September 15th, 2014 by Elma Jane

Visa has taken advantage of the hoopla surrounding Apple’s application of digital account tokens to replace card numbers for online and mobile purchasing by initiating the roll out of its Token Service to US clients.

Visa Tokens will be made available to issuing financial institutions globally, starting with US banks next month, and followed by a phased roll-out overseas beginning in 2015. The technology has been designed to support payments with mobile devices using all major mobile platforms.

More than 750 staff from across the Visa organisation globally were involved in the effort, working closely with initial launch partners – financial institutions, merchants and processors to ensure the ecosystem was ready. Today, Visa is making these services available and believe it will help transform connected devices and wearables into secure payment vehicles.

Visa Token Service replaces sensitive payment account information found on plastic cards with a digital account number or token. Because tokens do not carry a consumer’s payment account details, such as the 16-digit account number, they can be safely stored by online merchants or on mobile devices to for e-commerce and mobile payments.

The release of the service has been given added urgency by a spate of successful hacks on merchant card data stores, such as the recent plundering of card account data at Home Depot and Target.

MasterCard has its own equivalent Digital Enablement Service, which will be released outside of the US in 2015.

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce, Mobile Payments, Visa MasterCard American Express Tagged with: account details, card, card account data, card data, data, digital account, digital account number, e-commerce, financial institutions, MasterCard, merchant card data, Merchant's, mobile, Mobile Devices, Mobile Payments, mobile platforms, online merchants, payments, processors, Token Service, tokens, visa, Visa organisation, Visa Token Service, wearables

April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

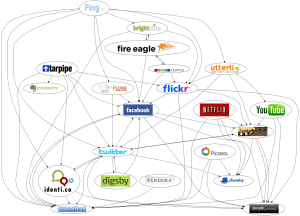

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter