, providing a number of benefits to all stakeholders.”

Partners in the deal ensure that Facebook will succeed in Autofill with Facebook, it doesn’t care about payments, it cares about reaping the benefits that come from making the payment experience better.”

‘The Potential to Be Lucrative’ There could be significant financial benefits as well. “This approach has the potential to be lucrative for Facebook in that it will help plug the mobile conversion gap,” McKee suggested. “If Facebook can prove to its partner merchants that an ad on its site led to a purchase, the validity of its platform can easily be proven. Ideally, this will help convince other companies to advertise with Facebook as well.”

Taking it a step farther, Facebook will also gain transaction data, which McKee believes has considerable value. “Facebook can leverage transaction data with what it already knows about us for precision ad targeting. This will increase the relevance and placement of ads on Facebook.”

The Security Factor While many mobile customers will appreciate the Autofill function, security issues still lurk in the back of every consumer’s mind. Yet while privacy concerns have been an ongoing issue for Facebook, it has a good track record where security is concerned. “Facebook has been relatively incident-free when it comes to security breaches.” “However, this is more a problem of consumer perception. Will consumers feel comfortable storing their payment credentials with a social media platform?

“Facebook is already approaching ‘big brother’ status, and this takes it one step further.” “To succeed, Facebook must provide visibility into what it plans to do with transaction data.”

‘It’s a No-Brainer’ The convenience factor, meanwhile, could be a compelling one for consumers. “It’s no-brainer useful to mobile users…who wants to enter their credit card on a mobile phone more than once?” “It could be more secure than mobile payment alternatives.” If Facebook gets past its hurdles, it will also succeed in building strengths in areas where it has been lacking to date.

“Right now Facebook isn’t super strong at the conversion side of e-commerce.” “Autofill will give them a lot of data about purchases, which might help them remedy that.”

‘Strategic Smarts and Ambition’ As for those benefits to Facebook, there are potentially many. One example,”Autofill admits them to the online payments world.”

“This is another example of the strategic smarts and ambition of Zuck.” “One gets the sense that he wants to be a major competitor for everything online.”

Posted in Credit card Processing, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Mobile Payments Tagged with: Amazon, commerce, credit card, e-commerce, Facebook, google, media, mobile, mobile phone, network, payment, payment information, payment services, PayPal, platform, processes, secure, social, transaction

September 26th, 2013 by Elma Jane

5 Effective and Unusual Ecommerce Pricing Strategies

Most online retailers set pricing using the cost-plus or the value-based method. While these work well, there are several other ways to price products. Here are the five effective and unusual ways to price products on your ecommerce site.

1. Name your Price

This is a variation of the PWYW model, where the price has to exceed a threshold to get the product. This threshold price is not shown to shoppers to allow them to name their own price. This model has been successfully used in the travel industry, among others, where availability of airlines, hotels, and travel dates is based on the named price. This strategy can also work well for online retailers that are selling the following types of products.

Defined Price Ranges – Gifts site where NYP can be a guide to show products that are within that price range. NYP can be used as a guided selling tool to show gifts within a defined price range. The retailers can use price discrimination in combination with this strategy to increase their profits.

High Perceived Value – The perceived value of the product is much higher than the cost of procuring it, prompting the consumers to name a higher price. This can apply to books, music, and food products.

Imprecise Value – The products can be sold at a wide range of prices and still generate a profit. This could include one-of-a-kind products or art, where it is difficult to assess the value.

2. Pay What You Want

The pay-what-you-want strategy — PWYW — has been around for a while but has not been used heavily in the online retail space. A well-publicized offline success is Panera Bread restaurants, which has used this pricing strategy in a few of its restaurants. In the online world, Humble Bundle a music and game store has been using this too. In almost all cases, this strategy did not result in a significant profit or loss but led to a lot of free marketing. That is one of the big reasons for adopting this strategy in retail. There are several types of online retailers that can benefit.

Limited Categories – This strategy does not need to be implemented for your complete online store. It can be limited to a few products or a few categories that are the best fit.

Link to Charities – If your site shares revenue with charities, then PWYW can work, as customers often pay more to help the charity, increasing your share of the revenue in the process.

Offer an Incentive – You can also tie the PWYW strategy with an incentive…such as an additional product once the price exceeds a certain threshold, say $10. This threshold can be kept secret or made public on the site as a marketing tactic to encourage customers to pay more.

Proper Customers – If you believe that your customers are fair-minded and understand the value of your products, then PWYW might be effective.

3. Personalized Pricing

This is a relatively new strategy where specialized yield management algorithms are used to personalize the price offered to each visitor. With the rise of Big Data, most of the personalized pricing is done in real-time by analyzing a variety of factors like customer loyalty, device used by the shopper, customer preferences, history of purchases, and so on. This strategy is best suited for the following types of online retailers.

New Products Regularly – There are many products in the online store, with new products introduced regularly. This makes personalized pricing more effective as repeat customers see the new product and the new promotional pricing to reward their loyalty, or to encourage a first purchase for new ones.

Repeat Customers – Customers know that they will be rewarded with personalized pricing and promotions based on the loyalty to your site.

Wide Profit Margins – Products are sold with good margins, allowing the retailer to offer discounts at any time. For example if the product is sitting in a shopper’s cart for a few days, the retailer might offer a discount or drop the price to encourage the shopper to complete the purchase.

4. Flat Pricing

Flat pricing is a strategy where a limited number of prices are used for all product offerings, such as in dollar stores where every product is priced at one dollar. This strategy works well in the following situations.

Many Similar Products – Your site sells a wide variety of products that are priced nearly the same. In this scenario, flat pricing is simpler to manage, easier for consumers, and also results in greater profit.

Subscription Pricing – A new trend in online retail is subscription pricing, where customers can sign up for a flat price of, say, $25, $49, or $99 to receive a set of products every month.

5. Free

Several software companies are using free pricing successfully where the software is given away for free and customer is charged either for support or for premium features. A free pricing strategy can be an effective strategy for ecommerce merchants to attract customers by following the following guidelines.

Basic vs. Premium Versions – This strategy can be effective if the basic version is free and the customer pays for a premium version. The life insurance industry uses this approach, where a basic $10,000 insurance is often free. If even a small percentage of customers buy the premium offering, the insurer makes a profit.

Emphasize Consumables – Products that have durable and consumable components can benefit from a free pricing strategy, if customers can only buy both pieces from your site. For example, Gillette sometimes offers shaving razors for free since only Gillette shaving blades will work with its razors. On the other hand, it does not make sense to give away a laser printer for free because the printer paper and toner can be bought from anywhere.

Loss Leader – Use this strategy to offer products for free using the loss leader model. Customers come to the site to get the free products and once they are on the site, you can up-sell or cross-sell them other products.

Seasonal Products – If your site sells seasonal products, then this strategy can drive traffic. For example, a retailer could give away free U.S. flags during the July 4th holiday to generate traffic, while also pushing other non-free July 4th merchandise.

Posted in e-commerce & m-commerce, Electronic Payments, Travel Agency Agents Tagged with: Airlines, e-commerce, hotel, online store, pricing, subscription, travel industry

August 16th, 2013 by Admin

Today the PCI Security Standards Council (PCI SSC), an open, global forum for the development of electronic transaction security standards published PCI Data Security Standard (PCI DSS) and Payment Application Data Security Standard (PA-DSS) 3.0 Change Highlights as a preview of the new version of the standards coming in November 2013. The changes will help companies make PCI DSS part of their business-as-usual activities by introducing more flexibility, and an increased focus on education, awareness and transaction security as a shared responsibility with merchant account holders.

The seven-page document is part of the Council’s commitment to provide as much information as possible during the development process and eliminate any perceived surprises for organizations in their PCI credit card security planning. Specifically, the summary will help PCI Participating Organizations and the assessment community as they prepare to review and discuss draft versions of the standards at the 2013 Community Meetings in September and October.

Changes to the standards are made based on feedback from the Council’s global constituents per the PCI DSS and PA-DSS development lifecycle and in response to market needs. Key drivers for version 3.0 updates include: lack of education and awareness; weak passwords, authorization, verification and authentication challenges; third party payment security challenges; slow self-detection in response to malware and other threats; inconsistency in assessments.

“Today, most organizations have a good understanding of PCI DSS and its importance in securing credit card data during transactions, but implementation and maintenance remains a struggle – especially in light of increasingly complex business and payment technology environments,” said Bob Russo, PCI SSC general manager. “The challenge for us now is providing the right balance of flexibility, rigor and consistency within the standards to help organizations make payment security business-as-usual. And that’s the focus of the changes we’re making with version 3.0.”

Based on feedback from the industry, in 2010 the Council moved from a two-year to a three-year standards development lifecycle. The additional year provides a longer period to gather feedback and more time for organizations to implement changes before a new version is released. Version 3.0 will introduce more changes than version 2.0, with several new sub-requirements. Proposed updates include:

- Recommendations on making PCI DSS business-as-usual and best practices for maintaining ongoing PCI DSS credit card compliance

- Security policy and operational procedures built into each requirement

- Guidance for all requirements with content from Navigating PCI DSS Guide

- Increased flexibility and education around password strength and complexity

- New requirements for point-of-sale terminal security

- More robust requirements for penetration testing and validating segmentation

- Considerations for credit card data in memory

- Enhanced testing procedures to clarify the level of validation expected for each requirement

- Expanded software development lifecycle security requirements for PA-DSS application vendors, including threat modeling

Note that these updates are still under review by the PCI community. Final changes will be determined after the PCI Community Meetings and incorporated into the final versions of the PCI DSS and PA-DSS published in November.

The change highlights document with tables outlining anticipated updates is available on the PCI SSC website:https://www.pcisecuritystandards.org/security_standards/documents.php

The Council will host a webinar series for the PCI community and the general public to outline the proposed changes. To register, visit: https://www.pcisecuritystandards.org/training/webinars.php

“PCI DSS and PA-DSS 3.0 will provide organizations the framework for assessing the risk involved with technologies and platforms and the flexibility to apply these principles to their unique payment and business environments, such as e-commerce, m-commerce, mobile acceptance or cloud computing,” added Troy Leach, PCI SSC chief technology officer.

PCI DSS and PA-DSS 3.0 will be published on 7 November 2013. The standards become effective 1 January 2014, but to ensure adequate time for the transition, version 2.0 will remain active until 31 December 2014.

For more information and to register for the 2013 Community Meetings, please visit:https://www.pcisecuritystandards.org/communitymeeting/2013/

About the PCI Security Standards Council

The PCI Security Standards Council is an open global forum that is responsible for the development, management, education, and awareness of the PCI Data Security Standard (PCI DSS) and other standards that increase payment data security. Founded in 2006 by the major payment card brands American Express, Discover Financial Services, JCB International, MasterCard Worldwide and Visa Inc., the Council has more than 650 Participating Organizations representing merchants, banks, processors and vendors worldwide. To learn more about playing a part in securing payment card data globally, please visit: pcisecuritystandards.org.

Connect with the PCI Council on LinkedIn: http://www.linkedin.com/company/pci-security-standards-council

Join the conversation on Twitter: http://twitter.com/#!/PCISSC

Posted in Credit Card Security, Digital Wallet Privacy, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: credit card, DSS, e-commerce, m-commerce, mobile, PA-DSS, PCI Compliance, Security, transaction

New legislation is working its way through congress to require e-commerce retailers and mail order telephone order business to collect local sales taxes on transactions. e-commerce web sites and mail order telephone order businesses that conduct over $1 million gross sales and sell products and services in states where they don’t maintain brick and mortar presences would be required to collect and pay local and state taxes in those states. Targeting remote retailers that engage in interstate commerce the most obvious being mail order and telephone order as well as e-commerce shopping cart sites. Read more of this article »

Posted in Electronic Payments Tagged with: brick and mortar, DSS, e-commerce, electronic payment, mail order, merchant, merchant account, PCI, shopping cart, tax, taxes, telephone order

As a society, our smartphones are increasingly becoming a more important in our daily lives. Already replacing watches, alarm clocks, wallets and calendars today we carry our smartphones with us everywhere, including the bathroom. While smartphone users are traveling everywhere with their smartphones, are they actually booking travel with their smartphones? eMarketer asked that very question in a survey of 1,200 internet users and asked about their travel booking habits on the internet. The responses indicate that 40% of digital travel researchers will use their smartphones and tablets and mobile payments to complete travel bookings. Read more of this article »

Posted in Merchant Services Account Tagged with: agencies, agent, agents, credit card, e-commerce, gateway, ipad, Iphone, laptop, merchant account, notebook, smartphone, tablet, ticketless, travel

Cyber Crime InfoGraphic by Vericode.

Today anyone can have an e-commerce web site set up in mere minutes. There are a lot of open source e-commerce solutions that allow a web site owner to establish a site very easily, some require just a few clicks to get going. Once you have your color scheme chosen and your navigation all set a decision on how to accept payments is inevitable. e-commerce payment gateways allow your site to connect securely to a payment processor to accept your electronic transactions. These digital transactions can be used by hackers to target your site and your customers credit card information and much more. Whether the data targeted is stored on the merchants network or on the customers mobile device, business need to implement a cyber security strategy. Read more of this article »

Posted in Credit Card Security Tagged with: credit card, DSS, e-commerce, electronic, fraud, gateway, Malware, payment, PCI, Phishing, Processing, Security, Skimming, smartphone, SMSishing, tablet