August 30th, 2024 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

If You need help setting up a merchant account, Call 888-996-2273 Today!

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

July 18th, 2024 by Elma Jane

The way we pay for goods and services has undergone a dramatic transformation. From bartering to coins to paper money, the journey of payment methods has been long and fascinating. But no shift has been as revolutionary as the rise of electronic payments. Let’s dive into this evolution and explore where this exciting technology might lead us next.

Early Days (1950s – 1970s):

- 1950: The Diners Club card emerges as the first multipurpose charge card, laying the foundation for modern credit card systems.

- 1958: American Express launches its charge card, initially paper-based, revolutionizing travel and expense tracking.

- 1966: Barclays Bank in London introduces the first Automated Teller Machine (ATM), allowing customers basic account access outside banking hours.

- 1970s: Electronic Funds Transfer (EFT) systems gain traction, enabling direct deposit of paychecks and automated bill payments.

Rise of Digital Networks (1980s – 1990s):

- 1979: Visa introduces the first electronic authorization system and point-of-sale (POS) terminal, paving the way for real-time transaction processing.

- 1983: Debit cards become more prevalent, allowing consumers to access funds directly from their bank accounts.

- 1994: First Virtual Holdings pioneers the first secure online payment system, marking the dawn of e-commerce.

- Late 1990s: Online banking explodes in popularity, offering customers convenient account management and payment options.

The Internet Age (2000s – Present):

- 1998: PayPal emerges, simplifying online transactions and boosting consumer confidence in online shopping.

- 2003: Mobile payments gain momentum in various countries, driven by the increasing adoption of mobile phones.

- 2010s: Near Field Communication (NFC) technology enables contactless payments, giving rise to mobile wallets like Apple Pay and Google Pay.

- 2020s: Biometric authentication adds another layer of security to electronic payments, using fingerprints and facial recognition. Real-time payment systems gain popularity, allowing for instant fund transfers.

The Future of Electronic Payments:

- Invisible Payments: Imagine a world where payments happen seamlessly in the background. Technology like Amazon Go is already showcasing this, with customers simply walking out of stores with their purchases.

- Cryptocurrency and Blockchain: While still in its early stages, the potential of cryptocurrencies and blockchain technology to disrupt traditional payment systems is enormous. Expect to see more integration and wider acceptance in the coming years.

- AI-Powered Payments: Artificial intelligence will play a crucial role in fraud prevention, personalized payment experiences, and the development of even more innovative payment solutions.

- Increased Financial Inclusion: Electronic payments have the potential to bring banking services to underserved populations, promoting financial inclusion on a global scale.

The evolution of electronic payments is an ongoing journey. As technology continues to advance, we can expect even more exciting developments that will reshape the way we transact and interact with the world around us.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

May 19th, 2024 by Elma Jane

NTC Product and Services

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 20 years of experience, National Transaction offers a variety of electronic payment services and technology for Retail and Ecommerce industries. From Travel, Medical Industry, Charitable Institution and Franchise.

Our services include:

Loans/Funding Program

Credit and Debit Card Processing

Currency Conversion

Electronic Checks

Electronic Invoicing

Gift and Loyalty Card Programs

Mobile and Online Solutions

Shopping Cart E-commerce Payment Gateway

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, nothing to integrate; secure and fast.

Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-996-2273

or visit Nationaltransaction.Com

Posted in Best Practices for Merchants, Credit card Processing, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Services Account Tagged with: debit card, ecommerce, electronic payment, loans, Loyalty Card, mobile, online, payment gateway, travel

April 17th, 2024 by Elma Jane

Intelligent Use Of Big Data

In understanding Big Data for Merchants, NTC provided a general overview of how online merchants can use Big Data. Think about this application of big data as adopting a more intelligent use of data.

Keeping customers happy is the key to the travel industry, but customer satisfaction can be hard to gauge in a timely manner. Big data analytics gives these businesses the ability to collect customer data, apply analytics and immediately identify potential problems before it’s too late.

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex.

One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as a CRM and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter.

A business could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions.

In a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

A Virtual Terminal can capture email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected.

As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants. Application of big data is a more intelligent use of data.

You know WHO, WHAT, WHEN, AND WHERE a purchase took place.

NationalTransaction.Com 888-996-2273.

Posted in Best Practices for Merchants Tagged with: data, database, merchants, mobile, online, point of sale, virtual merchant, website

September 10th, 2020 by Admin

There are few moments like now where American consumers are collectively open to the idea of new payment methods – especially contactless ones such as mobile wallets. This is good news for businesses since mobile wallets offer a safer payment alternative to credit cards and drastically reduce customer wait times at checkout.

Mobile wallets (such as Apple Pay and PayPal) use authentication, monitoring and data encryption to secure and transmit personal information, and the level of security associated with them has payment card issuers backing their use. This is certainly helping drive consumer adoption, as does convenience.

In fact, global mobile wallet transaction value is estimated to reach nearly $14 trillion by 20201 – and that is a pre-COVID-19 estimate. New estimates are higher and point to further rapid adoption given the current need for touch-free payment options. According to a recently published Visa Back to Business report,* 70 percent of consumers surveyed in June 2020 have used a new shopping or payment method for the first time this year.

A rapid shift has begun and the numbers tell the storySo what is holding back business adoption of mobile wallets? Until recently, it just wasn’t a priority for many small- and medium-size businesses to enable it or educate their employees on its use. The lack of preferential demand didn’t make it a pressing topic. But that is changing. Consider this:

- According to Forbes,2 by 2026, digital natives will be 59 percent of the consumers in the U.S. market.

- Of this, 45 percent will be specifically Millennials and Gen Z, representing the largest purchasing power.

- As Gen Z move into becoming the largest generation cohort, their purchasing power will be $143 billion.

But it’s not just what lies ahead that SMBs should be focused on now.

According to Visa’s Back to Business report, shoppers are now putting COVID-19 safety measures at the top of their shopping lists and they will reward stores that do the same. In fact, if all other factors were equal (price, selection, location), nearly 63 percent of consumers surveyed would switch to a new store that installed contactless payment options, such as mobile wallets.3

What does this mean for you? Now is the time to connect with customers to make sure they are fully contactless capable and have the technology in place to accept many of the most popular mobile wallets.

1Payments Industry Intelligence, “The rise of digital and mobile wallet: Global usage statistics from 2018,” November 25, 2018.

2Forbes, January 2020

3Visa Back to Business report 2020

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Uncategorized Tagged with: business, digital payment, digital payments, Digital Wallet, Digital wallets, mobile, mobile commerce, Mobile Devices, mobile payment, Mobile Payments, mobile wallet, mobile wallets, payment, payments

November 15th, 2018 by Admin

When you think of starting a business, you often think of making a huge investment: Office, marketing materials, furniture, inventory, etc. The reality is that not all companies need that and not all need an office to start. Here are ten businesses you can start from home now.

1. Web Design: If you have experience building websites or do it as a hobby, do it this one is for you. Website design is in high demand, and although there are Do-It-Yourself sites available, not everyone wants to spend the time doing it. This is where you come in, create a fantastic website, a portfolio with your best work and get started.

2. Virtual Assistant: If you have experience as an Administrative Assistant, Executive Assistant or you are just good at the computer this one is perfect for you. With many people working and managing the business online, it is only fit that many entrepreneurs look for virtual admins to help them with everyday tasks. Some might hire you for a short-term/one task kind of project, while others might want to hire you for the long term. Be sure you outline a plan to figure out which type of projects you want and which industries you would want to focus on.

3. eBay Seller: If you have been online, we are sure you or someone you know have heard of Gary Vaynerchuk and his flip challenge. Essentially, you would buy items at a garage sale that you know you can sell for more online. You can try this approach or start by selling books and other things you have already at home, and you don’t use. It is an easy and not complicated way start a side business. Just be sure to abide by their terms of service.

4. Accountant: Do you work as an accountant? Those online businesses and even brick and mortar businesses are always in need of an accountant. Find out competitive rates in your area and reach out to companies that might be in need of your services. Do a good job and good luck!

5. Copywriter: Marketing is significant for any business, writing good copy is essential for this part of the business, and you might be the person who makes a difference in the company’s advertising efforts.

6. Driver: With companies like Uber and Lyft offering ride services, it is easy to start your own ride service business. You can join either of them and get started. Do keep in mind that they do have guidelines when it comes to the vehicles. After all, they are the brand.

7. Consultant: If you are highly knowledgeable about a specific topic and you know there is a demand for this kind of information, you can sell your services as a consultant. Set up a rate and know who your customer will be and get started.

8. Coach: This is another one that pays off when you are good at a specific skill. People can coach in a variety of subjects like Business, Life, work, spirituality and more. For this one, we recommend you get the tools needed by becoming a certified coach, although it is not necessary.

9. Meal Delivery Service: Similar to the ride services, you can deliver food by joining companies like GrubHub, Uber Eats DoorDash. Many companies offer this service, and you can get started as soon as your application is accepted. The benefit, like Uber or Lyft, is that you make your schedule.

10. Social Media: If you are creative like to write and enjoy social media, this might be a good business to start. This is the kind of business that is needed and can compliment a good marketing strategy. Remember to stay on top of trends, news and be willing to learn as this industry changes quickly but can be a rewarding experience.

There are many more businesses you can start home that requires minimal to no investment; we hope this list gives you an idea to get started.

Posted in Uncategorized Tagged with: business, coach, consultant, copywriter, customer, data, driver, ebay, entrepreneur blog, entrepreneurship, lyft, mobile, social media, tips, uber, uber eats, virtual assistant, web design, work from home, writing

August 25th, 2017 by Elma Jane

A travel merchant account helps you manage all your transactions. It also allows you to integrate into your booking software; plus, there are more features that you get to process payments in a secure environment.

Virtual Merchant Payment Terminal

This is a web-based system that allows you to view processed payments in real-time. You can access it using any web browser, and the transactions are conducted over a secure and encrypted connection.

Customers get receipts for their payments via email once the transaction is complete. You can also handle installments and recurring payments online. It also accepts different payment methods, including gift cards, electronic checks, and credit and debit cards.

Loyalty Programs

With a travel merchant account, you are able to reward your loyal travel customers. You can personalize your loyalty program for customers basing on their behavior. A loyalty program can offer free products or discounts on certain tour or travel packages.

Also, you can make gift cards part of your program. With these cards, you can simply load them with any dollar amount and present them to your customers. Plus, they’re re-loadable and offer a great way of advertising. These programs can go a long way in boosting your customer’s loyalty.

Trams & Sabre Integration

If you’re using Sabre Travel Network for agency services, you can easily integrate your account into Sabre to improve your travel options. This integration allows you to provide convenient payment methods for customers searching for cruise lines, hotel properties, car rental services, and airlines.

Also, for those using Trams for accounting and reporting, NTC travel merchant account lets you make a simple integration. In the long run, you are able to focus on growing your travel agency and offer quality services to your clients.

Mobile Processing

Accepts payments fast and on-the-go with mobile processing solutions that are PCI compliant. With this service, you only need to use a mobile device card reader to swipe cards.

Mobile payment processing allows you to use your own iOS or Android device with a free mobile app which you can integrate with your account to manage transactions.

Offering a convenient and smooth payment methods to your clients is one of the ways to grow your business. National Transaction Corporation merchant account, offers secured travel payment processing services e-Pay, to process your payments; with no delays and at a very competitive rates.

Also, you can accept payments from anywhere and get 100 percent funding. Faster deposits for bookings, which can occur as quick as the next business day.

To speak to our travel payment consultant, call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: card reader, credit, debit cards, electronic checks, Gift Cards, Loyalty Programs, mobile, payment processing, payments, PCI, swipe, terminal, transactions, travel agency, Travel Merchant, virtual merchant

March 15th, 2017 by Elma Jane

Payment Options

Technology continues to evolve, offering multiple billing and payment methods increases satisfaction by improving customer experience.

Customers will continue to move toward digital life, like embracing different forms of online billing and ways to accept payments.

Creating convenient ways to accept payments and having more options can reduce the time it takes your business to get paid.

Accept debit and credit card payments online; to offer this feature you need to get a merchant account.

Options for accepting payments:

Electronic Check Service (ECS) – convert paper checks to electronic transactions, with NTC’s ECS. Converting paper checks to electronic transactions eliminates many of the risks and costs, adding money to your bottom line.

Mobile Payments – the opportunity to increase revenue through mobile payments is huge. Many consumers find that mobile bill pay makes shopping easier, more convenient and saves time. Converge Mobile Solution lets you accept card payments using smartphone or tablet. The app works with most Apple and Android mobile devices.

Online Payment Gateway – offering customers an online payment form enables them to pay you easily and allows you to accept payments by credit card, debit card or echeck.

Electronic Invoicing (NTC ePay) – send your customers an invoice by email and get paid in minutes. Electronic Invoicing gives your customer the ability to pay their bills and receive a receipt in seconds by email.

Learn more about accepting electronic payments with NTC or sign up with us.

No setup or cancellation fees, there’s no risk! call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, echeck, ECS, Electronic invoicing, electronic transactions, merchant account, mobile, online, payment, payment gateway

February 13th, 2017 by Elma Jane

Smart Device for Lodging Transactions

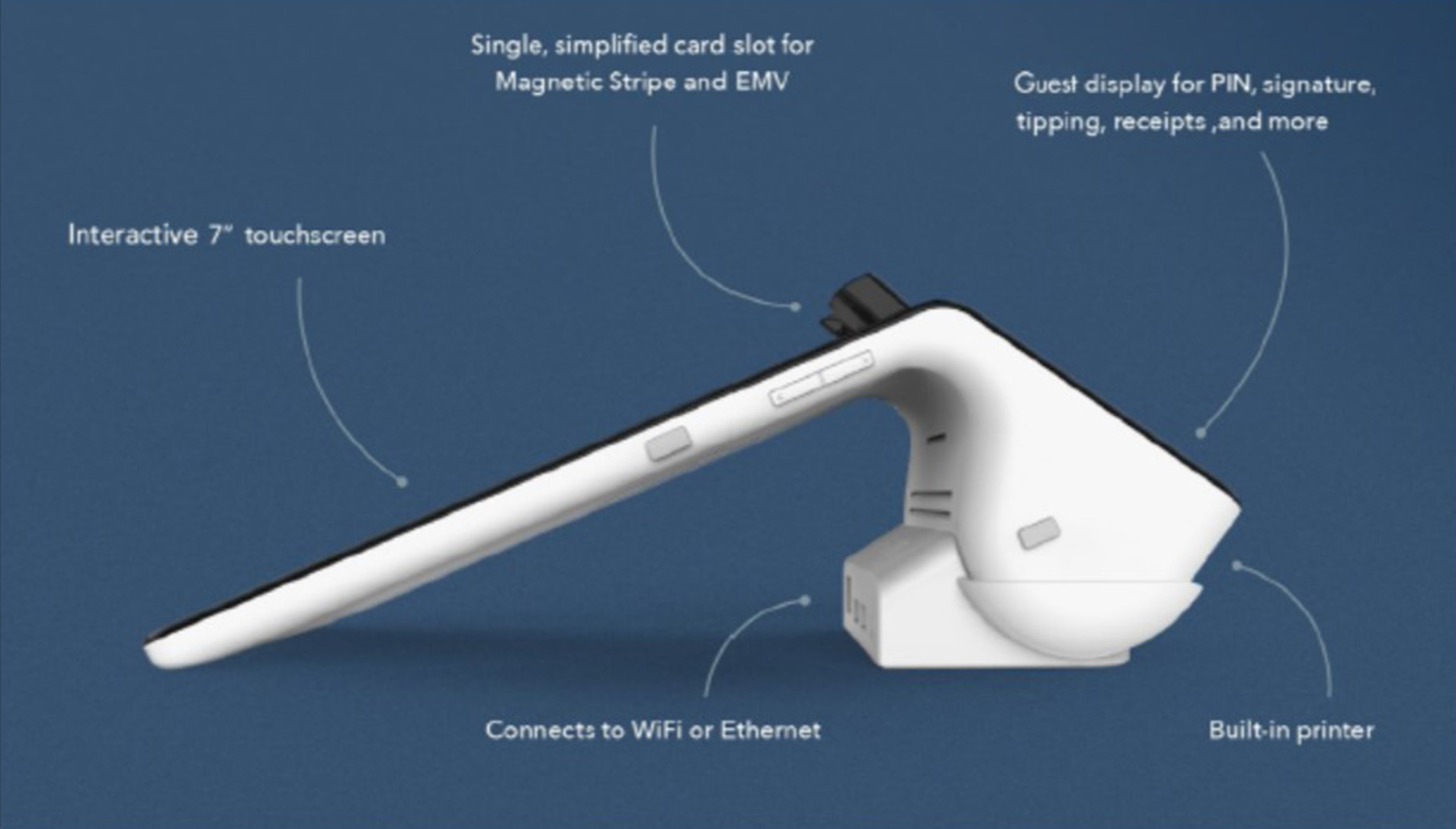

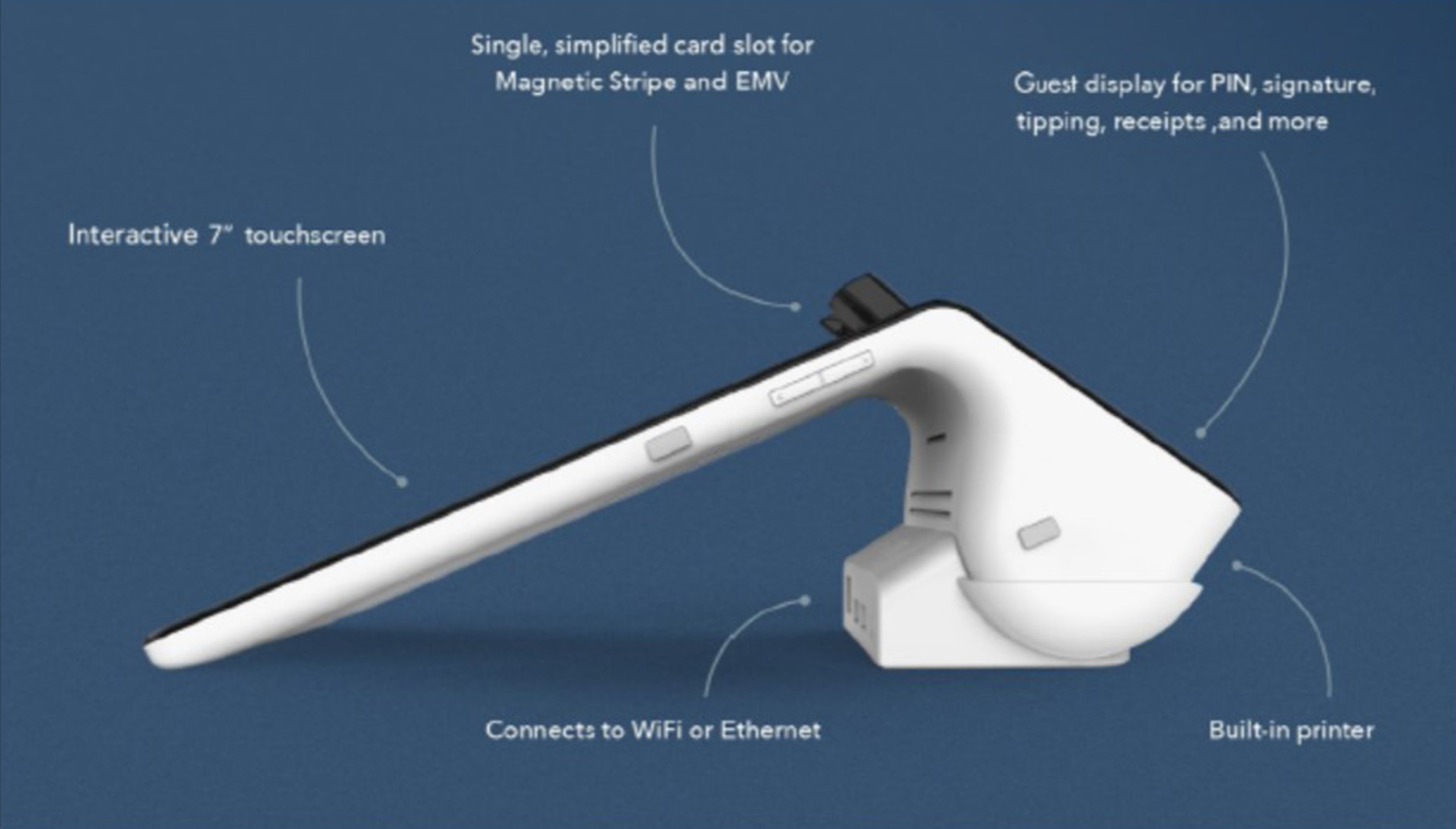

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

February 9th, 2017 by Elma Jane

Electronic Giving Is it Right for your Church?

The congregation is ready for Electronic Giving, implement Electronic Giving in your Chruch with NTC.

According to Federal Reserve Bank, people are writing fewer checks and using electronic payments more.

Reasons Church should offer Electronic Giving:

Donors can make additional contributions.

Electronic Giving encourage and promote Financial Health.

Infrequent givers become regular givers with Recurring Payments.

People who can’t attend service or forgot to bring checkbook can still give.

NTC Electronic Giving Offers:

Mobile offsite activities fundraising-NTC E-Pay email invoicing-Security data Breach Protection

Automatic, recurring donations: Reoccurring Donations: Secure Payment Form For:

Online Electronic Giving Auto updater Website

Use credit or debit card Web Form Social Media

For Electronic Giving call now 888-996-2273 or visit www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants Tagged with: credit or debit card, E-Pay, electronic, electronic payments, financial, invoicing, mobile, online, Recurring Payments, Security