February 10th, 2015 by Elma Jane

National Transaction Corporation and it’s medical software partners is introducing new “Payment Processing” solutions that can help your practice, securely and efficiently, capture payments and better serve patients. NTC offers a variety of solutions to accept patient payments/co-pays in the office, on the phone and online. With our solutions, you can make it more convenient for patients to pay via debit or credit card at the point of care to help drive more consistent cash flow. In addition we can help expedite receipt of claim payments using Medipaid, our new solution from NTC that replaces paper check payments you receive from insurance companies with fast, secure electronic deposits. Medipaid combines the convenience of electronic payments with standardized ERAs (electronic remittance advice) and automated posting options. It can help your practice accelerate cash flow and simplify reconciliation processes.

Here are some benefits when using this new and exciting program:

- Eligibility resolution

- Claims and tracking

- Rejections and denials

- Patient billing and payments

- Reporting and metrics

- Clinical tools

- 24/7 support

- Updated payer list information

- Payment Integrity/PCI compliant

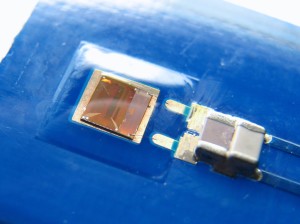

- Tokenization & Encryption payment security (EMV microchip cards)

- Clinical exchange solutions

- HIPAA simplified

- E-payment (EFT & ERA)

- ICD-10 information on deadline set for October 1, 2015

- Regulation mandates from HIPAA and Affordable Care Act

If you are interested in learning more about our payment processing solution and Medipaid, we will be happy to e-mail additional information. Please feel free to contact us regarding any of your payment processing needs.

Contact Elaine Zamora RN @ 954-346-3300 Ext. 1111 or Email: elaine@nationaltransaction.com

Posted in Medical Healthcare, nationaltransaction.com Tagged with: cash flow, claim payments, credit-card, debit, electronic deposits, electronic payments, electronic remittance advice, insurance companies, paper check, payment processing, payments, solutions

January 26th, 2015 by Elma Jane

Accept Electronic Payments in Their Currency,

Convert it to Yours

DCC or Dynamic Currency Conversion is a system where the Visa or MasterCard holder in a foreign country can shop on an American based web site that displays prices in their own local currency. The web site can offer multiple choices as to which country the shopper is based in and the shopper can be immediately familiar with the pricing of goods and services.

Exchange rates are in constant flux. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. Even if the shopper does not choose the correct currency, at the time the card information is presented, the system automatically recognizes that the card is foreign and applies the appropriate currency and exchange rate.

At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied. In today’s global business environment, this level of convenience to the customer insures they are comfortable with the transaction from shopping cart to the door. Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line.

On the merchant end, all transactions are settled in $USD. Reporting mechanisms can display the consumers pricing and the exchange rate they paid for analysis and cost reduction.

Currency Conversion

- Accept currencies from other nations.

- Convert funds to US Dollars.

- Set prices in local currency to avoid confusion or calculation.

- Works with e-commerce as well as Mail Order / Phone Order.

- Ease the sales process for your customers.

- Increase customer familiarity.

- Immediately convert currency to avoid value gaps.

Posted in Best Practices for Merchants, Electronic Payments Tagged with: Bank Reference Table, Card Recognition Table, consumer, conversion rate, currency, customer, Dynamic Currency Conversion, e-commerce, electronic payments, exchange rate, invoice, MasterCard, Merchant's, receipt, shopping cart, transactions, visa

November 4th, 2014 by Elma Jane

“Healthcare’s Unique, Robust MEDIPAID Rolls Out”

Delivering paperless, next-day deposits for Medical Billers

National Transaction Corporation (NTC) in Coral Springs, Florida announced today that, by the first of December 2014, their paperless medical insurance electronic funds capturing suite: MEDIPAID will be fully functional nationwide. NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance billing. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

NTC’s agents help merchants standardize their Electronic Remittance Advice (ERA) and distribution options to automate posting which further reduces paper and time burdens. At a rate far less than credit card processing or third party billing companies, MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

For more information, Contact us anytime.

National Transaction Corporation

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: billing, check payments, credit card processing, credit-card, electronic funds, electronic payments, Electronic Remittance, health insurance, Medical Billers, merchant accounts, Merchant's, paperless medical insurance, secure electronic payments

October 8th, 2014 by Elma Jane

When the PCI Security Standards Council (PCI SSC) launched PCI DSS v3.0 in January 2014, businesses were given one year to implement the updated global standard. Now that the deadline is fast approaching, interest is picking up in what v3.0 entails. On Jan. 1, 2015, version 3.0 of the Payment Card Industry (PCI) Data Security Standard (DSS) will reach year one of its three-year lifecycle.

Trustwave, a global data security firm, is on the frontlines of helping secure the networks of merchants and other businesses on the electronic payments value chain against data breaches. As an approved scanning vendor, Trustwave is used by businesses to achieve and validate PCI DSS compliance.

PCI DSS v3.0 is business as usual for the most part, except for a few changes from v2.0 that considers impactful for large swaths of merchants. The top three changes involve e-commerce businesses that redirect consumers to third-party payment providers. The expansion of penetration testing requirements and the data security responsibilities of third-party service providers.

Penetration testing

Penetration testing is the way in which merchants can assess the security of their networks by pretending to be hackers and probing networks for weaknesses. V3.0 of the PCI DSS mandates that merchants follow a formal methodology in conducting penetration tests, and that the methodology goes well beyond what merchants can accomplish using off-the-shelf penetration testing software solutions.

Merchants that are self assessing and using such software are going to be surprised by the rigorous new methodology they are now expected to follow.

Additionally, penetration testing requirements in v3.0 raises the compliance bar for small merchants who self assess. Those merchants could lower the scope of their compliance responsibilities by segmenting their networks, which essentially walls off data-sensitive areas of networks from the larger network. In this way merchants could reduce their compliance burdens and not have to undergo penetration testing.

Not so in v3.0. If you do something to try to reduce the scope of the PCI DSS to your systems, you now need to perform a penetration test to prove that those boundaries are in fact rigid.

Redirecting merchants

The new redirect mandate as affecting some, but not all, e-commerce merchants that redirect customers, typically when they are ready to pay for online purchases to a third party to collect payment details. If you are a customer and you are going to a website and you add something to your shopping cart, when it comes time to enter in your credit card, this redirect says I’m going to send you off to this third party.

The redirect can come in several forms. It can be a direct link from the e-commerce merchant’s website to another website, such as in a PayPal Inc. scenario, or it can be done more silently.

An example of the silent method is the use of an iframe, HTML code used to display one website within another website. Real Estate on the merchant’s website is used by the third-party in such a way that consumers don’t even know that the payment details they input are being collected and processed, not by the e-commerce site, but by the third party.

Another redirect strategy is accomplished via pop-up windows for the collection of payments in such environments as online or mobile games. In-game pop-up windows are typically used to get gamers to pay a little money to purchase an enhancement to their gaming avatars or advance to the next level of game activity.

For merchants that employ these types of redirect strategies, PCI DSS v3.0 makes compliance much more complicated. In v2.0, such merchants that opted to take Self Assessment Questionnaires (SAQs), in lieu of undergoing on-site data security assessments, had to fill out the shortest of the eight SAQs. But in v3.0, such redirect merchants have to take the second longest SAQ, which entails over 100 security controls.

The PCI SSC made this change because of the steady uptick in the number and severity of e-commerce breaches, with hackers zeroing in on exploiting weaknesses in redirect strategies to steal cardholder data. Also, redirecting merchants may be putting themselves into greater data breach jeopardy when they believe that third-party payment providers on the receiving end of redirects are reducing merchants’ compliance responsibilities, when that may not, in fact, be the case.

Service providers

Service provider is any entity that stores, processes or transmits payment card data. Examples include gateways, web hosting companies, back-up facilities and call centers. The update to the standard directs service providers to clearly articulate in writing which PCI requirements they are addressing and what areas of the PCI DSS is the responsibility of merchants.

A web hosting company may tell a merchant that the hosting company is PCI compliant. The merchant thought, they have nothing left to do. The reality is there is still always something a merchant needs to do, they just didn’t always recognize what that was.

In v3.0, service providers, specifically value-added resellers (VARs), also need to assign unique passwords, as well as employ two-factor authentication, to each of their merchants in order to remotely access the networks of those merchants. VARs often employ weak passwords or use one password to access multiple networks, which makes it easier for fraudsters to breach multiple systems.

The PCI SSC is trying to at least make it more difficult for the bad guys to break into one site and then move to the hub, so to speak, and then go to all the other different spokes with the same attack.

Overall, v3.0 is more granular by more accurately matching appropriate security controls to specific types of merchants, even though the approach may add complexity to merchants’ compliance obligations. On the whole a lot of these changes are very positive.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (PCI SSC), call centers, cardholder data, consumers, credit-card, customers, data breaches, data security assessments, Data Security Standard, e-commerce breaches, e-commerce businesses, e-commerce merchant's website, electronic payments, global data security, global standard, Merchant's, merchant’s website, mobile, networks, payment, payment card data, Payment Card Industry, payment providers, PCI Security Standards Council, PCI-DSS, Penetration testing, Service providers, shopping cart, software solutions, web hosting, website

August 21st, 2014 by Elma Jane

Accept Electronic Payments in Their Currency, Convert it to Yours. National Transaction helps you and your customers transact with confidence.

DCC provides convenient currency conversion service at the time of purchase benefiting both the credit card holder and merchants. Our solution provides a system where the Visa or MasterCard holder in a foreign country can shop on an American based website that displays prices in their own local currency. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied.Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line and making international transaction with confidence. We have diverse set of applications to enable various kinds of business models and financial frameworks.

Posted in Best Practices for Merchants Tagged with: Bank Reference, Card Recognition, conversion rate, credit-card, currency, Currency Conversion, customers, DCC, Dynamic Currency, electronic payments, exchange rate, financial, invoice, MasterCard, Merchant's, pricing, rate, receipt, transactions, visa, website

February 3rd, 2014 by Elma Jane

The migration to cards that use chips instead of magnetic strips, known as EMV technology, is well underway in the U.S. No government regulation is needed to make it happen. But the EMV migration and the Target breach are different things. It’s true that EMV chip cards can prevent criminals from producing counterfeit cards using stolen account numbers. But EMV doesn’t stop criminals using stolen cards online. So innovators are deploying new technologies to deter other forms of fraud.

Headline-grabbing events inevitably lead to calls for new laws. But in the case of our nation’s electronic payments systems, new government mandates would stifle marketplace innovations that hold great promise for providing consumer benefits and reducing criminal activities.

Financial institutions compete for customers by providing consumer protections even beyond requirements of current law. Many retailers also offer customers speedy transactions, such as “sign and go” and “swipe and go” for small transactions, while the payments industry ensures consumers still have zero liability. These protections and flexibility are why U.S. consumers are going cashless and carry more than one billion debit and credit cards. More than 70% of retail purchases are made with electronic payments, and our member companies process more than $4 trillion in electronic payments each year.

Fraud accounts for fewer than six cents of every $100 spent on payments systems – a fraction of a tenth of a percent. U.S. companies have made significant financial and technological investments, building sophisticated fraud tools that insulate consumers from liability. To build on this, Congress should foster greater international law enforcement cooperation to fight cybercrime, particularly in countries that harbor crime rings, and replace 46 divergent state breach notification laws with a uniform national standard.

The private sector is best positioned to address the constantly shifting tactics of criminals, and it is doing so without government mandates. Do Americans really want the government in charge of the security and monitoring of our payments?

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Visa MasterCard American Express Tagged with: counterfeit cards, cybercrime, data breach, debit and credit cards, electronic payment systems, electronic payments, emv chip cards, emv technology, fraud, liability, magnetic strips, migration, online, security and monitoring of our payments, small transactions

December 5th, 2013 by Elma Jane

Recently, Consumer Reports reviewed 26 different prepaid cards and evaluated them based on different factors. The cards Consumer Reports considered to be the best scored well in each of these four factors:

- Clarity of Fees — How well the fees are disclosed.

- Convenience — Availability of in-network ATMs, bill pay features and how widely the card network brand is accepted.

- Safety — Whether funds are protected with FDIC deposit insurance.

- Value — How much they cost to use.

This is the first time Consumer Reports has evaluated and ranked prepaid cards, revealing a shift in the market for prepaid. As prepaid cards continue to grow in popularity, consumers are going to become savvier about which prepaid cards they purchase. Consider taking a closer look at this Consumer Report to determine how your financial institution’s (FI’s) prepaid offering measures up.

Highest ranked cards are those like the ATIRA suite of prepaid cards TMG’s clients issue. They have fewer fees and make it easier for consumers to avoid them, carry FDIC insurance for each cardholder, offer features comparable to traditional checking accounts and do a better job of disclosing fees.

Not surprisingly, the worst prepaid cards reviewed scored poorly in at least one, and sometimes several, of the above categories. All of the lowest ranked cards have high, unavoidable fees, including activation and monthly fees. Additionally, the lower scoring cards fail to make their fees clear and easy for consumers to access and understand.

Specifically, the report found some prepaid cards fail to provide clear explanations of how to use features such as electronic payments, text alerts and mobile remote deposit capture, and the fees that may be charged for them. Further, while all of the cards reviewed claim to offer some form of protection for consumers, the report found in these policies are often not clearly defined.

Consumer Reports also found it problematic that although issuers provide safeguards voluntarily, they can cancel them at any time. Additionally, according to the report, fee information is often hard to find and difficult to understand. The report states this problem is compounded by the lack of consistency with fee names and descriptions” from card to card, making it challenging for consumers to compare fees and costs. Consumer Reports also found that prepaid cards offered by some of the big banks are not necessarily less expensive than other prepaid cards. Also, these big bank offerings may be less attractive to consumers because they often don’t provide the option of making both electronic payments and payment by paper check.

Posted in Credit card Processing, Financial Services Tagged with: accounts, activation, ATMs, banks, bill pay, card network, cardholder, cards, costs, deposit, electronic payments, fees, financial institution, In-network, insurance, mobile remote deposit capture, monthly fees, paper check, prepaid, text alerts

August 12th, 2013 by Admin

Small businesses are gaining traction in the mobile payment landscape. Mobile credit card readers attached to a smartphone or tablet now account for billions of dollars in m-commerce sales. “Together, mobile and social are transforming the way SMBs acquire and retain customers, With the heavy use of social media, SMB marketing is quickly becoming a two-way engagement rather than a one-way promotion.” Said Steve Marshall of BIA/Kesley. As more people switch to and upgrade their smartphones, AT&T, Verizon and T-mobile are looking to partner with digital wallet provider Isis. Read more of this article »

Posted in Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Smartphone Tagged with: American Express, biometrics, electronic payments, iPhones, m-commerce, mobile, PayPal, recognition, Smartphones, Square

China

People’s Online Daily is reporting that online electronic payment transactions carried out on Chinese mobile payment providers is expected to be above 9 Trillion yuan, which is $1.45 Trillion in U.S. Currency. China’s mobile electronic payments in 2012 were at 800 billion yuan. That sets an increase in mobile payments made on smartphones and tablets at 265% over the previous year. With more and more Chinese citizens coming online analysts say that the steady growth in the mobile payment landscape is expected to continue to rise well into 2020. Last year, mobile electronic payment transactions rose 66% to nearly 3.7 trillion yuan. Read more of this article »

Posted in Mobile Payments Tagged with: China, Digital Wallet, electronic payments, Illinois, India, mobile payment, mobile wallet, Processing, transactions

Businesses looking to make an impact on their bottom line should take a look at the way they process electronic transactions. Today consumers view their transactions as an experience gravitating toward convenience. Long lines at the cash register can often turn away customers, sending them to competitors who might have more convenient ways to pay and therefore shorten time spent to complete the purchase. Impulse buyers are another reason to make sure that transactions go as smooth as possible increases the chance of future purchases. Read more of this article »

Posted in Electronic Payments Tagged with: account, application, electronic payments, electronic transactions, fees, merchant, process, process transactions, Processing, Rates