February 9th, 2022 by Admin

John Stewart

January 17, 2022

https://www.digitaltransactions.net/trends-like-open-banking-and-bnpl-will-sustain-e-commerces-hot-streak-a-report-says/

Open banking, single-click checkout wallets, and the hot buy now, pay later trend will all help drive e-commerce volume worldwide in the coming five years, predicts Juniper Research in a report released Monday. This momentum is likely to push online sales long after the short-term impetus from the pandemic subsides, Juniper says.

E-commerce volume totaled $4.9 trillion globally in 2021, a figure the United Kingdom-based research firm forecasts will reach $7.5 trillion in 2026, when China will control a 37% share. Wider availability of multiple e-commerce channels, including mobile devices, will propel the overall growth worldwide, Juniper says. But along with the boom in e-commerce will come a corresponding growth in fraud via identity theft, account takeovers, and fraudulent chargebacks, the report warns. China, for example, will account for more than 40% of fraud losses worldwide in 2025, at more than $12 billion, Juniper forecasts.

Open banking is a trend by which fintechs can verify balances in consumers’ accounts and transfer funds to pay for online purchases. As standards bodies work to promulgate standards for this business, e-commerce payment providers “should … partner with specialists in … specific emerging payment areas to keep pace with changing merchant expectations around acceptance types,” the research firm says in its release, referring to digital wallets and crypto as well as open banking.

Open banking has taken on a higher profile in the global payments market with efforts by both of the global card networks to acquire firms that specialize in this area. Visa Inc. has acquired Tink AB, while Mastercard Inc. bought Aiia and Finicity Corp.

Physical goods will continue to dominate e-commerce spending, the report says, accounting for 82% of payment value by 2026. To tap into the trend, Juniper advises, payments providers should support buy now, pay later plans, which allow consumers to split purchases into four equal installments paid over a six-week period at no interest. BNPL is becoming more controversial, however, as the Consumer Financial Protection Bureau has launched an investigation of the option and as reports emerge that consumers with multiple accounts are more likely to miss a payment.

While still a big trend, e-commerce sales in the U.S. market cooled significantly last year as the pandemic effect lost some of its force. Third-quarter sales in 2021 reached $214.6 billion, up 6.6% year-over-year, according to the Census Bureau, which tracks retail sales. That follows an 8.9% rise in the second quarter and three straight quarters with increases of 32% or more. Fourth-quarter 2021 results are not yet available.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Financial Services, Mail Order Telephone Order, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone, Uncategorized, Visa MasterCard American Express Tagged with: banking and e-commerce, e-commerce, e-commerce businesses, e-commerce merchants, e-commerce processor, e-commerce transactions, ecommerce, ecommerce merchant, ecommerce merchants, ecommerce sites, mobile commerce payment, mobile payment, Mobile Payments, mobile processing transactions, mobile transactions, mobile wallet, mobile wallet transactions, mobile wallets, mobile-commerce payments, online transactions, point-of-sale transactions, transaction processing, transactions, wallet

September 10th, 2020 by Admin

There are few moments like now where American consumers are collectively open to the idea of new payment methods – especially contactless ones such as mobile wallets. This is good news for businesses since mobile wallets offer a safer payment alternative to credit cards and drastically reduce customer wait times at checkout.

Mobile wallets (such as Apple Pay and PayPal) use authentication, monitoring and data encryption to secure and transmit personal information, and the level of security associated with them has payment card issuers backing their use. This is certainly helping drive consumer adoption, as does convenience.

In fact, global mobile wallet transaction value is estimated to reach nearly $14 trillion by 20201 – and that is a pre-COVID-19 estimate. New estimates are higher and point to further rapid adoption given the current need for touch-free payment options. According to a recently published Visa Back to Business report,* 70 percent of consumers surveyed in June 2020 have used a new shopping or payment method for the first time this year.

A rapid shift has begun and the numbers tell the storySo what is holding back business adoption of mobile wallets? Until recently, it just wasn’t a priority for many small- and medium-size businesses to enable it or educate their employees on its use. The lack of preferential demand didn’t make it a pressing topic. But that is changing. Consider this:

- According to Forbes,2 by 2026, digital natives will be 59 percent of the consumers in the U.S. market.

- Of this, 45 percent will be specifically Millennials and Gen Z, representing the largest purchasing power.

- As Gen Z move into becoming the largest generation cohort, their purchasing power will be $143 billion.

But it’s not just what lies ahead that SMBs should be focused on now.

According to Visa’s Back to Business report, shoppers are now putting COVID-19 safety measures at the top of their shopping lists and they will reward stores that do the same. In fact, if all other factors were equal (price, selection, location), nearly 63 percent of consumers surveyed would switch to a new store that installed contactless payment options, such as mobile wallets.3

What does this mean for you? Now is the time to connect with customers to make sure they are fully contactless capable and have the technology in place to accept many of the most popular mobile wallets.

1Payments Industry Intelligence, “The rise of digital and mobile wallet: Global usage statistics from 2018,” November 25, 2018.

2Forbes, January 2020

3Visa Back to Business report 2020

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Uncategorized Tagged with: business, digital payment, digital payments, Digital Wallet, Digital wallets, mobile, mobile commerce, Mobile Devices, mobile payment, Mobile Payments, mobile wallet, mobile wallets, payment, payments

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

September 12th, 2016 by Elma Jane

Ingenico RP457c card reader is now available at NTC for $75.00 plus encryption and shipping!

NTC are pleased to announced the launch of Converge Mobile 1.3, which includes support for the new Ingenico RP457c.

An all-in-one card reader that accepts:

- Mag stripe

- chip card

- contactless payments including mobile wallets

Customers can utilize audio jack to connect the device to their either smartphone, tablet or connect via Bluetooth.

In addition to the converge Mobile portfolio, Ingenico RP457c is a lower price point for customers who are cost sensitive. It offers the same payment flexibility as the iCMP.

Both RP457c’s and iCMP devices also offer encryption technology, adding another layer of security to help protect card data at the point of entry and throughout the payment lifecycle.

One key difference is that iCMP is a PIN pad that supports chip & PIN as well as debit PIN transactions, while the PR457c is a card reader only; therefore chip and signature and signature debit are supported on this device.

For your electronic payment needs or to purchase the device give us a call now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card data, card reader, Chip & PIN, chip and signature, contactless payments, customers, mobile wallets, payment, PIN pad, Security, signature debit, smartphone, transactions

June 10th, 2016 by Elma Jane

In-app purchases are important in getting customers engaged with mobile wallets, now, NTC has made it easier to implement Apple Pay into mobile apps with the launch of Converge In-App Payments. You are able to provide your customer with Commerce SDK, a software development kit, to integrate Apple Pay with our powerful omni-commerce platform, Converge. By reducing development effort, customers can save time and resources. Their mobile app gets to market faster, and they can capitalize on the growing market.

More mobile wallets will be available in the future.

To know more about this platform give us a call at 888-996-2273

Posted in Uncategorized Tagged with: commerce, customers, Mobile Apps, mobile wallets, omni-commerce, payments, platform

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

May 25th, 2016 by Elma Jane

No one likes waiting in a checkout line, the faster your checkout line moves, the faster you are able to turn more sales. Quick checkout lines lead to increased sales and higher customer satisfaction .

Cut your line and increase your sales by:

Upgrading your POS – if you haven’t upgraded your POS, do it now. Choosing a modern POS that is simple and easy to use like the iCT250, offers a smart, effective and highest security payment experience designed for merchants and easier for employees to understand.

Multiple Checkout – multiple checkout counters may be necessary depending on the size of your store. In a high volume situation such as the holiday season, more opportunities for checkout may be beneficial.

Accept A Variety of Payments – having alternative forms of payment by accepting credit, debit, EMV/NFC and mobile wallets, will open the door for a variety of customers, but also allow the customer to pay the way they want in a most convenient way.

Train Employees – most importantly, train your employees on how to use your new POS system. Employees need to be the expert on POS so that they are able to assist customers who may need help conducting their transaction.

Posted in Best Practices for Merchants Tagged with: credit, customer, debit, EMV, merchants, mobile, mobile wallets, nfc, payment, POS, sales, Security, transaction

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 25th, 2016 by Elma Jane

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

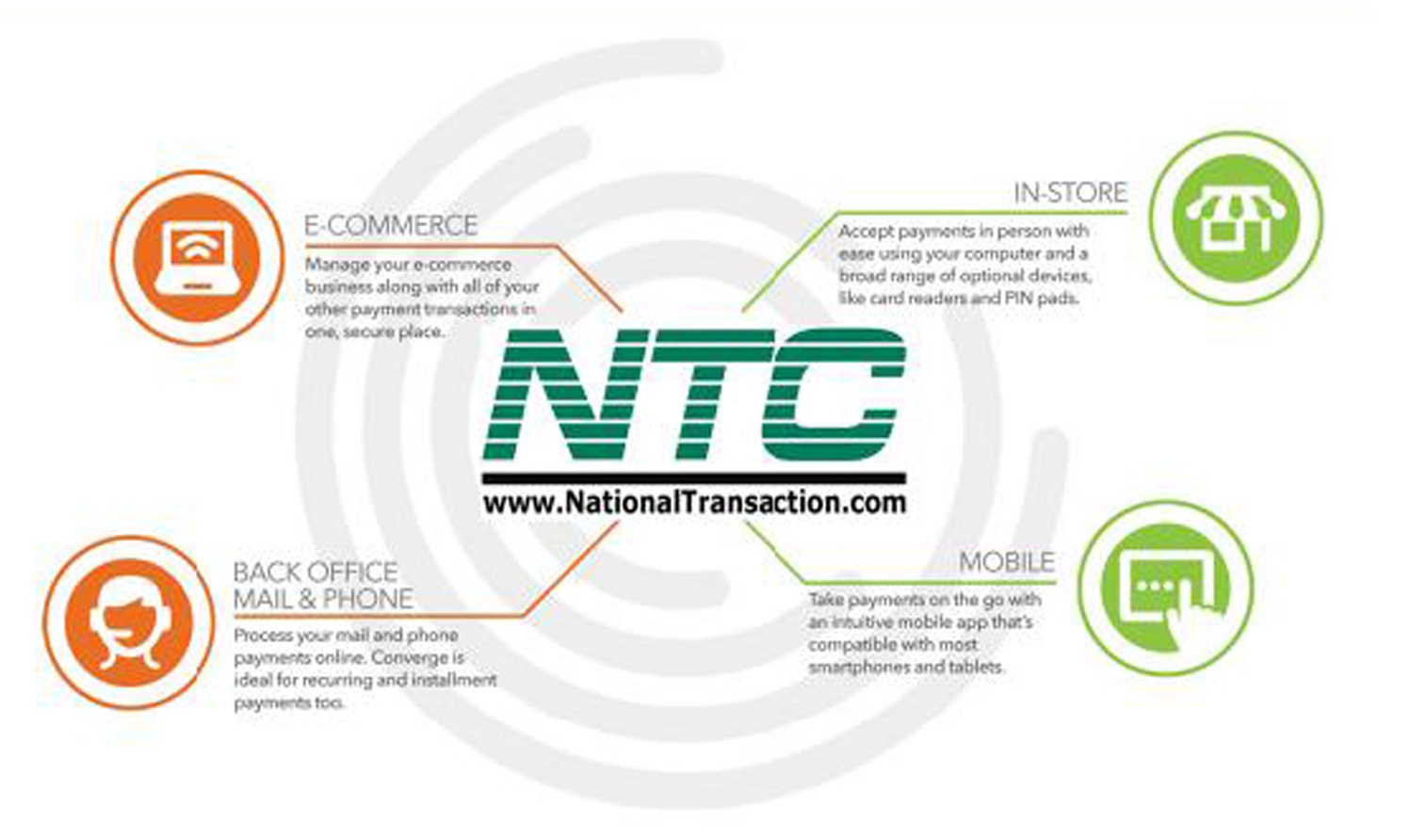

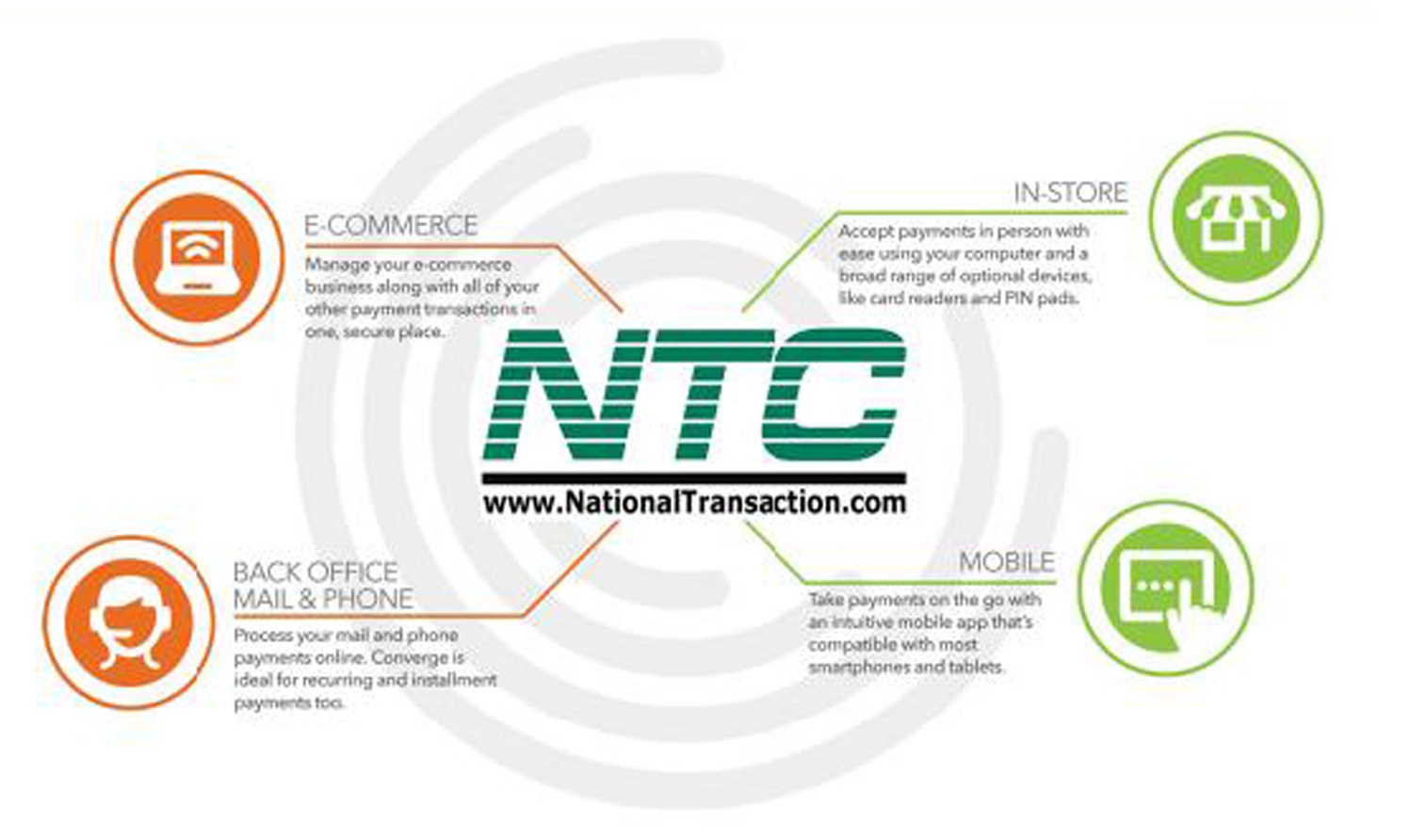

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions