May 9th, 2016 by Elma Jane

Preventing double refunds depend on the timing of the chargeback. It is a bit challenging, the key lies in attention to detail.

A chargeback may already exist for the transaction when a customer say they just spoke to their bank. Merchants must pay attention to this big clue.

There are different time limits for resolving disputes before they become actual chargebacks, depending on the issuing bank.

- If customers indicate they did contact their bank, merchants need to call the issuing bank to determine if a case number has been assigned to the transaction dispute.

- If there is a case number that has been assigned, the merchant can disregard the refund request.

If a case number has not been assigned, merchants need to inform the bank that a refund has been initiated and a chargeback is not necessary.

Preventing Double Refunds Before Chargebacks are Filed

Provide prompt refunds to customers when they are warranted.

- Estimate when the funds will be available.

- Let customers know that a refund has been issued.

- Take care to ensure the credit isn’t process as a debit.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, credit, customer, debit, merchants, refunds, transaction

May 5th, 2016 by Elma Jane

Businesses or merchants accepting payments online needs an up-to-date and active security software that includes:

- FIREWALL PROTECTION – a software program that helps to screen out malware and hackers that try to reach you through the internet.

- ANTI-VIRUS PROGRAMS – Not all anti-virus program offers protection against all kinds of malware. Viruses are one type of malware. Spyware is another type of malware that can steal credit card information or your bank account.

Update:

- Keeping your operating systems, security software programs, and browser current can help secure your data information.

- Evaluate browser’s privacy settings, limit or disable cookies. Other cookies can be used maliciously and collect data information.

- Back up your data regularly. If your computer or device got compromised, you still have access to important files.

Need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, data, merchants, online, payments, Security

May 4th, 2016 by Elma Jane

Credit Card Terminal for…..

Some processors offer a free terminal to their merchants, but as we all know, there ain’t no such thing as a free lunch! A free terminal carries with it a yearly Terminal Replacement or Warranty charge of $50 to $100/year. That’s still much less than what a lease would cost you, but it’s not really FREE

If you’re not currently in a lease but are considering one, don’t be deceived. Instead, calculate the total cost of leasing vs. owning. The best and most affordable option still lies in ownership.

If you need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchants, processors, terminal

May 4th, 2016 by Elma Jane

Some processors specialize in leasing terminals, but equipment lease locks up merchants and ends up costing you more, whereas you could get that same machine in a matter of months and get more than one.

If you lease a terminal you may also be required to purchase equipment insurance, another added cost. And, have the equipment return at the end of your lease. If a merchant owns an existing equipment, it can be reprogrammed at NO CHARGE and the merchant can continue to use it.

For account set-up, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchants, processors, terminals

May 3rd, 2016 by Elma Jane

MerchantConnet is a great tool for merchants, it contains all the information that a merchant needs to manage their electronic payment activity. It’s fast, easy and secure!

- Merchant can view or update account information and make changes.

- Find copies of statements.

- Find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History.

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal.

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, card, chargeback, merchants, payment, terminal, transactions

April 27th, 2016 by Elma Jane

Near field communication is a contactless communication protocol between devices like (smartphones, tablets, smartwatches or even credit cards themselves) with a nearby NFC-enabled terminal by simply authorizing your device with a passcode or fingerprint authentication.

Both merchants and customers benefit from near field communication technology, by integrating credit cards, train tickets, and coupons all into one device. Faster payment transaction times and fewer physical cards to carry around.

If your smartphone has an integrated NFC chip, you can use a mobile wallet app like Apple Pay, Android Pay and Samsung Pay for items at retailers that support NFC transactions. Just load up your credit cards on your mobile device and wave or tap your device near an NFC compatible terminal to pay, no card swiping required.

As the technology keeps growing, more NFC compatible smartphones will be available and more businesses will offer NFC card readers for customer’s convenience.

Apple Pay, integrated into the newest generation of Apple mobile devices and incorporates NFC technology. If it becomes widely used by many iPhone users, perhaps merchants will be encouraged to more quickly adopt NFC technology.

Many major banks and credit cards are supporting NFC technology, issuing new cards with embedded NFC chips. This means that you may be able to tap or wave your card at the terminal instead of swiping, no phone required, in the next few years.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: cards, contactless, credit cards, customers, merchants, mobile wallet, Near Field Communication, nfc, payment, Smartphones, tablets, terminal, transaction

April 15th, 2016 by Elma Jane

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

April 11th, 2016 by Elma Jane

Card-not-present fraud is projected to worsen. However, 3D secure technology has made progress and is gaining more and more adoption.

How can e-Commerce merchants avoid CNP fraud?

Here are other ways to make card-not-present transaction safe:

Biometrics – Using Fingerprint Scans and Facial Recognition or Selfie. To validate the identity of the consumer.

Challenge Questions – Such as listing your father’s middle name or a fact known only to the consumer is an effectively added layer of security.

Location Data – Another way to fight against fraud is location data and the use of IP addresses to certify the location and identity of the consumer making the transaction.

Outsource Your Payment Platform – Payments pages hosted by a reputable payment service provider are much more secure.

One-time Passwords – During the checkout process, there will be a window to enter a one-time password which the consumer receives a text message on his/her mobile phone. The consumer enters the password within a short time frame to authenticate the transaction. This solution is especially effective against cyber criminals who steal credentials.

For your payment services needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: 3D Secure, biometrics, card-not-present, cnp, consumer, data, e-commerce, fraud, merchants, payment, Security, service provider, technology, transaction

April 8th, 2016 by Elma Jane

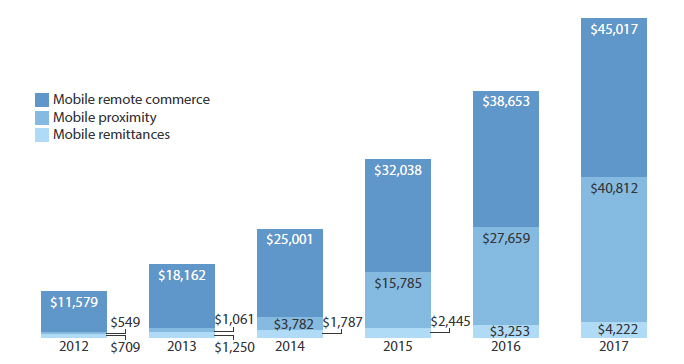

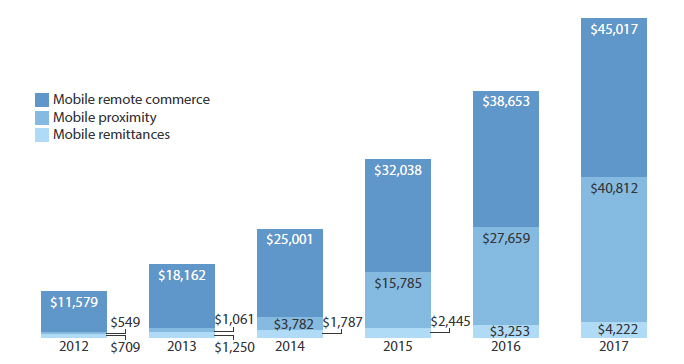

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's