March 15th, 2017 by Elma Jane

Payment Options

Technology continues to evolve, offering multiple billing and payment methods increases satisfaction by improving customer experience.

Customers will continue to move toward digital life, like embracing different forms of online billing and ways to accept payments.

Creating convenient ways to accept payments and having more options can reduce the time it takes your business to get paid.

Accept debit and credit card payments online; to offer this feature you need to get a merchant account.

Options for accepting payments:

Electronic Check Service (ECS) – convert paper checks to electronic transactions, with NTC’s ECS. Converting paper checks to electronic transactions eliminates many of the risks and costs, adding money to your bottom line.

Mobile Payments – the opportunity to increase revenue through mobile payments is huge. Many consumers find that mobile bill pay makes shopping easier, more convenient and saves time. Converge Mobile Solution lets you accept card payments using smartphone or tablet. The app works with most Apple and Android mobile devices.

Online Payment Gateway – offering customers an online payment form enables them to pay you easily and allows you to accept payments by credit card, debit card or echeck.

Electronic Invoicing (NTC ePay) – send your customers an invoice by email and get paid in minutes. Electronic Invoicing gives your customer the ability to pay their bills and receive a receipt in seconds by email.

Learn more about accepting electronic payments with NTC or sign up with us.

No setup or cancellation fees, there’s no risk! call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, echeck, ECS, Electronic invoicing, electronic transactions, merchant account, mobile, online, payment, payment gateway

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

February 21st, 2017 by Elma Jane

The Travel Payment Expert

No Setup or Cancellation Fees

100% Next day Funding

Lowest price Guarantee

24/7 US Based Support

#1 Preferred Payment Processor among Travel Associations

NTC ePay, our exclusive electronic invoicing platform. (Email customers invoices and get paid even faster, eliminating paperwork and saving time).

For Electronic Payment Setup or FREE Rate review, call us now 888-996-2273

or visit www.nationaltransaction.com/travel/ and use our contact form.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: Electronic invoicing, electronic payment, payment, processor, travel

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

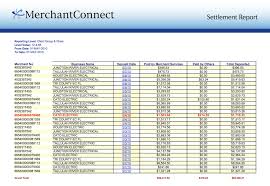

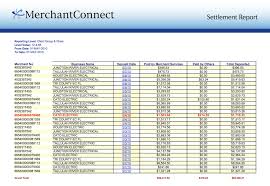

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

March 9th, 2016 by Elma Jane

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

September 18th, 2014 by Elma Jane

Electronic invoicing is the exchange of the invoice document between a supplier and a buyer in an integrated electronic format. Traditionally, invoicing, like any heavily paper-based process, is manually intensive and is prone to human error resulting in increased costs and processing lifecycles for companies.

The issue of compliance seems to have separated E-Invoicing from B2B. Surprisingly many Finance leaders are unaware that their company is already sending/receiving EDI electronic invoices.

E-Invoicing is a common B2B practice and National Transaction is ready to launch its E-Invoicing system.

True definition of an electronic invoice is that it should contain data from the supplier in a format that can be entered integrated into the buyer’s Account Payable (AP) system without requiring any data input from the buyer’s AP administrator.

There are number of formats to be employed, it is useful to Apply below guidelines:

An E-Invoice:

1) Structured invoice data issued in Electronic Data Interchange (EDI) or XML formats.

2) Structured invoice data issued using standard Internet-based web forms.

Not a true E-Invoice:

1) Paper invoices sent via fax machines.

2) Scanned paper invoices.

3) Unstructured invoice data issued in PDF or Word formats.

Although significant cost and time savings can be achieved by removing paper and manual processing from your invoicing, the real benefits of E-Invoicing come with the level of security that comes with E-invoicing. Integration between your trading partners and your invoicing software and other business systems are optional. National Transaction can offer a customized Electronic Invoice Structure .

Posted in Best Practices for Merchants Tagged with: (AP), Account Payable, AP administrator, b2b, buyer, compliance, data, E-Invoice, E-Invoicing, E-Invoicing system, EDI, EDI electronic invoices, electronic data interchange, electronic format, electronic invoices, Electronic invoicing, Finance leaders, Internet-based web, invoice document, invoicing, National Transaction, Paper invoices, Security, supplier, web