December 18th, 2024 by Elma Jane

What makes your travel merchant account high risk?

Travel environments are unique and transactions are usually keyed in. There’s almost always a delayed delivery period, and large ticket transactions.

One card holder may be paying for multiple tickets and they tend to be seasonal; with peak season months generating an unusual spike in their “average” monthly volume and chargebacks, pose a potential threat by travelers who are unable to complete their trip.

These factors can cause for either a reserve or account termination. Therefore travel merchant accounts are considered high risk.

Most merchants do not realize that merchant processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank. Therefore, a merchant account is an unsecured loan.

The merchant runs a transaction and at the end of the day they settle their batch. The merchant will receive the funds for that batch in their bank account within 2 business days, even though the travel arrangements the client paid for do not take place right away.

Here at National Transaction Corp, we specialize in understanding what makes your transactions as a travel agent unique and how they affect your merchant account.

Educating the merchant and ensuring they have a good understanding of what makes travel merchant account high risk, is one of our specialties.

Call NTC to speak with a Travel Merchant Account Specialist today!

Dial 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, card, chargebacks, financial, loan, merchant, payment, processors, transactions, travel, travel agent, Travel Merchant

March 7th, 2017 by Elma Jane

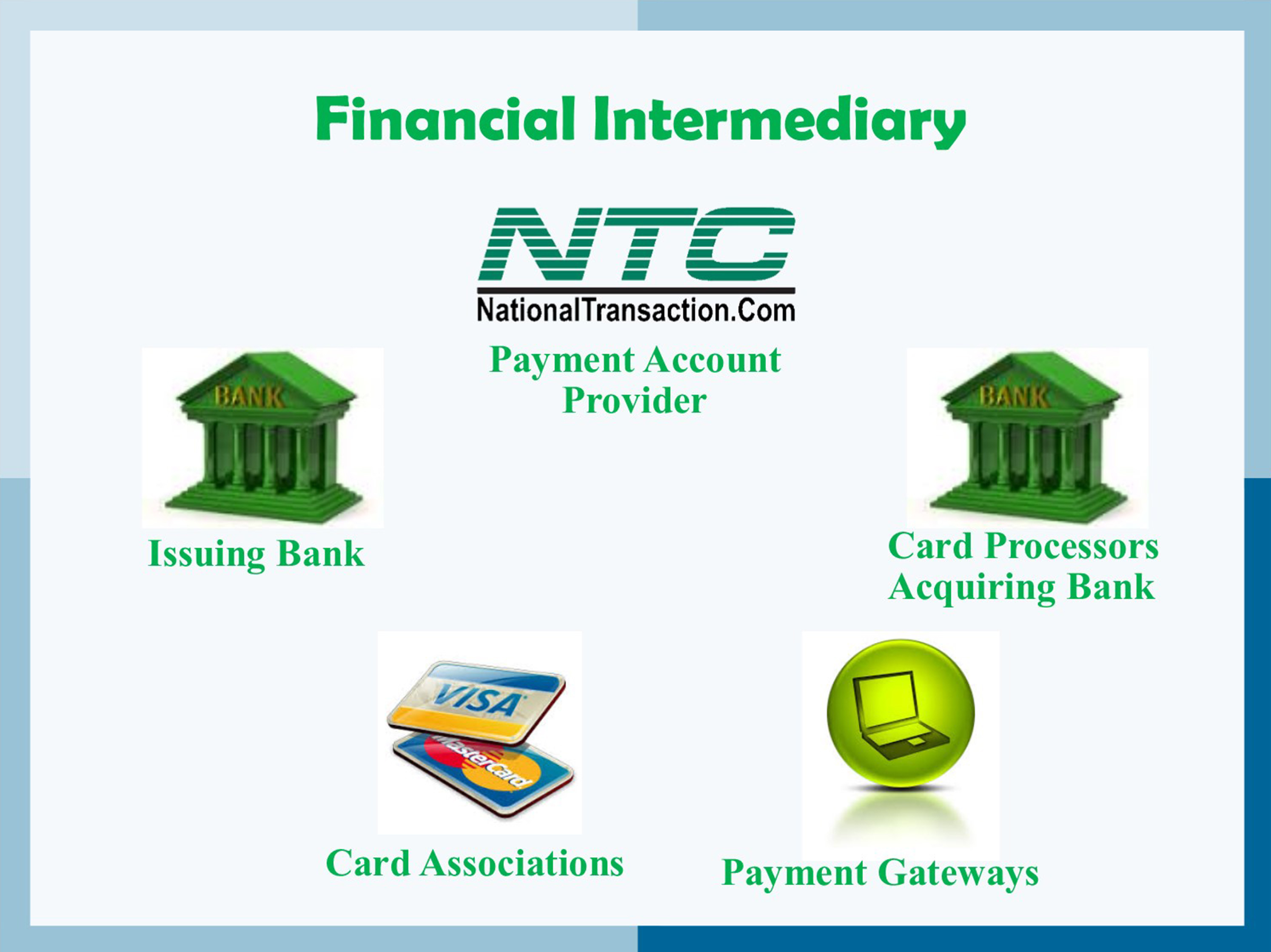

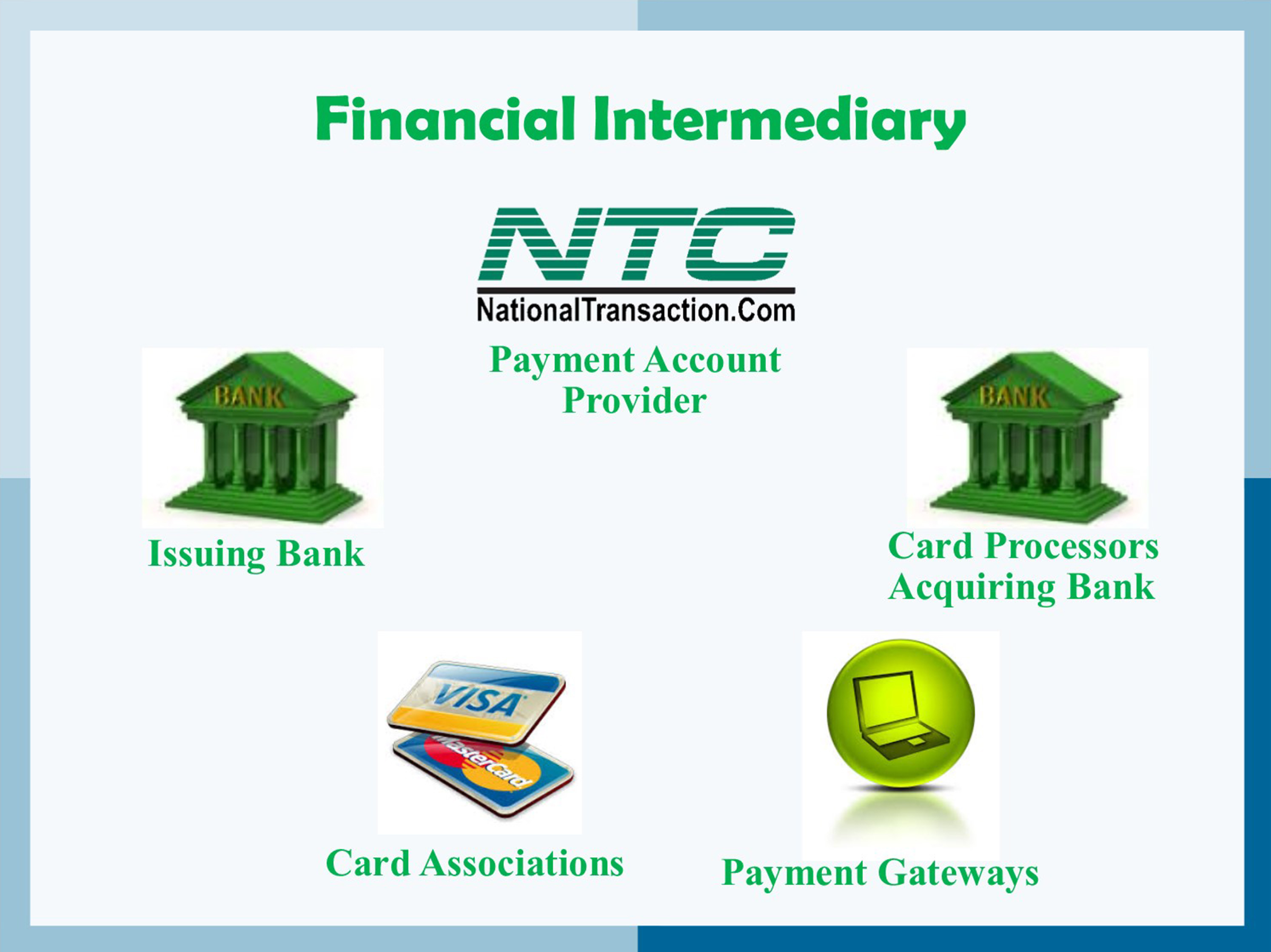

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

February 9th, 2017 by Elma Jane

Electronic Giving Is it Right for your Church?

The congregation is ready for Electronic Giving, implement Electronic Giving in your Chruch with NTC.

According to Federal Reserve Bank, people are writing fewer checks and using electronic payments more.

Reasons Church should offer Electronic Giving:

Donors can make additional contributions.

Electronic Giving encourage and promote Financial Health.

Infrequent givers become regular givers with Recurring Payments.

People who can’t attend service or forgot to bring checkbook can still give.

NTC Electronic Giving Offers:

Mobile offsite activities fundraising-NTC E-Pay email invoicing-Security data Breach Protection

Automatic, recurring donations: Reoccurring Donations: Secure Payment Form For:

Online Electronic Giving Auto updater Website

Use credit or debit card Web Form Social Media

For Electronic Giving call now 888-996-2273 or visit www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants Tagged with: credit or debit card, E-Pay, electronic, electronic payments, financial, invoicing, mobile, online, Recurring Payments, Security

July 5th, 2016 by Elma Jane

With the ever growing number of financial crimes occurring within the payments industry, initiatives to identify patterns of possible suspicious behavior has been enhanced. The Loss Prevention team recently put into place a new procedure for collecting information pertaining to the Anti-Money Laundering requirements of “Customer Due Diligence” (CDD) and “Customer Identification Program” (CIP).

If a merchant reaches their Processing Limit (Soft Cap), or they request a change to their MCC/SIC, Loss Prevention is required to obtain and validate CDD and CIP information prior to making updates to the account. Loss Prevention representatives will reach out to the customer’s Merchant Service provider (MSP) office first, in an effort to effectively obtain the information without causing potential alarm to the customer.

Thank you for being a partner with NTC, and helping to prevent financial crimes in our industry.

Posted in Best Practices for Merchants Tagged with: customer, financial, merchant, payments, payments industry, service provider

June 28th, 2016 by Elma Jane

Financial Cost – on average, it costs a small business between $36,0000 and $50,000 in the event of a data breach. From PCI examination to liability costs and POS upgrades. The many costs of a data breach add up.

Notification Cost – if your business falls victim to a data breach, it is your moral and sometimes legal (depending on the state in which your business operates) obligation to notify your customers of the breach.

Reputation Cost – data breach lessens your credibility and trust with your customers. This can have a long-term affect on your business.

Time Cost – as a small business owner, your focus is on the daily operations of your business. In the event of a data breach, your focus will be shifted entirely to clearing up the issue.

The cost of a data breach is more than financial and can often have a lasting negative impact on your business.

The quickest and easiest way to protect your business is to prevent fraud from happening. At National Transaction, we give importance to your security. For your electronic payments needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: customers, data breach, electronic payments, financial, fraud, PCI, POS, Security

June 14th, 2016 by Elma Jane

Getting a merchant account is an important step for any business that sells services. Helping merchant to understand the underwriting process and some of the key things that are reviewed, in order to get approved.

Billing policy – Does the business bill in advance or after products or services are rendered? Businesses that bill too far in advance are at greater risk for a chargeback.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip, you’ll need to reimburse your customers.

Business type – Some business types are riskier. Industries with vague products or services are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback might be issued by the cardholder when they feel that the merchant does not fulfil the product or service being rendered as agreed.

Owner / signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – Are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting, it speaks for their legitimacy. They are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants Tagged with: business, cardholder, chargeback, customers, financial, Industries, merchant account, products, services, travel, travel agency

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

March 4th, 2016 by Elma Jane

A number of financial institutions are beginning to implement biometric authentication. They started to replace traditional knowledge-based passwords with biometric authentication.

A British multinational banking is introducing biometric tests for its customers in U.K., letting account holders access online banking using their fingerprint or voice. If you’re using phone-banking services you can register your voiceprint with the company instead of using a regular password. A special voice biometrics technology will analyze a customer’s voice when they call the bank.

Customers using Apple’s Touch ID will be able to access their accounts on their mobile phones using their fingerprint.

Customers in the U.S., Canada, Mexico, Hong Kong, and France will have the technology by the end of the year. Other markets will follow in 2017 and 2018. The British multinational banking and financial services company have nearly 50 million retail banking customers around the world.

Posted in Best Practices for Merchants, Financial Services Tagged with: account, bank, banking, biometric, customers, financial, financial institutions, financial services, mobile, online, retail

November 19th, 2015 by Elma Jane

Cyphort Advance Malware Defense, the next generation Advanced Persistent Threat (APT) defense company, recently analyzed the top financial malware threats cybercriminals are using to target electronic payment systems. This will raise awareness of the dangers they present.

Most dangerous financial malware threats of 2015:

Zeus – Since debuting in 2007, this malware has infected tens of millions of computers worldwide. Financial service professionals consider it to be the most severe threat to online banking.

SpyEye – This Trojan horse has infected 1.4 million computers worldwide. Banking information is stolen using a keylogger application, and the bot can take screenshots of a victim’s machine.

Torpig – This botnet is spread using a Trojan horse called Mebroot. Torpig steals targeted login credentials to access bank accounts. It is difficult to detect because it hides its files and encrypts its logs.

Vawtrak – This a relatively new Trojan that can spread itself via social media, email and file transfer protocols. Its unique feature is that it can hide evidence by changing the balance shown to the victim.

Bebloh – This malware targets login credentials to intercept online transactions and breach financial systems.

Shylock – Attacks European banks via Man-in-the-Browser exploits. Worldwide, it has infected 60,000 computers using Microsoft Windows.

Dridex – Malicious code is executed via email attachments and Microsoft Word documents that contain macros that can download a second-stage payload, which can then download and execute the Trojan.

Dyre – Relies on malicious PDF attachments that can exploit unpatched versions of Adobe Reader. The email subject line will be misspelled and read “Unpaid invoic” or contain the attachment “Invoice621785.pdf.” Once the document is opened, Dyre can obtain bank account credentials.

Financial malware has been around for more than a decade, it is quickly evolving in sophistication, to make sure your organization is protected from financial malware, Cyphort recommends the following:

- Keep system and applications patched.

- Educate employees to be careful when visiting websites with popups. If a person does need to go to such a site, do so from a non-Windows platform.

- Adopt a new defense paradigm that continually monitors, diagnoses and mitigates attacks.

Posted in Best Practices for Merchants Tagged with: bank, banking, electronic payment systems, financial, financial service, financial systems, online transactions, payment

September 5th, 2014 by Elma Jane

A cup of coffee, a pack of chewing gum., a newspaper at the airport. For even the smallest, most casual purchase, credit cards and debit cards are replacing cash as the preferred form of payment. One in three usually uses a credit card or a debit card for in-person purchases of less than $5. Eleven percent prefer credit cards, 22% debit cards and 65% cash, but the generational divide is striking. A slight majority (51 percent) of consumers 18-29 prefer plastic to cash, the only age group to do so. A preference for cash becomes stronger in each advancing age bracket, until at age 65-plus, 82 percent prefer cash.

Survey conducted by landline and cellphone found that: Credit cards and debit cards are used more frequently for small purchases by those employed full time (42%) or part time (34%) than for the unemployed (23%). People with children are more likely to use the cards for small purchases (41%) than those without children (30%), perhaps because parents have less time to wait around for change. Income doesn’t seem to be much of a differentiator, except for those near the bottom of the scale. A combined 38% of those making $75,000 or more preferred plastic for small purchases, compared with 43 percent of those making $50,000 to $74,900, 32% of those earning $30,000 to $49,900 and only 23% percent of those making less than $30,000.

Politically, we’ve finally found something on which we all can agree. Thirty percent of Democrats and a nearly identical 28% of Republicans favor credit cards or debit cards rather than cash for small purchases. Interestingly, those describing themselves as politically independent also were more independent from cash, 40% of them prefer plastic for such transactions.

The casual use of plastic is moving steadily through age brackets and already has a firm grip not only on millennials, but also increasingly on Gen Xers. Crunched another way, the data show that if you’re 49 or younger, you’re almost as likely to pay for a $5 purchase with plastic as you are to pay with cash. Fifty two percent prefer cash, 46% prefer debit or credit cards. Now, if you’re 50 or older, you’re still somewhat unlikely to pay for a $5 purchase with plastic. Seventy seven percent still prefer cash, with 21% reaching for debit cards or credit cards. Those who graduated from or attended college are significantly more comfortable than others with using plastic for small purchases.

A combined 39% of those with college degrees prefer debit cards (21%) or credit cards (18%) over cash (59%). Only 16% of those who have not attended college usually use debit cards for purchases of less than $5, along with only 6 percent who prefer credit cards for that purpose.

The trend is clear. Regardless of some differences in magnitude based on demographic factors, plastic is replacing cash as the currency of choice even for small purchases. Plastic use will increase for small purchases, both for debit and credit cards.

Why the shift to cards There are many reasons:

Technological advancements at the point of sale have made it just as fast to pay by plastic as by cash. Rewards have become a common feature of credit cards, with two out of three credit cards offering rewards, encouraging rewards chasing. Debit cards, with their balances available instantly and online have largely replaced paper checks and tedious manual records.

Financial institutions have spent decades persuading consumers to use and merchants to accept cards universally. Small purchases represent particularly appropriate uses of a debit card, assuming you don’t get carried away and overdraw the card-linked bank account. Why keep going to the bank and then carry cash if you don’t have to? Moving away from cash and moving toward using cards for even small purchases is more convenient.

Debit cards are everywhere already, but because their use can’t be reported to the credit bureaus and thus, they don’t build credit, they should only be used as a matter of convenience. People who frequently use credit cards for small, casual purchases also could overdo it, but probably not to a great degree. It would take a lot of lattes to send someone into credit counseling or bankruptcy court. In truth, we like the idea of using credit cards frequently for small, manageable expenses. This gives users the benefit of an active credit history, but leaves them with monthly bills that are small enough to pay off in full, so they don’t have to pay any interest. It’s getting to the point where, if I’m out and about, I’m using plastic the whole time. It’s just so much easier.

Posted in Best Practices for Merchants Tagged with: account, bank, bank account, bankruptcy, bills, cards, cash, cellphone, credit, credit counseling, credit history, data, debit cards, financial, financial institutions, Merchant's, payment, transactions