February 11th, 2016 by Elma Jane

E-commerce is a virtual platform, where we can get products and services and make payments through the internet.

E-commerce trend is constantly changing, it is necessary for a merchant to watch out for the upcoming Trends in this industry for a business to success.

To help boost your conversion rates here are the trends to be followed:

Contextual Commerce – The next big thing in payments and e-commerce. Providing complete description with images and videos to help your customer decide to purchase a product. Customization is an important factor as well to convince about the products or services.

Fast Delivery Shipping – Customer wants to receive the products after purchasing as soon as possible. So Reliable, Timely shipping means a lot.

Mobile Shopping – getting your online store ready for mobile shoppers is not an optional feature, it’s a mandatory part of a strategy.

Multiple Channels For Shopping – optimization is a great experience for shoppers. Having online store presence in different technology gadgets is a must.

Real Time Analytics – analyzing consumer behavior based on data entered into a system less than one minute before the actual time of use. Finds out why a customer leaves the store and prevents customer loss.

Virtual Sales Force – Hiring virtual salesforce, utilizing pop-ups and live chat who will help customers which are similar in a physical store.

Step ahead out of the conventional methods and adapt prevailing trends by embracing innovation so you can offer something new to your customer.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: business, consumer, customer, data, e-commerce, internet, merchant, mobile, online, payments

February 9th, 2016 by Elma Jane

Since the implementation of the EMV liability shift last year, consumers are still unsure whether to dip or swipe their payment cards at the checkout register, and transaction process itself is slower than a card swipe.

As the EMV process continues, can contactless register only help to make checkout process faster? With contactless register checkout only, consumers can just tap and pay with either card or mobile wallet.

Contactless like NFC is now a standard feature in most high-end smartphones, and most EMV-enabled point-of-sale terminals contain the necessary technology to accept contactless payments. So the idea of contactless register checkout only is something to test for some merchants in a certain retail sector.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Near Field Communication, Point of Sale Tagged with: cards, consumers, contactless, EMV, merchants, mobile, mobile wallet, nfc, payment, payment cards, point of sale, Smartphones, terminals, transaction

February 5th, 2016 by Elma Jane

Businesses and banking institutions must require consumers to use other types of authentication methods, like biometrics, mobile verification codes and geo-location.

Merchants and banks can expect more hackers to breach customer accounts that rely only on usernames and passwords for online authentication.

This type of fraud will only grow more as hackers recognize and take advantage of the opportunity presented by on-file accounts protected by weak authentication.

Many online users use the same username and password for multiple accounts, once those credentials are compromised, criminals can use them to access accounts on different websites.

With the ease and simplicity of password vaults and safes that are easy and efficient to use and user education, this problem finds a solution.

A stronger authentication that goes far beyond username and password, is a powerful tool in effort to prevent data breaches.

Posted in Best Practices for Merchants Tagged with: banking institutions, banks, biometrics, consumers, customer, data, data breaches, fraud, merchants, mobile, online

January 28th, 2016 by Elma Jane

The shift to EMV is helping to address vulnerabilities in the United States payments ecosystem. It has been shown that EMV can deliver benefits as a part of industry efforts to combat fraud.

EMV migration is a critical focus for enhancing payments security, which is why the current efforts around chip card deployment are greatly beneficial for consumers and merchants alike. EMV technology helps to reduce counterfeit card fraud, as it generates dynamic data with each payment to authenticate the card, after which the cardholder is prompted to sign or enter a PIN to confirm their identity.

The EMV rollout represents a dynamic time for card payments that promises great advances, among them is enhanced security for cardholders. It also presents an opportunity to consider other innovations such as mobile wallets and mobile POS to further engage your customers and drive customer loyalty. When merchants continue to invest in EMV and NFC (near field communications, used for tap-and-pay transactions), the purchases made at their EMV-enabled terminals are made more secure than magnetic stripe.

New mobile payment options such as mobile wallets support EMV and therefore offer this added layer of security. Ultimately, by enabling contactless payments, merchants can also enable more flexibility in addition to increasing security for their customers.

Additionally, industry players are backing major mobile wallets, such as Android Pay, Apple Pay, and Samsung Pay.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card, cardholder, chip card, consumers, contactless payments, customers, data, EMV, fraud, magnetic stripe, merchants, mobile, mobile payment, mobile wallets, near field communications, nfc, payments, PIN, POS, Security, terminals, transactions

January 27th, 2016 by Elma Jane

MasterPass To Make Booking Travel Experience Even Easier For JetBlue

MasterCard today added JetBlue as its latest merchant to accept digital payments with MasterPass. MasterPass will be available later this year on the airline’s website and mobile app, giving customers the opportunity to speed up their booking travel experience, according to a press release.

With MasterPass, shoppers can pay for the things they want at thousands of merchants with the security they demand, anywhere online or in app, using any device. The wallet securely stores shoppers’ preferred payment and shipping information which is readily accessible when they click on the “Buy with MasterPass” button and sign into their account.

U.S. consumers can sign up for a MasterPass account by visiting the MasterPass website or through a participating bank. Launched in 2013, MasterPass by MasterCard is free, easy to set up, and available anywhere you see the Buy with MasterPass button. It is currently available in 29 countries and is accepted at 250,000 merchants globally.

Accepting MasterPass by MasterCard on JetBlue’s online and in-app properties expands the relationship between the two companies. JetBlue announced in October 2015 that MasterCard would be its network partner for its co-brand portfolio.

Posted in Travel Agency Agents Tagged with: bank, customers, digital payments, merchant, mobile, mobile app, online, payments, Security, travel

January 26th, 2016 by Elma Jane

The convenience, simplicity and security of Apple Pay are now available to customers who use U.S. Bank FlexPerks American Express Cards.

U.S. Bank which is the fifth-largest bank in the nation will add TouchID biometric capabilities to its mobile app in March.

The company made the disclosure as part of a notable iOS app update released last Friday. Release appears to include, among other enhancements, improvements such as easier navigation, quicker accessibility to account information, and the ability to search transactions from previous months.

U.S. Bank Minneapolis did not give many details about how TouchID will be used within its iOS app, other than to say for fingerprint authentication for enabled devices.

Many major banks already have TouchID implemented in their mobile apps, including Citibank, Wells Fargo and Bank of America. Citibank, for example, implemented TouchID last July. Apple introduced TouchID in mid-2013.

Last week, U.S. Bank enabled for Apple Pay use the last of its debit and credit cards that had not been Apple Pay-capable. Apple Pay relies on TouchID for security and authentication.

Apple Pay is now available with the:

- U.S. Bank FlexPerks Reserve American Express Card.

- U.S. Bank FlexPerks Travel Rewards American Express Card.

- U.S. Bank FlexPerks Select+ American Express Card.

Posted in Best Practices for Merchants Tagged with: account, bank, biometric, cards, credit cards, customers, debit, mobile, mobile app, Security, transactions

January 25th, 2016 by Elma Jane

New Timeframes for Electronic Gift Card Orders

Please be aware that NTC’s Electronic Gift Card (EGC) Design & Artwork team has upgraded their printers. The new timeframes for both FanFare and EGC (Givex) gift card shipments during non-peak times are the following:

- Standard Card Orders: 8 Business days, plus 2 Day Delivery

- Custom Card Orders: 12 Business days, plus 2 Day Delivery

Converge Mobile: Frequently Asked Questions

Will there be more EMV chip card readers in the future? Yes! Additional devices ranging in price points and feature/functionality will be introduced throughout 2016.

Do VirtualMerchant Mobile login credentials work with Converge Mobile?Yes! The mobile login credentials that customers use today for VirtualMerchant Mobile are the same for Converge Mobile.

Is the talech iCMP the same as the one sold for Converge and Converge Mobile? No! Please use item code CICMP for devices that will be used with Converge and/or Converge Mobile. Otherwise, there is device reconfiguration work that has to take place resulting in a negative customer experience.

UPCOMING EVENTS

April 19-21 May 2-4

TRANSACT 16 (ETA) Southeast Acquirers Association (SEAA)

INDUSTRY LINKS

|

|

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: card, chip card, Electronic gift card, EMV, gift Card, merchant, mobile, payment, payment technology, processor, travel, travel industry

January 21st, 2016 by Elma Jane

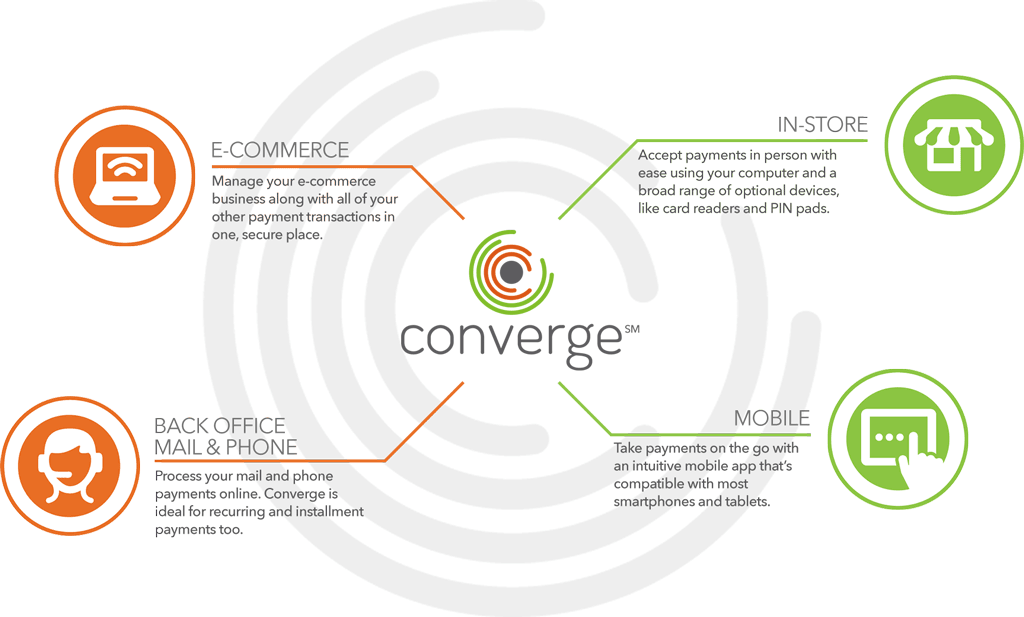

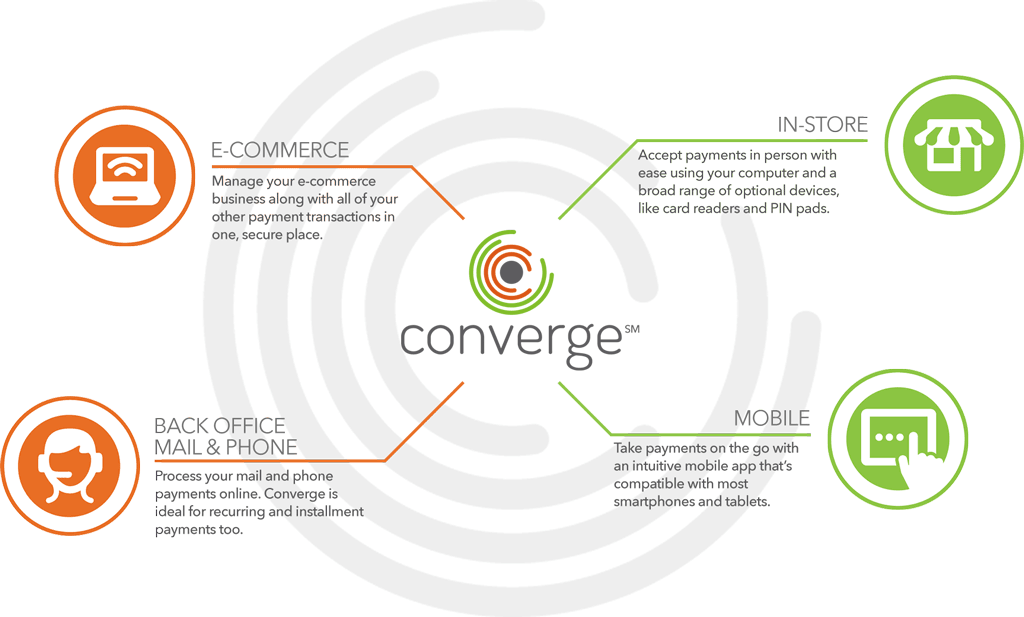

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

January 18th, 2016 by Elma Jane

EMV + NFC = BIG PLUS FOR YOUR BUSINESS

The business is already making upgrades, so If you’re a merchant, business owner who’s still on the fence about upgrading your payment processing equipment to accept EMV cards why not take that upgrade a step further and add NFC while adding EMV systems?

Not only will the upgrade help prevent potential financial responsibility for fraudulent transactions, but you can also realize the added benefit of being able to process NFC transactions at the same time.

Customers want the ability to pay with a mobile device, and NFC will allow for such transactions to go on.

Having NFC tools in place will help provide a valuable note of future-proofing to systems in place, being ready for it will be to the business’ benefit.

EMV and NFC technology is just good business sense for three important reasons Added Security, Economic Sense and Staying Current.

For more information about terminal upgrade and features that suits best for your business give us a call at 888-996-2273.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale, Smartphone Tagged with: cards, customers, EMV, merchant, mobile, nfc, Security, transactions

December 17th, 2015 by Elma Jane

We are pleased to announce that the new Converge Mobile App is now available for download in the App Store (Apple iOS devices) and Google Play (Android devices)!

Ingenico iCMP – Item code CICMP for Converge and Converge Mobile

With the launch of the new app, you can now order the Ingenico iCMP PIN Pad for Converge Mobile too!

Please use item code CICMP for those devices that will be used with Converge and Converge Mobile applications.

The Talech iCMP is configured differently and will not work properly without substantial reconfiguration work by our support teams. This creates a negative customer experience and is avoidable when you use the right code – CICMP!

Posted in Best Practices for Merchants Tagged with: Converge, Ingenico iCMP, mobile, Talech iCMP