July 12th, 2016 by Elma Jane

Interchange is where transactions are submitted for payment from the Acquirer or Merchant Processor to the Card Issuer or Debit Network. It also represents the fees paid by the merchant acquirer to the Card Issuer.

At the time the transaction is exchanged fees are paid and vary based on processing method utilized. It is more expensive to process a hand-keyed transaction than a card-swiped transaction.

Several rates may apply to your transactions, depending on your method of processing each transaction and the interchange qualification that is assigned to each transaction by the Card associations for processing transactions.

Rate qualification criteria: The card associations consider the card product used in the transaction, how the transaction data is entered, the time of settlement versus time of authorization.

Interchange Category Based on Card Type: Credit, Debit, and Rewards purchasing.

Industry Type: Retail or E-commerce.

Qualification Elements: Swiped card or Key entered.

When you settle your transactions each day, Acquirer or Merchant Processor like NTC routes them to the Card Associations (Visa, MasterCard, Discover) and debit networks through Interchange.

Visa, MasterCard, Discover (Card Associations and Debit Networks) establish the rules and manage the Interchange of all transactions.

Posted in Best Practices for Merchants Tagged with: card, card-swiped, credit, debit, e-commerce, merchant, payment, processor, transactions

July 5th, 2016 by Elma Jane

With the ever growing number of financial crimes occurring within the payments industry, initiatives to identify patterns of possible suspicious behavior has been enhanced. The Loss Prevention team recently put into place a new procedure for collecting information pertaining to the Anti-Money Laundering requirements of “Customer Due Diligence” (CDD) and “Customer Identification Program” (CIP).

If a merchant reaches their Processing Limit (Soft Cap), or they request a change to their MCC/SIC, Loss Prevention is required to obtain and validate CDD and CIP information prior to making updates to the account. Loss Prevention representatives will reach out to the customer’s Merchant Service provider (MSP) office first, in an effort to effectively obtain the information without causing potential alarm to the customer.

Thank you for being a partner with NTC, and helping to prevent financial crimes in our industry.

Posted in Best Practices for Merchants Tagged with: customer, financial, merchant, payments, payments industry, service provider

June 20th, 2016 by Elma Jane

Batch – is a collection of credit card transactions, usually a single day’s worth.

Batch Processing – refers to a one-time closing or settling the entire batch of transactions.

The point-of-sale terminal or credit card processing software can be set on:

Manual Batch close – merchant will need to batch out at the end of each day. The processor will receive a command to settle all transactions that have been entered. There will be a printed report showing the transaction totals in the batch once a batch is settled.

Changes can be made to existing transactions in the batch before a batch is settled. Example: If you want to change an amount of one of the transactions or you want to void a transaction.

Automatic Batch close – The terminal or software will automatically close the batch, (settle the transactions) at a certain time each day, no manual intervention is needed by the merchant or in some case the processor will settle the batch (called host batch close at the processor level). Automatic batch close set-up is advisable for most businesses unless a tip edit function is required, manual batch close would be the better option.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, point of sale, processor, terminal, transactions

June 13th, 2016 by Elma Jane

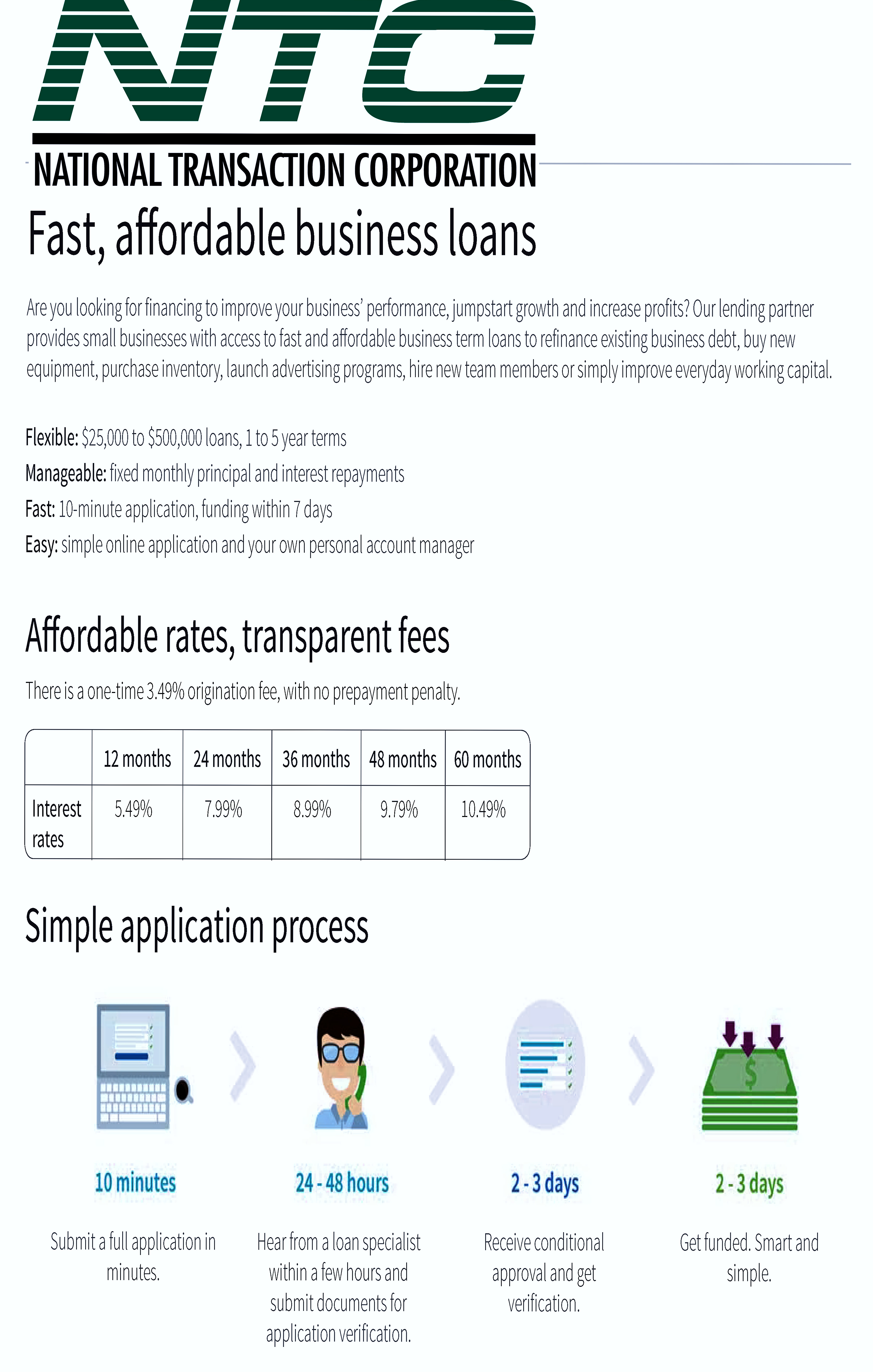

Lines of Credit – is for Businesses with an inconsistent cash flow, businesses that only need to borrow a small amount of capital, businesses that use invoices.

Different types of lines of credit:

Cash Account the most basic line of credit – which you can access when you’re in need of capital, whether to make a large purchase or cover a temporary gap in cash flow. This form of financing is that the money is always available when it’s needed, and you only have to pay interest on the amount that you borrow.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

First, you can purchase inventory wholesale.

Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit.

If your business is new to qualify for a business loan, consider using a personal loan. Personal loans are term loans that can be used for a number of purposes.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing give us a call at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance Tagged with: cash advances, credit, financing, loans, merchant

May 27th, 2016 by Elma Jane

Refunds – transfers funds from your merchant account to the customer’s account.

Refunds are always associated with a transaction that has settled.

A settled transaction – is funds that have already transferred from the customer to the merchant. You can only refund a transaction with a Settling or Settled status.

The refunded transaction goes through the typical settlement process. As the refund settles, the funds are sent back to the customer’s bank account. It is normal for your customer to experience a delay because the customer’s bank may take a couple of days to deposit these funds.

Voids – will cancel the transfer of funds from the customer to the merchant and can be issued if the transaction is either Submitted for Settlement or Authorized. The original authorization should disappear from the customer’s statement within 24 to 48 hours.

Posted in Best Practices for Merchants Tagged with: account, bank, customer, funds, merchant, merchant account, refunds, transaction

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

May 24th, 2016 by Elma Jane

Top terms in your Merchant Statement:

Interchange – are the variable fees charged by the card payment networks for processing transaction. Credit card brands set these non-negotiable rates based on card type, business size, and industry.

Ancillary Fees – this include statement, batch and customer service fees, monthly minimums and more.

Authorizations – this section shows the charges per authorization that come from an interchange plus provider and is then split by card brand and transaction type. On your statement, you will see these charges as either AUTH or WAT charges.

Deposit Summary – following the summary is the deposit summary, where lists of your account activity broken down by day and card type.

Discount Rate – every transaction percentage that is deducted as a fee. Rates are categorized as qualified, mid-qualified and non-qualified.

Processing Services – this states your discount rate charges that you receive from your interchanges plus processor. This is divided by card brand and sales volume.

Summary – summary shows the processed sales by AMEX, Discover, JCB, MasterCard or Visa, as well as the total fees paid in order to process these sales. You can find this at the top of your statement.

Other items included in the summary:

Account adjustments, chargebacks, the breakdown of sales by card brand and number of refunds.

Understanding these terms on your statement will give you the confidence to read your merchant account statement with ease.

Posted in Best Practices for Merchants Tagged with: card, chargebacks, credit card, customer, fees, merchant, merchant account, payment, refunds, service, transaction

May 12th, 2016 by Elma Jane

Electronic commerce (eCommerce) is a type of business transaction, that involves the transfer of information on the Internet. This allows consumers to exchange goods and services with no barriers of time or distance electronically.

Business-to-Business (B2B) this refers to electronic commerce, between businesses rather than between a business and a consumer. These transactions electronically provide competitive advantages over traditional methods. It’s faster, cheaper and more convenient.

Creating a successful online store can be difficult if you don’t have knowledge of e-commerce and what it is supposed to do for your online business.

What do you need to have an online store?

- Shopping cart – an operating system that allows consumers to buy goods and or services. Track customers, and tie together all aspects of e-commerce into one.

- Or you can check out our NTC e-Pay no shopping cart Solution.

- Taking online payment by getting a merchant account and accept credit cards through an online payment gateway.

You just need to make a better decision in choosing the right shopping cart and a merchant account for your eCommerce shop.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: b2b, commerce, consumers, credit cards, customers, ecommerce, gateway, merchant, merchant account, NTC e-Pay, online, online payment, payment gateway, shopping cart, transaction

May 9th, 2016 by Elma Jane

Double refunds are when a customer is provided with two refunds for the same transaction. Chargebacks can be involved in a double refund.

Double Refunds Happen When:

Chargebacks are filed after a refund is issued. The consumer contacts the merchant and requests a refund, but the funds aren’t returned immediately. The consumer thinks the request for the refund was ignored and files a chargeback. Then both the chargeback and the refund are being processed.

Chargebacks are filed before a refund is issued. The consumer calls the bank and initiates a chargeback. Then, the consumer calls the merchant and expresses dissatisfaction. To try to avoid a chargeback, the merchant provides a refund. However, the merchant has no idea of the fact that a chargeback has already been filed because the consumer calls the bank first

Even thou a merchant provided a refund with a customer that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

Just because a merchant provided a customer with a refund that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

It is possible for the customer to receive a double refund for the one purchase transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, consumer, customer, merchant, refunds, transaction

May 5th, 2016 by Elma Jane

- A terminal lease carries with it a 48-month lease agreement.

- The cost of that lease can run anywhere from $50-$100/month.

That is a LONG time to be paying for a terminal equipment that doesn’t cost more than $400 these days.

- If a merchant pays upfront the cost of the purchase is completely tax deductible, you don’t need to pay $2400 for a terminal equipment that costs $400.

If you can’t pay cash for your credit card terminal, you can just charge it to a business credit card. The interest paid is still tax deductible. That’s a savings of nearly $2,000 that can be better directed toward developing and expanding your business.

Need to set up account give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, terminal