March 7th, 2017 by Elma Jane

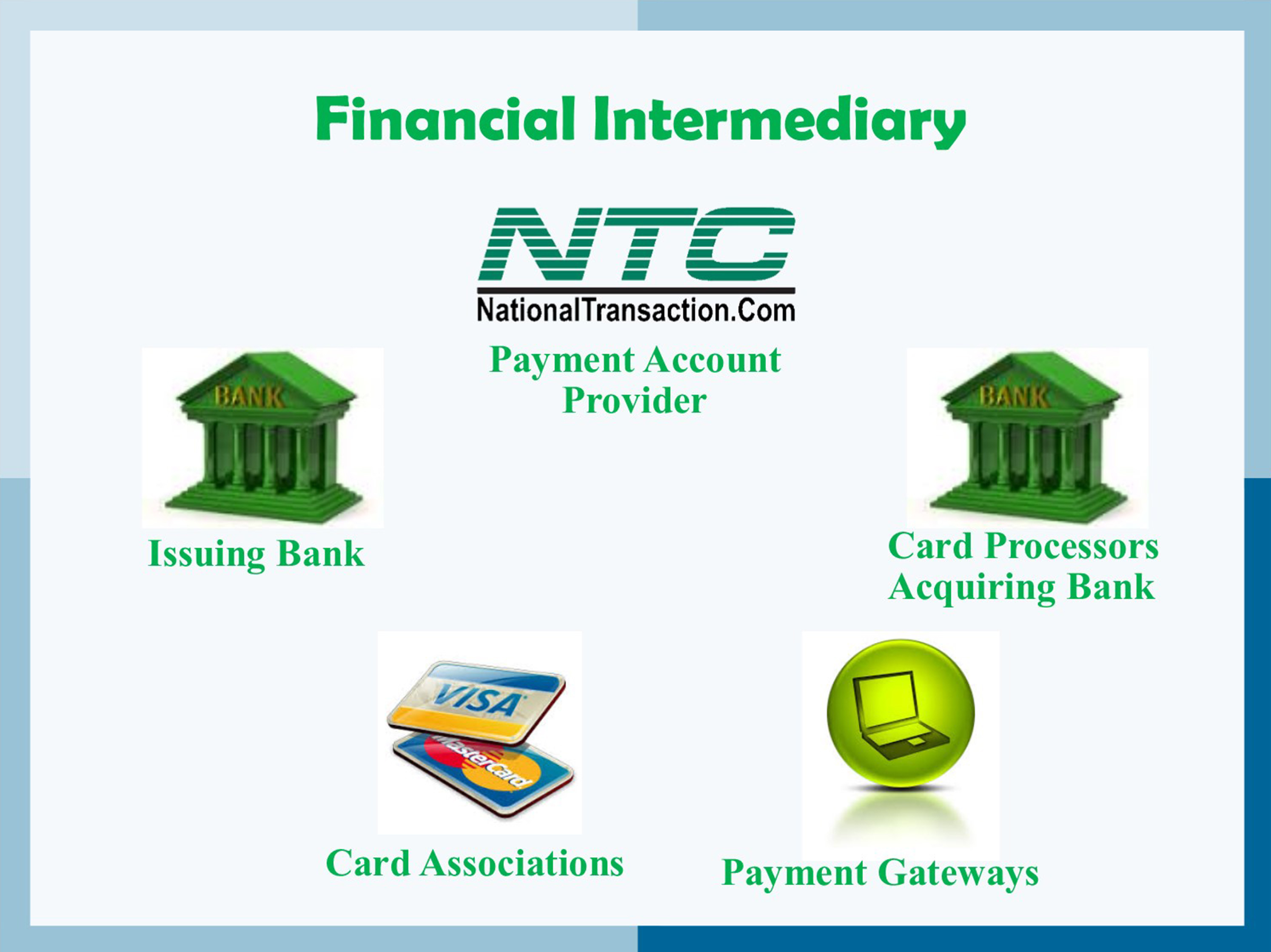

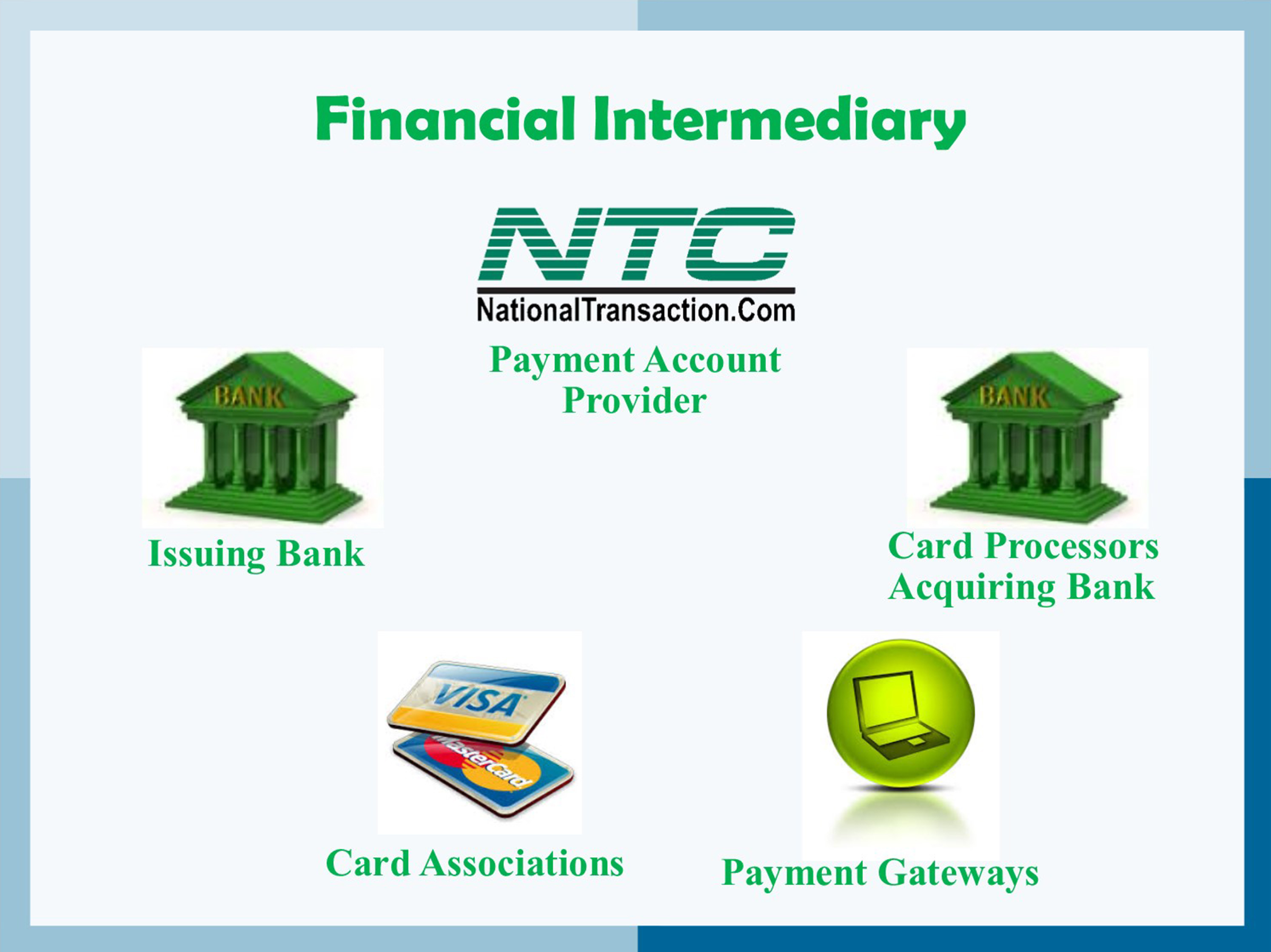

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction

January 23rd, 2017 by Elma Jane

What Makes Up The Rate That You’re Paying?

Most rates are made up of three parts:

Interchange – Goes to the bank that issued the card, and is typically made up of a flat rate plus a percentage of the sale.

Assessments – Go to card network like Visa, MasterCard, Amex, Discover etc.

Processor fees – Fees involved with providing the service, risk assessments, the type of transaction, and the size of the transaction. This portion includes the margin between the total rate and the two previous parts, along with any incidental fees, like chargeback or statement fees.

There are a lot more intricacies of what makes up a credit card rate, but this information gets you off to a good start. If you’re interested in learning more about electronic payments, check our website www.nationaltransaction.com or call now 888-996-2273 and talk to our Payment Consultant.

Posted in Best Practices for Merchants Tagged with: bank, card, card network, chargeback, credit card, merchant, payment, processor, transaction

January 20th, 2017 by Elma Jane

Qualified vs Non-Qualified credit card rates

The most common forms of rate structures for credit card rates are:

2-Tiered: Qualified and Non-Qualified

3-Tiered: Qualified, Mid-qualified, or Non-qualified

Each and every transaction you accept is classified into one of the above and is the basis for the credit card rate you see on your statement.

As a general rule, qualified transactions are going to be “standard” cards; without any consumer or corporate rewards associated with them. Accepted in the “standard” method expressed in your merchant processing agreement, this is where Card-Not-Present (CNP) setup comes into play.

Mid and Non-Qualified transactions include:

Rewards cards, keyed-in payments (for swipe accounts), AVS (Address Verification Service) does not match or is not performed, not all required fields are entered, or the payment was entered in a late batch. Ex. the payment was sent to the processor 48 hours or more past the time of the authorization.

Posted in Uncategorized Tagged with: card-not-present, consumer, credit card, merchant, payment, processor, transaction

January 19th, 2017 by Elma Jane

Card-Present vs Card-Not-Present – It’s important for a merchant to know what types of credit card payments their business will be taking.

If you rely on mailed, over-the-phone, or online payments a Card-Not-Present merchant account is what you need.

With this type of account, you don’t need the physical card. You are set up to accept credit cards where card information is being keyed into a credit card terminal or online.

A card-not-present merchant accounts base rate is higher than if you signed up for a Card-Present or swipe merchant account.

Why are card-not-present rates higher? There is less risk associated with a business swiping a credit card than keying it in. Why? When a card is swiped, a person is present; where the merchant can check ID and signature. When a person is not present, it’s open for consumer fraud.

However, when you’re setting up a Card-Not-Present merchant account, these factors are taken into consideration during the underwriting process, which leads to a lower base rate for keyed-in payments

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card present, card-not-present, credit card, merchant, online, payments, terminal

January 9th, 2017 by Elma Jane

The Travel industry payment experts! Why NTC?

NTC is the preferred payment processor for over 3,000 Travel Related Agencies.

High application approval rates while striving to eliminate holds & reserves is a big part of our Travel Merchant’s success.

Guaranteed Lowest Rates

Next Day Deposits

We Integrate with Trams & Sabre Red

Integration with a wide range of Booking Engines

Live US Based Concierge Service within three rings

Preferred by Many Associations including ASTA

NTC ePay Electronic Invoicing

Highest Approval Rating

Accept Payment from Anywhere in the World

Online Reporting and Processing Tools Included

Get the most from your Payment Processing Call Now 888-472-7112

Not all Travel Merchant Accounts Are The Same!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchant, online, payment, payment processing, payment processor, travel, travel industry, Travel Merchant

December 27th, 2016 by Admin

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional merchant account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days. (A client of ours who signed up with an aggregator came back in tears and wants to open her merchant account with us again because her funds was held with the merchant aggregator. She then promised will not leave and stay for life with NTC).

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

Setting up a Merchant Account? Call us now! 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, fees, funds, merchant, merchant account, payments, transactions

November 29th, 2016 by Elma Jane

GET THE LOWEST CREDIT CARD TRANSACTION RATES & FEES BY DOING THE FOLLOWING:

1. Use newer POS systems to reduce credit card fees.

2. Find out what percentage of your gross sales go toward credit card rates.

3. Perform a statement review at least annually.

Any time a customer uses a credit card to purchase services and goods the merchant pays various rates and fees processing those transactions. Most of these fees go to the bank issuing the credit card as they take on the bulk of the risk in credit card transactions.

Visa, American Express and Discover own the network on which these credit card transactions are processed on and they receive part of the fee and percentage rate as well as establish these rates and fees. Finally the bank that provides merchant account services gets part of these rates and fees.

To a small business 2, 3, or even 4% might not sound like much but when these fees are on the gross total of sales they can be significantly higher than originally thought.

For this reason it’s a great idea to assess your merchant account statement to see if rates are in line and that your most frequently used cards and transaction types are getting the best rate possible. By going over your statement, you can see exactly what you pay per transaction and get details about your most common transaction types and credit card used to get the process going.

If you are unfamiliar with what these rates and fees mean on your statement companies like National Transaction can perform the review for you. Free of charge.

Ultimately the best thing to have is a merchant account service provider that will take the time to go over your business with an eye lowering your rates and fees. The savings can be significant. As a business grows it changes and there should be an ongoing strategy at maintaining the best processing rates and fees possible. Today with so many different credit card types, like rewards cards, airline miles programs and more it can pay off to check once or twice a year.

For FREE Rate Review give us 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, credit card, customer, merchant, merchant account, POS, rewards cards, service provider, transaction

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors