September 28th, 2016 by Elma Jane

Business Lines of Credit – is for businesses with an inconsistent cash flow. Either businesses that needs to borrow a small amount of capital, and businesses that use invoices.

Different types of lines of credit:

Cash Account, the most basic line of credit – which you can access when you’re in need of capital; whether you’re making a large purchase or covering a temporary gap in cash flow. You only have to pay the interest on the amount that you borrow; with this form of financing, the money is always available when it’s needed.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

- First of all, you can purchase inventory wholesale.

- Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit. Furthermore, personal loans are term loans that can be used for a number of purposes.

If your business is new to qualify for a business loan, consider using a personal loan.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

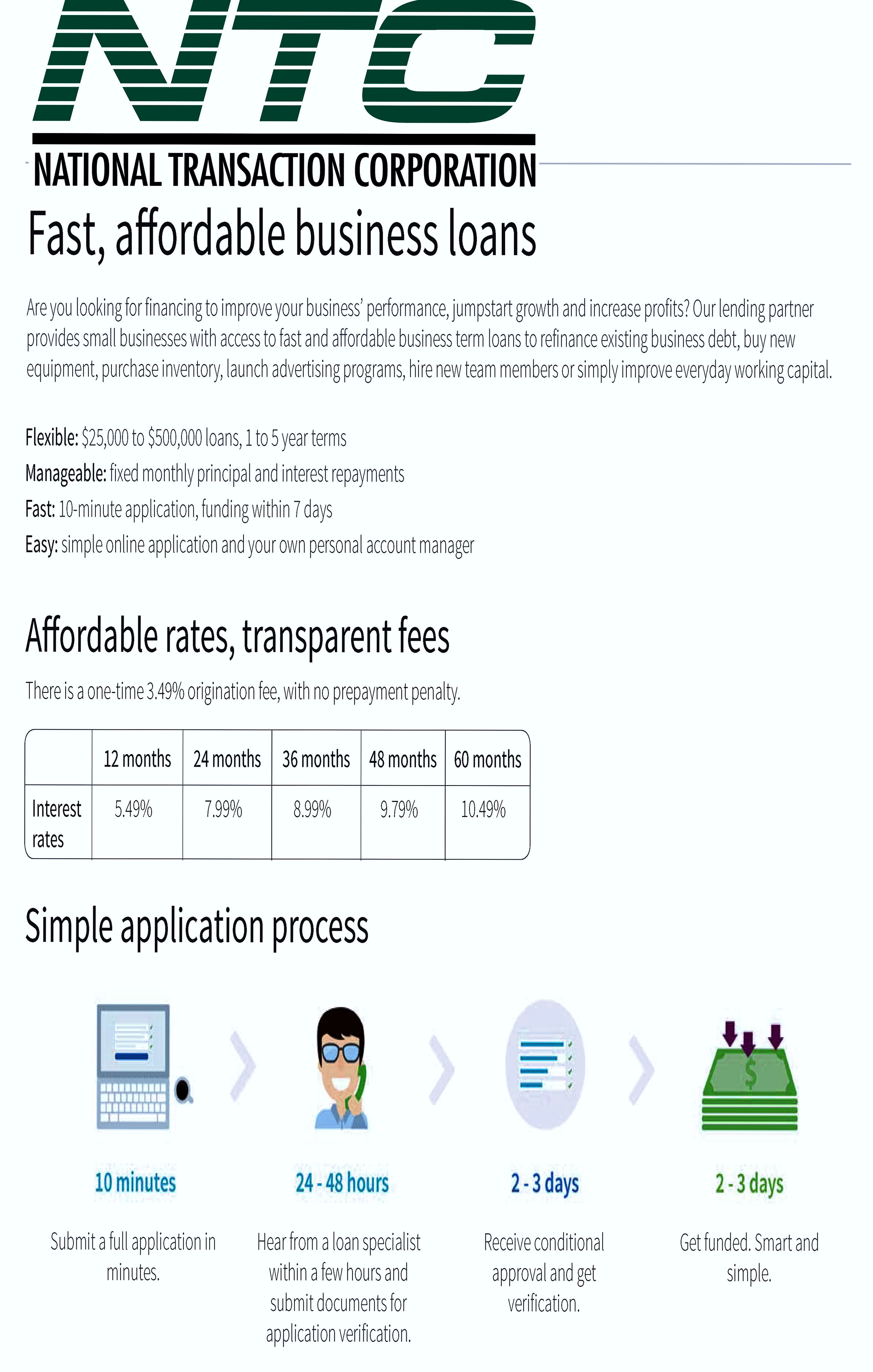

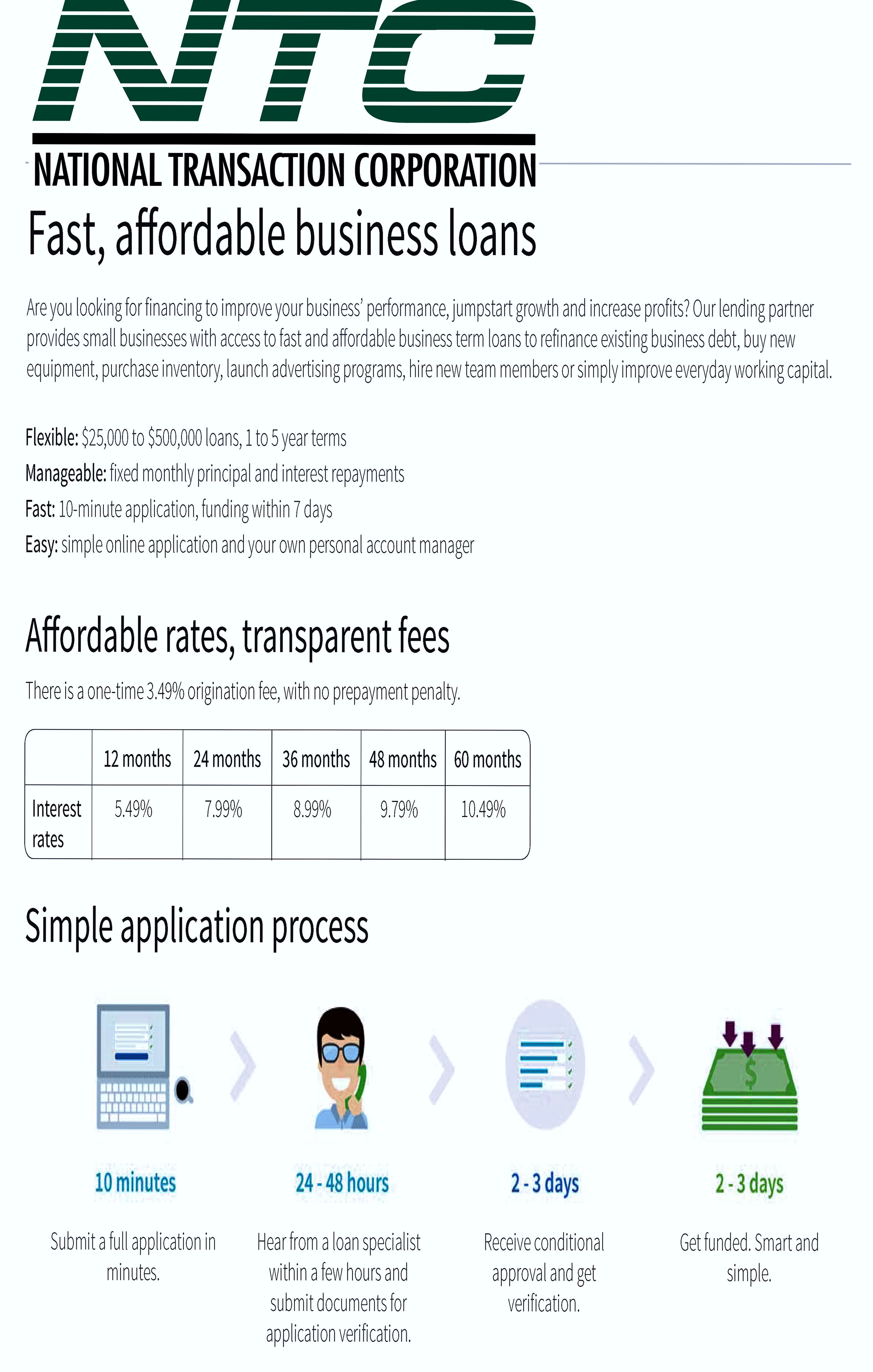

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing call us at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance, Small Business Improvement Tagged with: cash advances, credit, financing, loans, merchant

September 21st, 2016 by Elma Jane

PCI compliance applies to any company, organization or merchant of any size or transaction volume that either accepts, stores or transmits cardholder data.

Any merchant accepting payments directly from the customer via credit or debit card must be Compliant. The merchant themselves are therefore responsible for becoming Compliant, as the deadline for the merchant becomes overdue.

Understanding and knowing the details of Payment Card Industry Compliance can help you better prepare your business. Because failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms as part of the operating regulations. The regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, cardholder, compliance, credit, customer, data, debit card, Discover, jcb, MasterCard, merchant, Payment Card Industry, payments, PCI, transaction, visa

September 9th, 2016 by Elma Jane

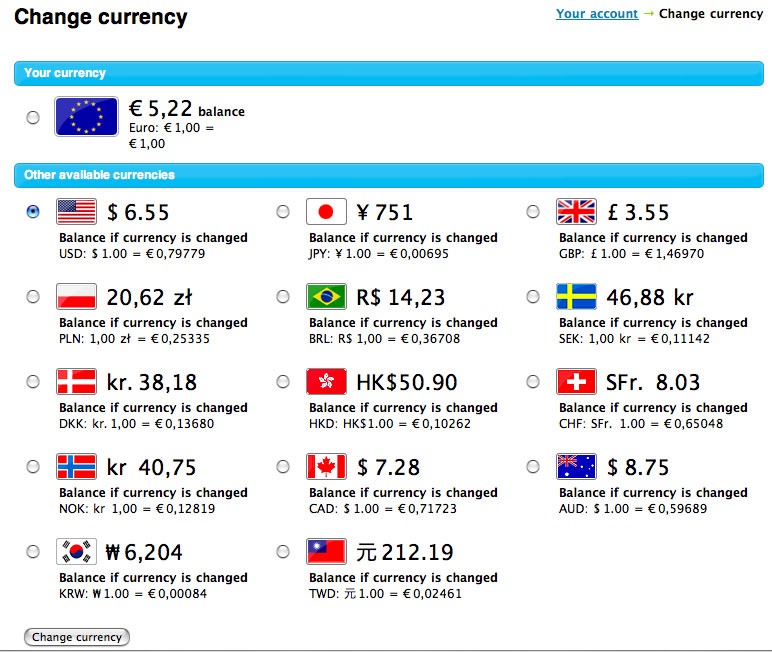

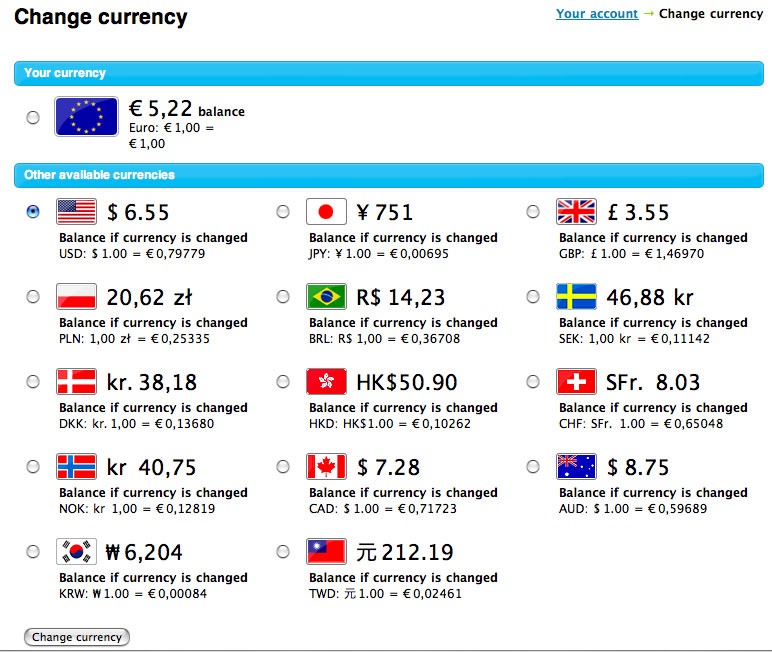

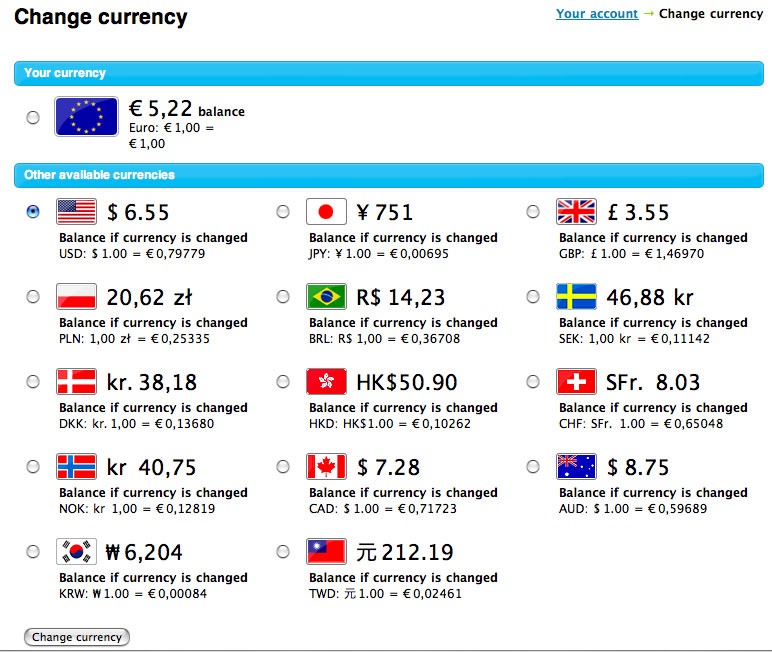

Multi Currency Conversion (MCC):

- In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

- Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

- Conversion occurs between the point of sale and settlement.

- E-commerce only and no merchant rebate.

- Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC):

- Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

- Conversion occurs at the point of sale and five supported currencies less than MCC.

- Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

- Price listed in merchant’s currency conversion.

- For Retail, Restaurant, MOTO and E-commerce.

- Supported by terminals, via Warp and Virtual Merchant.

For more information give us a call at 888-996-2273 or visit our website: www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order Tagged with: customer, e-commerce, merchant, moto, Multi Currency Conversion, point of sale, terminals, transactions, virtual merchant

September 1st, 2016 by Elma Jane

A woman named Gabriela visited one of our merchant.

Gabriela stated that she’s from the company that processes REK Storage credit card transactions to upgrade their credit processing system.

She even claimed that the company she worked with was the parent company of National Transaction.

Gabriela presented some of the savings his company would receive in addition to a lower processing rates.

To start processing, they had to remove the old credit processing terminal because it was a company policy.

If you receive a phone call or visited by somebody claiming as NTC’s parent company give us a call 888-996-2273.

Posted in Best Practices for Merchants Tagged with: credit card, credit processing, merchant, terminal, transactions

August 11th, 2016 by Elma Jane

CURRENCY CONVERSION

Multi Currency Conversion (MCC):

In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

Conversion occurs between the point of sale and settlement.

E-commerce only and no merchant rebate.

Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC): Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

Conversion occurs at the point of sale and five supported currencies less than MCC.

Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

Price listed in merchant’s currency conversion.

For Retail, Restaurant, MOTO and E-commerce.

Supported by terminals, via Warp and Virtual Merchant.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Point of Sale Tagged with: currency, customer, DCC, Dynamic Currency Conversion, e-commerce, Internet Secure, MCC, merchant, moto, Multi Currency Conversion, point of sale, retail, terminals, transactions, virtual merchant

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

July 26th, 2016 by Elma Jane

Mobile payment space is growing yet, many small businesses and retailers are choosing to overlook the idea of mobile payment acceptance.

Here are stats that prove the importance of mobile payments:

About 45% of consumers use mobile payments out of convenience.

1 billion users will use in-store mobile payments by 2019.

An increase from $3.2 billion in 2014 to $487 billion by 2020 in US in-store mobile payments is predicted.

Millenials use contactless payments on a regular basis.

Over the next five years, mobile payments will reach about $3 trillion in volume.

There are 16 million Starbucks mobile app active users that make 8 million mobile payments per week.

Transactions globally are on mobile devices.

It is a great investment for a merchant to upgrade your point-of-sale (POS) to have near field communication (NFC) capabilities. If you’re not currently accepting mobile payments, you should start now, your customers who are already using mobile payments will thank you and your business will be ahead of the game as more businesses onboard mobile payment acceptance.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, Mobile Payments, Near Field Communication, Point of Sale Tagged with: contactless payments, customers, merchant, mobile payment, Near Field Communication, nfc, point of sale, POS, transactions

July 21st, 2016 by Elma Jane

Always ask for the card security codes:

CVV2 for Visa

CVC2 for MasterCard

CID for Discover and American Express.

Always use the Address Verification Service (AVS) and only process sales after receiving a positive AVS response.

Avoid using voice authorizations, unless absolutely necessary.

Billing descriptor must set up properly and shows your phone number. Customer can contact you directly if there is an issue,

Consider using the associations’ 3-D secure services:

Verified By Visa

SecureCode by MasterCard

A 3-D transaction confirmation proves card ownership and protects you from certain types of chargeback. An additional layer of security for online credit and debit card transactions.

Inform your customers by email when a refund has been issued or a membership service cancelled. Notify them of the date the refund was processed and provide a reference number.

Make available customer support phone number and email address on your website so that customers can contact you directly. You need to meet this requirement before opening a merchant account.

Make it easy for your customers to discontinue a recurring plan, membership or subscription. Have a no-questions-asked policy.

Notify your customers by email of each transaction and indicate that their cards will be charged.

Obtain a confirmation of delivery for each shipment.

Process refunds as quickly as possible.

Secure an authorization approval for every transaction.

Secure customers’ written or electronic signatures, for recurring payments or monthly fees. Giving you express permission to charge their cards on a regular basis.

Terms and conditions must be clearly stated on your website. Customers must acknowledge acceptance by clicking on an Agree or a similar affirmative button.

Transaction amount must never exceed the authorized amount.

You are required to reauthorize the transaction before settling it if an authorization approval is more than seven days old.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Merchant Services Account Tagged with: card, chargeback, credit, customer, debit, merchant, merchant account, online, sales, Security, service, transaction

July 14th, 2016 by Elma Jane

PCI Compliance applies to every merchant who is accepting credit cards large or small. Refusing or delaying to become PCI Compliant can end up being a costly mistake.

If you accept any credit or debit card payment, you need to be PCI Compliant no matter the volume is.

PCI applies to any company, organization or merchant of any size or transaction volume that accepts, stores or transmits cardholder data. Any merchant accepting payments directly from the customer via credit or debit card must be PCI Compliant.

The merchant themselves are responsible for becoming PCI Compliant, as the deadline for merchants to become Compliant is long overdue

Understanding and knowing the details of PCI Compliance can help you better prepare your business. Failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms part of the operating regulations, the regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, credit cards, customer, data, debit card, merchant, payment, PCI Compliance, transaction

July 13th, 2016 by Elma Jane

Monthly statement fee is a fixed fee that is charged monthly and is associated with the statement that is sent to a merchant in one billing cycle, approximately 30 days worth of credit card processing by the merchant account provider; whether it’s a printed one, a mailed statement or an electronic version. Requesting online statements won’t necessarily be able to waive statement fee.

Every credit card and merchant account provider have a different set of costs associated with its services, but remember that there are several processors out there that are very transparent with their fees like National Transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, fee, merchant, merchant account, processors, provider, services