May 23rd, 2014 by Elma Jane

State senate in California is advancing a bill SB 1351, mandates April 1, 2016, that would require California-based bankcard issuers and retailers to adopt Europay/MasterCard/Visa (EMV) chip card technology. SB 1351 bill is introduced March of 2014, passed out of committee on May 6 and may be voted on by the full senate as early as tomorrow, May 22nd.

Additionally, the bill specifies that any contracts entered into by financial institutions and card brands on or after Jan. 1, 2015, would have to include the provision that any new or replacement cards issued after April 1, 2016, be EMV compliant. The rationale for the bill comes from oft-cited evidence that EMV cards substantially reduce fraud.

In April 2014, Sen. Hill stated, My legislation holds all stakeholders accountable to protect consumers from scam artists who use fake cards to game the system.

The Electronic Transactions Association, however, does not see the issue the same way. Passing a single state technology standard will open the floodgate to additional state responses and create an expensive, unsafe and inefficient myriad of technology standards, the ETA said. The ETA is urging payment professionals in California to contact their legislators and let their opinions be heard.

The bill initially mandated Oct. 1, 2015, as the deadline for EMV implementation, which is the date set by Visa Inc. and MasterCard Worldwide for retailers to be EMV complaint or face potential fines in case of fraud. The bill also makes exceptions for small retailers and convenience stores/gas stations; they have until Oct. 1, 2017, to transition to EMV.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa Tagged with: bankcard, card brands, card technology, cards, chip, consumers, Electronic Transactions Association, EMV, EMV compliant, EMV implementation, ETA, Europay/MasterCard/Visa, fake cards, financial institutions, fraud, MasterCard, payment professionals, retailers, scam, small retailers, technology standards, Visa Inc.

May 21st, 2014 by Elma Jane

Mobile credit card processing is way cheaper than traditional point-of-sale (POS) systems. Accepting credit cards using mobile devices is stressful, not to mention a hassle to set up and customers would never dare compromise security by saving or swiping their credit cards on a mobile device. Some of the many myths surrounding mobile payments, which allow merchants to process credit card payments using smartphones and tablets. Merchants process payments using a physical credit card reader attached to a mobile device or by scanning previously stored credit card information from a mobile app, as is the case with mobile wallets. Benefits include convenience, a streamlined POS system and access to a breadth of business opportunities based on collected consumer data. Nevertheless, mobile payments as a whole remains a hotly debated topic among retailers, customers and industry experts alike.

Although mobile payment adoption has been slow, consumers are steadily shifting their preferences as an increasing number of merchants implement mobile payment technologies (made easier and more accessible by major mobile payment players such as Square and PayPal). To stay competitive, it’s more important than ever for small businesses to stay current and understand where mobile payment technology is heading.

If you’re considering adopting mobile payments or are simply curious about the technology, here are mobile payment myths that you may have heard, but are completely untrue.

All rates are conveniently the same. Thanks to the marketing of big players like Square and PayPal – which are not actually credit card processors, but aggregators rates can vary widely and significantly. For instance, consider that the average debit rate is 1.35 percent. Square’s is 2.75 percent and PayPal Here’s is 2.7 percent, so customers will have to pay an additional 1.41 percent and 1.35 percent, respectively, using these two services. Some cards also get charged well over 4 percent, such as foreign rewards cards. These companies profit & mobile customers lose. Always read the fine print.

Credit card information is stored on my mobile device after a transaction. Good mobile developers do not store any critical information on the device. That information should only be transferred through an encrypted, secure handshake between the application and the processor. No information should be stored or left hanging around following the transaction.

I already have a POS system – the hassle isn’t worth it. Mobile payments offer more flexibility to reach the customer than ever before. No longer are sales people tied to a cash register and counters to finish the sale. That flexibility can mean the difference between revenue and a lost sale. Mobile payments also have the latest technology to track sales, log revenue, fight chargebacks, and analyze performance quickly and easily.

If we build it, they will come. Many wallet providers believe that if you simply build a new mobile payment method into the phones, consumers will adopt it as their new wallet. This includes proponents of NFC technology, QR codes, Bluetooth and other technologies, but given very few merchants have the POS systems to accept these new types of technologies, consumers have not adopted. Currently, only 6.6 percent of merchants can accept NFC, and even less for QR codes or BLE technology, hence the extremely slow adoption rate. Simply put, the new solutions are NOT convenient, and do not replace consumers’ existing wallets, not even close.

It raises the risk of fraud. Fraud’s always a concern. However, since data isn’t stored on the device for Square and others, the data is stored on their servers, the risk is lessened. For example, there’s no need for you to fear one of your employees walking out with your tablet and downloading all of your customers’ info from the tablet. There’s also no heightened fraud risk for data loss if a tablet or mobile device is ever sold.

Mobile processing apps are error-free. Data corruption glitches do happen on wireless mobile devices. A merchant using mobile credit card processing apps needs to be more diligent to review their mobile processing transactions. Mobile technology is fantastic when it works.

Mobile wallets are about to happen. They aren’t about to happen, especially in developed markets like the U.S. It took 60 years to put in the banking infrastructure we have today and it will take years for mobile wallets to achieve critical mass here.

Setup is difficult and complicated. Setting up usually just involves downloading the vendor’s app and following the necessary steps to get the hardware and software up and running. The beauty of modern payment solutions is that like most mobile apps, they are built to be user-friendly and intuitive so merchants would have little trouble setting them up. Most mobile payment providers offer customer support as well, so you can always give them a call in the unlikely event that you have trouble setting up the system.

The biggest business opportunity in the mobile payments space is in developed markets. While most investments and activity in the Mobile Point of Sale space take place today in developed markets (North America and Western Europe), the largest opportunity is actually in emerging markets where most merchants are informal and by definition can’t get a merchant account to accept card payments. Credit and debit card penetration is higher in developed markets, but informal merchants account for the majority of payments volume in emerging markets and all those transactions are conducted in cash today.

Wireless devices are unreliable. Reliability is very often brought up as I think many businesses are wary of fully wireless setups. I think this is partly justified, but very easily mitigated, for example with a separate Wi-Fi network solely for point of sale and payments. With the right device, network equipment, software and card processor, reliability shouldn’t be an issue.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: (POS) systems, aggregators rates, apps, BLE technology, bluetooth, card, card processor, card reader, cash, cash register, chargebacks, consumer data, credit, credit card payments, credit card processing, credit card processors, credit card reader, credit-card, customer support, data, data loss, debit card, debit rate, device, fraud, fraud risk, hardware, industry experts, merchant account, Merchant's, mobile, mobile app, mobile credit card processing, Mobile Devices, Mobile Payments, mobile point of sale, Mobile processing apps, mobile processing transactions, mobile technology, mobile wallets, network, network equipment, nfc, nfc technology, payment solutions, payment technology, PayPal, phones, point of sale, qr codes, retailers, rewards cards, Security, Smartphones, software, Square, tablet, tablets, vendor's app, wallet providers, Wi-Fi network, wireless mobile, wireless mobile devices

May 6th, 2014 by Elma Jane

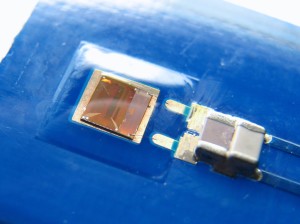

Mobile commerce platform provider ROAM, an Ingenico company has expanded its mPOS solutions to include chip-and-PIN acceptance with the RP750x mobile card reader. The reader allows mPOS players to get to market quickly with their own custom-branded solution, providing merchants with a powerful set of features that include device and fraud management, remote application configuration, and an mPOS application that can be localized for any language and currency in any country. Features include: Backlit display, EMV PIN pad, magnetic stripe reader, NFC reader and smart card reader. Configurable through the cloud, enabling direct shipment from factory to any country. Connects with smartphones, tablets and feature phones via Bluetooth or audio jack. Customizable for branding and form factor. Just Slightly larger than a credit card, a compact form factor. PCI PTS 3.1 with SRED, EMV Level 1 and 2, Visa-ready (Compliant with the latest industry standards).

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Financial Services, Mobile Payments, Mobile Point of Sale, Near Field Communication, Payment Card Industry PCI Security, Point of Sale, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: bluetooth, Chip and PIN, cloud, compliant, credit-card, currency, EMV, fraud, magnetic stripe reader, Merchant's, mobile card reader, Mobile commerce platform, mPOS solutions, nfc, PIN pad, smart card reader, Smartphones, tablets, visa

February 3rd, 2014 by Elma Jane

The migration to cards that use chips instead of magnetic strips, known as EMV technology, is well underway in the U.S. No government regulation is needed to make it happen. But the EMV migration and the Target breach are different things. It’s true that EMV chip cards can prevent criminals from producing counterfeit cards using stolen account numbers. But EMV doesn’t stop criminals using stolen cards online. So innovators are deploying new technologies to deter other forms of fraud.

Headline-grabbing events inevitably lead to calls for new laws. But in the case of our nation’s electronic payments systems, new government mandates would stifle marketplace innovations that hold great promise for providing consumer benefits and reducing criminal activities.

Financial institutions compete for customers by providing consumer protections even beyond requirements of current law. Many retailers also offer customers speedy transactions, such as “sign and go” and “swipe and go” for small transactions, while the payments industry ensures consumers still have zero liability. These protections and flexibility are why U.S. consumers are going cashless and carry more than one billion debit and credit cards. More than 70% of retail purchases are made with electronic payments, and our member companies process more than $4 trillion in electronic payments each year.

Fraud accounts for fewer than six cents of every $100 spent on payments systems – a fraction of a tenth of a percent. U.S. companies have made significant financial and technological investments, building sophisticated fraud tools that insulate consumers from liability. To build on this, Congress should foster greater international law enforcement cooperation to fight cybercrime, particularly in countries that harbor crime rings, and replace 46 divergent state breach notification laws with a uniform national standard.

The private sector is best positioned to address the constantly shifting tactics of criminals, and it is doing so without government mandates. Do Americans really want the government in charge of the security and monitoring of our payments?

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Visa MasterCard American Express Tagged with: counterfeit cards, cybercrime, data breach, debit and credit cards, electronic payment systems, electronic payments, emv chip cards, emv technology, fraud, liability, magnetic strips, migration, online, security and monitoring of our payments, small transactions

December 16th, 2013 by Elma Jane

1. Account Updater (Visa)

Incorrect billing information leads to declined credit cards, loss of sales and unhappy customers.

Visa touts its Account Updater as an easier way to keep customer data current. The tool appends all card data with up-to-date customer info so businesses can avoid difficulties over address changes, name changes, expired cards and more.

The tool can benefit any business that bills customers on a recurring basis.

It eliminates the need for manual administration, so it can lower your business’s operational costs and customer-service expenses. And by saving your clients the hassle of a declined payment, you can boost customer satisfaction and overall sales.

2. Netswipe

Paying online is convenient for customers, but keying in an unwieldy credit card number is still a pain.

Netswipe from Jumio gives customers an easier way: The tool lets users pay by snapping a photo of their credit card; it’s almost as easy as swiping your card through a traditional card reader.

According to Jumio, customers can use their smartphone or tablet to scan a card in as little as 5 seconds, whereas traditional key entry takes 60 seconds or more, on average. Having a quick and convenient way to pay could help contribute to a positive buying experience and encourage repeat business.

The system is compatible with any iOS or Android mobile device, as well as with any computer with a webcam.

3. Netverify

Jumio’s fraud-scrubbing tool helps you determine if your customers are who they say they are.

Net verify allows customers to snap a picture of their driver’s license or other identification using a smartphone, tablet or PC webcam. Once the image is taken, the tool can verify the authenticity of the documentation in as little as 60 seconds.

That’s much faster and more convenient than asking a customer to fax or mail a copy of their ID in the middle of a transaction.

The tool can verify identifying documents from more than 60 countries…including passports, ID cards and driver’s licenses, and even bank statements and utility bills. Jumio says its software is smart enough to automatically reject nonauthentic documents.

And customers can rest easy knowing that all submitted information is protected with 256-bit encryption to prevent identity theft.

Online merchants embed Netverify into their websites as part of the checkout process.

4. Payment Gateway

Payment Gateway service does all the heavy lifting of routing and managing credit card transactions online.

Portals like this one benefit small businesses by providing a fast and secure transmission of credit card data between your website and the major payment networks. It works a lot like a traditional credit card reader, but uses the Internet to process transactions instead of a phone line.

Payment Gateway also offers built-in fraud-prevention tools and supports a range of payment options, including all major credit cards and debit cards.

5. PayPal Here

Mobile credit card processing services like PayPal Here make it easy to accept credit cards in person using a smartphone or tablet.

PayPal Here and other similar services send you a dongle that attaches directly to your iPhone, iPad or Android device, allowing you to swipe physical credit cards wherever you are.

One major benefit of mobile credit card readers is that they work with the devices you already own. That means there’s no need to carry around additional hardware, aside from the reader add-on itself. Most credit card readers attach to your device via the headphone jack or charger port, and are small enough to fit in your pocket.

The smallest businesses have the most to gain by opting for mobile credit card readers, which are cheaper and far more portable than traditional options.

6. Virtual Terminal

If you do business online, your website needs the infrastructure to accept credit card information.

Web-based applications like virtual terminal offer the basic processing functionality of a physical point-of-sale system, and are easy to install on your business’s website.

The system allows merchants to collect orders straight from the Web, or take orders via phone or mail and before initiating card authorizations online.

It also includes extensive transaction history to help you manage payment data, split shipments, back orders and reversals. Business owners can even receive a daily email report of all credit card transaction activity from the prior day.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, e-commerce & m-commerce, Electronic Payments, EMV EuroPay MasterCard Visa, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: account, Android, authenticity, card data, card reader, checkout, checkout process, credit card number, credit card transactions, debit cards, declined payment, expired, fraud, id, iOS, mail, mobile device, nonauthentic, online, online merchants, passports, payment data, payment gateway, payment options, phone, point of sale, recurring, smartphone, tablet, verify, visa, webcam

December 2nd, 2013 by Elma Jane

Europay, Mastercard, and Visa (EMV) standards. Considered safer and widely used across Europe and other nations, the chip-based cards require insertion of the card into a terminal for the duration of a transaction, a break here from our traditional swipe-and-buy behavior. That’s just one way in which EMV changes things here… but it’s not the only way, nor is it the most important way. By way of reminder, October 2015 is the date by which all restaurants and other merchants are due to have implemented these standards, or potentially be liable for counterfeit fraud, which primarily reflects a shift from magnetic-stripe credit cards to chip cards.

The main driver in the EMV migration is card-related financial fraud. As an example, and traditionally, card fraud in the United Kingdom has always been considerably higher than here in the States, primarily because the U.K. previously used offline card authorization as opposed to the online card methodology used here. As losses due to fraud rose steadily in Europe, despite the best efforts of global law enforcement agencies to reduce it, the pressure to find a solution built around some alternative authentication strategy mounted. From this concern, EMV was born.

Is it working? Recent statistics from the European Central Bank (ECB) revealed that, despite growing card usage, fraud in the Single Euro Payments Area (SEPA) – a mature EMV territory that includes all 28 members of the European Union, Finland, Iceland , Liechenstein, Monaco and Norway, – fell 7.6% between 2007 and 2011. This decline is underpinned by a slowdown in the growth of ATM fraud as well as a 24% drop in fraud carried out at point of sale terminals. The 2008 Canadian roll-out of Chip and PIN had a dramatic impact on fraud there. Card Skimming had accounted for losses totaling $142 million, but that figure dropped to $38.5 million in 2009, according to figures provided by the Interac Association. Some critics point to the fact that most of this decrease comes in the form of face-to-face card fraud, and that criminals merely shift their focus onto some other area that is less anti-fraud focused. Still, there are positive gains and as technologies improve, more successes are sure to follow.

Part of the reason why the U.S. not embraced EMV sooner is because our fraud problem, while significant, has typically been among the lowest rates in the world among highly developed economically mature countries. Much of that is due to the online authentication methods at work here. Here at home, our online authentication methodology permits authorizations to be done in real-time, thus thwarting a significant percentage of the fraudulent attempts at the point-of-sale, the best place to stop fraud. Our online authentication methods also incorporate multiple fraud and risk parameters as well as advanced neural networks that are ‘built-in’ to the approval process. It’s been a highly effective system that works well, when compared to most alternatives. The effectiveness of our authentication processes has helped fuel the resistance to full EMV adoption here. However, the EMV migration has gained momentum to the point where it is only a matter of time. The truth is that, despite the gains in preventing credit card fraud, and despite the best efforts of EMV’s backers to push acceptance through, global adoption of the EMV standard is still considerably less than 100%.

In England’s old offline authentication method, credit card transactions were gathered together at specific times- typically, at the end of the business day- and then batched over to the card issuers for authorization. It’s a method that gave those committing fraud a significant time lag between the transaction and the authorization, and this time lag contributed greatly to the higher levels of fraudulent activities in England. However, for Europe and for much of the rest of the world, adoption of the EMV technologies changes things dramatically, at least in terms of authentication protocols for both online and offline purchases. During an offline transaction using the EMV chip card, the payment terminal communicates with the integrated circuit chip (ICC), embedded in the payment card. This is a break from the old method which involved using telecommunications to connect with the issuing bank. The ICC / terminal connection enables real-time card authentication, cardholder verification, and payment authorization offline. Alternatively, in an online EMV transaction, the chip generates a cryptogram that is authenticated by the card issuer in real time.

Posted in Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Near Field Communication, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, batched, card, card authorization, card-related, chip cards, chip-based, credit cards, cryptogram, EMV, EuroPay, financial, fraud, fraudulent, icc, insertion, integrated, magnetic stripe, MasterCard, Merchant's, networks, online, payment, restaurants, Skimming, standards, swipe-and-buy, terminal, transaction, verification, visa

October 31st, 2013 by Elma Jane

While credit card processors and retailers have made strides to combat credit card fraud, it is still rampant across the U.S. In fact, credit card fraud jumped 17 percent between January, 2011, and September, 2012, according to the most recent data from the FICO Falcon Fraud Manager Consortium.

Debit cards obviously have better safeguard measures in place, since debit card fraud rose less than 1 percent between January, 2011, and September, 2012. Plus, the average fraud loss per compromised account fell by 3 percent.

Card-not-present (CNP) fraud is the biggest challenge by far, accounting for 47 percent of all credit card fraud. CNP fraud – which includes payments via the internet, mail and phone – grew 25 percent over the two-year period. So, where the problems with credit cards lie.

Unfortunately, CNP fraud may get worse before it gets better, in FICO’s Banking Analytics Blog. This problem may even intensify as the US moves away from magnetic stripe and toward EMV [chip] card technology. In other countries adopting chip-based authentication technology, we’ve seen counterfeit fraud decline, but as a counterbalance, fraudsters often ramp up efforts around CNP fraud.

However, there was a glimmer of light in the credit card fraud fiasco. While card fraud attempts rose, the average loss per compromised account dropped 10 percent. Plus, the ratio of fraud to non-fraud spending remained constant. “In other words, the volume of card fraud increased proportionally to the volume of consumer credit card spending.

Even though many retailers have implemented successful fraud prevention programs, Visa provides retailers with the warning signs for CNP fraud, including:

Multiple cards used from a single IP address. Orders made up of “big ticket” items. Orders that include several of the same item. Shipping to an international address. Transactions with similar account numbers.

Posted in Digital Wallet Privacy, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Payment Card Industry PCI Security Tagged with: account, analytics, authentication, banking, big ticket, card-not-present, chip card, chip-based, cnp, counterfeit, credit-card, debit cards, EMV, fraud, fraudsters, international, internet, magnetic stripe, mail, non-fraud, orders, payments, phone, prevent, processors, retailers, safeguard, spending, transactions, visa

October 18th, 2013 by Elma Jane

All Alerts, All The Time

Will mobile payment apps hail the arrival of mobile interruptions that never let up? Consumers worry that adopting a mobile wallet app will open them up to a barrage of alerts, sounding the alarm every time the local supermarket has toilet paper for half-off. The services can even track your purchases, opening the floodgates for targeted ads. Frequent alerts could be a deal breaker.

Battery Woes

As smartphones gets bigger, badder and more powerful, battery technology is struggling to keep up. That’s a problem if you want to make a call — but it could be an emergency if your smartphone is your wallet, too. Users are already scrambling to find a charging outlet by lunchtime. Soon, failure to recharge might mean you lack the funds to buy lunch in the first place. Meanwhile, credit cards never need a battery boost, and paper money has worked faithfully since well before the invention of the light bulb.

Do I Have The Right Phone?

You’re ready to make a mobile payment — but is your smartphone? Only the most popular new Android and Windows smartphones have NFC support to enable tap-to-pay services, and Apple has decided to forgo NFC altogether with its iPhone handsets. Users of budget smartphones are likewise out of luck. And though smartphones may seem ubiquitous, only a little more than half of U.S. adults have one.

Is It Secure?

Mobile payments open up a whole new frontier for fraudsters — or so cautious consumers worry. In fact, tap-to-pay technology is as secure as swiping a plastic bank card, and cloud services like PayPal Here support two-factor authentication for extra reassurance. Still, consumers worry their personal information could be intercepted during a transaction, and not everyone is convinced that Google can provide the same level of protection as their bank. But hope remains. The survey found about half of the most security-conscious respondents were much more likely to be interested in mobile payment options if they could be promised 100 percent fraud protection.

Limits, Limits, Limits

Even with a glut of mobile payment options, most lack at least one critical feature. Google’s Wallet app lets you stow your payment information in your phone to buy items in brick-and-mortar shops, but its touch-to-pay functionality is limited to Android devices on Sprint and other smaller carriers. Last year, Apple introduced Passbook, a mobile wallet app that lets users store gift card credits, loyalty card information and more on their iPhones — but only a handful of participating businesses support the app. The mobile payment model isn’t just fragmented — it’s fundamentally limited by countless companies competing for an ever-smaller piece of the pie.

Mobile What?

A recent CMB Consumer Pulse survey showed about half of smartphone users have never even heard of mobile payments. And of the 50 percent who have, a meager 8 percent said they’re familiar with the technology. Banks, credit card companies and others hoping to cash in on consumer interest will have to invest in better messaging first.

What Are The Perks?

Credit cards come with alluring perks — signing bonuses, cash back and travel accommodations, to name a few. But mobile payment systems have serious benefits. They can utilize GPS technology to direct you to deals, keep tabs on your bank account to alert you when you’re near your spending limit, and store unlimited receipts straight to the cloud. Businesses profit from mobile wallets, too, which often charge lower fees than credit card companies and encourage return trips by storing digital copies of loyalty cards.

What’s In It For Me?

To convince consumers to abandon trusted payment options for something new, companies must strike an undeniable value proposition. In the late ‘90s, electronic retail giants like Amazon compelled consumers to enter their 16-digit credit card numbers into online portals, opening up a whole new world of convenience with online shopping. But today’s consumers aren’t convinced that mobile wallets are any more convenient than their physical counterparts. Credit and debit cards already offer a speedy, reliable way to pay on the go. And since they’re accepted virtually everywhere, customers can fork over a card without worry or confusion. Convincing people that new technology is worth their time and effort might ultimately be the toughest nut to crack for mobile payment purveyors.

Where’s The Support?

Even the most enthusiastic adopters are out of luck if their favorite shops lack the infrastructure to process mobile payments. Big-box retailers sprang up in the infancy of computer technology, so joining the mobile payment revolution could necessitate updates to check out hardware and software. Mobile payments could be a boon to businesses, but installing the upgrades could be expensive and disruptive — especially when consumer interest remains low.

Which to Pick?

Even curious consumers are confounded by the array of mobile payment options available. Google, Visa, MasterCard and even mobile carriers like Sprint and Verizon are among the heavy hitters on the mobile payment scene, each offering a discrete service with different apps — and different rules. Some rely on Near Field Communication (NFC) technology that lets users simply tap their smartphone against a special reader to pay, while others offer up scannable QR codes. Mobile payments may never take off until one company rises above the rest with a single killer service.

Forget about cash or credit. In 2013, consumers can simply swipe or scan their smartphones at the checkout to pay. A huge array of mobile payment services have sprung up in recent years, urging customers to abandon their plastic credit cards for the “mobile wallet” revolution, but so far, adoption of mobile payment technology has been dismal.

Posted in e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: alerts, Android, Apple, bank card, battery, cautious, consumers, crack, credit cards, deal, digital, fraud, gift card credits, google, GPS, information, Iphone, lower fees, loyalty cards, mobile, nfc, online, options, paper money, Passbook, payment, PayPal, personal, phone, plastic, portals, powerful, protection, purchases, secure, Smartphones, sprint, storing, support, Swiping, Tap to Pay, touch-to-pay, track, two-factor authentication, wallet, windows

October 14th, 2013 by Elma Jane

First what is a Merchant Account? It is a type of bank account that allows businesses to accept payments by payment cards, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator such as PayPal, the agreement contractually binds the merchant to obey the operating regulations established by the card associations.

Merchant Account comes in 2 Basic Types – Aggregated Accounts and Dedicated Accounts.

Aggregated Merchant Account – such as those provide by PayPal that use a single merchant account to provide credit card processing for an entire portfolio of companies.

Dedicated Merchant Account – are provisioned specifically for your business.

Each has its Advantages and Disadvantages.

4 Key Points to Consider when deciding which type is the most advantageous for your small business.

1. Creditworthiness: To obtain a dedicated credit card processing merchant account your business will need to go through comprehensive underwriting. If you’re in a difficult to underwrite industry or if your business is very new and if it has a less than stellar credit history then an aggregated merchant account is the best choice. You still need to provide information about your business, underwriting for aggregated accounts is typically far less rigorous than for dedicated merchant accounts.

2. Funds Control: With an aggregated merchant account, transaction proceeds go to the service provider and are then deposited to your bank account at the provider’s discretion. There are no industry standards or rules that govern how an aggregated merchant account provider handles or disburses your money. The provider makes the rules, and can change them at will, so if you choose an aggregated merchant pay very close attention to the contract terms and any changes made to them. With a dedicated merchant account, transaction proceeds, less processing fees, are deposited directly into your business account. While the merchant account provider can correct errors, react to potential fraud and debit your account for customer “chargeback” claims. This must all be done based on industry-standard credit card processing rules.

3. Neighborhood: With an aggregated account, you’ll have no idea about the other companies processing transactions. If a good number of them engage in fraudulent activity, it is possible that the service provider’s processing account will be terminated and even honorable businesses like yours will lose credit card processing ability. If you do go with an aggregated account, it is very important to make sure that your provider is large enough to absorb fraud generated by a few bad apples.

If you’re using a small provider, try to get a list of the other business using the service and check them out to see if you want to live in the same neighborhood. With a dedicated merchant account the only company processing credit card transactions through it will be yours. You are in full control of keeping the account in good standing.

4. Speed: Getting a dedicated merchant account can take time. While there are some providers automating the process and providing same-day decisions. A typical application will take 48 hours to approve and additional time to integrate into a POS or electronic payment processing environment. Signing up for a credit card processing under an aggregated account service provider can usually be done in minutes, and it often comes with an online system that can have you actively processing payment within the hour.

Offering your customers the option to pay with a credit card is a great way to enhance revenue for your small business. Customers want the points associated with rewards cards, and they want to manage their own cash flow by floating balances or financing their purchases. Allowing them to use credit cards accomplishes both. So, give the customers what they want. If you don’t accept credit cards yet, now is a great time to start. Having made that decision, the next step is to obtain a merchant account for credit card processing.

The actual credit card processing rates you’ll be charged are a critically important factor as well. But as with most things, you get what you pay for. So don’t choose a low rate without also considering how the provider you select will impact your overall business.

For Merchant Account Services Please call National Transaction at 888-996-2273 or visit our website www.nationaltransaction.com to know more about our services.

Posted in Credit card Processing, Merchant Services Account Tagged with: account, accounts, acquiring, aggregator, card, cards, chargeback, credit, debit, electronic, environment, fees, financing, fraud, ISO, merchant, msp, payment, PayPal, POS, Processing, provider, transaction, underwriting

October 3rd, 2013 by Elma Jane

Here’s how typical credit card transaction works:

When a consumer pays with a credit card, the merchant sends the details of the transaction along with the credit card information to the merchant’s bank. The merchant’s bank forwards the information to the cardholder’s bank for approval. If approved, the cardholder’s bank sends the required amount to the merchant’s bank, minus the merchant discount rate. The credit card companies don’t receive any revenue directly from interchange rates. Instead they make their money by charging the banks fees for networks, transactions and other kinds of services.

Up until April 2008, interchange rates were simple and inflexible. At that point, the company decided to move to a more dynamic system.

Interchange rates now vary from card to card, depending on the types of services and incentives offered. Typically, premium cards, which come with rewards for things like travel, cost merchants more to process. The rates also vary by type of transaction, and even by type of retailer. At times, the card companies have, for example, set special rates for grocery and gas retailers in a bid to boost credit-card use in locations where cash and debit traditionally dominated. The card companies have also introduced a growing number of premium and even super-premium cards that cost merchants more to process. The cards appeal to consumers because they contain a number of attractive incentives, such as travel and other rewards. The changes in the rate structure followed a change in the credit card companies’ business model in the mid 2000s.

Visa and MasterCard evolved from private associations owned mainly by the banks they serviced to publicly traded, profit-driven entities beholden to a wide range of shareholders. Merchants say the fees they pay to accept credit cards are rising as a result and have become increasingly unpredictable. Critics of the credit card companies say the merchant is a powerless middleman in a system that entices consumers to use their cards and banks to reap the benefits.

The credit card companies say the system benefits everyone, including merchants, by providing a rapid, secure form of payment.

Every time you use your credit card to make a purchase, the merchant pays what is called the “merchant discount fee.” The merchant discount fee is calculated as a percentage of the good or service purchased. It can range from 1.5 per cent to 3 per cent. On a $100 item, for example, the merchant could pay a fee of between $1.50 and $3.The merchant discount fee covers a number of things, such as terminal rentals, fraud protection and transaction slips. But the biggest component of it is based on the interchange rate, which is set by the credit card companies.

In a complicated twist, the credit card companies don’t make any money from the interchange rate. The banks do. The interchange rate is what makes the credit card system work. This rate ensures the banks have a financial incentive to issue and accept credit cards.

Posted in Credit card Processing, Electronic Payments, Merchant Services Account, Visa MasterCard American Express Tagged with: associations, bank, card, cardholder, charging, credit, credit-card, discount rate, dynamic, fees, financial, fraud, interchange, merchant, Merchant's, networks, payment, process, protection, Rates, rentals, secure, services, terminal, transaction, travel