February 23rd, 2016 by Elma Jane

Cardless ATM’s Could Help Push Mobile Wallet Adoption

The mobile wallet will be the payment method in five to 10 years.

Cardless ATM transactions is a great way to introduce smartphones as payments devices. It could help with the adoption of mobile payments and wallets. Mobile Smart Phones will become the piece of plastic and cards will be a thing of the past…

A multinational banking corporation intends to use (NFC) near-field communication for its service. It will let customers leverage NFC technology on their smartphones to authenticate at the bank’s ATM without a debit card.

An NFC cardless ATM transactions could be compatible with Apple Pay which uses NFC technology.

Benefits:

Speedier ATM cash withdrawal takes about 15 seconds without the debit card compared with 60 to 90 seconds with a debit card, whether it’s a chip or magnetic-stripe transaction.

Safer ATM transaction. No physical connection between the phone and ATM, skimming device to intercept the transaction is gone.

The barcode represents the time of day and what terminal the transaction is taking place at. Everything is tokenized.

Cardless ATM transactions are interesting and an appropriate evolution.

Posted in Best Practices for Merchants, Near Field Communication, Smartphone Tagged with: banking, cards, debit card, Mobile Payments, mobile wallet, Near Field Communication, nfc, payments, transactions

February 4th, 2016 by Elma Jane

Companies providing electronic money services, such as online or mobile payments accounts, have more than doubled since 2013.

This number has been on the rise over the past few years as consumer confidence in alternative payments methods has increased.

UK consumers and businesses are increasingly comfortable with the idea of a cashless economy, in which they might not be able to physically see or access money. More are embracing pre-paid cards, contactless and mobile payment systems for ease of use, efficiency and enhanced security.

According to a specialist financial services regulatory consultancy, there has been a significant increase in the number of electronic money providers registered with the Financial Conduct Authority (FCA).

E money providers must be authorized with the FCA under the Electronic Money Regulations 2011 and meet stringent consumer protection criteria, including adequate capital, the separation of customer’s money from the company’s funds.

The regulatory background is complex and electronic money providers need to ensure that systems, processes and controls are tight to ensure a high level of consumer protection. The FCA is not afraid to place these businesses under a microscope.

Many are concerned that this increase in alternative payments methods will lead to the death of the traditional bank, but only if they fail to innovate and adapt to market trends and consumer needs.

Posted in Best Practices for Merchants Tagged with: bank, cards, consumers, contactless, customers, electronic money, financial services, Mobile Payments, online, payment systems, payments, payments methods, provider's, Security

January 11th, 2016 by Elma Jane

Chase Commerce Solutions, the global payment processing and merchant acquiring business of JPMorgan Chase & Co., sold its entire portfolio of Independent Sales Organization (ISO) accounts and associated contracts.

Financial terms of the deal were not disclosed.

Chase has been decreasing the number of merchant relationships it supports through traditional ISOs and increasing the number of direct acquiring relationships it has with merchants since it formed Chase Merchant Services, a partnership with Visa that began 2013.

During that time it has focused more on e-commerce, reports said, though the biggest news for Chase Commerce Solutions recently was its agreement with Starbucks in November to take over processing of all its non-mobile payments.

Posted in Best Practices for Merchants Tagged with: Commerce Solutions, e-commerce, Independent Sales Organization, ISO, merchant, merchant services, Mobile Payments, payment processing, visa

January 6th, 2016 by Elma Jane

A company is teaming up with MasterCard to help other companies integrate mobile payments into their fitness devices, smart watches, jewelry, or clothing. Anything and everything that can fit an NFC chip inside it.

The program is a small iteration on something MasterCard announced last October, in which MasterCard was setting up essentially the same thing: Tokenized payment systems device makers could embed in virtually anything.

To start, the two companies have partnerships set up with Atlas, Moov and Omate, all of whom make wearable or fitness devices. The idea is that if you’re out for a run, you can just use the fitness band you’ve already got on you to buy something. That makes sense, but it also may mean you’ve got yet another payment system to set up and think about, one that presumably isn’t fully integrated either into your Apple Pay or Android Pay setup.

http://www.theverge.com/2016/1/6/10704812/coin-mastercard-partnership-ces-2016-atlas-wearables-moov-ornate

Posted in Best Practices for Merchants Tagged with: Mobile Payments, nfc, payment system

December 21st, 2015 by Elma Jane

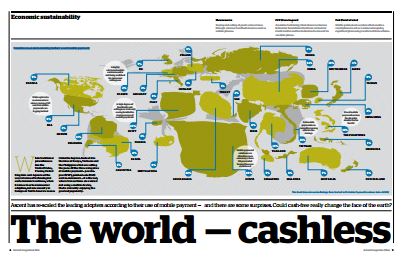

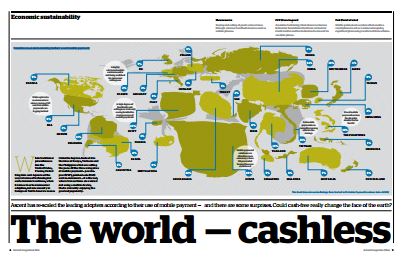

You will think United States or China are the two world’s biggest market when it comes to digital payments and other cashless spending systems. But according to a study, the answer is a less likely source: Sweden is actually on its way to becoming a fully cashless society.

Several factors have come together to give the Swedes an unexpected edge, a combination of IT awareness, and a growing number of useful mobile payments solutions.

The entire country currently only has about 80 billion Swedish crowns in circulation, and as users more often turn to mobile payment systems, the need for cash only declines. About 20 percent of all purchases made in cash in Swedish retail, and that number is falling off almost daily.

Some transactions can only be carried out by digital payments, since the mobile apps are convenient, free to use, and generally regarded as secure, there’s not much impediment for users to turn to such systems.

A truly cashless society is probably a bridge too far; there will always be those who’d rather handle cash. Only time will tell if the market shapes up looking like this, but even with lower actual results than projected, that’s still a lot of people turning to mobile payment and other cashless payment systems. There will still be a huge majority trending toward cashless society.

http://paymentweek.com/2015-12-18-world-leader-in-cashless-trading-an-unexpected-source-9182/

Posted in Best Practices for Merchants Tagged with: digital payments, mobile payment systems, Mobile Payments, mobile payments solutions, payment systems, payments solutions

December 17th, 2015 by Elma Jane

Mobile Payments – It is bound to see more actions with tech giants Apple, Google and Samsung in mobile payment trends. We will also see new technologies like smartwatches, bracelets and rings that will give us the ability to provide payment options.

NFC – Near Field Communication, another familiar face among the payment trends. NFC, however, goes way beyond making payments using smartphones. These speed up POS payment processing quickly and easily without requiring a PIN or signature. While there are other POS payment methods, such as QR codes, NFC will come out on top. Merchants should ensure they have an overview of the current Point-of-Sale options and should, if needed, upgrade to the latest technology.

Security: Tokenization and biometric authentication will have a strong influence on the payment industry.

Tokenization – when applied to data security, is an extremely interesting method of securing credit card data. As the credit card numbers are substituted by tokens that has no value, then no harm can be done if tokens are stolen, which makes tokenization a secure process.

There are several new inventions when it comes to payment processing authentication such as password, PIN, and fingerprint methods. But they are weak so two-factor authentication is increasingly used to improve security.

Biometrics Authentication – like finger print scan, facial recognition, voice recognition, and pulse recognition are set to become increasingly significant. This will increase both security and convenience.

International E-Commerce – It’s important that merchants offer shoppers their preferred local payment method. Merchants who are looking for e-commerce success will need to create an international strategy. Merchants should also consider checking with their payment service providers. Providers know their way around to alternative payment methods.

Cash on the Retreat – Cashless Society? Some countries in Europe are certainly cutting down on the usage of cash. In Sweden, it is now almost impossible to use cash to pay for bus tickets. Acceptable payment methods include customer cards, credit cards, and payments via smartphone apps. Traditional cash-based bakeries no longer exist and instead, now display signs requesting that customers use cashless payment methods for even the smallest amounts. The situation in Denmark is similar; the government is currently debating whether or not to release smaller retailers from the obligation of having to accept cash as a payment method. Cash is on the retreat, and alternative payment methods are advancing. However, cash is still on the list.

Real-Time Payments (Instant Payments) – The European Central Bank (ECB) will bring instant payments strongly in the near future. Instant or real-time payments are a trend which will be with us for a long time to come.

Regulatory Changes – The first Payment Services Directive (PSD) from 2007 is still currently implemented domestically. After a tough two-year negotiation period, the EU has now, finally, agreed on a second payment services directive (PSD2). The European Banking Authority (EBA) is set to develop more detailed guidelines and regulatory standards for various industries. Payment industries should begin preparing themselves now for implementation, doing this will allow them to be ready for the appropriate steps necessary in 2016/2017.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: Apple, biometric, credit card, data security, e-commerce, google, merchants, Mobile Payments, Near Field Communication, nfc, payment industry, payment methods, payment options, payment processing, payment service providers, payment services, payment trends, payments, PIN, point of sale, POS, qr codes, real-time payments, Samsung, tokenization

December 11th, 2015 by Elma Jane

The use of in-store mobile payments increased in the US this year, from 5% in 2014 to 18% in 2015, research reveals, with approximately one in five consumers using their phone to make a payment at the point of sale.

The most popular uses of mobile payments in the US:

Public Parking (19%)

Gas Station Purchases (18%)

Coffee Shops and Fast Food Dining (17%)

Paying for Groceries (16%)

Public Transportation (16%)

Paying for a Taxi (16%)

Paying for restaurant bills (15%)

Checking out of a Hotel and Paying the Bill (13%)

Shopping for Clothing (12%)

Shopping in General on the High Street or in the Mall (10%)

Other (7%)

US consumers aged between 25 – 34 were seen as driving the largest portion of mobile payment activity at 36%, with those aged from 45-74 accounting for less than 10% of activity.

Half of the survey’s 2,000 respondents in the US cited security concerns as the main reason for not using mobile devices for in-store payments, while consumers place the greatest trust in traditional financial institutions like banks (49%) for provision of payment services.

Mobile technology is now moving beyond simply being a mode of communication and advancing towards the era of the always-connected consumer, says US telecommunications sector leader at Deloitte.

http://www.nfcworld.com/2015/12/11/340588/store-mobile-payments-increase-four-fold-across-us/

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: banks, financial institutions, Mobile Payments, payment services, payments, point of sale

December 3rd, 2015 by Elma Jane

Industry professionals agree that mobile payments technology has surpassed e-commerce as the trend in the daily spending behavior of modern retail customers.

E-commerce’s impact on consumer spending has actually decreased, but it seems that the ability to pay with mobile devices has finally swayed consumers away from their computers.

The payments outlook has changed rapidly with the increasing availability of mobile technologies to the average retail consumer within the last year. Products like Apple Pay, Android Pay and Samsung Pay have totally altered the landscape of payment options.

Small Businesses will have to adapt in order to keep up with the rapid pace of technological developments. The evolution of payments technologies not only alters how consumers spend their money, but how that money is processed during a transaction.

There are still some concerns over cyber risks and data security, which led 58 percent of surveyed professionals to agree that point-of-sale debit and credit card transactions were still the safest form of payment, while mobile payments garnered 20 percent of support. But hypothetical worries over security aren’t real enough to slow mobile payments’ momentum moving forward.

Mobile payments transaction value is expected to hit $8.71 billion by the end of 2015. That figure will triple to $27.05 billion in comparison to 2016, according to new research; as a bigger base of consumers begin to use their phones for point-of-sale transactions and a wider range of merchants begin to accept mobile payments. By 2019, essentially all mobile payment transactions will be done on smartphones.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Point of Sale Tagged with: credit card, credit card transactions, debit, e-commerce, merchants, Mobile Payments, payments technologies, point of sale

November 6th, 2015 by Elma Jane

Money 20/20 was billed as the largest convention in payments history held in Las Las Vegas, during the last week of October 2015.

The show delivered well-organized, incisive content such as Europay, MasterCard and Visa (EMV) migration, mobile payments, security and omnichannel commerce.

20/20 Highlights

- Alternative lending and credit.

- Bill Payments, Financial Services: Newly released market research provides insights into the future of household bill payments, millennials, and financial services.

- Connected Commerce and the Mobile Enterprise: The Internet of Things is changing the way that consumers interact with their environments. Analysts predict up to 30 billion interactive devices will be connected to the Internet by 2020, noting that many of these devices will be payment-enabled.

- Marketing and Customer Experience: Most marketers agree that the era of demographic profiles and pull marketing is over. Retailers, card brands and information technology professionals looked at the customer experience in the digital world. They explored new marketing practices, trends in e-commerce and mobile commerce, and big data findings in other industries that may be useful to financial service companies.

- Mobile Banking: Banks are undergoing an incremental transformation as they learn to compete with nonbank lenders, balance cash management with digital currencies, and shift from local branches to online and mobile forms of banking.

- Mobile Payments: Payments analysts reviewed Apple Pay a year after its launch and a range of other mobile wallet offerings, and they speculated on how third-party wallets will impact bank apps.

- Payment Card Evolution: Payment card issuers, processors and network service providers analyzed the changing look, feel and role of payment cards in the greater ecosystem. Discussions ranged from card linking to the coolness factor of gift cards to how e-cards are expanding market opportunities.

- POS, Processing and Open Platforms: Executive roundtables with leading acquirers explored front-end and back-end technology and omnichannel commerce for small and midsize businesses.

- Regulatory Landscape: Increased federal and state oversight has had a significant impact on the financial services sector.

- Security: Security analysts made in-depth presentations on tokenization, end-to-end encryption, and secure methods of authentication designed to protect consumers, merchants and industry stakeholders from cybercriminals. Many agreed that EMV implementation in the United States will drive fraudsters to the card-not-present space. They discussed how EMV adoption has changed fraud patterns in other regions and offered examples of best practices geared toward identifying and preventing electronic payment fraud.

More than 10,000 attendees and 3,000 exhibitors from 75 countries attended Money20/20. Financial services professionals from mobile, retail, marketing services, data and technology met at what show organizers described as the intersection of mobile, retail, marketing services, data and technology.

The years to come will be a turning point in the payments sector, and with the recent shift to EMV, the entire conference confirmed that all the players are more interested than ever in finding innovative solutions for combating online fraud.

Posted in Best Practices for Merchants Tagged with: Apple Pay, big data, bill payments, card-not-present, e-commerce, electronic payment, EMV, EuroPay, financial services, Gift Cards, MasterCard, merchants, Mobile Payments, mobile wallet, payments, POS, processors, Service providers, tokenization, visa

November 5th, 2015 by Elma Jane

EMV-compliant POS systems are now being equipped with NFC technology to accept contactless payments. What does this mean for the future of payments?

EMV lays the foundation for increased card-present and contactless payments security, with EMV, magnetic stripe cards are soon to be a bygone technology. Plastic EMV cards will not have a long lifespan as payments move into a more digital space, security and NFC upgrades merchants and consumers now will carry over into the digital and mobile payments space.

Consumers are constantly looking for more convenient ways to transact, which is made possible by the simultaneous adoption of EMV and NFC. While EMV supports plastic chip cards, payments are going digital and POS systems equipped with NFC technology save consumers from digging through their wallets, making it easier for consumers to transact via mobile devices. Mobile payments should be simple, scalable and affordable in today’s payment landscape and consumers should have the option to securely store and use multiple cards within their digital wallets or applications they most often use.

EMV standards increase security for card-present payments, which are relevant to many consumers today, but the convenience of mobile and contactless payments is the future. In an era of EMV, NFC plays as critical a role in propelling both technologies forward. Retailers and card issuers alike must recognize the opportunity to take advantage of both.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: (POS) systems, card present, chip cards, contactless payments, Digital wallets, EMV, magnetic stripe cards, merchants, Mobile Payments, nfc technology, payments