December 18th, 2024 by Elma Jane

What makes your travel merchant account high risk?

Travel environments are unique and transactions are usually keyed in. There’s almost always a delayed delivery period, and large ticket transactions.

One card holder may be paying for multiple tickets and they tend to be seasonal; with peak season months generating an unusual spike in their “average” monthly volume and chargebacks, pose a potential threat by travelers who are unable to complete their trip.

These factors can cause for either a reserve or account termination. Therefore travel merchant accounts are considered high risk.

Most merchants do not realize that merchant processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank. Therefore, a merchant account is an unsecured loan.

The merchant runs a transaction and at the end of the day they settle their batch. The merchant will receive the funds for that batch in their bank account within 2 business days, even though the travel arrangements the client paid for do not take place right away.

Here at National Transaction Corp, we specialize in understanding what makes your transactions as a travel agent unique and how they affect your merchant account.

Educating the merchant and ensuring they have a good understanding of what makes travel merchant account high risk, is one of our specialties.

Call NTC to speak with a Travel Merchant Account Specialist today!

Dial 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, card, chargebacks, financial, loan, merchant, payment, processors, transactions, travel, travel agent, Travel Merchant

August 17th, 2017 by Elma Jane

How Do Credit Cards Work?

Paying with a credit card seems like a simple process. You charge the customer, they swipe their card, and then they walk out the door.

But behind the scenes, it’s a bit more complicated.

A credit card payment involves four parties.

- The Merchant

- The Customer

- The Issuing Bank

- The Merchant Services Provider

You know who the Merchant and Customer are – that’s the easy part.

The Issuing Bank is the institution that lends money to the Customer.

When the Customer swipes their card, the Issuing Bank lends them the sale amount. This loan is given with the understanding that the Customer will pay the amount back within 30 days or repay it with interest.

Before the Merchant sees any of that money, it goes through the Merchant Services Provider. In exchange for their credit card processing services, they take out a fee before paying that money to the Merchant.

These fees vary between Merchant Services Providers, but one thing is certain: The Merchant always receives less money than the Customer paid them.

This might seem like a raw deal. However, accepting credit cards can lead to more sales than if you only accept cash.

On our next article we will discuss how to start accepting credit card payments and understanding the processing fees….so stand by for more information about Electronic Payment Processing.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments Tagged with: bank, credit card, customer, electronic payment, loan, merchant, payment

August 16th, 2017 by Elma Jane

National Transaction.Com

We work with Business owners to find the easiest and least expensive way for your business to access capital. For Loan Consultant call now at 888-996-2273 Ext 1159

Thank You – from my MMC!

First approved loan $1.2 Million August 10, 2017 Thursday! Very cool

1.2-Million 4.35%

Thank you for all the help -all done First business- towards many More.

Elisea

Sent from my iPhone

Posted in Best Practices for Merchants Tagged with: loan

April 7th, 2017 by Elma Jane

Merchant Cash Advance Or Loans

Merchant Cash Advance – is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Loans generally are lower rates than MCA? Monthly payments not daily and many of these loans may also be lines of credit. Lines of credit sometimes have collateral, real estate or other guarantees. These options can be uncovered through consultation service at NTC.

MCA companies provide funds to businesses in exchange for a percentage of the businesses daily credit card income directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring short-term business loans, and it has a different set of rules and rates.

Cash advance has some advantage over a conventional loan structure. Payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans.

Ask our loan consultant if you were told you do not qualify for a loan.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, loan, merchant cash advance, payments

March 9th, 2017 by Elma Jane

Merchant Cash Advance

A Merchant Cash Advance is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Merchants sell a specific amount of their business’ future credit and debit card receivables at a discount in exchange for the capital they can use for business. Payments are often more flexible as they are based on sales.

For your loans and funding needs call now at 888-996-2273 Extension 1159

Posted in Best Practices for Merchants Tagged with: cash advance, credit, debit card, loan, merchant, payments

March 3rd, 2017 by Elma Jane

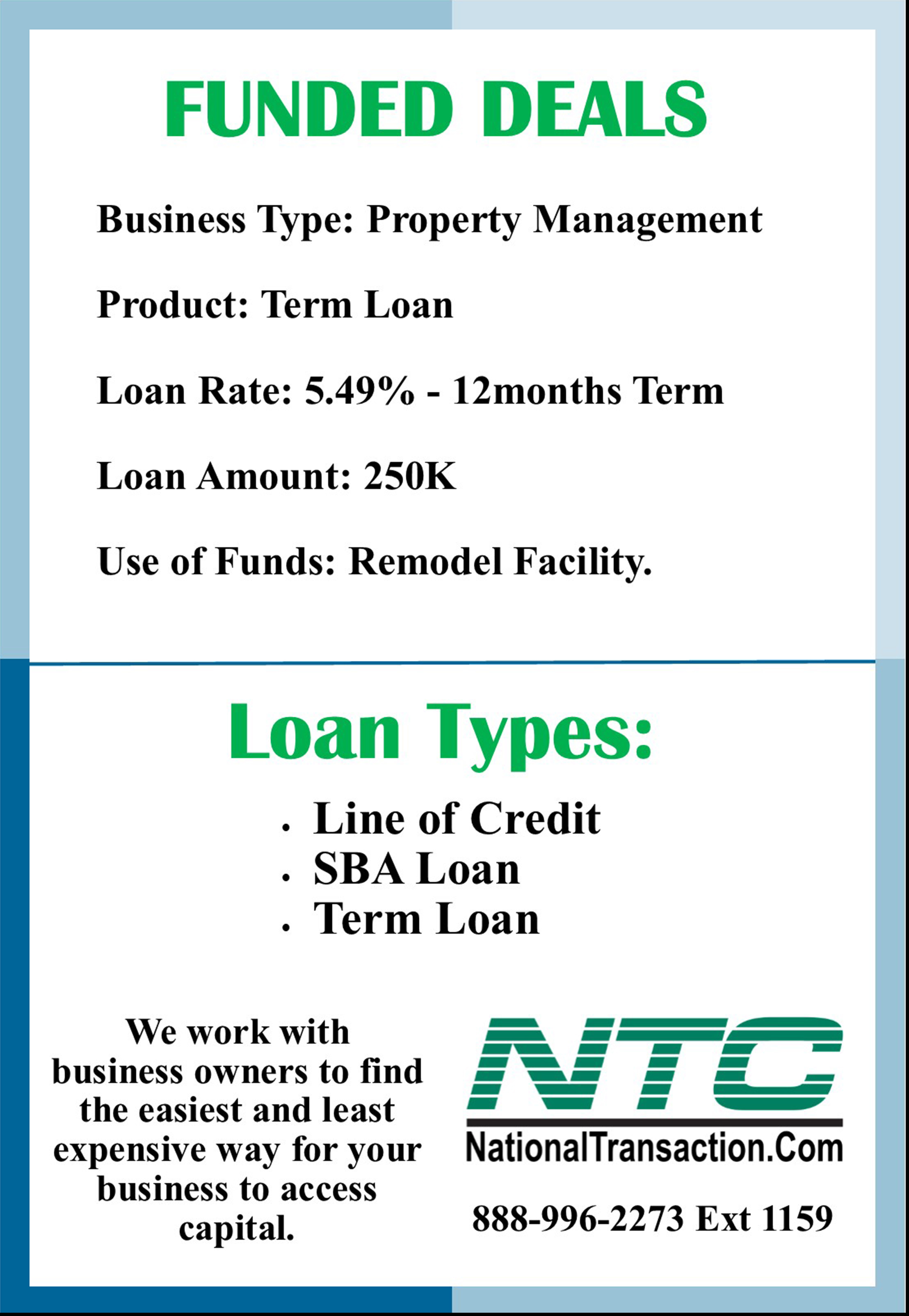

RECENTLY FUNDED DEALS

Our Loan Specialist work with business owners to find the easiest and least expensive way to access capital.

Call now 888-996-2273 Ext 1159

Posted in Best Practices for Merchants Tagged with: loan

March 1st, 2017 by Elma Jane

ELECTRONIC PAYMENTS

When it comes to electronic payments, certain types of businesses are considered high risk.

Most merchants do not realize that electronic payment processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank.

Essentially, a merchant account is an unsecured loan.

Different factors used to determine when a business is a high risk are:

- Types of products

- Services they sell how

- How they sell them

Online transactions are considered high risk because there are increased risks of fraud.

A key factor used to determine the risk of a business is chargebacks.

Chargebacks include customer refunds and fraudulent transactions.

Payment providers assess this risk to determine the percentage of chargebacks your business is likely to experience.

Businesses that are considered high risk where they take advanced payments:

- Travel agencies

- Ticketing services

Electronic payments provider is necessary if you want to accept debit and credit card transactions.

For high-risk electronic payments please feel free to call us at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, credit card, debit, electronic payments, fraud, loan, merchant accounts, merchants, online, payment processors, transactions, travel agencies

February 22nd, 2017 by Elma Jane

Recently Funded Deals

Business: SPA

Product: SBA Loan

Loan Rate: 6.25%

Term: 10-Year

Funded Amount: 100K

Monthly: $1247

Use of Funds: Equipment Purchase

888-996-2273 Ext 1159

888-996-2273 Ext 1159

NTC works with business owners to find the easiest and least expensive way for your business to access capital.

Loan Types:

Line of Credit

SBA Loan

Term Loan

Posted in Best Practices for Merchants Tagged with: loan

December 22nd, 2016 by Elma Jane

What is a Merchant Account?

If you want to remain competitive virtually, every business needs access to a merchant account to accept card payments from their customers. “Merchant” is another word for a seller or business owner. Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. This allows a merchant to receive funding for the credit transaction. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for payment providers or processors; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Merchant account helps facilitate the complex interactions that need to occur between your business and your customer, the credit card networks (Amex, Discover, MasterCard, Visa) and your payment provider every time you receive a card payment. It helps to ensure that you receive funding as quickly as possible, that the banks are protected from losses, and that buyers are protected from scams. Everyone is held accountable based on the rules of the credit card processing agreement with a merchant account.

There’s cost associated in taking credit cards, but it’s much easier and more secure to open a merchant account than it is to keep a book of credit accounts for all of your customers!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: amex, card, credit, customers, Discover, loan, MasterCard, merchant account, payment provider, payments, transaction, visa

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors