May 8th, 2017 by Elma Jane

Tips for preventing funding delays!

If you’re running an unusual transaction and know of it beforehand, let your merchant provider know; sending an invoice in advance can cut processing time.

Make sure to give your most up to date information. Keeping provider in the loop on the fluctuations in your processing volumes will help tremendously, especially as your business grows.

Funding delays are an inconvenience, but being prepared can keep the delay to a minimum. If you keep these tips in mind, you’ll be processing without ever having to worry about delays again.

Flagged, Security and Review Process

Why some merchant accounts hold funds and others do not?

There are a number of reasons:

Underwriting merchant account is ongoing. Imagine a small business convenience store was set up and accidentally enters $1,000.000 should we transfer that or hold it?

One reason is something has gone with that particular business account.

Another reason could be that particular institution’s practices are more efficient than others.

Financial institutions use different payment processing systems, and they are not uniform in their practices. For this reason, some transactions are significantly faster than others.

Though there are other reasons funds get held, the main reason for this occurrence is when a payment is out of the ordinary patterns.

Unusual transactions are any transaction that vary from your typical processing patterns.

If It’s for security, an account will be flag as a way to reduce fraud as well as ensuring no one is using your account.

How do I know if I’m flagged?

Security checks are carried out by processing banks or processor. You’ll be contacted by a loss prevention officer. They’ll provide all details of the hold, including the review process as well as the next steps.

What’s the review process?

The review is simply to verify your transaction before delivering your funds. A typical review is confirming the transaction with yourself as well as your customer’s credit card company. You’ll speak briefly with a loss prevention officer to discuss the transaction. If further review is required, the loss prevention officer may ask you for a copy of the transaction’s invoice.

How can I speed up the process?

For an easy review, make sure to provide detailed documents. When an invoice is asked for, make sure it clearly shows the following:

- Product Description of Items Sold

- Your Customer’s Name

- Address

- Phone Number

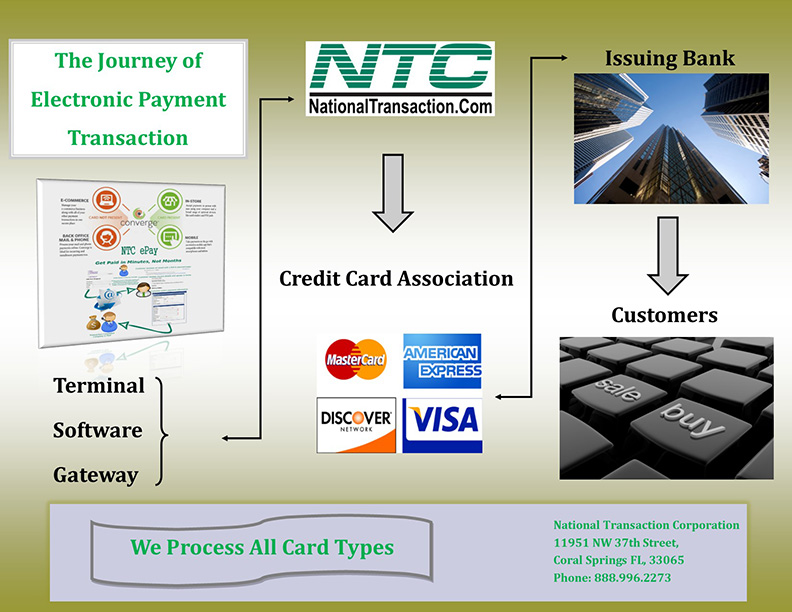

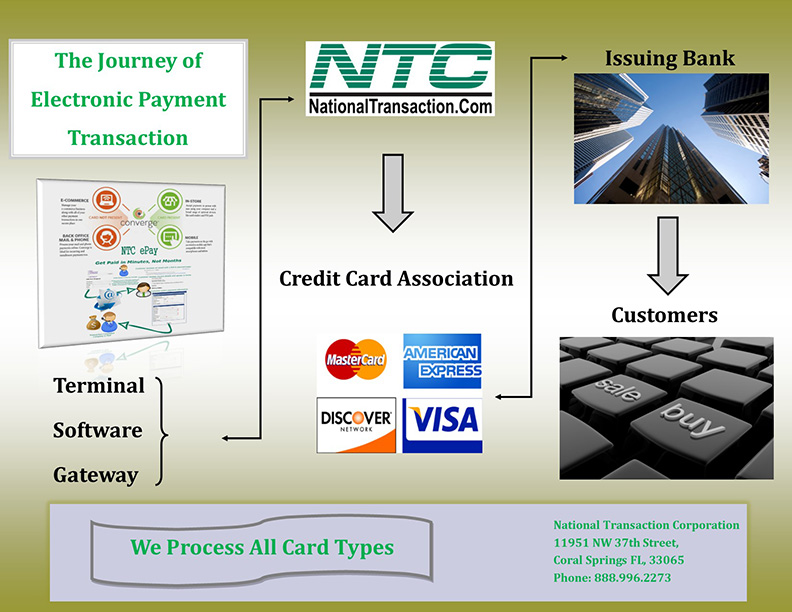

For Electronic Payment set up call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: credit card, electronic payment, funds, merchant provider, processor, Security, transaction

February 6th, 2017 by Elma Jane

Managing Chargeback:

Chargeback – a forcible reversal of funds due to a credit card holder’s dispute of the transaction. Chargebacks can be a huge headache for a business owner, it can affect a business’ ability to maintain a credit card processing account and put funds on hold.

How can you protect your business and maintain a good processing account? First, you need to know the basic chargeback types:

- Clerical – duplicate billing, incorrect amount billed or refund never issued.

- Fraud – consumer claims they did not authorize the purchase or claims identity theft. Fraud disputes can be more complicated since they are the result of fraudulent consumer purchases.

- Quality – consumer claims to have never received the goods as promised at the time of purchase.

- Technical – expired authorization, non-sufficient funds or bank processing error.

Managing chargebacks is an important piece and it can certainly be reduced, to save your business, time, money and reputation.

For Electronic Payments Set up call now 888-996-2273 or visit www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants Tagged with: bank, chargeback, consumer, credit card, fraud, funds, processing account, refund, transaction

December 27th, 2016 by Admin

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional merchant account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days. (A client of ours who signed up with an aggregator came back in tears and wants to open her merchant account with us again because her funds was held with the merchant aggregator. She then promised will not leave and stay for life with NTC).

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

Setting up a Merchant Account? Call us now! 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, fees, funds, merchant, merchant account, payments, transactions

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

August 19th, 2016 by Elma Jane

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days.

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

For more information in setting up an account with NTC give us a call at 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Merchant Services Account Tagged with: fees, funds, merchant account, Merchant aggregator, payments, transactions

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service

May 27th, 2016 by Elma Jane

Refunds – transfers funds from your merchant account to the customer’s account.

Refunds are always associated with a transaction that has settled.

A settled transaction – is funds that have already transferred from the customer to the merchant. You can only refund a transaction with a Settling or Settled status.

The refunded transaction goes through the typical settlement process. As the refund settles, the funds are sent back to the customer’s bank account. It is normal for your customer to experience a delay because the customer’s bank may take a couple of days to deposit these funds.

Voids – will cancel the transfer of funds from the customer to the merchant and can be issued if the transaction is either Submitted for Settlement or Authorized. The original authorization should disappear from the customer’s statement within 24 to 48 hours.

Posted in Best Practices for Merchants Tagged with: account, bank, customer, funds, merchant, merchant account, refunds, transaction

May 10th, 2016 by Elma Jane

What is (AML) Anti-Money Laundering?

Anti-money laundering (AML) is a set of regulations designed to stop the practice of generating income through illegal actions.

AML regulations place an obligation on financial institutions such as NTC to maintain accurate customer records to ensure they know who their merchants are and the nature of their business and that these institutions are not aiding in money-laundering activities.

Anti-Money Laundering (AML) Break Down:

AML laws and regulations target activities that include

- Corruption of public funds and evasion of tax, as well as all activities that aim to conceal these deeds

- Market manipulation

- The trade of illegal goods

Financial institutions are expected to comply with Anti-Money Laundering laws and make sure that clients are aware of these laws.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, financial institutions, funds, merchants

May 26th, 2015 by Elma Jane

MasterCard is aiming to change the way people transfer money between debit cards, with its new program called MasterCard Send. This first-of-its-kind, global personal payments platform allows consumers to send and receive funds within seconds, rather than waiting for the standard 1-3 business day transfer time.

Unlike most person-to-person (P2P) processors like PayPal, MasterCard Send is not designed specifically for consumers. Instead, it aims to help businesses send disbursements and cash back to customers in something very close to real-time.

Customers can receive direct deposits into their debit card accounts for shipping rebates. There is no waiting for a check in the mail or a long transfer process.

Consumers can still use MasterCard Send to send and receive money from friends and family members. The recipient does not need a debit card to access the funds. Send will also work with programs like Western Union.

According to MasterCard, cash and checks still contribute $1 trillion in global spending every year. MasterCard Send is attempting to be a safer, faster and cheaper alternative to these transactions. The program is now live in the United States.

MasterCard Send is addressing a real need that exists in today’s digital world to enable consumers, businesses, governments and more to have a safe, simple and secure way to transfer and receive funds quickly.

Posted in Financial Services Tagged with: card accounts, cash back, check, consumers, debit cards, direct deposits, funds, MasterCard, p2p, payments, processors, transactions

October 31st, 2013 by Elma Jane

Ingenico Biometric Credit Card Terminal with EMV Chip and PIN Processing NFC.

Ingenico’s new biometric payment device (the iWB 220) is to be used in a pioneering project, to bring financial support to low-income families.

Payment solutions provider, Ingenico are to deploy Ingenico´s biometric solution in Colombia and the Dominican Republic, together with Carvajal Tecnología y Servicios, a player in the electronic payment industry in Latin America,

This biometric point of sale solution complies with the Image Quality Specifications for single finger capture device defined by the FBI, the United States Federal Bureau of Investigation.

In addition to high security standards, the solution is a mobile device with an embedded Magstripe, as well as Chip & PIN readers.

Upon government approval for each of the applications, funds will be sent to the banks and through the use of these unique devices, beneficiaries can withdraw their funds, with the use of a fingertip. Approved family members are the only ones able to withdraw the funds, and the government is assured that the benefit is being paid to the right person.

Posted in Credit Card Reader Terminal, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: banks, biometric, capture, Chip & PIN, deploys, device, electronic, finger, fingertip, funds, ingenico, iwb220, magstripe, mobile, paid, payments, readers, solution, withdraw