October 8th, 2015 by Elma Jane

Rules have changed in regards to swiping credit cards October 1st, 2015 with the EMV Liability Shift; which may not cause much concern for most consumers, but for merchants.

EMV compliance isn’t a legal requirement. However, if you’re a merchant that accepts credit cards in-person, then you need to find out whether you’re meeting the EMV Standard. The new rule for the liability shift applies October 1st, regardless of the size or type of business.

What Is EMV Standard?

EMV stands for EuroPay, MasterCard, and Visa, the three companies that originally created the standard.

The EMV Shift is to provide enhanced security and prevent fraudulent activity with credit cards. Updated equipment is also necessary for processing the new computerized cards, and unfortunately, the responsibility of securing up-to-date hardware falls on the merchant.

Since card evolves more instead of cash in our society, fraud and data breaches is on the increase, and now a common occurrence. Adapting new technology is therefore necessary. A hassle for many merchants, but there are actually benefits from all parties involved in a credit card transaction.

Data shows that fraud decreases dramatically when EMV Standards are implemented In Europe. The region has experienced an 80% reduction in credit card fraud, while the USA has seen a 47% increase by NOT implementing EMV standards.

The new liability rules took effect on October 1st in the US, and any party that has not yet implemented EMV-compliant machines might now be liable for fraud committed with counterfeit chip cards. Note that this liability shift only applies to in-person transactions. Phone order and web order transactions will be dealt with as they always were.

For Merchants, it means you’ll eventually need to get new equipment for processing credit cards payments in-person (unless you’ve already done so not too long ago, as nearly all POS terminals sold in the USA nowadays are EMV compliant). For most business owners, it’s a good idea to implement the new system sooner rather than later.

Step to take as a Merchant Until you get your EMV equipment

- Ask for an official ID from customers whose credit card you process.

- Conduct some research to see which EMV system would be best for your business.

- Start shopping around for new payment processing options that are EMV compliant.

If you already have a machine that can process chip cards, you’re fully EMV-compliant.

If you don’t accept any in-person payments, then you’re all set.

If you do accept in-person payments and you do not have a chip card machine, chances are you’ll be fine for a little while. But those of you with a high risk of encountering a fake card (if you are a high-volume business with a large average ticket, for instance) should probably upgrade soon.

Fraudsters are going to be taking advantage of businesses that haven’t upgraded so it’s a great time to switch!

Check out NTC’s EMV/NFC Capable Terminal!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: chip cards, credit card transaction, credit cards, credit cards payments, EMV, EMV equipment, EuroPay, high risk, MasterCard, merchants, nfc, payment processing, POS terminals, visa

October 6th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Liability Shift rules set by Visa and MasterCard as of October 1st. The liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

National Transaction Terminals with EMV and NFC (near field communication) Capability To accept Apple Pay, Android Pay and other NFC Transactions at your business. You will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs.

If you’re using Virtual Merchant Mobile now called Converge please contact our office at 888-996-2273 to know your options.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: Android Pay, Apple Pay, chip cards, contactless readers, Converge, credit cards, EMV, EuroPay, magnetic stripe, MasterCard, merchants, Near Field Communication, nfc, payments, POS, terminal, Virtual Merchant Mobile, visa

October 1st, 2015 by Elma Jane

The day the payments industry has pointed to for several years arrives today, a turning point in the U.S.‘s migration to EMV chip-and-PIN cards.

Rules set by Visa and MasterCard as of today, the liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards. Banks will be issuing EMV Chip Cards.

An enormous change, as everyone learns to deal with the new technology that requires consumers to insert their cards and leave them in the store machines throughout a payment transaction, rather than swipe.

In a recent survey, less than a third of merchants overall have invested in EMV-compliant technology, and one study said 80 percent of small and midsize merchants have not upgraded their systems as of today’s liability shift.

Issuers are claiming to be more prepared than merchants, but according to the Smart Card Alliance, around 200 million chip cards have been issued to U.S. cardholders. That, however, is less than 17 percent of the approximately 1.2 billion payment cards in circulation.

What is clear is that today does not represent the end of the journey. The lack of preparedness at the physical point of sale, however, may be beneficial for card-not-present merchants.

Over the past few months, the mainstream media has awoken to the fact that implementing EMV does not mean fraud will disappear. Fraudsters quickly adapted to the difficulty of counterfeiting cards by attacking Card-Not-Present channels, where a chip has no effect.

In other markets, fraud migrated quite rapidly to card-not-present channels. It is necessary on e-commerce merchants to protect themselves with an array of tools, like device authentication, one-time passwords, randomized PIN pad and biometrics. Fraud mitigation tools like data analytics, address and CVV verification, 3D secure and tokenization. These services should be available from their merchant acquirer processor or gateway.

There should be a gradual reduction in card fraud over the next 12-18 months in spite of the delays in this country’s EMV migration. It’s going to take time for the technology to be adopted.

U.S. Merchants’ overall relative lack of preparedness for EMV may give e-commerce and mobile merchants time they didn’t think they would have to explore the options.

Sophisticated authentication technologies such as biometrics will help increase the security of card transactions. Device-based verification could be easily incorporated in an EMV transaction.

Banks have expressed interest more in using the phone as a biometrics. It’s all going to depend on what is the most convenient way to access your funds. The nice thing about biometrics is it’s meant to enable more convenience and stronger security.

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: banks, biometrics, card fraud, card-not-present, chip cards, chip-and-PIN cards, e-commerce, EMV, gateway, merchant acquirer, merchants, mobile merchants, payments industry, point of sale, POS system, processor, tokenization, Visa and MasterCard

September 24th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Questions to ask to help you decide about terminal upgrade.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: chip, credit card reader, credit cards, data, EMV, emv cards, EuroPay, magnetic stripe cards, MasterCard, merchants, Mobile Devices, Near Field Communication, nfc, payments, point of sale, POS terminal, visa

September 22nd, 2015 by Elma Jane

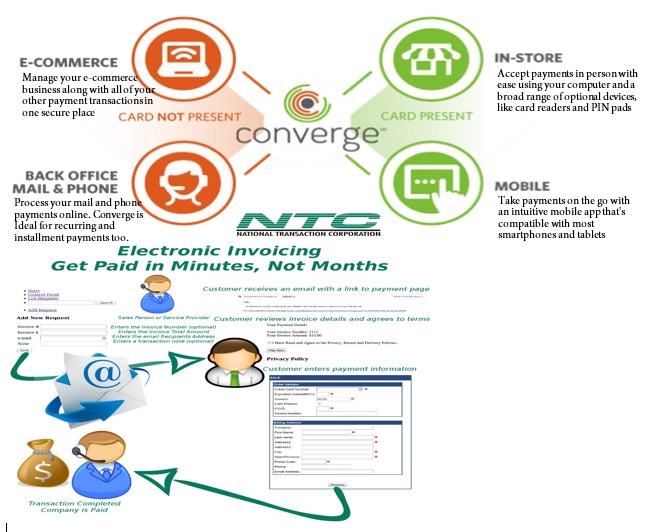

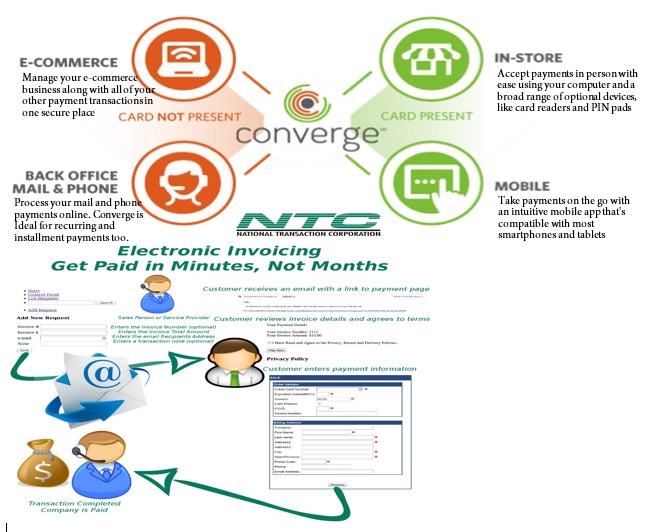

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

August 13th, 2015 by Elma Jane

The credit card processing industry, have been working towards including EMV technology in all of the point of sale systems.

Many processors have sent out EMV capable devices that will need to be adjusted before they can start accepting EMV card transactions.

See which category you fall into so you are prepared when October 1 rolls around.

First, check and see if your credit card machine has the slot to accept EMV cards (it’s either a slot in front, or on the top of, the unit). If you don’t, you need to contact your processors or sales agent to update your equipment .

If you do have the slot for EMV cards, you’ll need to contact National Transaction to see if your EMV capable machine has been enabled to accept EMV cards.

What is the difference between EMV capable and EMV enabled?

- EMV Capable – EMV capable means that your credit card machine is equipped with the hardware (i.e. the slot) and has the capability to do a transaction, but first you’ll have to update the application to enable you to process the cards. At National Transaction, we have a support specialist to assist you with step-by-step instructions to switch your credit card Point-of-Sale System, from EMV capable to EMV enabled.

- EMV Enabled – When your machine is EMV enabled, your terminal is ready to accept EMV transactions. According to MasterCard, 73 percent of consumers say owning a chip card would encourage them to use their card more often. In addition, 75 percent of consumers expect to use their chip card at the merchants where they shop today. Keeping these numbers in mind, it only makes sense to equip your business with an EMV enabled credit card POS system.

What makes EMV technology so important?

EMV is a global payment system that adds a microprocessor chip into credit cards and debit cards, and reduces the chance a transaction is being made with a stolen or copied credit card. Unlike traditional magnetic-stripe cards, anytime you use an EMV card, the chip in the card creates a unique transaction sequence that can’t be replicated. Because the number will never be valid again, it makes it hard for hackers to fake these cards. If they attempt to use the copied EMV card, the transaction would be denied.

The rollout of EMV technology is ongoing, but even with the October 1 deadline, it’s estimated that only 70 percent of credit cards and 40 percent of debit cards in the U.S. will support EMV. Despite these numbers, that doesn’t mean you shouldn’t update your equipment.

Following the deadline, card present fraud liability will shift to whoever is the least EMV compliant party in a fraudulent transaction.

Make sure that’s not you!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: card present, card transactions, chip, chip card, credit card, credit card processing, debit cards, EMV, EMV capable, EMV enabled, emv technology, magnetic stripe cards, merchants, payment system, point of sale, POS, processors, terminal

July 30th, 2015 by Elma Jane

Converge Powers Potential

Over the next several weeks, we’ll focus on a series of topics to hopefully provide a better understanding of the payment capabilities

Converge can bring you customers. In this article, we’ll zoom in on the card-present product enhancements of Converge first, including bringing EMV and mobile wallet capabilities to in-person payments, and ultimately VirtualMerchant Mobile later this year.

New Peripherals Added to Converge – Ingenico iSC250 and Star Micronics TSP650II Printer

Ingenico iSC250 Signature-Capture PIN Pad – is a signature-capture PIN pad offering the ability to accept PIN-based transactions, like debit card and Electronic Benefit Transfer (EBT), as well as EMV chip card and mobile wallet payments.

The iSC250 will initially ship EMV-capable meaning it’s physically configured with a slot to accept an EMV chip card, but it does not yet have the EMV application to process a chip card transaction.

A simple download process later in the year will allow customers to accept chip cards. The good news is customers can accept NFC contactless payments right away, including Apple Pay and Google Wallet.

Key features of the Ingenico iSC250 include:

- EMV-capable smart card reader to support EMV chip cards; EMV-enabled with a download later in the year

- NFC-enabled for contactless cards and Apple Pay and Google Wallet mobile wallets

- Magnetic stripe capture for all standard mag stripe cards

- Encryption technology to help secure cardholder data at point of entry and throughout the payment network

- Signature Area Display for signature capture with electronic stylus

- Bright color 4.3″ display and backlit key pad for ease of use

Star Micronics TSP650III:

In addition to the new iSC250PIN pad, a new USB printer were also added to the lineup of Converge supported peripherals, the Star Micronics TSP650II receipt printer. Now customers have two options for thermal receipt printing!

ConvergeConnect Makes Device Setup a Snap

A new peripheral and device management software called ConvergeConnect to make it easier for your customers to setup their devices quickly as well as add additional peripherals as their business needs grow. It will be the go-forward device management application, and we’ll be able to bring more and more EMV and NFC devices to market faster, giving our customers even more in-store payment processing options.

Legacy peripherals, like magnetic stripe card readers, check imagers and the Epson ReadyPrint T20 printer will continue to be managed using the Device Assistant.

Customers may have to use both ConvergeConnect and Device Assistant depending on their peripheral configuration.

A new Peripheral Device Installation and Setup Guide was developed to help customers install and manage their peripherals for both applications.

Converge Mobile with EMV on the Horizon

Work continues on the new VirtualMerchant Mobile app to be branded as Converge Mobile, and releasing the Ingenico iCMP in the third quarter. The Ingenico iCMP accepts EMV and NFC transactions, including contactless cards and mobile wallets, like Apple Pay. Stay tuned as more information becomes available.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication Tagged with: card-present product, cardholder, chip card, contactless payments, data, debit card, EBT, Electronic Benefit Transfer, EMV, mag stripe cards, mobile wallet, nfc, NFC transactions, payment network, payments, PIN pad, PIN-based transactions, smart card reader, VirtualMerchant Mobile

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

July 10th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal. Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: cardholder, cards, chips, EMV, emv cards, EMV terminal, EuroPay, magnetic stripes, MasterCard, merchant, nfc, payment cards, payments, PIN transactions, terminal, visa

June 25th, 2015 by Elma Jane

A product or service using a credit card or debit card should be efficient, fast and most importantly safe. There are a lot of regulations in place to make sure that the processing of payments using a card is safe and secure. One of the way is the EMV (Europay, MasterCard and Visa) technology, where payment cards used in an ATM and POS Terminals have been embedded with microchips. This form of payment technology has long been in use and is widely accepted in many regions such as Europe, Canada and Asia Pacific. The US, which is considered to be the largest number of plastic card users is one of the countries that have not yet fully optimized this otherwise global standard.

Advantages Of EMV – EMV embedded chip is a lot more secure than the traditional magnetic stripe, especially when it comes to face-to-face credit/debit card transactions. Credit card fraud is rampant, but using this embedded chip has added another layer of protection against consumer fraud. Once the card has been inserted into a terminal, the payment will then be authenticated and processed using the EMV network. The chip within the card is hard to duplicate.

What Does This Mean For Your Business? – You will create more credibility and garner more customers in the market place by utilizing this more safe and secure payment method. There will be increased in consumer confidence.

What Happens When You Don’t Upgrade? – There is a Liability Shift. Currently, If a payment processing transaction has been approved and it turns out to be fraud, it’s the card issuer loss. With the new rule, liability shifts to merchants who has not implemented the EMV technology. When fraud happens, the responsibility falls on the business owner who makes the transaction.

How To Prepare Your Business For EMV? – Upgrade your terminal. Contact National transaction and we’ll help you prepare your business for the EMV migration.

Upgrading your current payment processing system is easy with NTC.

Give Us A Call Now! 888-996-2273

Check our website http://nationaltransaction.com click Demos and Videos to learn more!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: atm, card, chip, credit card, Credit card fraud, debit card, Debit Card transactions, EMV, EMV migration, EMV network, EuroPay, magnetic stripe, MasterCard and VISA, merchants, microchips, payment, payment cards, payment processing, payment technology, payments, POS terminals, terminal