October 30th, 2024 by Elma Jane

This is a question we encounter on a daily basis. Travel environments are unique in that your transactions are usually keyed, there is almost always a delayed delivery period, large ticket transactions are not uncommon since one cardholder may be paying for multiple tickets, they tend to be seasonal, with peak season months generating an unusual spike in their “average” monthly volume, and chargeback’s pose a potential threat by travelers who are unable to complete their trip. Combine even a few of these factors together and you have cause for a reserve, or even account termination.

Being a part of a MO/TO (Mail Order/Telephone Order) or Keyed environment carries an increased risk of potential fraud or unauthorized use of a credit card. Since the credit card and cardholder are not present at the time of the transaction, the merchant has a limited ability to ensure the card is not being misused or that the proper AVS (address Verification Service) information is provided. NTC stresses the use of Credit Card authorization forms in order to obtain the correct credit card number, expiration date, billing address, and signature of the cardholder.

Travel merchants tend to have periods of increased volume based on peak travel seasons, whereas most other industries tend to have the same average monthly volume every month. This can generate spikes in volume on the merchant account that can trigger security concerns with the processor. Helping the merchant to analyze their volume trends and reporting the trends to the underwriters helps eliminate the security concerns when these spikes occur.

Large transactions which exceed the average sale amount for the merchant account can also trigger security concerns. Merchants who do not inform their merchant processor of large transactions prior to charging the credit cards can trigger security concerns and cause funding delays and reserve holds. Educating and clearly communicating with the merchant how to handle large tickets, volume spikes, and group bookings, prevents reserves, funding delays and/or other merchant account issues.

Another concern from the underwriters is the delayed delivery time frame. Delayed Delivery refers to the amount of time between accepting a credit card payment (whether a deposit or full purchase) and the time the cardholder travels. The client’s credit card is billed and the travel agent is paid however, the trip the travel agent was paid for doesn’t generally take place for 2 to 3 months. This leaves a lot of time for things to change, and should the client not travel for some reason, the first thing they do if the travel agent does not issue a refund, is claim a chargeback. NTC offers quite a few tips that can help protect the travel agent from chargeback situations.

Most merchants do not realize that merchant processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank. Essentially, a merchant account is an unsecured loan. The merchant runs a transaction and at the end of the day they settle their batch. Generally the merchant will receive the funds for that batch in their bank account within 2 business days even though the travel arrangements the client paid for do not take place right away.

Here at National Transaction Corp, we specialize in understanding what makes your transactions, as a travel agent, unique in how they affect your merchant account. Educating the merchant and ensuring they have a good understanding of what makes travel merchant account high risk, is one of our specialties. We have established a special relationship with our underwriting department which facilitates our ability to approve your high risk travel merchant account.

Contact your travel merchant account specialists at NTC today.

Mark Fravel

National Transaction Corp

Founder and President

888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: address verification service, avs, card holder, card payment, chargeback, credit card, Mail Order/Telephone Order, merchant, merchant account, merchant processor, moto, transactions, travel agent, Travel environments, travel merchants

September 20th, 2024 by Elma Jane

Merchant Account Risks for Travel Agencies

The travel industry, with its high-value transactions and international clientele, faces unique challenges when it comes to credit card processing. While accepting plastic is crucial for smooth booking and customer convenience, travel agencies must be aware of the inherent risks and implement strategies to mitigate them. Here’s a breakdown of the key credit card processing risks and how to minimize them:

1. Chargebacks:

- The Problem: Travel plans change, flights get delayed, and unforeseen circumstances arise. This can lead to a higher rate of chargebacks, where customers dispute charges with their credit card company. Chargebacks can be costly, involving fees, lost revenue, and potential damage to your merchant account reputation.

- Mitigation:

- Clear Cancellation Policies: Crystal-clear terms and conditions regarding cancellations, refunds, and travel changes are essential. Ensure these are easily accessible during booking.

- Thorough Documentation: Maintain detailed records of all transactions, customer communications, and travel itineraries. This provides evidence in case of a dispute.

- Proactive Communication: Keep customers informed about any changes to their travel plans and address concerns promptly.

- Secure Payment Processing: Utilize 3D Secure (like Verified by Visa or Mastercard SecureCode) for added authentication and fraud prevention.

2. Fraud:

- The Problem: The travel industry is an attractive target for fraudsters due to high transaction values and the potential for anonymity. Fraudulent activities can include using stolen credit card details, booking fictitious trips, or exploiting vulnerabilities in online booking systems.

- Mitigation:

- Address Verification System (AVS): Verify the billing address provided by the customer against the address on file with the credit card company.

- Card Security Code (CVV): Always require the CVV code for card-not-present transactions.

- Fraud Detection Tools: Implement fraud screening tools that analyze transactions for suspicious patterns and flag potentially fraudulent activity.

- PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure handling of sensitive cardholder data.

3. Currency Fluctuations:

- The Problem: International travel often involves transactions in multiple currencies. Fluctuating exchange rates can impact your profit margins and create uncertainty in pricing.

- Mitigation:

- Dynamic Currency Conversion: Offer customers the option to pay in their home currency, providing transparency and potentially reducing chargebacks related to exchange rate discrepancies.

- Hedging Strategies: Explore financial instruments to mitigate currency risk, such as forward contracts or currency options.

4. High Processing Fees:

- The Problem: Travel agencies often face higher processing fees due to the perceived risk associated with the industry.

- Mitigation:

- Negotiate with Processors: Shop around and compare rates from different credit card processors. Don’t hesitate to negotiate for better terms, especially if you have a high volume of transactions.

- Consider Interchange-Plus Pricing: Opt for transparent pricing models like interchange-plus, which separates the interchange fee (charged by card networks) from the processor’s markup.

5. Technological Challenges:

- The Problem: Keeping up with evolving payment technologies and security standards can be challenging. Outdated systems can increase your vulnerability to fraud and data breaches.

- Mitigation:

- Invest in Secure Technology: Use a robust and secure online booking system that integrates with reputable payment gateways.

- Regular System Updates: Ensure your software and security protocols are regularly updated to address emerging threats.

- Partner with Reliable Providers: Choose payment processors and technology vendors with a strong track record of security and reliability.

By understanding and proactively addressing these credit card processing risks, travel agencies can protect their business, enhance customer trust, and navigate the exciting world of travel with greater financial security.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card-not-present, cardholder, chargeback, credit card, customer, fraud, high-risk merchants, merchant account, merchants, payment, processors, risk, transaction, travel, travel agencies, travel agency, travel agents

Cash When You Need it by Not Holding Funds

In our second installment, we talked about NTC’s newest solution, NTC ePay. This third and final reason in this series we will go over how NTC keeps your cashflow going.

Due to the history of travel businesses, many travel agencies are given a travel merchant account with monthly credit card processing volume caps. This means merchants are only permitted to handle a specific number of credit card transactions or volume amount per month. Once that limit amount is reached, the merchant can no longer take credit cards for purchases that month. This keeps a business, especially an e-commerce merchant that relies on credit card payments, from operating effectively.

Imagine the impact on as a travel agent when you no longer have to worry about having your cash flow stopped. We work very hard to eliminate holds and reserves on all our travel merchant accountsaccounts.

Now imagine getting approved for large volume.

You will agree that those two factors will have a huge positive impact on your business growth.

Most merchant providers usually hold funds from travel agents, because historical data shows that consumers are much more likely to dispute and chargeback travel agency transactions because of a change in their travel plans.

You may be wondering, why do we not hold your funds?

Well simply said, because we understand your business. NTC has been doing business with travel professionals like you for over 20 years and we understand that holding funds creates a huge hassle for your operation. We understand that cash flow is essential to your continued success.

With NTC travel agents can feel confident that they will maintain cash flow to help their business operate smoothly and efficiently without interruptions.

Why do travel merchants flag large transactions?

Many times travel merchants run tens of thousands of dollars worth of transactions and their processor tells them they’re going to simply hold the funds and pay the merchant at a later date.

We understand how critical it is to have funds available because many agents have shared how with other merchant providers, their cash flow has come to a complete halt at times.

Remember that when you choose a travel payment processor, you must be sure to choose one with experience in working with travel agencies like NTC.

At NTC, we assist you in developing and implementing your fraud prevention procedures, so that you can be proactive in identifying and correcting potential weak spots in your processing cycle.

Over these past three blog articles, we have shared the three main reasons why travel agents like you prefer National Transaction Corporation. Now we want to hear from you as to which of these three reasons is most important for your travel agency business. We’d love to read your comments below.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Merchant Services Account, nationaltransaction.com, Travel Agency Agents Tagged with: credit cards, e-commerce, electronic payment, merchant account, travel

Over the next three weeks we will explore on this blog some of the reasons why National Transaction Corporation is the preferred choice for travel agents.

The Travel industry is one of the world’s largest industries with a global economic contribution of over 7.6 trillion U.S. dollars in 2016. (Statista)

At NTC we recognize that travel agency payment processing has some unique hurdles to overcome, but we are leveraging our innovation because we want our travel agency partners to explore how our solutions transcend the challenges that travel agents face.

Secure processing is one of the reasons why National Transaction is the preferred choice for travel agents

National Transaction Corporation has Secure Merchant Payment Processing – Because when your customers know their data is safe, they keep coming back!

You’ve heard of the many data breaches within major corporations that have occurred in just the last few years, when customers’ confidential credit card information is stolen and businesses lose a small fortune in repairing the problem. The cost of such a security breach goes far beyond that, however; once a business has lost the trust of its customers, 60% of those cardholders will go elsewhere for their purchases and services, according to studies on the problem.

Imagine if this happened to your travel agency merchant account? It could be disastrous, especially because agencies tend to deal with high-dollar sales from a moderately-sized pool of customers – so every client counts.

NTC knows that you, like us, care about your customers, and we want your travel agency to be seen as a trustworthy place to book a dream vacation. The first step is for your business to be PCI-DSS compliant.

PCI-DSS (Payment Card Industry-Digital Security Standards) requirements were put in place by the credit card associations to deal with the increasing problem of identity theft and data loss. The requirements vary according to the types and the number of payment transactions your agency goes through, but you can be sure that NTC will help you stay compliant with the latest security standards.

In the event of a data breach, we are here to eliminate the negative impact it can have on your company. NTC may be able to help you with the fines, assessments, and other costs from the networks, and we will consult with you on how to proceed to protect your agency and your reputation.

As you know, data security is as much a concern for the business owner as it is for the cardholder – your customer. When your clients know that their data is safe with you, they will keep coming back to your agency to book their next great trip!

If you cannot wait to read blog number two out of this three part series, feel free to call NTC now at 888-996-2273 to find out the best options for your travel agency!

Posted in Credit card Processing, Credit Card Security, Travel Agency Agents Tagged with: cardholder, data, fraud, merchant account, payments, Security, transaction, travel, visa

February 25th, 2024 by Admin

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

But what exactly is m-commerce? M-commerce is a hybrid technology that takes web technologies that scale screens to mobile devices like Apple iPads and Android tablets. The commerce end of it comes from shoppers and merchants actually executing payment transactions over mobile devices of some form. Read more of this article »

Posted in Credit Card Security Tagged with: credit card, Digital Wallet, e-commerce, gateway, m-commerce, merchant account, nfc, payment, shopping cart, smartphone, tablet

Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

NTCePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

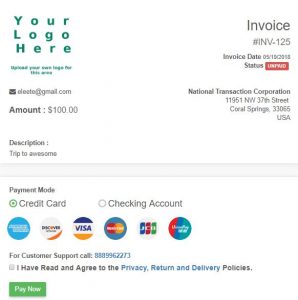

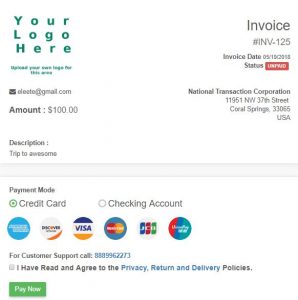

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Things flow better when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not your business, as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the e-commerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now, when you run a social media campaign you can leverage our NTCePay technology to help you increase sales. Use our ePay links to post vacation travel packages or special sales and have customers pay in two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel

October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

April 23rd, 2018 by Admin

Have you ever had issues with your credit card processing provider only to get turned around and around by the rep on the phone? IF you can even get someone on the phone. You hang up feeling frustrated, angry, and without any answers.

Have you ever had issues with your credit card processing provider only to get turned around and around by the rep on the phone? IF you can even get someone on the phone. You hang up feeling frustrated, angry, and without any answers.

Sometimes it’s a small problem, but what happens when they “misplace” your money, or there’s a problem with your account and you can’t receive any payments – and no amount of calling, emailing, or “chatting” seems to help you resolve anything?

There’s a better alternative to credit card payment processing, a company that’s been around for a long time, and is backed by one of the biggest banks in the country. National Transaction Corporation. And we have live, knowledgeable, friendly advisors waiting to pick up your calls and help you with your questions – no runaround, no excuses, no delays.

That’s the NTC way: Help when you need it, on a human level.

You may have had to make a lot of phone calls about chargebacks if you are using one of the more familiar service providers like PayPal, Stripe or Square. Chargebacks are a primary cause of business owners’ complaints with these companies, because these services will usually side with the cardholder in the event of a dispute as they arbitrate the chargeback themselves.

NTC does business fairly and sensibly. When you process your credit card sales through NTC, you will be dealing with Visa, MasterCard, American Express or other credit card companies directly.

When you work with those other service providers, you may be worried about where your money might end up – especially if you’ve read all the nightmarish complaints that business owners like you have posted on trusted sites like the Better Business Bureau and Consumer Affairs.

Imagine you’ve processed a credit card transaction, and the cash seems to disappear? You call and you write and you chat, but no one has anything helpful to offer you and you wonder just where your money went, and what will happen to it now.

NTC knows that’s not how you build trust with your customers. We pride ourselves on our outstanding customer support, ease of use of our services, and the confidence and integrity that comes from being backed by one of the biggest banks in the country, US Bank.

National Transaction Corporation aims to make growing your business easier and more profitable by tailoring our services to your specific needs. We do this because we like you to establish a long-term partnership with us.

Whether you are a florist, a restaurant, or any other kind of merchant, remember to look beyond just the advertised rate when looking for the best credit card payment processing service provider.

If after reading this article and you would like to speak to one of our live customer service representatives, simply call NTC today at 888-996-2273.

Posted in Credit card Processing Tagged with: consumers, credit card, customer, customers, electronic payment, merchant account, Security

March 15th, 2017 by Elma Jane

Payment Options

Technology continues to evolve, offering multiple billing and payment methods increases satisfaction by improving customer experience.

Customers will continue to move toward digital life, like embracing different forms of online billing and ways to accept payments.

Creating convenient ways to accept payments and having more options can reduce the time it takes your business to get paid.

Accept debit and credit card payments online; to offer this feature you need to get a merchant account.

Options for accepting payments:

Electronic Check Service (ECS) – convert paper checks to electronic transactions, with NTC’s ECS. Converting paper checks to electronic transactions eliminates many of the risks and costs, adding money to your bottom line.

Mobile Payments – the opportunity to increase revenue through mobile payments is huge. Many consumers find that mobile bill pay makes shopping easier, more convenient and saves time. Converge Mobile Solution lets you accept card payments using smartphone or tablet. The app works with most Apple and Android mobile devices.

Online Payment Gateway – offering customers an online payment form enables them to pay you easily and allows you to accept payments by credit card, debit card or echeck.

Electronic Invoicing (NTC ePay) – send your customers an invoice by email and get paid in minutes. Electronic Invoicing gives your customer the ability to pay their bills and receive a receipt in seconds by email.

Learn more about accepting electronic payments with NTC or sign up with us.

No setup or cancellation fees, there’s no risk! call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, echeck, ECS, Electronic invoicing, electronic transactions, merchant account, mobile, online, payment, payment gateway

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction

With smartphone users on the rise

With smartphone users on the rise