June 1st, 2016 by Elma Jane

Close more sales and overcome some of the common strategic mistakes sales people make with the following strategies.

Become a partner – people don’t buy from companies, people buy from people. Building a relationship with a potential partner by getting to know them personally and know their professional needs is very important in sales. Your potential partner must value you before he or she can trust you with their business.

Be the expert – Show your knowledge and expertise about your industry. Offer a valuable service and be the expert in your field.

Communicate – in building trust with a partner, establishing and maintaining effective communications is essential. Follow up in a timely manner, be available, return calls promptly with the information requested. Keeping communications open is the best way to keep a partner.

Eliminate the difficulty of switching – it is vital to let your partner know the ease of transition and benefits to moving to your solution. No matter how great the product or service is, when a business considered making a change there still apprehension.

Focus on value – build value. Most are willing to pay fairly for a good service.

Make it simple – make your product, service or offer simple. Explain your offer in a way they can not only understand but convey to others.

Hard work and dedication are important in sales, but you will close more deals if you have a good sales strategy.

Posted in Best Practices for Merchants Tagged with: industry, product, sales, service, solution

September 16th, 2014 by Elma Jane

When plastic cards become digital tokens, they become virtual. So how do you say that the Card is Present or Not Present. The legendary regulatory difference that the cards industry has relied on to differentiate between interchange fees for Card Present and Card Not Present transactions.

Apple secured Card Present preferential rates for transactions acquired by iTunes on the basis that the card’s legitimacy is verified with the issuer at the time of registration and the token minimizes probability of fraud. If an API call to the issuing bank is sufficient to say that the Card is Present, who is to say that the same logic can’t apply to online merchants who also verify the authenticity of Cards on File when they tokenize them? How can one arbitrarily say that the transaction processed with token from an online merchant is Card Not Present, but the one processed with Apple Pay is Card Present even though both might have made the same API call to the bank to verify the card’s validity?

In the Apple case, a physical picture of the card is taken and used to verify that the person registering the card has it. It is not that hard for an online merchant to verify that the Card on File converted as a token does belong to the person performing an online transaction.

As we move towards chip and pin the card present merchants will spend substantial money upgrading their hardware and POS systems. That expense will be offset by that savings in losses due to fraud. MOTO and e-commerce transactions ( card NOT present ) will always have a higher cost because the nature of processing is NON face to face transactions. Of course the fraud and losses are higher when the card is manually entered or given to someone over the phone……Face to face will always have the lowest cost per transaction because it is usually the final step in the sale. Restaurants are low risk because you had the transaction AFTER you eat. If there is a dispute it happens before the merchant even sees the credit card.

In the long run, as cards become digital and virtual through tokens, we are all going to wonder if card is present or not present. May be some will say. Card is a ghost.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: (POS) systems, API call, Apple secured Card Present, bank, Card Not Present transactions, card present, card present merchants, cards, cards industry, chip, credit-card, digital and virtual, digital tokens, e-commerce transactions, fees, fraud, hardware, industry, interchange, interchange fees, issuer, issuing bank, low risk, Merchant's, moto, NON face to face transactions, online, online merchants, online transaction, PIN, Processing, Rates, token, transactions

August 28th, 2014 by Elma Jane

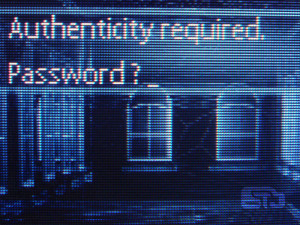

Merchants are still using pedestrian passwords that crooks can easily break, security company Trustwave has found. Of the nearly 630,000 stored passwords that Trustwave obtained during penetration tests in the past two years, its technicians were able to crack more than half in just a few minutes and 92% within 31 days. Even though adding new information about weak passwords or ongoing malware investigations gets frustrating because the same problems facing the financial and payments industries persist, it does not surprise Trustwave researchers. For a lot of software or hardware developers, their main concern is availability of the service. They want to make sure their POS is available and running to accept credit cards, often at the cost of a lot of security controls. It is difficult to implement security and to do it correctly.

Trustwave recommends longer passwords with more characters, rather than shorter ones with letters and numbers. A longer password that is a phrase not easily figured out is better than a shorter, complex password. These findings have been added to an online version of the 2014 Trustwave Global Security Report. To accommodate the fast changing nature of security threats, Trustwave is regularly updating its research and making the information available to consumers and payments industry stakeholders on the company’s site. The criminals stealing data are a constantly moving target. It no longer made sense for those interested in our research to have to wait a year to see new statistics. Having access to updated security reporting should be helpful to merchants. They can see how trends are tracking over time, instead of constantly having to go online to see what is relevant to them or rely on the trade groups to keep them informed. This provides one switch to keep them in the know, so there is some value there and it’s a smart move on Trustwave’s part. Since the new Payment Card Industry security requirements call for security measures to be embedded in software development lifecycles, there is some utility in Trustwave’s new approach to sharing research information.

Trustwave said the trend of businesses detecting breaches continues to rise, with 29% of businesses doing so in 2013 compared to only 9% in 2009. Trustwave compiled that data from 691 post-breach forensics investigations conducted in 2013. The report also indicated e-commerce breaches are increasing, with 54% of all breaches targeting e-commerce sites in 2013, compared to only 9% in 2010. More regions, including the U.S., being in various stages of converting to EMV chip-based cards for card-present transactions fuels the criminals’ shift to e-commerce fraud. Additionally, the company is working with law enforcement officials after discovering a control center of eight servers behind what is being called Magnitude, an exploit kit of Russian origin that has led to thousands of attacks and millions of attempted malware attacks globally.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security, Point of Sale Tagged with: breaches, card, card-present transactions, company, credit cards, data, e-commerce, EMV chip-based cards, financial, fraud, Global Security, hardware, industry, Malware, Merchant's, online, passwords, payment, Payment Card Industry security, payments, payments industries, POS, Security, servers, software

August 8th, 2014 by Elma Jane

The U.S. Defense Department is planning to issue a requests for bids on a multibillion dollar electronic health records or HER system by the end of September. The department issued its third draft of a Request for Proposals to industry early last month, conducted a briefing for vendors later in June and received responses to the draft earlier this month. The objective of the program is to modernize DoD’s EHR system and to make records accessible to the Department of Veterans Affairs, as well as to private medical providers. The goal of the planned system is to improve the quality of care from a clinical standpoint, while contributing to the seamless movement of medical records among key care providers. DoD has titled the project the (Defense Healthcare Management System Modernization Program) or DHMSM. DoD has shaped the contracting process to ensure that the project is well defined and properly managed from the start and it has sought feedback from the vendor community and other health IT experts. That accounts for the three draft RFPs, the meetings with vendors and consultations with Healthcare Organizations. This deliberative approach could help DoD avoid the pitfalls of the ill-managed Affordable Care Act launch.

Posted in Medical Healthcare Tagged with: Care Act, Department of Veterans Affairs, DHMSM, DoD, electronic health records, health experts, Healthcare Organizations, HER, industry, proposals