November 13th, 2015 by Elma Jane

It’s important for merchants to understand the basic of how a credit card terminal works. It is the channel through which the process flows and the merchants can choose the right one for their processing needs, whether they use a point-of-sale (POS) countertop model, a cardreader that attaches to a smartphone or mobile device, a sleek handheld version for wireless processing or a virtual terminal for e-commerce transactions.

A credit card terminal’s function is to retrieve the account data stored on the payment card’s EMV microchip or a magnetic stripe and pass it along to the payment processing company (also known as merchant account provider).

For card-not-present (CNP) – mail order, telephone order and online transactions – the merchant enters the information manually using a keypad on the terminal, or the e-commerce shopper enters it on the website’s payment page. The back half of the process remains the same.

The actual data transmission goes from the terminal through a phoneline or Internet connection to a Payment Processing Company, which routes it to the bank that issued the credit card for authorization.

In card-present transactions where the card and cardholder are physically present, the card is connected to the reader housed in the POS terminal. The data is captured and transmitted electronically to the merchant account provider, who handles the authorization process with the issuing bank and credit card networks.

A POS retail terminal with a phone or Internet connection works best in a traditional retail setting that deals exclusively in card present transactions. For a business with a mobile sales, a mobile credit card processing option like Virtual Merchant Converge Mobile relies on a downloadable app to transform a smartphone or tablet into a credit card terminal equipped with a USB cardreader.

Wireless Terminals are compact, allowing you to accept credit cards in the field without relying on a phone connection. If you process debit cards, you’ll need a PIN pad in addition to your terminal so cardholders can enter their personal identification number to complete the sale.

Selecting the right terminal for your credit card processing needs depends largely on the type of business you run and the sorts of transactions you process. Terminals are highly specialized and provide different services. At National Transaction we offer a broad range of terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC/Contactless payment transactions at your business. An informed business decision benefits your bottom line. Start accepting credit cards today with National Transaction.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Point of Sale Tagged with: Android Pay, Apple Pay, card-not-present, card-present transactions, cardholder, cardreader, cnp, contactless payment, Converge Mobile, credit card, credit card networks, credit card terminal, debit cards, e-commerce, EMV, magnetic stripe, mail order, merchant account provider, merchants, microchip, mobile credit card processing, mobile device, Near Field Communication, nfc, online transactions, payment processing company, PIN pad, point of sale, POS, POS terminal, smartphone, telephone order, virtual merchant, virtual terminal, wireless processing

November 6th, 2015 by Elma Jane

Money 20/20 was billed as the largest convention in payments history held in Las Las Vegas, during the last week of October 2015.

The show delivered well-organized, incisive content such as Europay, MasterCard and Visa (EMV) migration, mobile payments, security and omnichannel commerce.

20/20 Highlights

- Alternative lending and credit.

- Bill Payments, Financial Services: Newly released market research provides insights into the future of household bill payments, millennials, and financial services.

- Connected Commerce and the Mobile Enterprise: The Internet of Things is changing the way that consumers interact with their environments. Analysts predict up to 30 billion interactive devices will be connected to the Internet by 2020, noting that many of these devices will be payment-enabled.

- Marketing and Customer Experience: Most marketers agree that the era of demographic profiles and pull marketing is over. Retailers, card brands and information technology professionals looked at the customer experience in the digital world. They explored new marketing practices, trends in e-commerce and mobile commerce, and big data findings in other industries that may be useful to financial service companies.

- Mobile Banking: Banks are undergoing an incremental transformation as they learn to compete with nonbank lenders, balance cash management with digital currencies, and shift from local branches to online and mobile forms of banking.

- Mobile Payments: Payments analysts reviewed Apple Pay a year after its launch and a range of other mobile wallet offerings, and they speculated on how third-party wallets will impact bank apps.

- Payment Card Evolution: Payment card issuers, processors and network service providers analyzed the changing look, feel and role of payment cards in the greater ecosystem. Discussions ranged from card linking to the coolness factor of gift cards to how e-cards are expanding market opportunities.

- POS, Processing and Open Platforms: Executive roundtables with leading acquirers explored front-end and back-end technology and omnichannel commerce for small and midsize businesses.

- Regulatory Landscape: Increased federal and state oversight has had a significant impact on the financial services sector.

- Security: Security analysts made in-depth presentations on tokenization, end-to-end encryption, and secure methods of authentication designed to protect consumers, merchants and industry stakeholders from cybercriminals. Many agreed that EMV implementation in the United States will drive fraudsters to the card-not-present space. They discussed how EMV adoption has changed fraud patterns in other regions and offered examples of best practices geared toward identifying and preventing electronic payment fraud.

More than 10,000 attendees and 3,000 exhibitors from 75 countries attended Money20/20. Financial services professionals from mobile, retail, marketing services, data and technology met at what show organizers described as the intersection of mobile, retail, marketing services, data and technology.

The years to come will be a turning point in the payments sector, and with the recent shift to EMV, the entire conference confirmed that all the players are more interested than ever in finding innovative solutions for combating online fraud.

Posted in Best Practices for Merchants Tagged with: Apple Pay, big data, bill payments, card-not-present, e-commerce, electronic payment, EMV, EuroPay, financial services, Gift Cards, MasterCard, merchants, Mobile Payments, mobile wallet, payments, POS, processors, Service providers, tokenization, visa

October 12th, 2015 by Elma Jane

Setting up a merchant account.

- First find a Merchant Service Provider.

- Then setup your Business Profile.

Put together your business profile so you can start applying for a merchant account. There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should setup your account.

Some of the questions are:

- Is your business seasonal? For Travel Company it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

- How do you intend to accept payments? Different business models require different methods of accepting payments. If you’re doing face to face transaction and have physical location then you need a credit card terminal. If you process checks, then you need Electronic Check and ACH Transfers. For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

- How much volume do you plan on processing? Merchant account providers are going to want to know how much sales volume you plan on processing per month. New in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation. Been in the business – you’ll already have this number ready.

- What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call now at 888-996-2273 or go to www.nationaltransaction.com to know more about our services.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: ach, Converge, credit card terminal, e-commerce, Electronic Check, merchant account, merchant service provider, NTC e-Pay, payments, Travel Company, virtual merchant

October 1st, 2015 by Elma Jane

The day the payments industry has pointed to for several years arrives today, a turning point in the U.S.‘s migration to EMV chip-and-PIN cards.

Rules set by Visa and MasterCard as of today, the liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards. Banks will be issuing EMV Chip Cards.

An enormous change, as everyone learns to deal with the new technology that requires consumers to insert their cards and leave them in the store machines throughout a payment transaction, rather than swipe.

In a recent survey, less than a third of merchants overall have invested in EMV-compliant technology, and one study said 80 percent of small and midsize merchants have not upgraded their systems as of today’s liability shift.

Issuers are claiming to be more prepared than merchants, but according to the Smart Card Alliance, around 200 million chip cards have been issued to U.S. cardholders. That, however, is less than 17 percent of the approximately 1.2 billion payment cards in circulation.

What is clear is that today does not represent the end of the journey. The lack of preparedness at the physical point of sale, however, may be beneficial for card-not-present merchants.

Over the past few months, the mainstream media has awoken to the fact that implementing EMV does not mean fraud will disappear. Fraudsters quickly adapted to the difficulty of counterfeiting cards by attacking Card-Not-Present channels, where a chip has no effect.

In other markets, fraud migrated quite rapidly to card-not-present channels. It is necessary on e-commerce merchants to protect themselves with an array of tools, like device authentication, one-time passwords, randomized PIN pad and biometrics. Fraud mitigation tools like data analytics, address and CVV verification, 3D secure and tokenization. These services should be available from their merchant acquirer processor or gateway.

There should be a gradual reduction in card fraud over the next 12-18 months in spite of the delays in this country’s EMV migration. It’s going to take time for the technology to be adopted.

U.S. Merchants’ overall relative lack of preparedness for EMV may give e-commerce and mobile merchants time they didn’t think they would have to explore the options.

Sophisticated authentication technologies such as biometrics will help increase the security of card transactions. Device-based verification could be easily incorporated in an EMV transaction.

Banks have expressed interest more in using the phone as a biometrics. It’s all going to depend on what is the most convenient way to access your funds. The nice thing about biometrics is it’s meant to enable more convenience and stronger security.

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: banks, biometrics, card fraud, card-not-present, chip cards, chip-and-PIN cards, e-commerce, EMV, gateway, merchant acquirer, merchants, mobile merchants, payments industry, point of sale, POS system, processor, tokenization, Visa and MasterCard

September 22nd, 2015 by Elma Jane

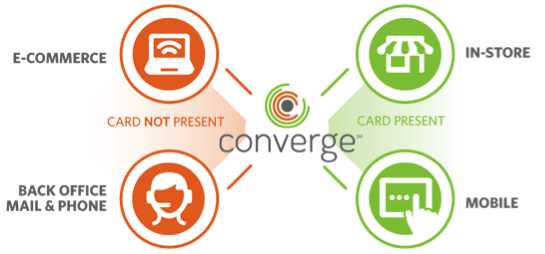

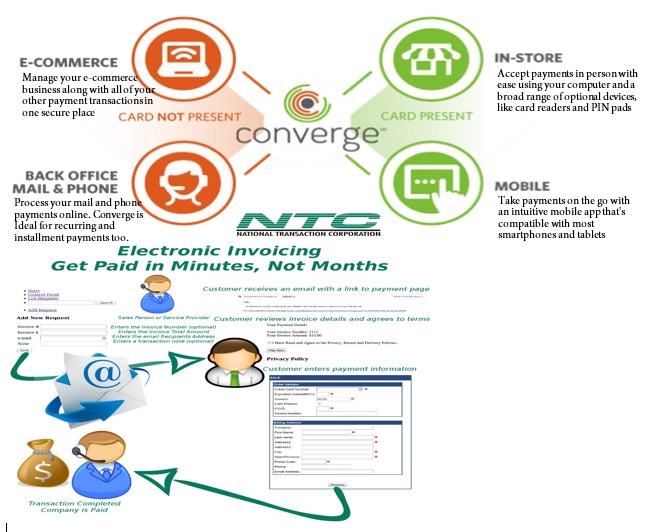

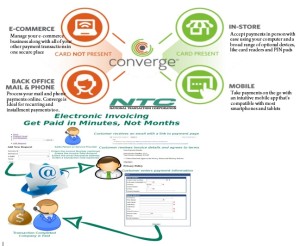

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

August 20th, 2015 by Elma Jane

We live in a nearly cashless society. Accepting credit cards is a requirement in today’s business trend.

What are the benefits of accepting both credit and debit at your business? Check out NTC’s List.

Convey a sense of trust.

When launching a business, you won’t have the credibility of a well-established company, so gaining instant credibility by promoting that you’re able to accept credit cards will help your business evolve.

You’ll be able to acquire respectability and strong customer relationships, compared to companies that don’t accept credit cards.

The more payment options, the better the sales.

Why limit your customers to just cash? The number of people carrying cash decreases every day, accepting credit cards will open the door to more opportunities.

Credit Cards drive e-commerce.

Nearly every transaction made on the Internet is paid for by some sort of payment card, be it credit, debit or gift cards, so having a successful online presence and creating an excellent revenue stream is crucial for the growth of your business.

Plastic is better than a check.

Because of the high level of diligence done by Credit Card Processors, it’s less likely that you’ll be a victim of fraud when compared to accepting checks. Accepting one bad check can make a business susceptible to spending valuable time dealing with banks and trying to find the customer to get reimbursed.

National Transaction can help you with your Merchant account set up, making the application process as seamless as possible.

Our goal is to create a smooth, fast and secured transaction process, leading to a better relationship with your customers.

Customers tend not to hesitate with convenient, nice to have purchases when they use a credit card compared to harder-to-part-with cash.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: checks, credit cards, debit, e-commerce, Gift Cards, merchant, merchant account, payment card, processors

July 14th, 2015 by Elma Jane

If you own a business, you should consider opening a merchant account. If you accept credit cards for transactions, you will take your business to a higher level, increase your revenue, and gain new customers. Most people nowadays use credit cards and debit cards to pay for their purchases, so no business should go without processing card payments. Electronic, Credit card processing payments are a must-have for any kind of business including Internet businesses.

If you accept several forms of payments, you will provide your customers with multiple options and you will enhance their experiences. If you do not accept credit cards, the people who prefer to pay for their purchases with credit cards and debit cards will go somewhere else, and you will lose the transaction. So many benefits are attached with merchant accounts and millions of small business owners have found success with them. If you have a merchant account, you will be able to accept Discover, MasterCard, Visa, and American Express from your customers.

With National Transaction, securing Electronic, Credit card payment processing service instore, online and on the go are easy to acquire. It will boost your income, so it is worth the investment. You can apply online for a merchant account, the applications will only take you a few minutes to complete, and you will find out if you have been approved for a merchant account in a day or so.

A credit card processing service will also protect your business and valued customers against fraud. Customers feel safe using credit cards because they know that if their cards get stolen, they can cancel them, dispute the purchases, and get their money back. Your customers will feel safe when they make purchases. Some consumers will not purchase from a company that does not accept credit/debit card.

National Transaction offers advanced payment processing solutions like Currency Conversion, EBT and Debit Cards Processing, E-commerce Gateways, Electronic Check and ACH Transfers, Gift Loyalty Card Programs, Loans and Advances, Mobile Processing and MediPaid, you will definitely benefit from opening a merchant account. National Transaction offers Free CRM and we can even help promote your business through Social Media Sites. We offer a very competitive rate and Customer/Technical Support to our Partners because we answer our phone.

Merchant accounts are a necessity for any kind of business, so don’t wait. Sign up for a merchant account right now and discover what your business can gain from accepting credit cards! With 73 percent of American households owning a credit card, it’s easy to think that everyday credit card usage is a way of life.

Give us a call 888-996-2273 or check our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: ACH Transfers, Advances, card payments, credit card processing, credit cards, crm, Currency Conversion, debit cards, Debit Cards Processing, e-commerce, EBT, Electronic Check, gateways, Gift Loyalty Card, loans, MediPaid, merchant account, Mobile Processing, payments, transactions

June 5th, 2015 by Elma Jane

Traditionally, travel-related merchants have a difficult time obtaining merchant accounts. National Transaction Corporation (NTC) is a full service merchant account provider with extensive experience in the travel arena and related markets, servicing thousands of travel-related merchant accounts by specializing in non-cash electronic transactions. Our services include processing credit card transactions, gift card transactions, and e-commerce transactions, among others. We offer a full line of products including credit card terminals, cellular devices, supplies, and accessories for each model sold. We offer aggressive rates and pricing for mail/telephone order, retail/restaurant, wireless, and online transactions while specializing in the travel and high volume sectors of merchant processing, and we are proud to be the preferred merchant provider for ASTA.

NTC is dedicated to providing the highest caliber of service and solutions in the merchant processing industry. We actually answer the phone when you need assistance! NTC has a team of dedicated employees providing personalized service to each account holder and are available directly through their toll free number, never hidden behind a menu system. Our excellent service truly separates us from everyone else in the industry. The principals of NTC have extensive experience in the processing arena for over 25 years, with experience in all facets of operation, including credit cards, credit initiation, credit investigation, loss prevention, deployment, and customer and terminal support. We employ internal sales associates as well as independent sales agents who offer many opportunities through their referral reward services and Independent Sales Organization (ISO) programs.

NTC’s online gateway allows for processing transactions, reviewing account history, and interacting with various shopping cart and accounting applications such as QuickBooks, Peachtree, and many other titles. Reservation software such as Trams are compatible and integrate well with all National Transaction merchant accounts. Whether you are a travel agency or an independent agent, we offer many solutions that cater to the travel industry and will increase your revenue with quicker deposits into your bank account.

Travel environments are unique in that your transactions are usually keyed; there is almost always a delayed delivery period, and large ticket transactions are not uncommon since one card holder may be paying for multiple tickets. They also tend to be seasonal, with peak season months generating an unusual spike in their “average” monthly volume, and charge-back’s pose a potential threat by travelers who are unable to complete their trip. Combine even a few of these factors together and you have cause for a reserve, or even account termination. National Transaction Corp specializes in understanding what makes your transactions unique, as a travel agent, and how they affect your merchant account.

The importance of customer service is something that is over looked when merchants compare the overall cost of monthly fees with their merchant account. That is, until the moment they need assistance with their account. Whether searching for missing deposits, having problems processing transactions, issuing refunds, processing voids, or questioning their billing statement, a merchant should always remember you get what you pay for. If you wonder why they can offer you no monthly fee, they are offering you no LIVE customer support. Customer support for them will come via means of email. You will wait hours for answers, and even days for a simple confirmation or general email, let alone a resolution.

National Transaction Corporation has over 17 years of dedication and experience in providing quality solutions in the credit card processing arena. From internet e-commerce applications to food stamp processing, from small start up businesses to fortune 500 companies, NTC has a complete product selection to customize a solution to grow with your business. We at NTC pride ourselves on being a full service, member service provider. It is our mission to provide the same dedication and service in maintaining your business as you experience in us earning your business. NTC will provide service after the sale. It is that service that sets us apart! For more information, contact NTC for world class service and solutions.

Contact National Transaction Corporation today at 888-996-2273 to see how we can help you with your travel merchant account, or visit us online at www.nationaltransaction.com for more information.

by Elizabeth Cody (Travel Research Online)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Gift & Loyalty Card Processing, Merchant Account Services News Articles, Merchant Cash Advance, Travel Agency Agents Tagged with: ASTA, bank account, billing statement, credit card terminals, credit card transactions, credit cards, customer service, deposits, e-commerce, e-commerce transactions, electronic transactions, gift card transactions, Independent Sales Organization, ISO, merchant account provider, merchant accounts, merchants, service provider, travel, travel agency, travel agent, travel industry

May 4th, 2015 by Elma Jane

The rate of payments fraud is steadily decreasing, the current frequency stands at 0.06 percent or six basis points.

The perception of risks associated with card payments are much larger than the actual threat or reported losses. But the lack of trust that comes from such perception could impact the growth of the payments industry.

Recent advancements in payments security, such as tokenization and multiple tier authentication protocols, have contributed to the manageable number of fraudulent transactions. The EMV migration is expected to push the figure even lower, as chip-enabled technology spreads to over 50 percent of the US by the end of 2015.

For criminals, breaking into robust financial systems is becoming more costly and time consuming, which has discouraged many from attempting such unlawful acts.

Fraud is something that we can’t say will be eliminated completely. But efforts by all stakeholders in the industry can contain it to the minimum.

Counterfeit cards and payments data falling into the wrong hands are the two most common types of fraud that consumers are facing today. The surge in e-commerce has been linked to greater risks of fraud in the online channel, and while counterfeiting cards may be more difficult with EMV in place, online fraud has historically increased in its place.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: card payments, cards, consumers, data, e-commerce, EMV, EMV migration, fraud, payments, payments industry, Payments Security, tokenization, transactions