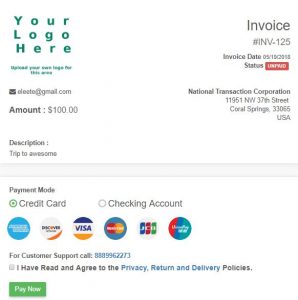

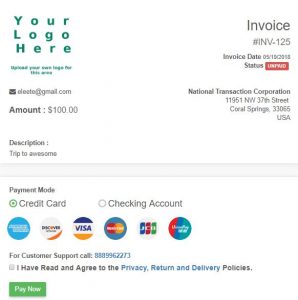

Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

NTCePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Things flow better when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not your business, as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the e-commerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now, when you run a social media campaign you can leverage our NTCePay technology to help you increase sales. Use our ePay links to post vacation travel packages or special sales and have customers pay in two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel

January 21st, 2023 by Admin

Data Breaches Cost Consumers Billions

Exposure of personal information is a new challenge in todays environment, the initial exposure being a nightmare to unravel. A Javelin Strategy and Research study shows that a single data security breach can cost Billions of dollars in consumer fraud losses. Data security breaches rose 48% from 2011 in 2012 to 1,611 data breaches. Identity theft is on the rise too.

Walmart CEO Mike Duke Expecting $10 Billion in e-commerce payments 2013.

Commenting at a shareholder meeting WalMart CEO Mike Duke expected WalMarts online e-commerce site to bring in $10 Billion in transactions this year.

India Sees Spike in e-commerce and Mobile Payment Investments.

India is seeing deeper saturation of broadband rollouts connecting personal computers and laptops online at a faster pace. Big names such as Intel are keen on India’s development for market opportunities. Amazon and ebay just staked claims to India’s e-commerce playing field with deals to deliver their e-commerce services. Read more of this article »

Posted in Electronic Payments Tagged with: Breach, Digital Wallet, e-commerce, electronic payments, Mobile Payments, nfc, tablet, Virtual Currency

January 17th, 2023 by Admin

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Posted in Mobile Payments Tagged with: bluetooth, Chip and PIN, EMV, gift Card, Mobile Payments, MPOS, nfc, PayPal, QR Code Payments, retailers, smartphone, Square, tablet, Tap to Pay

February 9th, 2022 by Admin

John Stewart

January 17, 2022

https://www.digitaltransactions.net/trends-like-open-banking-and-bnpl-will-sustain-e-commerces-hot-streak-a-report-says/

Open banking, single-click checkout wallets, and the hot buy now, pay later trend will all help drive e-commerce volume worldwide in the coming five years, predicts Juniper Research in a report released Monday. This momentum is likely to push online sales long after the short-term impetus from the pandemic subsides, Juniper says.

E-commerce volume totaled $4.9 trillion globally in 2021, a figure the United Kingdom-based research firm forecasts will reach $7.5 trillion in 2026, when China will control a 37% share. Wider availability of multiple e-commerce channels, including mobile devices, will propel the overall growth worldwide, Juniper says. But along with the boom in e-commerce will come a corresponding growth in fraud via identity theft, account takeovers, and fraudulent chargebacks, the report warns. China, for example, will account for more than 40% of fraud losses worldwide in 2025, at more than $12 billion, Juniper forecasts.

Open banking is a trend by which fintechs can verify balances in consumers’ accounts and transfer funds to pay for online purchases. As standards bodies work to promulgate standards for this business, e-commerce payment providers “should … partner with specialists in … specific emerging payment areas to keep pace with changing merchant expectations around acceptance types,” the research firm says in its release, referring to digital wallets and crypto as well as open banking.

Open banking has taken on a higher profile in the global payments market with efforts by both of the global card networks to acquire firms that specialize in this area. Visa Inc. has acquired Tink AB, while Mastercard Inc. bought Aiia and Finicity Corp.

Physical goods will continue to dominate e-commerce spending, the report says, accounting for 82% of payment value by 2026. To tap into the trend, Juniper advises, payments providers should support buy now, pay later plans, which allow consumers to split purchases into four equal installments paid over a six-week period at no interest. BNPL is becoming more controversial, however, as the Consumer Financial Protection Bureau has launched an investigation of the option and as reports emerge that consumers with multiple accounts are more likely to miss a payment.

While still a big trend, e-commerce sales in the U.S. market cooled significantly last year as the pandemic effect lost some of its force. Third-quarter sales in 2021 reached $214.6 billion, up 6.6% year-over-year, according to the Census Bureau, which tracks retail sales. That follows an 8.9% rise in the second quarter and three straight quarters with increases of 32% or more. Fourth-quarter 2021 results are not yet available.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Financial Services, Mail Order Telephone Order, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone, Uncategorized, Visa MasterCard American Express Tagged with: banking and e-commerce, e-commerce, e-commerce businesses, e-commerce merchants, e-commerce processor, e-commerce transactions, ecommerce, ecommerce merchant, ecommerce merchants, ecommerce sites, mobile commerce payment, mobile payment, Mobile Payments, mobile processing transactions, mobile transactions, mobile wallet, mobile wallet transactions, mobile wallets, mobile-commerce payments, online transactions, point-of-sale transactions, transaction processing, transactions, wallet

September 10th, 2020 by Admin

There are few moments like now where American consumers are collectively open to the idea of new payment methods – especially contactless ones such as mobile wallets. This is good news for businesses since mobile wallets offer a safer payment alternative to credit cards and drastically reduce customer wait times at checkout.

Mobile wallets (such as Apple Pay and PayPal) use authentication, monitoring and data encryption to secure and transmit personal information, and the level of security associated with them has payment card issuers backing their use. This is certainly helping drive consumer adoption, as does convenience.

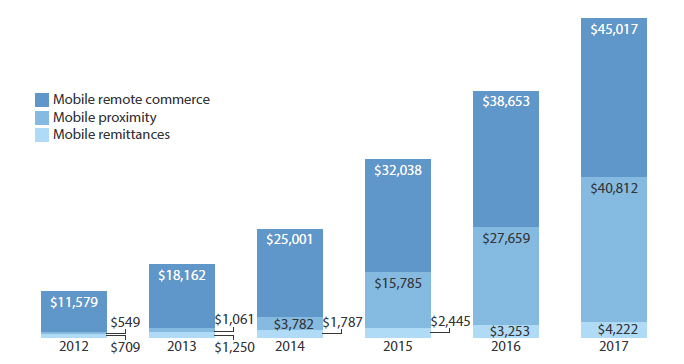

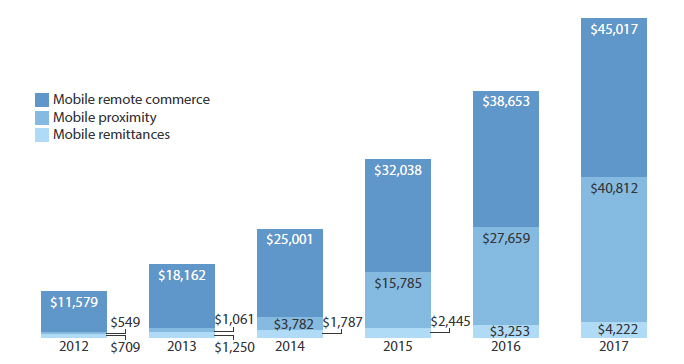

In fact, global mobile wallet transaction value is estimated to reach nearly $14 trillion by 20201 – and that is a pre-COVID-19 estimate. New estimates are higher and point to further rapid adoption given the current need for touch-free payment options. According to a recently published Visa Back to Business report,* 70 percent of consumers surveyed in June 2020 have used a new shopping or payment method for the first time this year.

A rapid shift has begun and the numbers tell the storySo what is holding back business adoption of mobile wallets? Until recently, it just wasn’t a priority for many small- and medium-size businesses to enable it or educate their employees on its use. The lack of preferential demand didn’t make it a pressing topic. But that is changing. Consider this:

- According to Forbes,2 by 2026, digital natives will be 59 percent of the consumers in the U.S. market.

- Of this, 45 percent will be specifically Millennials and Gen Z, representing the largest purchasing power.

- As Gen Z move into becoming the largest generation cohort, their purchasing power will be $143 billion.

But it’s not just what lies ahead that SMBs should be focused on now.

According to Visa’s Back to Business report, shoppers are now putting COVID-19 safety measures at the top of their shopping lists and they will reward stores that do the same. In fact, if all other factors were equal (price, selection, location), nearly 63 percent of consumers surveyed would switch to a new store that installed contactless payment options, such as mobile wallets.3

What does this mean for you? Now is the time to connect with customers to make sure they are fully contactless capable and have the technology in place to accept many of the most popular mobile wallets.

1Payments Industry Intelligence, “The rise of digital and mobile wallet: Global usage statistics from 2018,” November 25, 2018.

2Forbes, January 2020

3Visa Back to Business report 2020

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Uncategorized Tagged with: business, digital payment, digital payments, Digital Wallet, Digital wallets, mobile, mobile commerce, Mobile Devices, mobile payment, Mobile Payments, mobile wallet, mobile wallets, payment, payments

October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

June 2nd, 2016 by Elma Jane

Having the right tools to provide great service is important, this will make and keep your customers happy. An updated point-of-sale (POS) can help you improve customer satisfaction.

EMV – merchants are still behind in EMV acceptance. It may cost you to update but, it will save you money in the event of a fraudulent charge. EMV is here to stay, it is best to update your POS equipment now.

Insights – inventory management feature enables sales people to see available inventory. Tracking the products that sell the best and identifying products in high demand helps the owner stock strategically to better assist customers.

Loyalty Programs – an excellent way to keep current customers coming back.

Mobile Payments – Giving your customers more options on how to make payments by accepting mobile payments. Merchant gains the ability to speed up transaction times for customers.

Speed – customers want to check out at the store as quickly as possible. An updated point-of-sale solution will process transaction faster. A fast and easy system contribute to a better customer experience.

Need to upgrade your point-of-sale give us a call at 888-996-2273. NTC is here to help you.

Posted in Best Practices for Merchants Tagged with: customers, EMV, Loyalty Programs, merchants, Mobile Payments, payments, point of sale, POS, service, solution, transaction

April 28th, 2016 by Elma Jane

You may now give your customers the option to pay with PayPal in person. There is nothing you or they need to do – merchant card processing accounts with NTC have been automatically updated to accept PayPal in-person payments in addition to the other payment options currently offered.

How PayPal transactions work

When businesses accept a PayPal in-person payment, it could be processed in a number of ways. This will be reflected on the monthly processing statement and customer receipts, and the businesses you serve will receive the same pricing they currently do for payments over these networks:

- PayPal mobile payments will be processed as Discover transactions and are subject to Discover operating regulations.

- PayPal-branded card payments will be processed over the payment network designated on the card and are subject to operating regulations designated by the network on the card.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: card, card payments, card processing, customer, merchant, Mobile Payments, payment network, payments, transactions

April 8th, 2016 by Elma Jane

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.